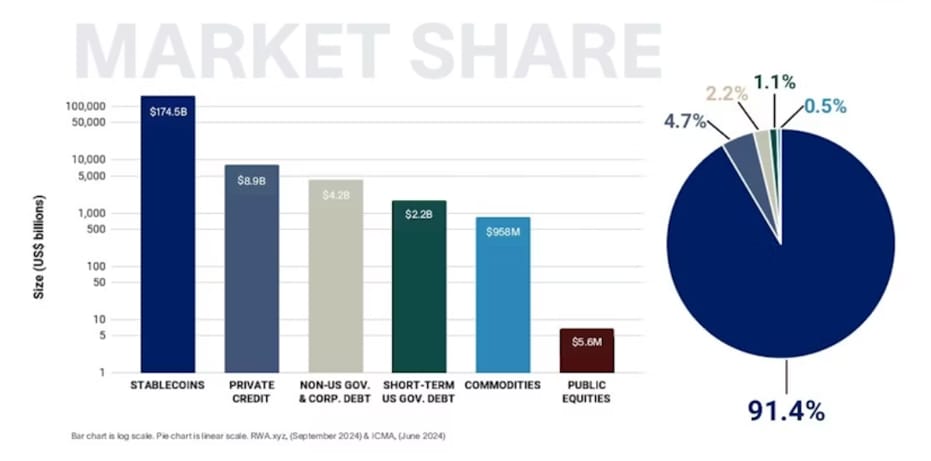

“Stablecoin market capitalization exploded by 3800% between 2020 and 2024; as of January 13, 2024, it reached $206.331 billion.”

The stablecoin market is ramping up. It is safe to say that tokenized real world assets will be the next big thing in 2025. The convergence of blockchain and RWAs is reshaping industries ranging from real estate to fine art. Tokenization transforms how we perceive, manage, and trade tangible assets that once were confined to the elite. This growing demand for transparency, liquidity, and fractional ownership is driving the new wave of innovation.

Let’s examine the intricacies of tokenized RWA ICO development, why it’s poised to dominate the fundraising landscape for tangible assets in 2025, and how businesses can leverage this trend to unlock exponential growth.

Tangible to Tokenized: The Concept of RWA Redefined

It refers to converting rights to RWAs into on-chain tokens, enabling fractional ownership of high-value physical assets like real estate, art, intellectual property, commodities, and luxury goods. This shift democratizes access to investments that were previously limited due to high entry costs.

Before we move ahead to learn about tokenized RWA ICO development, let’s explore why tokenization will make significant strides in 2025.

The Rise of Tokenized RWA ICOs

RWA tokenization is poised to disrupt traditional finance and create new liquid avenues for transparent and secure investment and value creation. ICOs break into the scenario, creating a more secure and investor-friendly fundraising model.

How Tokenized RWA ICOs Work:

- Asset Selection: Choose a tangible asset for tokenization.

- ICO Token Development: Develop blockchain-based tokens representing ownership or rights.

- Smart Contracts: Implement automated processes for transactions and compliance.

- ICO Software Development: Collaborate with an ICO development company to build a platform that efficiently targets the intended user base.

- ICO Launch: Raise funds by offering tokens to investors.

Benefits of Tokenized RWA ICO Development

- Increased Liquidity: Through ICO token development, businesses can turn traditionally illiquid assets into tradeable digital assets, enabling fractional ownership. This makes expensive RWAs more accessible to a wider range of investors, leading to increased liquidity, more efficient markets and price discovery.

- New Investment Opportunities: Tokenization opens up new investment opportunities in previously illiquid assets, such as real estate or fine art.

- Reduced Costs and Faster Transactions: Tokenized RWA ICO development can streamline administrative processes through automation and reduce intermediaries, lowering costs for both issuers and investors.

- Enhanced Transparency and Accessibility: Blockchain ensures an immutable record of ownership and transactions, increasing transparency and reducing the risk of fraud. Moreover, tokenized real world assets can be traded across borders without traditional financial limitations.

Trends Shaping RWA ICO Development in 2025

As we look ahead, several trends are poised to influence RWA ICO development:

- Integration with DeFi: The collaboration between tokenized assets and DeFi platforms will allow for innovative financial products and services.

- Government Regulation: Clear regulations will foster trust among investors and encourage institutional participation in tokenized markets.

- AI-Driven Valuation: Advanced algorithms will help assess the value of tokenized assets more accurately, ensuring fair pricing.

- Cross-Blockchain Compatibility: Improved interoperability between different blockchain networks will facilitate seamless trading of tokenized assets across platforms

Top Use Cases For Tokenized RWA ICO Development in 2025

- Real Estate:

Tokenization enables fractional ownership of high-value properties, making real estate investment more accessible.

Example: A luxury villa tokenized into 1,000 tokens allows investors to own a fraction of the property for as little as $1,000.

- Art & Collectibles:

Art tokenization is not just about owning a piece of art; it’s about owning a piece of history. Fine art and collectibles ownership can be democratized through RWA ICO token development.

- Commodities:

Gold, oil, and other commodities are being tokenized to facilitate efficient trading and ownership.

Conclusion: Embrace the Future with Antier

“Tokenization bridges the gap between traditional assets and the decentralized future.”

Tokenization indicates explosive growth and widespread adoption in the coming years. For real world assets, it unlocks new horizons of ownership and fundraising. The convergence of ICO development and RWA tokenization therefore marks a significant step forward in the evolution of finance. Harnessing the power of blockchain, industries can benefit from enhanced liquidity and more efficient tangible asset markets.

The future of finance is tokenized. Let the journey begin with Antier.

Why Partner with Antier for Tokenized RWA ICO Development?

As we embrace this new era at Antier, we remain committed to pioneering innovative solutions in asset tokenization and ICO innovation. Our end-to-end ICO Software Development solutions encompass everything from asset tokenization to ICO launch, ensuring a seamless and compliant process.

What We Offer:

- Custom Blockchain Development tailored to your asset class.

- ICO Development: Taking charge from ICO Token Development to ICO Software Development.

- Smart Contract Integration for automated processes and security.

- Regulatory Compliance Solutions to navigate global legal landscapes.

- Investor-Centric Platforms for enhanced user experiences.