Invest In Web3 Social Media dApp Development To Amplify Your Profits in 2025

January 10, 2025

How to Create a Successful Meme Coin Exchange in 2025?

January 10, 2025Imagine a supply chain company where vendor payments are delayed due to inefficiencies and dependency on middlemen. By adopting Blockchain smart contracts solutions, payments can be instantly triggered upon goods verification. This removes the need for intermediaries and ensures a seamless & transparent process.

While Ethereum and Binance Smart Chain have long dominated the space, the XRPL (XRP Ledger) is emerging as a powerful alternative with its innovative Hooks feature. Unlike traditional platforms that rely on resource-heavy virtual machines, XRPL’s approach focuses on simplicity and performance.

As reported by CoinDesk, Ripple plans to introduce Ethereum-compatible smart contracts to the XRP Ledger through a new sidechain to enhance its capabilities beyond simple transactions. By simplifying smart contract functionality and focusing on real-world usability, XRPL is paving the way for enterprises to unlock the full potential of decentralized, automated systems.

This blog sheds light on the following aspects of XRPL smart contracts:

- What is XRPL?

- What are XRPL Smart Contracts?

- How do XRPL Smart Contracts Work?

- XRPL Smart Contracts vs. Ethereum Smart Contracts: The Difference

- How to Build and Deploy Smart Contracts on XRPL: A Step-by-Step Guide

- XRPL Smart Contracts Use Cases

- Best Practices for XRPL Smart Contract Development

- Conclusion

What is XRPL?

The XRPL is a decentralized cryptographic ledger that powers the XRP cryptocurrency. Unlike traditional blockchains that rely on computationally intensive Proof-of-Work or Proof-of-Stake consensus mechanisms, the XRPL utilizes a unique Federated Consensus mechanism for rapid transaction settlement in just a few seconds with minimal fees.

Initially, the XRPL’s functionality was primarily focused on payments and asset issuance. However, the demand for more complex on-chain logic has driven the development of XRPL smart contracts capabilities. This evolution allows businesses to leverage the XRPL’s inherent speed and efficiency for a wider range of applications beyond simple transactions.

What are XRPL Smart Contracts?

XRPL smart contracts currently rely on a feature called “Hooks.” Hooks are lightweight, efficient pieces of code that developers can deploy on the ledger to enable programmable logic. They are embedded directly within transactions which allows businesses to create customized transaction behavior without the need for external scripting.

Types of XRPL Smart Contracts

- Pre-Transaction Hooks: These are executed before a transaction is added to the ledger. They allow the logic to inspect or modify transactions before they are finalized.

- Post-Transaction Hooks: These are triggered after a transaction is processed. They can be used to perform actions based on the outcomes of a transaction.

How do XRPL Smart Contracts Work?

Here’s a breakdown of how XRPL smart contracts function:

1. Native Ledger Features: The XRPL provides several built-in functionalities that can be combined to achieve smart contract-like behavior. These include:

- Payment Channels: These allow for off-ledger transactions with on-ledger settlement and enable complex payment agreements & escrow-like functionality.

- Escrow: This feature allows for conditional payments, where funds are held until certain conditions are met. This is a basic form of smart contract logic.

- Check: This is a deferred payment instrument that can be used for delayed payments or recurring billing.

- Offers (Decentralized Exchange): The XRPL’s built-in DEX allows for automated trading based on predefined conditions, effectively acting as a type of smart contract for financial transactions.

- Account Flags: These flags can be set on accounts to restrict or enable certain actions, providing another layer of control and conditional logic.

2. Hooks (The Primary Mechanism for Advanced Logic): Hooks are the closest equivalent to traditional smart contracts on the XRPL. They are small pieces of code that execute automatically on specific ledger events.

How do Hooks Work?

Hooks are written in a Wasm(WebAssembly) compatible language. They are deployed to a server and registered on an XRPL account. When a specific transaction or event occurs on the ledger that the hook is configured to watch, the hook’s code is executed. Hooks can be triggered by various events, including incoming payments, outgoing payments, account changes, and other ledger events.

