How Does AI Game Development Enhance Realism in Virtual Worlds?

January 8, 2025

Exploring the Potential of Asset Tokenization Studio

January 9, 2025The rise of crypto neo-banking is revolutionizing global finance, standing at the nexus of blockchain innovation and decentralized ecosystems. As demand for secure, borderless digital banking accelerates, platforms like Revolut have set a gold standard, blending cryptocurrency functionality with seamless user experiences. Developing a crypto neo-bank clone script modeled on Revolut offers a gateway to tap into the booming billion neo-banking market by 2028. These advanced solutions empower businesses to leverage Web3-driven scalability, precision-engineered financial architectures, and transformative crypto integration. In a rapidly evolving digital economy, a Revolut-inspired clone script isn’t just a solution—it’s the blueprint for leading the future of financial technology.

Let’s Begin!

What Creates the Demand for Crypto Neo Banks?

The escalating demand for crypto neo-banks reflects a convergence of technological innovation, shifting consumer behaviors, and evolving business strategies in the financial ecosystem. Here’s an analysis of the trending and latest factors fueling this demand:

- Evolving Consumer Expectations for Digital Financial Solutions

Millennials and Gen Z consumers increasingly expect financial services to align with their digital-first lifestyles. Crypto neo-banks are meeting these expectations by delivering innovative, user-friendly interfaces and the ability to manage traditional and crypto assets seamlessly. Enhanced features like instant transactions, transparency, and flexible payment solutions make crypto neo-banking indispensable.

- Accelerated Adoption of Blockchain and AI

The backbone of crypto neo-banking lies in cutting-edge blockchain technology, which ensures unparalleled security, transparency, and trust in digital transactions. Simultaneously, AI-driven analytics personalize financial offerings, optimize operations, and enhance fraud detection, creating a robust and future-ready financial ecosystem.

- The Rise of Embedded Finance and BNPL Integration

Embedded finance models, including “Buy Now, Pay Later” (BNPL) options, reshape consumer spending patterns. Crypto neo-banks incorporate BNPL features, enabling users to manage their cash flow while leveraging digital currencies, thus driving demand among tech-savvy consumers and merchants alike.

- Regulatory Evolution Driving Market Trust

The gradual maturation of cryptocurrency regulations fosters trust and confidence among consumers and businesses. Regulatory clarity empowers crypto neo-banks to integrate seamlessly with traditional financial systems, attracting institutions and retail users eager to engage with compliant crypto services.

- Strategic Business Adoption Across Multiple Sectors

Industries beyond traditional finance leverage crypto neo-banking for operational efficiency and customer engagement.

a) Fintech Companies : Utilize crypto neo-bank platforms to expand financial product portfolios and customer reach.

b) E-commerce Platforms : Adopt crypto payment gateways for fast, borderless, and secure transactions.

c) Retail Enterprises : Cater to crypto-paying customers, enhancing competitiveness.

d) Investment Firms : Offer clients crypto-asset exposure, capitalizing on the growing digital asset market.

- Financial Inclusion as a Game Changer

Crypto neo-banks bridge gaps in financial access by serving underbanked and unbanked populations globally. Their digital-first approach reduces barriers to entry, unlocking vast new markets and fostering financial inclusion in emerging economies.

- Globalization and Borderless Transactions

The decentralized nature of cryptocurrencies makes them ideal for cross-border commerce. Businesses and individuals prefer crypto neo-banks for their ability to execute fast, cost-effective, and borderless financial transactions, bypassing the inefficiencies of traditional banking systems.

In conclusion, the demand for crypto neo-banks results from evolving financial needs, technological innovation, and strategic business interests. By capitalizing on advancements like blockchain, embedded finance, and regulatory improvements, crypto neo-banks are carving a niche as transformative entities in the global financial ecosystem.

