Why Is Arcade Game Development a Smart Investment Opportunity in 2025?

December 23, 2024

The Legal and Regulatory Landscape of Telegram Games

December 24, 2024The Tokenization Market is projected to reach $13.23 billion by 2030, growing at a CAGR of 19.7% from 2023 to 2030. This growth is driven by the rising demand for secure payment solutions, the widespread adoption of digital payment methods, and the increasing prevalence of financial fraud in e-commerce. The push for compliance with stringent PCI DSS regulations further fuels the market’s expansion. Moreover, the increasing use of payment applications across industries presents lucrative opportunities for growth.

MARKET OPPORTUNITIES

The Asia Pacific region offers significant growth opportunities for the market, driven by rapid digitalization. As banks and financial institutions explore blockchain applications, the region is laying a solid foundation for the expansion of tokenization technologies.

A key example of this trend is the recent decision by the Philippines Bureau of the Treasury to issue 10 billion pesos (approximately 179 million dollars) in tokenized treasury bonds. This move, backed by Land Bank and Development Bank of the Philippines, highlights the increasing adoption of blockchain for government securities. This initiative points to a larger trend where blockchain is becoming integral to the financial landscape across Asia.

Beyond Asia, the Middle East and Europe are also embracing tokenization. Countries like the United Arab Emirates and the United Kingdom are paving the way for market expansion with their progressive stance on blockchain and digital assets.

Another notable opportunity lies within the Alternative Asset Management industry. Tokenization can significantly streamline, automate, and simplify various stages of alternative investments. By enabling enhanced portfolio customization, automating capital calls, and boosting liquidity and collateralization, tokenization could potentially unlock an additional $400 billion in annual revenue for the sector, benefiting both institutions and individual investors alike.

Global Tokenization Market Analysis by Application

As online shopping continues to surge, eCommerce businesses are increasingly prioritizing payment security. Tokenization plays a crucial role in protecting sensitive data, making it significantly harder for cybercriminals to access personal information, even in the event of a data breach. While it may not completely eliminate breaches, tokenization significantly reduces the financial impact of such incidents. This technology offers a smoother user experience without compromising on fraud prevention.

A Cybersource report highlights tokenization as a “win-win-win” for consumers, merchants, and issuers, benefiting all parties in the payment ecosystem. The integration of digital network tokens enhances security and improves the overall customer experience across a wide range of eCommerce transactions. In fact, nearly 95% of Visa card payments in North America are already facilitated through tokenization, with a large share of merchants and acquirer service providers driving this adoption.

According to a global survey conducted at the close of 2023, approximately two-thirds of online merchants reported using some form of tokenization in their payment systems. Nearly 50% of these businesses are utilizing gateway tokens, while 43% have implemented network tokens, showcasing the growing reliance on tokenization for secure, efficient payment management.

