- Introducing SynFutures: The First-Ever AI-Powered DeFi DEX on Base

- Current Market Trends Of Crypto Derivative Exchange Trading

- Must-Have Features for Your SynFutures-Inspired Decentralized Derivative Exchange

- Key Benefits Of AI DeFi Derivative Exchange Development

- Why is Base the Best Choice for AI-Powered DEX Development?

- Steps to Launch Your AI-Powered DeFi Derivative Exchange

- Essential Tech Stacks: AI-Agent DeFi Derivatives Exchange Development

Let’s be real—building a crypto derivative exchange isn’t just about deploying a matching engine and calling it a day. You’re operating in a space where ultra-low latency, risk mitigation, and liquidity aggregation aren’t just features—they are the backbone of survival. One flaw in liquidation logic, an overlooked slippage risk, or a vulnerability in your margining system, and the entire trading ecosystem collapses. In a market where institutions demand precision and traders expect instant execution, is your exchange architecture truly built to dominate, or is it just another platform waiting to be outpaced?

This is where partnering with a reputable crypto derivative exchange development company becomes a game-changer. From architecting a bulletproof risk engine to fine-tuning smart contract security and optimizing liquidity pools, expert developers ensure no critical element is overlooked. With the right team, you’re not just launching an exchange—you’re engineering a high-performance trading infrastructure built to disrupt the market. Thus, let us explore Coinbase’s first ever Defi derivative exchange, Synfutures, for inspiration!

Introducing SynFutures: The First-Ever AI-Powered DeFi DEX on Base

SynFutures is a next-generation decentralized derivatives exchange that integrates AI-driven optimization to enhance AMM, perpetual futures, and synthetic asset trading. As the first DEX built on Base Layer 2, it leverages the scalability and efficiency of optimistic rollups, ensuring high-speed, low-cost transactions for traders.

What sets SynFutures apart is its AI-enhanced trading infrastructure, which refines liquidity provisioning, risk assessment, and order execution. By utilizing machine learning models and predictive analytics, the platform minimizes slippage, improves capital efficiency, and mitigates price manipulation risks. Users can permissionlessly list and trade synthetic assets, democratizing access to derivatives markets. With the DeFi derivative exchange sector surging, SynFutures is pioneering a more efficient, AI-enhanced trading ecosystem, reshaping on-chain derivatives with automation, transparency, and composability at its core.

Current Market Trends Of Crypto Derivative Exchange Trading

The cryptocurrency derivative exchange market is experiencing significant evolution, driven by technological advancements and shifting trader preferences. Decentralized derivatives platforms, such as dYdX and GMX, are gaining prominence, with projections indicating that decentralized derivatives trading could account for over 30% of total market volume by 2025 as traders seek greater transparency and control over their assets.

Traditional financial institutions are increasingly integrating DeFi protocols into their operations, recognizing the efficiency and transparency these systems offer. This convergence is fostering innovative derivative products that blend conventional finance with cutting-edge blockchain technology. Regulatory landscapes are also adapting; for instance, the UK’s Financial Conduct Authority (FCA) has implemented bans on crypto derivatives for retail investors, sparking debates about consumer protection and market accessibility.