Introducing Revolut: The Benchmark Set For Crypto Neo Banks

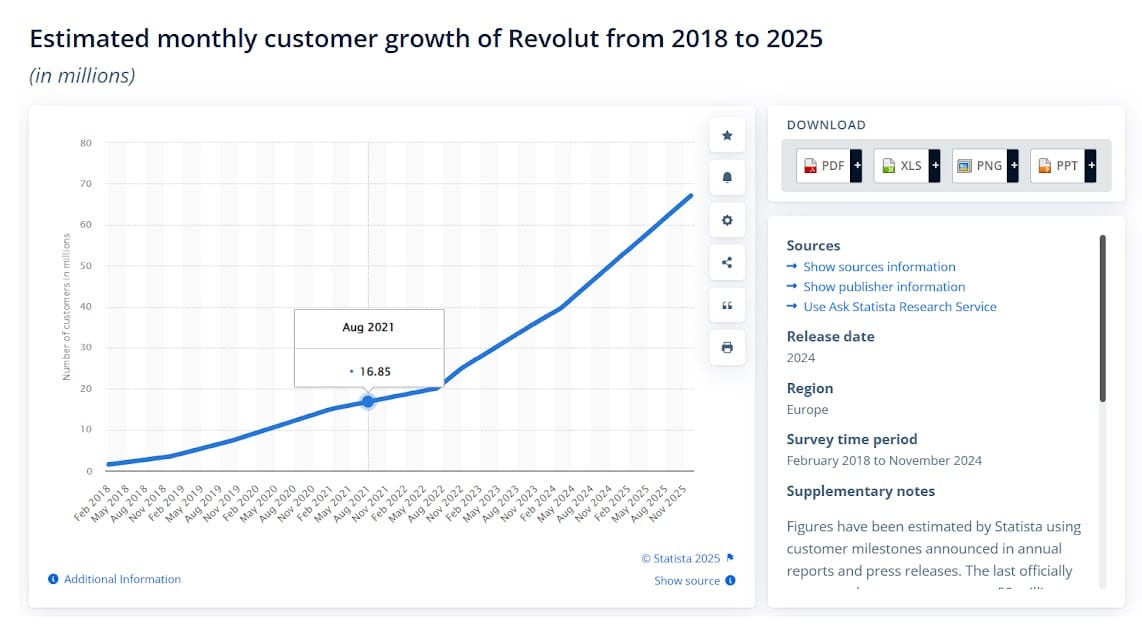

Revolut has surpassed 30 million retail customers globally, gaining over 5 million new users since November 2022. Its customer base now drives more than 400 million transactions every month!

Revolut has ascended to prominence within the fintech arena, establishing itself as a paragon among crypto neo-banks. Founded in 2015, Revolut has demonstrated an unparalleled capacity for rapid user acquisition, boasting a global customer base. Financially, Revolut’s performance underscores its robust business model. In 2023, the company reported revenues of £1.8 billion, marking a 94% increase year-on-year, and achieved a net profit of £438 million. Such impressive financial metrics reflect its effective monetization strategies and operational efficiency, further solidifying its status as a formidable player in the fintech sector.

Source Link : https://www.statista.com/statistics/943068/estimated-growth-of-online-banks-globally/

Moreover, Revolut’s global reach and adaptability have been instrumental in its widespread adoption. With a presence in multiple countries and a user-friendly platform that transcends traditional banking limitations, it has effectively addressed the needs of a globalized economy. This international orientation has enabled Revolut to tap into diverse markets, fostering a broad and loyal customer base. Revolut’s popularity as a neobank is a testament to its innovative approach, strategic market positioning, and commitment to redefining financial services in the digital age. Its success serves as a benchmark for emerging crypto neobanks aspiring to make a significant impact in the fintech ecosystem.

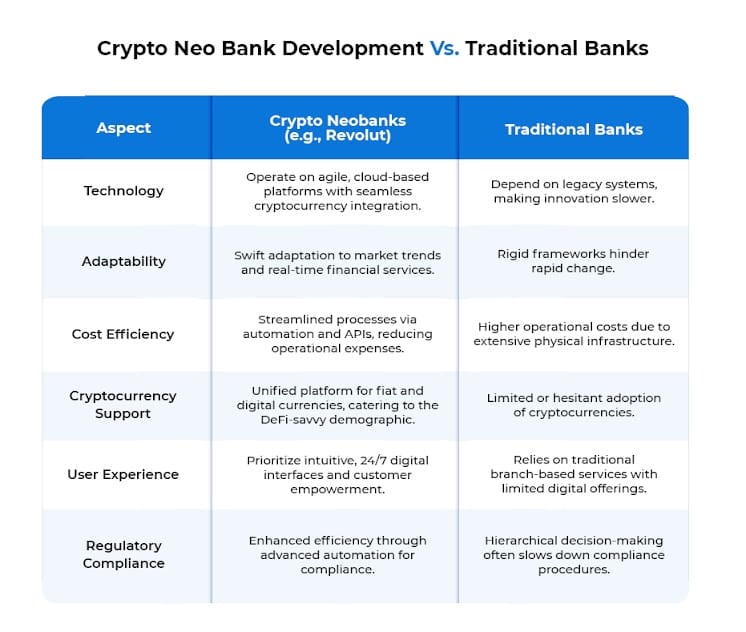

Crypto Neo-Banks like Revolut vs. Traditional Banks

Crypto neobanks like Revolut represent a transformative leap in the financial landscape, leveraging agile, cloud-based platforms to deliver cutting-edge services. Unlike traditional banks, which often struggle with legacy systems, neobanks adapt swiftly to market trends and seamlessly integrate cryptocurrency functionalities. Their cost-efficient operations, driven by automation and APIs, streamline regulatory compliance and reduce overheads.