Hook Actions

Hooks can perform a variety of actions, such as:

- Modifying Transactions: A hook can modify an incoming or outgoing transaction before it’s applied to the ledger. This allows for complex logic, like adding fees, routing payments, or enforcing specific conditions.

- Rejecting Transactions: A hook can reject a transaction if it doesn’t meet certain criteria.

- Creating New Transactions: A hook can create new transactions based on the triggering event. This can be used for automated payments, escrow releases, and other complex scenarios.

- Accessing Ledger State: Hooks have access to the current state of the ledger, allowing them to make decisions based on account balances, trust lines, and other data.

3. Combining Features for Complex Logic The power of XRPL smart contracts comes from combining these native features and Hooks. For example:

- Escrow with Hooks: An escrow can be set up using the native escrow feature. A hook can then be used to automatically release the funds when a specific condition is met, such as the delivery of a product or the completion of a service.

- Payment Channels with Hooks: Hooks can be used to manage complex payment channel interactions, such as automated top-ups or conditional payments within the channel.

- Decentralized Exchange with Hooks: Hooks can be used to implement more sophisticated trading strategies or market-making bots on the XRPL’s DEX.

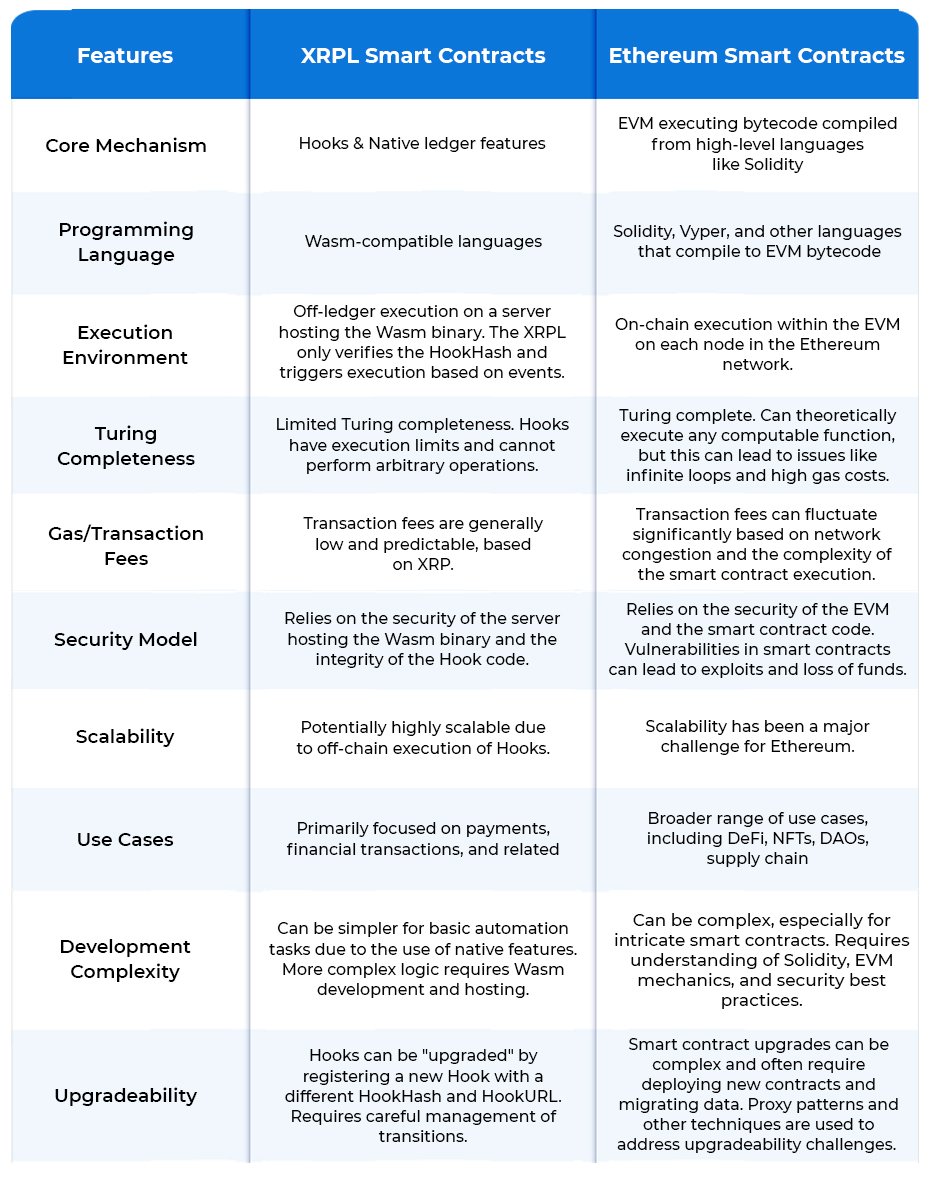

XRPL Smart Contracts vs. Ethereum Smart Contracts: The Difference

XRPL smart contracts prioritize efficiency, scalability, and security within the context of payments and financial transactions. It uses a more constrained execution environment to achieve this. On the other hand, Ethereum’s approach prioritizes flexibility and expressiveness, allowing for a wider range of applications but at the cost of potential scalability and security challenges.

Choosing between the two depends heavily on the specific use case and priorities. If the focus is on high-volume, low-cost financial transactions with specific automation requirements, XRPL smart contracts might be a more suitable choice. If the goal is to build complex decentralized applications with intricate logic and data management, Ethereum might be preferred.

XRPL Smart Contracts vs. Ethereum Smart Contracts

How to Build and Deploy Smart Contracts on XRPL: A Step-by-Step Guide

Deploying smart contracts on XRPL is different from deploying them on EVM-compatible chains like Ethereum. XRPL uses “Hooks” for similar functionality, which has a distinct deployment process. Here’s a step-by-step guide to deploying Hooks on XRPL:

1. Set up your Development Environment

