Exploring the Potential of Asset Tokenization Studio

January 9, 2025

Invest In Web3 Social Media dApp Development To Amplify Your Profits in 2025

January 10, 2025- Decoding White-Label P2P Lending Platforms: Why They Matter for SMEs?

- Unmatched Benefits of White-Label P2P Lending Development Solutions

- Necessary Elements That Make P2P Lending Platforms Stand Out

- Step-by-Step Blueprint for Building Your Own P2P Lending Ecosystem

- What’s Next? Future-Proofing Your Platform for SME Success

- Ending Words

One of the most innovative and transformative solutions for most small and medium enterprises in the modern finance environment, which is so constantly evolving, is peer-to-peer lending. Mostly believed to be the backbone of global economies, most SMEs have faced great obstacles in trying to access traditional sources of finance. With this in mind, the world has witnessed novel P2P lending platform software, devised to fill in the gap that exists between a lender and the borrower.

Flexible, transparent, and technology-driven financing options have placed a white-label P2P lending platform within the solution category. A white label P2P lending platform development approach would enable businesses to launch feature-rich platforms tailored specifically to the needs of small and medium-sized enterprises, without the hassles of building everything from the ground up. White-label solutions provide ready-to-use frameworks coupled with extensive customization, allowing organizations to quickly deploy platforms and then hone in on delivering the best experience for customers.

Let’s discuss the broad roadmap that has been designed to help you successfully craft P2P lending software for SMEs.

Decoding White-Label P2P Lending Platforms: Why They Matter for SMEs?

A white label P2P lending platform is more than a technology solution, it is a strategic tool that gives businesses the capacity to revolutionize lending experiences. P2P lending platform software allows direct interaction between lenders and borrowers.

Understanding the Financial Needs of SMEs

SMEs are a critical growth driver for the economic environment and often make up a large percentage of employment and innovation around the world. These businesses often hit roadside hurdles when trying to access traditional financing, such as:

- Strict Lending Requirements: Banks often require extensive documentation, very high credit scores, and collateral, which many SMEs usually may not have.

- Lengthy Approval Processes: Traditional loan approvals can take weeks or even months, leaving SMEs unable to access funds when they need them most.

- High Interest Rates: Limited options force SMEs to accept loans with exorbitant interest rates, which can hinder their growth.

- Funding Gaps for Startups: Newly established SMEs with limited credit history struggle to secure loans despite promising business models.

These challenges require novel financing options like white label P2P lending platform development, which mitigates the problems of SME borrowing and allows the direct connection between the SME and lenders who wish to invest in their growth.

Role of P2P Lending Platforms in SME Challenges

The P2P lending platform software is specifically designed to overcome the specific financial challenges that SMEs face. The platforms avoid traditional intermediaries, and hence, SMEs can raise funds much faster and at lower costs. The following are the key advantages of white label P2P lending platform solutions:

Key Benefits for SMEs:

- Simplified Loan Application Process: SMEs can complete applications online, which reduces the need for extensive documentation and simplifies the process.

- Faster Disbursement of Loans: The money is transferred quickly once approved, catering to urgent financial needs.

- Lower Interest Rates: Since there is a direct lender-to-borrower connection, overhead costs are reduced, allowing for more competitive interest rates.

- Flexible Terms: Borrowers and lenders can negotiate terms that meet their mutual requirements.

White label P2P lending platform development can help businesses create a customized ecosystem that caters to the financing challenges of SMEs, thus helping them grow and stabilize.

Unmatched Benefits of White-Label P2P Lending Development Solutions

White-label solutions often become the choice of businesses interested in developing a solid P2P lending platform software without long development cycles. Below, we discuss the numerous benefits:

Advantages for White Label P2P Lending Platform Owners

- Faster Market Penetration: White-label platforms cut significantly on time-to-market, so businesses can ride new trends much faster.

- Lower Development Costs: The development of a platform from scratch is a pricey and technical matter. White-label solutions save on these costs since they offer ready-made frameworks.

- Seamless Customization: Businesses can adapt the design and functionality of the platform to suit their brand identity and the requirements of their target audience.

- Scalability at Its Best: As the user base grows, these platforms provide the flexibility to scale operations effortlessly.