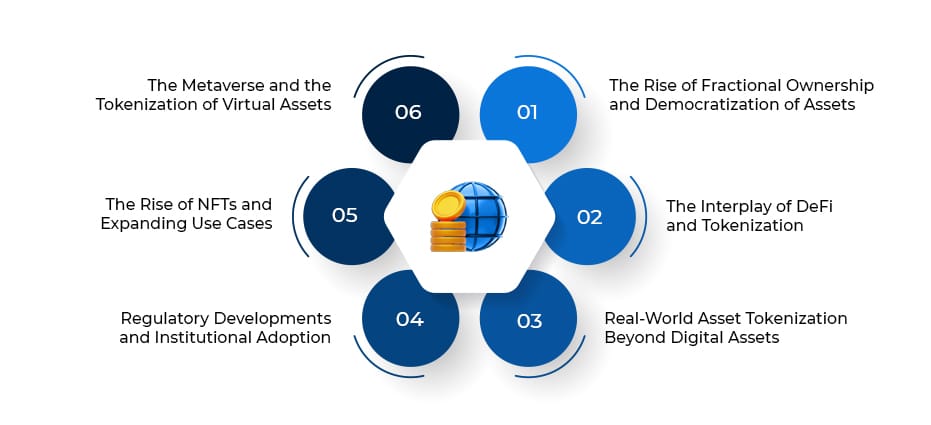

Top Asset Tokenization Trends That Will Dominate 2025

1. The Rise of Fractional Ownership and Democratization of Assets:

- Breaking Down Barriers to Entry: Tokenization allows for the fractional ownership of assets, making them accessible to a wider range of investors. This democratization of ownership opens doors to previously inaccessible asset classes, such as high-value art, private equity, and real estate, for individual investors with smaller capital.

- Unlocking Investment Opportunities: By enabling fractional ownership, tokenization unlocks a vast array of investment opportunities for individuals, fostering greater participation in the global economy.

- Increased Liquidity: Tokenization enhances liquidity for illiquid assets, such as private equity or real estate, making it easier to buy and sell shares in these assets. This increased liquidity can significantly impact market efficiency and investor returns.

2. The Interplay of DeFi and Tokenization:

- Decentralized Finance (DeFi): protocols are increasingly integrated with tokenization, creating innovative financial products and services.

- Yield Farming and Staking: Tokenized assets are being integrated into DeFi protocols, allowing investors to earn rewards through yield farming and staking mechanisms.

- Decentralized Lending and Borrowing: Tokenized assets are used as collateral for decentralized lending platforms, unlocking new avenues for credit access.

- Programmable Finance: Smart contracts enable the creation of complex financial instruments and automated workflows, further enhancing the capabilities of tokenized assets within the DeFi ecosystem.

3. Real-World Asset Tokenization Beyond Digital Assets:

- Shifting Focus: While initially focused on digital assets like cryptocurrencies and NFTs, the tokenization market is increasingly focused on tokenizing real-world assets.

- Real Estate Tokenization: This sector continues to gain traction, with platforms enabling fractional ownership of properties, tokenized rental income, and even the tokenization of entire real estate development projects.

- Supply Chain Tokenization: Tokenization can improve supply chain efficiency by tracking goods, verifying authenticity, and facilitating secure and transparent transactions.

- Commodities Tokenization: Tokenizing commodities like gold, oil, and agricultural products can enhance liquidity, improve price discovery, and facilitate more efficient trade.

4. Regulatory Developments and Institutional Adoption:

- Evolving Regulatory Frameworks: Governments and regulatory bodies are increasingly focusing on developing clear and comprehensive frameworks for tokenized securities, fostering a more regulated and secure environment for investors.

- Institutional Interest: Increasing interest from institutional investors, such as hedge funds, pension funds, and insurance companies, is driving the growth of the tokenization market.

- Compliance and Security: The focus is on ensuring compliance with regulations and enhancing security measures to protect investors and maintain market integrity.

5. The Rise of NFTs and Expanding Use Cases:

- Beyond Art and Collectibles: NFTs are moving beyond digital art and collectibles to encompass a wider range of applications, including ticketing, gaming, and supply chain management.

- Utility NFTs: NFTs are increasingly being used to provide access to exclusive services, membership benefits, and digital experiences, creating new models for membership and access control.

- Real-World Asset NFTs: NFTs are being used to represent ownership of real-world assets, such as real estate, luxury goods, and even physical art, bridging the gap between the physical and digital worlds.

6. The Metaverse and the Tokenization of Virtual Assets:

-

- The Metaverse is creating new opportunities for tokenization, with virtual land, digital assets, and experiences being tokenized and traded within virtual worlds.

- Decentralized Autonomous Organizations (DAOs) are leveraging tokenization to govern virtual worlds and communities within the metaverse.

The Future of Tokenization

The tokenization market is poised for significant growth in the coming years, driven by technological advancements, increasing regulatory clarity, and growing institutional adoption. As the technology matures and new use cases emerge, tokenization will continue to revolutionize various sectors, transforming how we interact with assets and shaping the future of finance, investment, and beyond.