- Choose a Wasm-compatible language: You’ll need to write your Hook in a language that can compile to WebAssembly. Popular choices include:

- Rust: Offers excellent performance and control.

- AssemblyScript: A TypeScript-like language that compiles to Wasm.

- Install necessary tools: You’ll need a compiler for your chosen language and potentially other tools for Wasm manipulation.

2. Write your Hook Code

- Define the Hook logic: This is where you implement the specific actions you want the Hook to perform. Consider the triggering events and the desired outcomes.

- Use the XRPL Hook interface: Your Hook code needs to interact with the XRPL. This involves using specific functions and data structures provided by the XRPL Hook interface. This interface defines how your Hook receives information about the triggering event and how it can interact with the ledger.

- Compile to Wasm: Once you’ve written your Hook code, you need to compile it to a Wasm binary.

3. Set up an XRPL Account

- Create an XRPL account: You’ll need an XRPL account to register your Hook. You can use an XRPL wallet or a service like XUMM.

- Fund the account: Ensure the account has sufficient XRP to pay for transaction fees.

4. Deploy and Register the Hook

- Host the Wasm binary: You need to host the compiled Wasm binary on a publicly accessible server. This server needs to be reliable and always online, as the XRPL will need to access the Hook code when it’s triggered.

- Create a SetHook transaction: This transaction is used to register your Hook on the XRPL. It includes the following information:

- Account: The XRPL account where the Hook will be registered.

- HookHash: A hash of the Wasm binary. This is used to verify the integrity of the Hook code.

- HookNamespace: A namespace to organize your Hooks.

- HookURL: The URL where the Wasm binary is hosted.

- HookOn: Specifies the events that will trigger the Hook.

- Sign and submit the transaction: Use your XRPL account’s secret key to sign the SetHook transaction and submit it to the XRPL.

5. Test the Hook

- Trigger the Hook: Perform actions on the XRPL that should trigger your Hook based on the HookOn settings.

- Monitor the results: Check the XRPL to ensure that the Hook is executed as expected and performs the desired actions. You can use an XRPL explorer to view transaction details and check for any errors.

XRPL Smart Contracts Use Cases

1. Cross-Border Payments and Settlements:

One of the core strengths of the XRP Ledger lies in its capacity to facilitate fast, low-cost cross-border payments. By leveraging XRPL smart contracts and XRPL Layer 2 solutions, businesses can automate and streamline international payments with ease.