Choosing white label P2P lending platform development is not just a technological investment—it’s a strategic move to deliver exceptional value to SMEs and stakeholders alike.

Necessary Elements That Make P2P Lending Platforms Stand Out

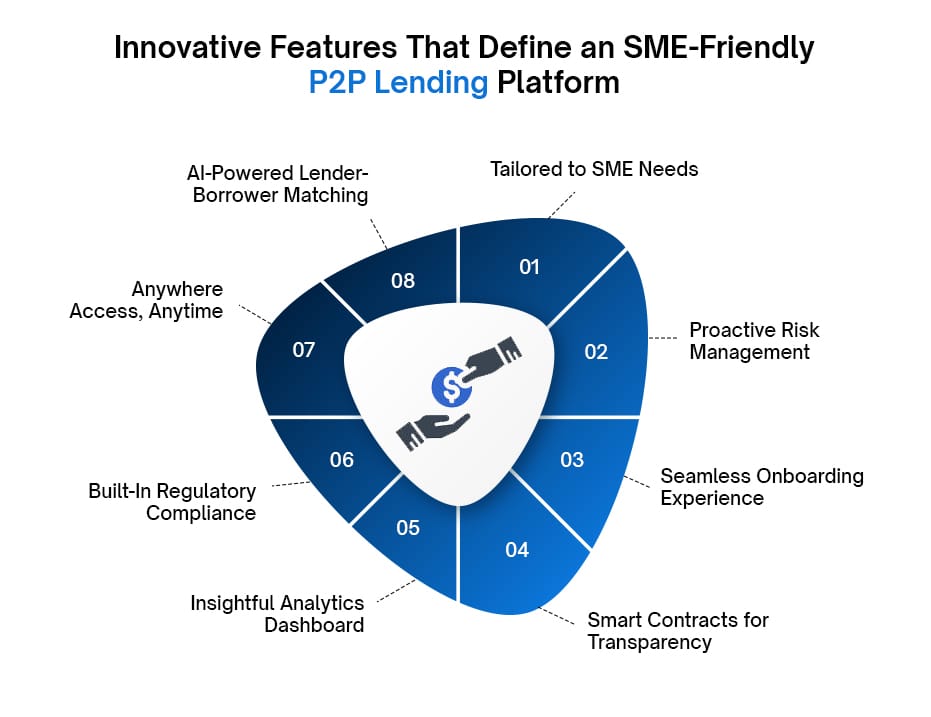

A P2P lending platform software must go beyond basic functionality to truly cater to the unique needs of SMEs. Below, we dive deeper into each feature that contributes to building an efficient, secure, and user-centric platform, offering insights into how they can drive SME financing success.

Customization for SMEs: Tailored Loan Terms for Diverse Needs

SMEs operate across varied industries, each with its own unique financial requirements. A white label P2P lending platform that offers customizable loan products, repayment schedules, and flexible interest rates ensures it caters effectively to this diversity. For instance, an SME in manufacturing may need longer repayment periods, while a tech startup might prioritize shorter-term loans with lower interest.

Risk Management Tools: Advanced Security and Credit Scoring Algorithms

The backbone of any white label P2P lending platform development is its ability to mitigate risks for lenders. Incorporating AI-powered credit scoring, fraud detection, and predictive analytics enhances trust and security, encouraging more lenders to join the ecosystem. These tools can assess borrower reliability in real time, flagging potential risks before they escalate.

Analytics Dashboards: Information for Lenders and Platform Owners

A dynamic dashboard, a real-time data analytical dashboard, works for the borrower so that he would be able to track repayments, for lenders so that they can track investments, and for users or administrators so that they can track the overall performance: one roof, they are all under and they all benefit from transparent and informed decision-making.

Smooth Onboarding: Making User Registration and Verification an Easy Process

Intuitive and fast onboarding reduces customer drop-off. Examples include digital document upload, KYC (Know Your Customers) requirements, and tutorial systems for new users registered in the system: these features simplify the registration process, making such P2P lending platform software less daunting and accessible to SMEs.

Automated Contracts: Transparent Agreements Using Smart Contracts

These smart contracts in white label P2P lending platform development provide an assurance that all agreements are between lenders and loaners that are tamper-proof, transparent, and self-executing without needing any intermediaries. This ensures fewer disputes in the form such as the terms of the agreement being enforced automatically.