Furthermore, crypto neo-banking platforms unify fiat and digital currencies, attracting the tech-savvy, DeFi-oriented demographic. Prioritizing 24/7 digital interfaces and customer empowerment, they outpace traditional banks, which remain reliant on physical branches and slower innovation cycles. This evolution positions crypto neobanks as the future of finance.

Must-have Features Needed To Build A Crypto Neo Bank Like Revolut

Building a crypto neo-bank clone script like Revolut demands incorporating cutting-edge features that align with the expectations of modern digital finance users. These features not only set a benchmark for functionality but also ensure scalability and innovation for businesses and fintech institutions looking to thrive in this competitive space.

✓ Multi-Currency Wallet Integration – A versatile wallet that supports fiat and cryptocurrencies is indispensable for a robust crypto neo-bank platform. This feature allows seamless transitions between digital and traditional currencies, catering to the growing demand for diversified asset management. Integrating this functionality in a crypto neo-banking app ensures user satisfaction and enhances global usability.

✓ DeFi and Staking Options – To compete with leading platforms, offering DeFi features such as staking and yield farming is crucial. These functionalities attract users keen on earning passive income through digital assets while setting the platform apart in the crypto neo-bank clone script development landscape.

✓ White-Label Virtual Cards – Provide businesses with customizable virtual cards that enable secure online transactions. These cards empower enterprises to deliver branded financial solutions, enhancing user trust and loyalty.

✓ Prepaid Debit Cards – Offer users reloadable debit cards that ensure easy access to funds for daily expenses. This feature combines flexibility and convenience, making it ideal for personal budgeting.

✓ Buy Now, Pay Later (BNPL) – Integrate installment-based payment options, allowing users to defer payments while maintaining financial transparency through blockchain-driven smart contracts.

✓ API-Driven Ecosystem – Open APIs enable seamless integration with third-party services, expanding the platform’s capabilities. Businesses using crypto neo bank development services can leverage APIs to scale operations without compromising performance.

✓ Savings and Wealth Management – Let users grow their savings with flexible interest rate options while offering tailored investment advice to optimize portfolios.

✓ Crypto Payment Gateway – Provide a seamless way for users to accept payments in cryptocurrencies through websites or apps, backed by automated settlement mechanisms.

✓ Currency Exchange and Forward Contracts – Enable users to exchange multiple currencies, lock in favorable rates, and schedule forward contracts for future transactions, ensuring financial predictability.

✓ Advanced Spend Analytics – Deliver insights into user spending habits with AI-powered categorization and visualized financial trends, helping users make informed decisions.

✓ Joint Accounts – Facilitate shared financial management by enabling multiple users, such as families or business partners, to operate a single account collaboratively.

✓ Crypto Trading and Portfolio Insights – Allow users to trade cryptocurrencies while providing real-time insights to monitor and optimize their portfolio’s performance.

✓ Risk and Fraud Mitigation – Use advanced algorithms to detect fraudulent activities, ensuring compliance with global financial regulations and protecting user funds.

✓ Recurring Invoicing Solutions – Automate recurring billing and invoicing for businesses, simplifying payment collection and providing real-time expense tracking.

✓ Notifications and Alerts – Keep users informed about account activities, transaction statuses, and potential security concerns through instant alerts.

✓ Education and Support Chat – Enhance user engagement by providing financial literacy resources and 24/7 support through AI-powered chatbots or live representatives.

This refined feature set demonstrates how a crypto neo bank clone script development integrates innovation, security, and efficiency into its offerings. A professional crypto neo bank development company ensures that these features address the latest fintech demands, setting the foundation for a revolutionary crypto neo banking app or platform.

Expert Steps: How To Create A Crypto Neo Bank Like Revolut?

Creating a crypto neo-bank like Revolut involves meticulous planning, advanced technological integration, and an in-depth understanding of financial regulations. The following five steps are typically followed by renowned crypto neo bank development companies to build platforms that are not only competitive but also scalable and secure in the fast-evolving digital banking ecosystem.

