NFT Metaverse Game Development: Transforming Crowdfunding into Sustainable Revenue

April 4, 2025

Blockchain for Health Insurance: A Game-Changer in Claims & Fraud Prevention

April 7, 2025With expansion of banking and Fintech sectors, limitations of traditional solutions are becoming obvious, but RWA Lending Development Solutions is changing that. By enabling users to secure via tokenized real-world assets, these solutions create a more secure, inclusive financial ecosystem for lenders and borrowers.

Read on to learn more about the Real-World Asset Lending Software and how it works in the decentralized space.

Understanding RWA lending Solutions and How They Benefits the Lender

The RWA lending Solutions allow the borrowers to convert the Real-World Assets into Digital tokens, which further are used as collateral and credit assessment. By using the Lending platform, users can borrow or lend against the tokenized assets and enhance the liquidity.

How Do the RWA Lending Platforms Work?

- Token Creation: In this first step, the owner of a real-world asset (such as real estate or invoices) converts it into a digital token, which represents ownership or rights to the underlying asset.

- Lending Pools: The tokenized assets are then integrated into lending pools on Blockchain RWA Lending Solutions. These pools allow borrowers to use their tokenized assets as collateral for loans.

- Loan Application: A borrower applies for a loan by pledging their tokenized assets as collateral. The loan terms (amount, duration, interest rate) are determined based on the asset’s valuation provided by oracles, SPVs, Token standards and platform rules.

- Loan Approval and Disbursement: The loan is approved after verifying the collateral value using price feeds (oracles) and ensuring compliance with liquidation thresholds. Once approved, the loan amount is disbursed in stablecoins or other crypto assets to the borrower.

- Investor Provides Capital: An investor provides capital to the lending pool (typically in stablecoins or cryptocurrencies like Ether). They earn interest from borrowers who use tokenized assets as collateral.

- Borrower Repays Loan: The borrower repays the loan with interest within the agreed timeframe. Failure to repay may lead to the liquidation of their collateralized assets. Smart contracts automate repayment tracking and collateral management.

Who Are the Participants?

- Asset Owners/Borrowers: Individuals or businesses that tokenize their real-world assets (e.g., real estate, invoices, or commodities) to use as collateral for loans.

- Lenders/Investors: Participants who provide capital to lending pools in exchange for returns through interest payments from borrowers.

- Liquidity Providers: Entities that distribute funds across multiple loans to minimize risk and ensure liquidity in the lending ecosystem.

- Underwriters/Auditors: Professionals who assess the value of tokenized assets and verify borrower eligibility to ensure loan quality.

- DeFi/Blockchain Platforms: Infrastructure providers that facilitate tokenization, lending pool management, and smart contract execution.

- Regulators: Authorities ensuring compliance with legal frameworks and protecting stakeholders’ interests.

- Technology Providers: Entities that provide the tools for tokenization, risk management, and transaction security.

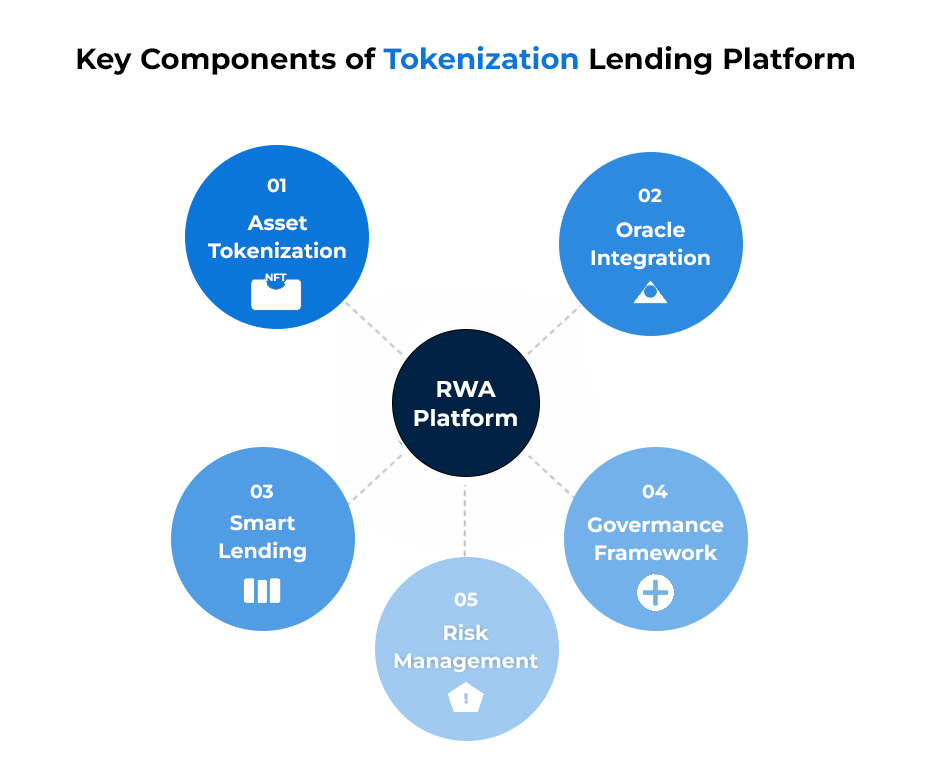

RWA Tokenization Lending Platform: Key Components

1. Asset Tokenization System

- Transform equity instruments and physical assets like real estate into digital tokens.