Compliance Assurance: Integrated Regulatory Module

The very important place to locate a co-designed white label P2P lending platform is that it includes internal compliance that allows global and regional standards to generate a lower legal risk.

Cross-Device Compatible: With Constant Access

It is a need nowadays; SMEs do not want applications and solutions created for only one specific platform. A well-designed platform for mobile and the web gives convenience to lenders and borrowers in accessing services anytime, anywhere, thereby improving user satisfaction and thus engaging the customers.

Intelligent Matching: AI Lender-Borrower Linkage

It is extremely important for a specific P2P lending platform software to match borrowers with lenders. Internal data and criteria analysis by the application used allows AI-created matches to be defined according to the loan amount and preference for interest rates and other matching metrics. Hence, with less mismatch, successful transactions will be relatively more.

These features ensure your white label P2P lending platform is not just functional but also highly competitive in a crowded market. They address critical pain points for SMEs, foster trust among lenders, and create a robust framework for sustainable growth.

Step-by-Step Blueprint for Building Your Own P2P Lending Ecosystem

1. Understanding the Core of a White Label P2P Lending Platform Development

- User Registration and Verification: Just like the lenders, the loan seekers must also be allowed simple, reliable registration processes coupled with verification of identity to establish trust.

- Loan Listings and Market Place: This is the heart of your P2P lending platform software as far as loan requests are concerned; lenders can also browse and fund loans here.

- Risk Assessment and Credit Scoring: A good credit scoring system suitable for use by borrowers will create a good risk assessment opportunity for lending and help generate a credible lending ecosystem.

- Escrow Fund Management: Regulation of the funds in escrow ensures that the disbursement of funds to lenders only takes place once the loan agreements have been satisfied.

- Payment Gateway Integration: Although it is comparatively easy and secure, it will really serve the need for disbursements and repayments.

By knowing these important features, you can customize the white label P2P lending platform to meet the specifications of your business, coming up with an efficient system for SMEs to access loans and offer them.

2. Customizations to Incorporate

Features enhancing user experience and operational efficiency must thus be priorities of your white label P2P lending platform development. Here is a rundown of:

- User-Specific Dashboards:

-Customized dashboards for both borrowers and lenders.

– Visible in real-time: the status of the loan and the repayment schedule.

- AI-Powered Credit Assessment Tools:

– External data source integration provides an all-around picture of creditworthiness.

- Flexible Funding Options:

– Peer-to-peer, pool, or hybrid options.

– Flexible interest rates depending on the borrower’s profile.

- Localization:

– Multi-language support and local currency.,

– Compliance with the region’s financial laws and regulations.

- White-Labeling:

– Personal branding options such as logos and color schemes.

– Scalable architecture as the requirement will grow per SME.

What’s Next? Future-Proofing Your Platform for SME Success

Building a White Label P2P Lending Platform is just the beginning. Ensuring its long-term success requires a forward-looking approach that anticipates market trends, adopts new technologies, and evolves alongside SME needs. Future-proofing your P2P Lending Platform Software is essential to maintain competitiveness and deliver lasting value. Staying ahead of the curve in White Label P2P Lending Platform Development means integrating the latest technologies. Emerging tools and innovations can optimize operations, enhance user experience, and future-proof your platform:

1. Artificial Intelligence (AI):

-

- Use AI-driven analytics for credit scoring and risk assessment.

2. Big Data Analytics:

-

- Leverage data to understand borrower behavior and lending trends.

- Provide SMEs with actionable insights to improve decision-making.

3. IoT Integration:

-

- Utilize IoT data for more accurate credit assessments in industries like agriculture or manufacturing.

What’s Next? Future-Proofing Your Platform for SME Success

The development of P2P Lending Platform Software for small and medium-sized enterprises (SMEs) is very fulfilling and transformative. SMEs are the backbone of economic growth worldwide, yet they are often bedeviled with chronic financial constraints that hinder their forward movement. The white label P2P lending platform helps companies fill the gap so that funds become accessible to SMEs in an easy, inexpensive, and efficient manner.

As a credible provider of white label P2P lending platform development, we offer customized solutions that are specifically designed to address your business requirements. Our methodology streamlines the intricacies associated with platform creation while delivering a feature-rich, secure, and scalable solution.