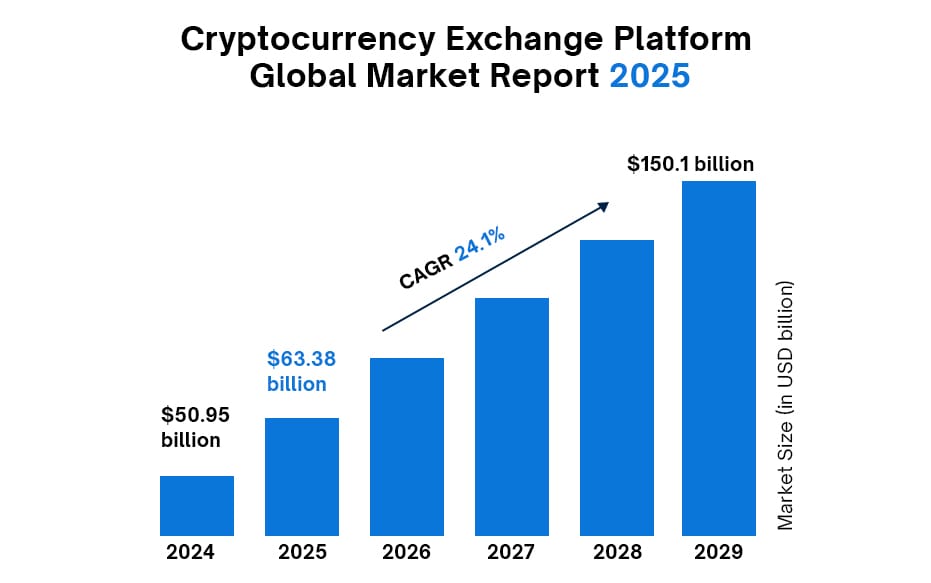

Source Link: Cryptocurrency Exchange Platform Market Report 2025, Statistics And Forecast

Furthermore, the global cryptocurrency exchange platform market is projected to grow from $50.95 billion in 2024 to $63.38 billion in 2025, reflecting a CAGR of 24.4%. Collectively, these trends underscore a transformative period in the cryptocurrency derivatives landscape. marked by technological innovation, regulatory evolution, and expanding market participation.

Must-Have Features for Your SynFutures-Inspired Decentralized Derivative Exchange

Key Benefits Of AI DeFi Derivative Exchange Development

As the crypto landscape shifts, incorporating AI into Crypto Derivatives Exchange development is transforming trading efficiency, security, and market accessibility. Unlike traditional platforms, an AI-driven cryptocurrency derivatives exchange development framework empowers traders with enhanced automation, predictive analytics, and real-time risk management. Below are the core benefits of developing an AI-powered crypto derivatives exchange:

- Advanced Market Predictability & Automated Strategies

AI-powered decentralized exchange development optimizes trading by leveraging predictive analytics and machine learning models. By analyzing massive datasets, AI enhances trade execution precision, automates strategies, and ensures smarter risk-adjusted investments for institutional and retail traders.

- Hyper-Efficient Liquidity Optimization

Integrating AI in decentralized exchange software ensures intelligent liquidity aggregation, mitigating slippage and spreads. AI-driven market-making algorithms dynamically balance order books, optimizing asset flow across multiple liquidity pools, and improving DEX development efficiency.

- Seamless Risk Mitigation & Fraud Prevention

AI models integrated in crypto derivative exchange platforms proactively detect anomalies, prevent flash loan attacks, and ensure robust compliance mechanisms. With real-time behavioral analysis, AI enhances trade security, preventing unauthorized access and malicious bot interference.

- Unparalleled User Personalization & Experience

Through AI-based behavioral analysis, crypto derivative exchanges personalize trading interfaces, recommend optimized investment strategies, and enhance UI/UX with intuitive dashboards. This results in a seamless, trader-friendly experience.

- Autonomous Smart Contract Execution & Adaptive Trading

AI-integrated crypto derivatives exchange development automates smart contract execution, adapting to market fluctuations in real-time. It ensures zero-lag trade settlements, reducing counterparty risks and optimizing contract efficiency.

- Scalability & Cost-Efficiency for Institutional & Retail Adoption

AI-powered decentralized derivative exchange development solution ensures scalable infrastructure, handling high-frequency trading (HFT) with minimal latency. It reduces manual operational costs, allowing businesses to maximize revenue streams while maintaining decentralized control.

- Competitive Advantage in the Evolving DeFi Ecosystem

Building an AI-enhanced cryptocurrency derivatives exchange development solution enables businesses to stay ahead in the evolving DeFi ecosystem. The synergy of AI and DEX development fosters continuous innovation, ensuring dominance in the rapidly expanding derivatives market.

Businesses that integrate AI into Crypto Derivatives Exchange Development can create a future-proof, efficient, secure, and scalable decentralized trading ecosystem. The fusion of AI with Decentralized Exchange Software not only redefines trading efficiency but also establishes a new paradigm in DEX Development Services.

Why is Base the Best Choice for AI-Powered DEX Development?