Step 1 : Market Research and Conceptualization

The first step in building a crypto neo bank platform involves comprehensive market research. This phase identifies target audiences, user demands, and competitive offerings within the space. With insights drawn from established players like Revolut, businesses can define their unique value proposition. The research also involves determining regulatory requirements and understanding technological demands to facilitate both fiat and crypto transactions. This groundwork is essential for tailoring the crypto neo banking app to meet user expectations while ensuring compliance.

Step 2 : Technology Stack Selection and Architecture Design

Choosing the right technology stack is crucial for scalability and security. A well-architected crypto neo banking platform should integrate advanced blockchain technology, cloud infrastructure, and APIs for seamless interoperability. The selection of frameworks and programming languages must also ensure high performance, real-time transaction processing, and top-tier security standards. In this step, businesses also prioritize the building of a robust backend infrastructure that can support millions of transactions while incorporating sophisticated AI algorithms for fraud detection and predictive analytics. Custom neo bank clone scripts are also developed to provide businesses with a solid foundation.

Step 3 : Integration of Cryptocurrency and Fiat Services

Building the foundation of the crypto neo-banking app requires integrating both cryptocurrency wallets and traditional banking services. This involves developing user interfaces and backend modules that facilitate smooth transitions between digital currencies and fiat. Ensuring the security of crypto transactions is paramount, with multiple layers of encryption and blockchain protocols safeguarding users’ assets. Integration with exchange platforms, liquidity providers, and payment gateways ensure seamless transactions and real-time currency conversion. Through a crypto-neobank development company, businesses can efficiently manage the complexities involved in building this crucial functionality.

Step 4 : Compliance Framework Implementation

Compliance is at the heart of any digital banking solution, especially in the crypto space where regulatory landscapes are ever-changing. A dedicated legal and compliance team works to embed AML and KYC processes into the crypto-neobank platform. These measures not only ensure adherence to financial regulations but also build trust with users. Given the global nature of cryptocurrencies, the crypto neo banking app must accommodate diverse regulatory requirements across various jurisdictions. Ensuring this compliance from the start streamlines the operational setup of the neo bank clone script.

Step 5 : Testing, Launch, and Continuous Upgrades

Once the platform is developed, extensive testing phases are undertaken to ensure robustness, security, and functionality. Stress tests, security audits, and user acceptance testing (UAT) are executed to fine-tune the system. After the crypto neo banking app is fully vetted, the launch occurs across targeted regions, with initial marketing and onboarding strategies in place. Post-launch, the continuous enhancement of the platform is vital, with regular updates to introduce new features, improve user experiences, and address emerging security threats. Regular upgrades keep the crypto neo bank development services aligned with user expectations and industry standards.

Building a crypto neo bank like Revolut demands technical prowess, regulatory expertise, and a deep understanding of market trends. Businesses can make sure their crypto neo bank clone script development is ready for success by adhering to these tried-and-true procedures. Engaging with a trusted neo bank company offers an added advantage in navigating the complexities of building a platform that stands out in the competitive fintech landscape.

The Future of Crypto Neo Banks in the Web3 Era

The future of crypto neo banks in the Web3 era is poised for exponential growth, driven by the rapid evolution of DeFi and blockchain technology. As more consumers and businesses adopt digital assets, crypto neo banks will become critical in facilitating seamless, secure transactions across Web3 platforms. AI agents will play a key role in automating processes, enhancing security, and offering personalized financial advice, thus improving the overall banking experience. Investors stand to gain significantly as these banks offer vast opportunities in cross-border payments, crypto lending, and decentralized finance solutions. The demand for crypto neo banking services is expected to rise due to the thriving cryptocurrency market and growing institutional interest. The peak season of crypto activity will see an influx of capital, positioning these platforms as central players in the next-gen financial ecosystem, offering substantial returns for early investors.

Design Your Crypto Neo Bank Clone Script 100X Faster With Us!

Partnering with Antier, a leading crypto neo banking app development company, positions you at the forefront of the rapidly evolving Web3 financial ecosystem. We guarantee that your crypto neo bank is future-ready and success-optimized thanks to our proficiency in cutting-edge blockchain technologies, decentralized finance solutions, and secure transaction systems. Working with us gives you a competitive advantage and allows you to enter the market 100 times quicker than your rivals. Our agile development approach accelerates your solution’s launch, enabling you to seize opportunities, attract investors, and capitalize on the booming crypto market with confidence.