- Use industry-standard token formats for both divisible shares and unique assets.

- Secure assets in legal structures that provide protection and ensure compliance.

2. Oracle Integration

- Connect with trusted data providers who deliver accurate asset valuations.

- Evaluate borrower risk using both blockchain and traditional financial data.

- Protect sensitive information with advanced privacy technology.

- Update values in real time for effective risk management.

3. Smart Lending Process

- Borrowers can tokenize assets, secure them legally, and use them as collateral.

- Lenders provide funds using stablecoins and earn interest from loans.

- Automated contracts match borrowers with lenders and enforce loan terms.

- Community members vote on loan approvals, giving stakeholders a voice.

4. Governance Framework

- Platform decisions are made through decentralized voting mechanisms.

- Participants can vote on loan approvals, protocol changes, and risk policies.

- Active participation is rewarded through staking benefits.

5. Risk Management Systems

- Continuous monitoring of collateral values and credit risk evaluation.

- Appropriate loan-to-value ratios are set based on asset types.

- Automated liquidation processes if collateral values drop below thresholds.

- Regular security audits and bounty programs to maintain platform integrity.

Benefits of Building an RWA Lending Platform

Generate Revenue Streams

The Fintech firms and Banking institutions can generate multiple income sources with Custom RWA Lending Technology via origination fees, interest margins, and service charges. This enables them to create a revenue model beyond traditional financing channels, promoting stability and profit rates.

Expanded Market Reach

By connecting borrowers with previously untapped capital sources, the RWA Tokenization platform serves clients who struggle with conventional financing options. This broadens the customer base beyond geographic and demographic limitations of traditional lending.

Operational Efficiency

Financial institutions can use the platform to Automate processes loan applications, underwriting, and compliance checks. This cut down the processing time from weeks to hours. Banks can also save big on administrative costs and allow their teams to focus on strategic relationship-building rather than complex paperwork.

Enhanced Risk Management

RWA Platform enables more accurate borrower and asset assessment than traditional methods. Advanced analytics identify potential issues early and implement the proactive risk mitigation strategies that protect both lenders and borrowers.

Competitive Advantage

Early movers in this space gain significant market advantages as demand for tokenized real-world assets continues to grow. Your organization positions itself as an innovator, attracting forward-thinking clients and partners.

Scalability

The platform accommodates growing transaction volumes without proportional increases in overhead costs. Its architecture allows quick adaptation to new asset classes or geographic markets as opportunities emerge.

Streamlined Compliance

Built-in protocols automatically track and document transactions according to relevant regulatory requirements. This reduces compliance risks while creating comprehensive audit trails for all platform activities.

Improved Customer Experience

Faster approvals, simplified applications, and accessible portfolio management tools dramatically enhance the borrower and investor experience. This builds loyalty and drives word-of-mouth referrals for continued growth.

Market Intelligence

The platform captures valuable data on borrower behavior, asset performance, and market trends. This intelligence informs strategic decisions and creates opportunities for product development based on actual user needs.

Integration With the DeFi Platform

The financial Institutions can also integrate their RWA Lending Tokenization Solution to the DeFi platform. This will enhance the efficiency and enable the investors to earn more returns and annual yield through their investment while dealing smartly with the involved risks.

Future of RWA Lending Tokenization Platform

The future of RWA Lending Tokenization Platform seems bright, there will be:

Standardization

- Industry-wide protocols for tokenizing real-world assets will emerge.

- Common frameworks will improve interoperability between platforms.

- Standardized documentation will streamline asset onboarding processes.

- Unified approaches will reduce fragmentation across the ecosystem.

Enhanced Risk Management

- Advanced analytics tools will be developed specifically for RWA-backed loans.

- Sophisticated monitoring systems will track collateral performance in real time.

- AI-powered risk assessment will improve underwriting accuracy.

- Insurance mechanisms will provide additional layers for investors.

Regulatory Development

- Clear regulatory frameworks will establish operational guidelines.

- Compliance standards will be adapted for tokenized asset lending.

- Legal structures will evolve to accommodate digital asset ownership.

- Consumer protection measures will be implemented as the market matures.

Institutional Adoption

- Professional investors will increase participation as the market stabilizes.

- Capital inflows will grow as confidence in the asset class improves.

- Traditional financial institutions will integrate RWA lending capabilities.

- Specialized RWA investment funds will emerge to meet demand.

Market Expansion

- New asset classes will become eligible for tokenization and lending.

- Geographic expansion will connect global capital with local borrowers.

- Cross-chain solutions will enable broader market participation

- Secondary markets will develop for improved liquidity management.

Transit From Traditional Finance to a Fluid and More Liquified Market with Antier

Unlock liquidity and offer borrowers innovative financing options with RWA Lending Platform Development. At Antier, we provide you with modular architecture that ensures rapid deployment and compliance with evolving regulatory landscapes. You get a unified system that works harmoniously with existing financial infrastructure. Our Tokenized Asset Lending Development services follow rigorous standards and meet the professional investors’ demands. Partner with Antier today to build your custom RWA lending platform and scale your operations to new heights.