- Automated FX Conversion: Enterprises dealing with multiple currencies can use XRPL smart contracts to automatically convert funds at favorable exchange rates, ensuring efficient and cost-effective cross-border transactions.

- Escrow and Payment Release: XRPL smart contracts can ensure that funds are only released when specific conditions are met. For example, businesses can automate the release of payments contingent on contract completion, thus eliminating trust issues in international trade.

- Settlement Finality: Smart contracts on XRPL can ensure the finality of settlements in real-time. With no intermediaries, businesses can trust that the funds are securely transferred and settled once the transaction conditions are fulfilled.

2. Tokenized Asset Management

Enterprise adoption of tokenization is rapidly increasing, with businesses issuing digital tokens to represent ownership of assets ranging from real estate to intellectual property. XRPL smart contracts and XRPL Layer 2 projects facilitate seamless token management, offering a range of automation and compliance capabilities.

- Automated Token Transfer: By using XRPL smart contracts, businesses can automate the transfer of digital assets between parties. This can be applied to tokenized securities, real estate, or any other asset that benefits from tokenization.

- Asset Fractionalization: XRPL smart contracts enable the fractional ownership of high-value assets. This is particularly useful in sectors like real estate, where businesses can issue tokens that represent shares of a property, allowing for easier transfer and liquidity of traditionally illiquid assets.

- Compliance and Reporting: XRPL smart contracts can automatically enforce regulatory compliance, such as ensuring that only accredited investors can participate in token offerings or managing voting rights for token holders in decentralized governance models.

3. Supply Chain Management

In supply chain management, the transparency, traceability, and security provided by blockchain technology can offer significant benefits. XRPL smart contracts are uniquely positioned to optimize and automate various processes within the supply chain, helping businesses reduce costs and enhance efficiency.

- Track and Trace: XRPL smart contracts can be used to automatically log each step of a product’s journey from manufacturer to consumer. This ensures that the data is secure, verifiable, and transparent, thus enabling businesses to track the provenance of goods.

- Automated Payments and Invoicing: Businesses can use smart contracts to automate payments once predefined conditions are met. For example, once goods are delivered and verified, the smart contract can automatically trigger the payment to the supplier, reducing delays and administrative costs.

- Inventory Management: Using smart contracts, businesses can create an automated inventory system where stock levels are dynamically adjusted based on the purchase and sale of goods. Smart contracts can also trigger reordering when stock levels reach a certain threshold.

4. Decentralized Finance (DeFi) Solutions

As the DeFi ecosystem continues to expand, enterprises are increasingly exploring the integration of decentralized finance solutions. XRPL smart contracts provide a reliable framework for building DeFi applications, thanks to the XRP Ledger’s scalability and low transaction fees, further enhanced by XRPL Layer 2 development.

- Lending and Borrowing: Enterprises can use XRPL smart contracts to create decentralized lending and borrowing platforms. These platforms can automatically match borrowers with lenders, enforce collateral requirements, and execute loan disbursements and repayments without the need for intermediaries.

- Staking and Yield Farming: Enterprises can develop staking platforms where users can lock their assets in return for rewards. Smart contracts can automate the process, calculating rewards based on the amount of tokens staked and the duration.

- Insurance: XRPL smart contracts can automate and manage insurance policies by defining the conditions under which a claim is made. For example, in the case of flight delays, an automated insurance claim could be processed once flight status is confirmed via an Oracle feed.

Best Practices for XRPL Smart Contract Development

1. Understand the Capabilities of XRPL Hooks

Before deploying smart contracts on XRPL, businesses must understand the specific functionalities and constraints of XRPL Hooks.

- Efficiency Over Complexity: XRPL Hooks are designed for efficiency, favoring lightweight business logic over complex decentralized applications. Businesses should focus on simple yet impactful use cases such as payment automation, compliance checks, and asset transfers, which are well-suited for XRPL smart contracts.

