A Step-by-Step Procedure to Building dApps on Avalanche Blockchain

September 30, 2024

Smart Contract Audit- Combating 8 Types of Security Risks

November 7, 2024Cryptocurrency trading has rapidly evolved, and with it, so have the tools that traders use to gain an edge in the market. Automated crypto trading bot development services are now at the forefront of this evolution, offering traders the chance to enter and exit trades without manual intervention. This hands-free approach not only simplifies trading but also opens doors for new investors by making the market more accessible.

Automated trading bots have become popular for a reason: they reduce emotional decisions, allow trading around the clock, and can even replicate the strategies of successful traders in real-time. This is particularly useful for copy trading, where crypto trading bots development solutions replicate the actions of experienced traders, making it easier for new or less-experienced users.

How do these bots work? Also, what does it take to develop a bot that can copy trade effectively? These questions become essential for traders and businesses seeking custom solutions through an AI crypto trading bot development company.

In this guide, we’ll cover:

- What is Copy Trading?

- The Role of AI in Copy Trading Bots

- How Copy Trading Bots Work: A Step-by-Step Breakdown?

- Benefits of Crypto Trading Bots for Copy Trading: Efficiency & Profitability

- Crypto Trading Bots Development Solutions: Building an Effective Copy Trading System

By the end, you’ll have a solid understanding of how automated bot solutions programmed for copy trading can create profitable and efficient investment opportunities.

Copy Trading Essentials: Leveraging AI Crypto Trading Bot Development for Smarter Strategies

Automated crypto trading bot development services have revolutionized copy trading by integrating powerful AI capabilities that ensure speed, accuracy, and accessibility. Let’s dive deeper into how copy trading works and why crypto trading bots development solutions are becoming essential tools for smarter investment strategies.

What is Copy Trading?

Copy trading allows one trader (the follower) to automatically replicate the trades of a more experienced trader (the master). This approach offers multiple benefits:

- Hands-Free Trading: New or busy investors can participate without needing to make each decision manually.

- Learning by Observing: Followers gain insights into market trends and strategies by observing the actions of expert traders.

- Risk Management Options: Most platforms provide tools to manage risks, allowing followers to set limits for loss or drawdown.

The Role of AI in Copy Trading Bots

AI plays a crucial role in crypto trading bots development solutions by improving accuracy and optimizing trade execution. Bots developed by an AI crypto trading bot development company enhance the copy trading experience with

- Speed and Precision

- Data-Driven Insights

- Risk Assessment

How Copy Trading Bots Work: A Step-by-Step Breakdown ?

- Selection of Master Traders

- Traders begin by choosing a master trader to follow based on factors such as past performance, risk tolerance, and trading style.

- Platforms typically offer comprehensive statistics, including return rates and risk scores, to help followers make informed choices.

- Fund Allocation

- After selecting a master trader, followers allocate a portion of their capital to copy their trades.

- This allocation can either be a fixed amount or a percentage of the total available funds, providing flexibility in investment levels.

- Automatic Trade Execution

- Crypto trading bots development solutions handle trade replication instantly, ensuring that followers receive the same entry and exit points as the master trader.

- This quick replication is essential in highly volatile markets where timing is everything.

- Risk Management Tools

- Most copy trading platforms offer risk management features like stop-loss orders and maximum drawdown settings.

- Followers can set limits on losses, adding an extra layer of protection to their investments.

- Portfolio Diversification

- Followers can diversify their investments by following multiple traders with different strategies or asset focuses.

- This diversification helps spread risk, offering more balanced exposure to various market conditions.

Example Scenario:

Imagine a follower who mirrors a master trader specializing in Ethereum. When the master trader buys Ethereum in anticipation of a price increase, the follower’s bot automatically replicates the trade. If the price rises, both the master trader and the follower profit. This automation not only makes the process hands-free but also ensures that all trades are timely and accurate.

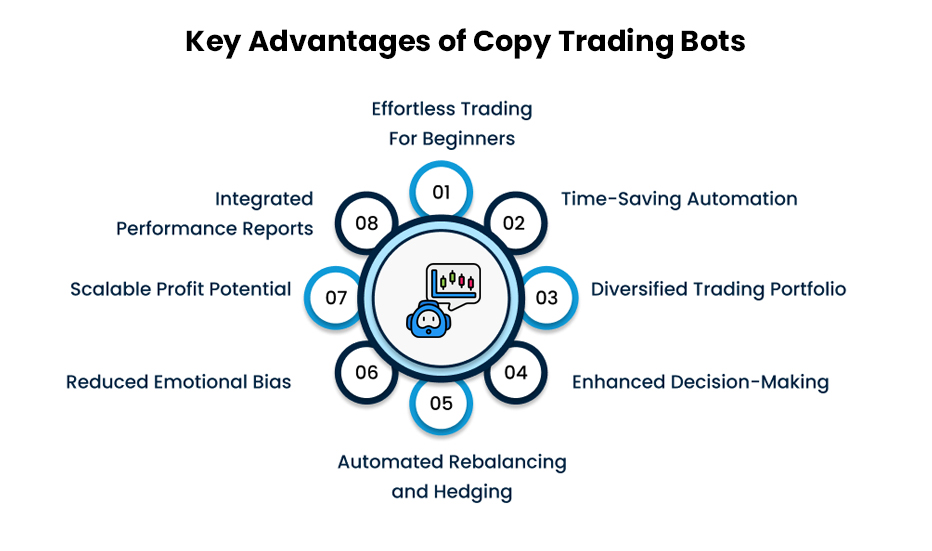

Benefits of Crypto Trading Bots for Copy Trading: Efficiency & Profitability

The crypto trading bots development solutions for copy trading provide unparalleled advantages, helping traders reduce the time, effort, and skill required to profit in the cryptocurrency market. Here are some of the major benefits. Below, we explore the key benefits of using crypto trading bots in copy trading and why partnering with a trusted AI crypto trading bot development company is essential for maximizing success.