Building an AI-powered crypto derivatives exchange requires a blockchain infrastructure that delivers high-speed transactions, low fees, security, and seamless scalability. Base Layer 2, developed by Coinbase and built on Optimistic Rollups, stands out as the optimal foundation for next-generation cryptocurrency derivatives exchange development. Here’s why Base Layer 2 is the ideal choice for launching an AI-driven decentralized exchange:

With its scalability, low fees, high-speed transactions, security, and AI-optimized infrastructure, Base Layer 2 emerges as the most strategic choice for crypto derivatives exchange development. Its seamless integration with Ethereum, backed by Coinbase’s trusted ecosystem, makes it a future-ready blockchain for AI-powered decentralized trading solutions.

Steps to Launch Your AI-Powered DeFi Derivative Exchange

AI-powered crypto derivatives exchange development demands a structured approach, combining decentralized trading infrastructure, AI automation, and robust security measures. A renowned DEX development company follows these five essential steps to create a high-performance, scalable, and feature-rich decentralized exchange.

Step 1. Define the Exchange Architecture & AI-Agent Framework

The foundation of a crypto derivatives exchange development lies in designing an optimized trading architecture that supports perpetual contracts, options trading, and real-time settlements. AI-agent integration enhances market prediction, automated risk assessment, and decision-making, while Base Layer 2 ensures scalability and low transaction costs for seamless trading.

Step 2. Develop Smart Contracts & AI-Powered Risk Management

Implementing smart contracts is crucial for trade automation, ensuring secure and tamper-proof derivative settlements. AI-powered risk management modules analyze market volatility, liquidation thresholds, and collateral health while mitigating front-running risks, slippage, and flash loan exploits through predictive analytics.

Step 3. Implement Liquidity Mechanisms & AI-Driven Market-Making

A cryptocurrency derivatives exchange development requires deep liquidity to sustain trading volume. Decentralized liquidity pools, AMM-based mechanisms, and AI-driven market-making algorithms ensure dynamic pricing, slippage reduction, and capital efficiency. Integrating liquidity aggregation across DeFi ecosystems further enhances order execution.

Step 4. Integrate AI-Powered Trading Tools & Decentralized Exchange Software

AI-enhanced trading functionalities, including automated order execution, predictive analytics, and high-speed matching engines, optimize performance. Decentralized exchange software featuring on-chain analytics, customizable trading interfaces, and AI-driven sentiment analysis empowers traders with data-driven insights and execution precision.

Step 5. Security Optimization, Compliance, & Mainnet Deployment

Security remains a top priority in DEX development. Institutional-grade security protocols, smart contract audits, AI-driven fraud detection, and multi-layer authentication ensure robust protection. Deploying the exchange on Base Layer 2 guarantees high-speed transactions, cost efficiency, and seamless interoperability with Ethereum-based DeFi ecosystems.

Businesses that follow these five essential steps can create an AI-driven crypto derivatives exchange that excels in automated trading, liquidity management, and market security, redefining decentralized derivatives trading in the evolving DeFi landscape.

Essential Tech Stacks: AI-Agent DeFi Derivatives Exchange Development

Building an AI-powered DeFi derivatives exchange requires a robust tech stack that ensures high-speed trading, AI automation, and secure smart contract execution. Key components include:

A well-structured crypto derivatives exchange development stack ensures seamless trading, enhanced liquidity, and AI-powered automation, setting the foundation for next-gen decentralized derivatives markets.

Hire Certified Experts For Derivative Exchange Development Services

In an industry where milliseconds define profitability and security is non-negotiable, partnering with the right development firm is the key to launching a truly impactful crypto derivative exchange. Antier, a globally recognized leader in crypto derivative exchange development, brings unmatched expertise in high-frequency trading engines, risk management protocols, liquidity optimization, and institutional-grade security—all tailored to deliver a frictionless trading experience.

Our USP lies in delivering scalable, low-latency, and regulation-compliant exchanges that empower businesses to stay ahead in the volatile derivatives market. From customizable trading modules and perpetual contracts to robust order-matching engines and seamless multi-asset support, we provide end-to-end development services that ensure your exchange is not just competitive but transformative. With Antier as your technology partner, you are not just building an exchange; you are also designing a high-performance trading ecosystem that will captivate traders, drive liquidity, and redefine market efficiency. Ready to set a new benchmark in crypto derivatives? Let’s build the future together.