- Focus on Transactional Logic: XRPL’s smart contracts are ideal for managing transactional logic, especially those involving financial products, token transfers, and settlement processes. Businesses should consider using them primarily for such tasks.

- Security Constraints: Unlike more traditional platforms, XRPL Hooks don’t have the flexibility of complex programming languages like Solidity. Therefore, businesses should focus on developing functional, well-tested, and reliable hooks that prioritize security and performance.

2. Modular Design for Smart Contracts

A modular design approach is key to ensuring the scalability and flexibility of XRPL smart contracts. It allows businesses to make modifications or upgrades to specific functions without affecting the entire system.

- Reusable Components: Develop smart contracts that leverage reusable components or modules. This will help streamline future upgrades and ensure consistency across different contracts. For instance, separating payment logic, compliance checks, and token management into distinct modules will allow easier maintenance.

- Condition-Based Logic: Smart contracts should be designed with conditions that trigger specific actions. This ensures that only validated transactions are executed, which is essential in environments requiring regulatory compliance.

By using modular design, enterprises can ensure that XRPL Layer 2 projects evolve with business needs without disrupting the system’s overall integrity.

3. Optimize for Gas Efficiency

Transaction fees, or gas costs, can become a significant operational expense, particularly in high-frequency environments like cross-border payments or DeFi applications. XRPL’s transaction model is already more efficient than Ethereum’s, but it is still crucial to optimize smart contracts for gas costs.

- Limit Complex Logic: While XRPL Hooks are lightweight, complex smart contract logic can still incur higher costs. Enterprises should aim to minimize the use of intricate loops or excessive checks in their smart contracts.

- Efficient Resource Usage: Use minimal resources when storing data or interacting with the ledger. Avoid storing large amounts of data within the contract, as this can increase the transaction costs. Instead, businesses should focus on leveraging off-chain data when possible.

By optimizing for gas efficiency, businesses can ensure that the use of smart contracts remains cost-effective and scalable in the long term, especially when integrated into XRPL Layer 2 development solutions.

4. Focus on Security and Risk Mitigation

Security is paramount when implementing XRPL smart contracts, especially since businesses are often dealing with valuable assets such as tokenized securities, financial data, or real-world assets.

- Code Audits and Testing: Businesses must perform rigorous code audits and testing before deploying any smart contract. Automated testing frameworks can simulate various conditions and edge cases to ensure that the contract performs as expected under all scenarios.

- Use of Safe Transaction Practices: Smart contracts should be built with safe transaction practices, including multi-signature authorization and account verification. This will reduce the risk of unauthorized access or manipulation.

- Error Handling and Fail-Safes: Implement comprehensive error handling within the smart contract code. For example, businesses should design contracts that automatically roll back transactions in the event of unexpected errors or conditions. This is particularly important in supply chain applications or asset transfers, where errors can lead to significant financial losses.

5. Testing and Deployment in Phases

Launching smart contracts on the XRP Ledger should be done in controlled phases to avoid unexpected issues post-deployment.

- Use Testnets: Before deploying to the XRP Mainnet, thoroughly test the smart contract on the Testnet or Devnet. These environments mimic real-world conditions without the risk of financial loss. Testing should cover edge cases, failure conditions, and scenarios where the contract logic may not behave as expected.

- Gradual Rollouts: Consider deploying the smart contract in phases, starting with a limited user base. This enables businesses to monitor performance, address bugs, and optimize before fully scaling the solution.

- Simulate Real-World Use Cases: Ensure that testing encompasses the entire transaction flow, from trigger conditions to settlement. This ensures the contract performs as expected in real-world business scenarios, such as cross-border transactions, supply chain operations, or financial services.

Conclusion

Implementing XRPL Smart Contracts offers businesses a range of opportunities to enhance efficiency, streamline processes, and integrate blockchain technology into various operations. However, to achieve maximum value, businesses must follow a set of best practices encompassing security, optimization, regulatory compliance, and scalability. Partnering with a smart contract development company like Antier can further ensure seamless implementation, as these experts bring in-depth knowledge and experience to design, build, and deploy robust XRPL smart contracts tailored to your business needs.