1. Effortless Trading for Beginners

Copy trading bots make it easy for newcomers to step into the world of crypto trading, as they remove the steep learning curve, allowing beginners to grow and learn at their own pace. With crypto trading bots development solutions, beginners don’t need to analyze complex market charts or indicators.

2. Time-Saving Automation

With Automated crypto trading bot development services, traders benefit from complete automation, saving significant time and effort. Crypto markets are open 24/7, and monitoring them constantly is impossible for most individuals. Here’s where bots step in to offer round-the-clock trading.

3. Enhanced Decision-Making and Precision

One of the most significant advantages of connecting with an AI crypto trading bot development company for copy trading is the precision and data-backed decision-making they bring to the table:

- Market Pattern Recognition enables more accurate decision-making and optimized entry/exit points.

- Elimination of Human Error, as bots make purely data-driven decisions, leading to better trade outcomes.

4. Scalability and Profit Potential

As traders gain confidence, crypto trading bots development solutions offer scalable options to increase profit potential without additional workload:

- Multiple Strategies: Bots can simultaneously execute multiple strategies across different assets, enabling traders to experiment and diversify.

- High-Frequency Trading (HFT): Bots can be equipped for HFT, allowing them to make small but frequent trades, capitalizing on minor market movements.

- Scalable Capital Allocation: As profits grow, traders can scale up their investments without requiring additional monitoring.

5. Automated Rebalancing and Hedging

Crypto markets can be unpredictable, but automated bots help manage risks through built-in rebalancing and hedging functions with automated crypto trading bot development services.

- Portfolio Rebalancing: Bots can automatically rebalance assets based on market shifts, ensuring that portfolios remain aligned with the chosen strategy.

- Hedging Capabilities: Many bots include hedging options to protect against significant losses during market downturns, stabilizing the portfolio.

- Flexible Risk Adjustment: Bots allow traders to adjust risk preferences, ensuring that investment strategies adapt to current market conditions.

By partnering with an AI crypto trading bot development company, one can access advanced features, adding a layer of security to their trading activities.

6. Real-Time Performance Tracking

Automated crypto trading bot development services often come with performance tracking tools, allowing traders to monitor and evaluate bot performance easily with

-Detailed Analytics

-Strategy Optimization

-Transparency and Control

With real-time performance tracking, traders can make data-backed adjustments, maximizing returns and minimizing risks.

Crypto Trading Bots Development Solutions: Building an Effective Copy Trading System

Creating a successful crypto trading bot for copy trading involves several key elements. To develop an efficient copy trading system, one needs access to robust crypto trading bots development solutions that focus on the following aspects:

-

Core Components of a Copy Trading Bot

A robust copy trading system integrates multiple key components to ensure functionality, user engagement, and consistent trading success. Here are the main elements required:

- Data Collection and Analysis: A foundational element, data gathering allows bots to analyze historical trading patterns, market trends, and real-time price fluctuations.

- Signal Generation: Copy trading bots by an AI crypto trading bot development company must interpret signals from experienced traders. This signal analysis is vital for directing the bot’s actions in buying, selling, or holding assets based on the strategies of these leading traders.

- Execution System: To perform trades accurately, an execution engine is essential, ensuring that followers’ trades align closely with those of expert traders.

- Risk Management Framework: Effective bots incorporating automated crypto trading bot development services prioritize safety by managing risks. This involves setting stop loss limits, allocating capital wisely, and reducing exposure to volatile assets.

- User Interface (UI): A user-friendly UI enables traders to manage their settings, track trades, and review performance.

-

Key Features for Successful Copy Trading Bots

An efficient crypto trading bot must incorporate several crucial features to facilitate reliable performance and user engagement. Below are some essential features that any AI crypto trading bot development company should focus on:

- Real-Time Synchronization

- Customizable Trading Parameters

- Automated Risk Management

- Performance Tracking

- Secure API Integration

By integrating these core features, crypto trading bot development solutions can ensure both functionality and flexibility, providing users with the tools to mimic expert strategies while managing individual risk preferences.

Conclusion

The relationship between AI-driven bots and copy trading strategies creates a feedback loop, where the popularity of one approach fuels the success of the other. With these advancements, crypto trading is no longer limited to experienced traders but is accessible to a broader audience. Automated crypto trading bot development services by experienced professionals streamline processes, enabling traders to engage in markets with minimal manual intervention.

For individuals and businesses looking to enter the automated trading space, working with a specialized AI crypto trading bot development company like Antier can be a wise investment. We have an established reputation for providing advanced trading solutions that cater to various trading needs, from beginner-friendly interfaces to complex algorithmic trading models.