A Complete Guide to Telegram Mini Apps in 2024

November 5, 2024

How to Launch Your Board Game in Just 2 Weeks

November 6, 2024A tectonic shift is underway as the crypto world gravitates towards on-chain trading. The movement birthed from the bigger self-custody revolution of 2022–23 propels the DEXs into the limelight.

We’re nearing the end of a fantastic year for on-chain exchanges (just another name for DEXs). As per the 2024 Q3 crypto industry report, CEXs already lost a significant share when spot trading volumes on off-chain exchanges plunged to $3.05 trillion. On the other hand, DEXs were on a roll. Even when writing this post, we see DEXs to CEXs spot trading volumes taking off, traversing the never-before 14.5% mark.

On-chain exchange platforms enable transparent, permissionless, trustless trading on the blockchain, empowering users to maintain control over their assets without intermediaries. In 2025, the trend of on-chain exchange development is going to accelerate, instigating businesses to tap into the proliferating demand for digital asset trading solutions. Without much ado, let’s explore:

How is 2025 the best year to launch your on-chain exchange platform?

The DeFi is transforming how financial services are accessed. The shift towards secure, transparent, and user-driven solutions is causing on-chain exchanges to gain prominence, pushing them to be at the forefront of revolution.

As more users seek transparency and control over their transactions, they get inclined towards on-chain trading platforms. Businesses follow their lead, entering the on-chain trading business to capture the hype.

With 2025 on the horizon, mastering on-chain exchange development has never been more important. Let’s discuss key reasons why on-chain trading platforms will witness exponential growth in 2025.

- Maturity of Scalability Solutions

Scalability has long been a bottleneck for decentralized exchanges. However, by 2025, layer-2 solutions (like Polygon, Optimism, and Arbitrum) and advanced sharding protocols will have matured, enabling higher transaction throughput with significantly lower gas fees. Now that layer 3s have also arrived, one can expect enormous blockchain scalability in 2025. This scalability allows on-chain exchange platforms to compete heads-on in terms of speed and cost with centralized counterparts.

- Regulatory Clarity

Governments and regulators worldwide are beginning to clarify policies surrounding DeFi, on-chain trading, and cryptocurrencies. By 2025, we can expect more defined regulations that promote innovation while protecting users, further legitimizing and encouraging on-chain exchange development. Recently, the SEC proposed various rules for DEXs that, according to Coinbase’s legal head, could stifle innovation and inflict inoperable compliance burdens on on-chain trading platforms.

- User Adoption and DeFi’s Rising Dominance

The adoption of DeFi protocols continues to grow, with billions in value already locked in decentralized applications ($87.50 billion recorded on August 27, 2024 by Statista). As users become more familiar with DeFi platforms and the benefits of self-custody, the demand for on-chain trading and therefore on-chain exchanges will skyrocket, making 2025 a landmark year for decentralized trading platforms.

- Institutional Participation

Institutions are increasingly turning to DeFi and tokenized assets for liquidity and transparency. As institutional adoption of blockchain technology and digital assets grows, the demand for secure, scalable, and regulated on-chain exchange platforms will further propel the space. 2024 saw the crypto ETF approvals of two titans of the industry: Bitcoin and Ethereum. The coming year can feature new crypto ETFs and therefore more institutional investments in the space.

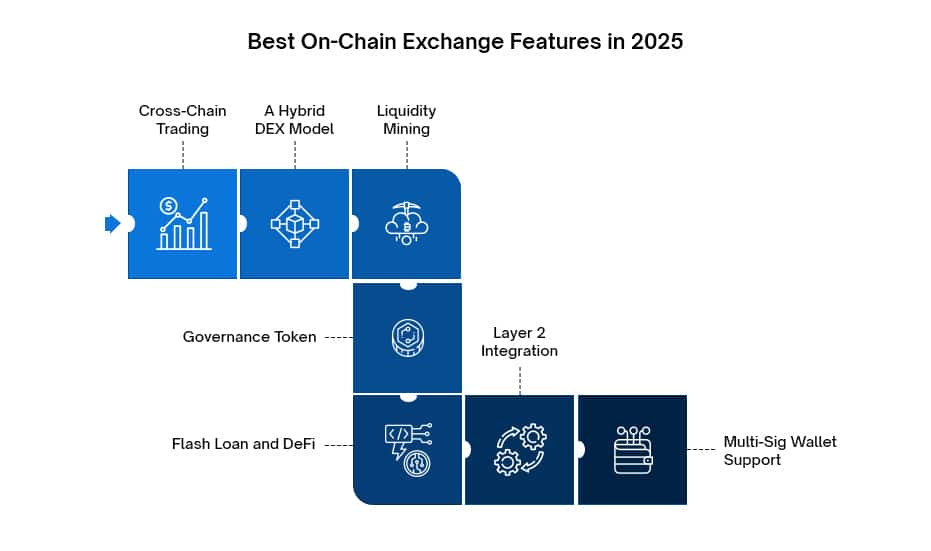

Building a Trendsetter On-Chain Exchange: Best Features To Integrate

To stand out in the highly competitive landscape of on-chain exchanges in 2025, your platform must be equipped with features that align with user expectations and the latest technological advancements.

To stand out in the highly competitive landscape of on-chain exchanges in 2025, your platform must be equipped with features that align with user expectations and the latest technological advancements.

Below are the best features to integrate into your on-chain exchange development.

- Cross-Chain Trading

Interoperability between different blockchains is a crucial factor determining the future readiness of exchanges and other Web3 solutions. Users want to trade assets across multiple blockchains without leaving the on-chain exchange platform. Consider integrating cross-chain functionality that allows seamless trading between ecosystems like Ethereum, Binance Smart Chain, Base and Solana.

- AMM and Order Book Hybrid Model

While AMM-based exchanges like Uniswap have proven to be extremely popular, incorporating a hybrid model with order books and AMMs to attract traders who prefer the traditional trading experience. A hybrid model gives your users the flexibility to choose their preferred trading method and therefore increases the utility of your on-chain exchange platform.

- Liquidity Mining and Yield Farming Incentives

Liquidity mining and yield farming have been major drivers of DeFi growth. By offering attractive incentives for liquidity providers, your on-chain exchange can ensure ample liquidity and attract more users to the platform. The customizable liquidity pools feature initiated by the Balancer is also gaining prominence due to its ability to allow users to create and manage liquidity portfolios with varied weights and tokens.

- Governance Token for Decentralized Governance

Empower your users by allowing them to participate in the governance of the on-chain exchange platform through governance tokens. Decentralized governance ensures that decisions regarding platform updates, fees, and new features are made by the community, enhancing trust and engagement.

- Flash Loans and DeFi Integrations

Offering advanced DeFi features such as flash loans—unsecured loans that must be repaid within a single transaction block—can appeal to experienced traders. Additionally, integrating with DeFi lending and borrowing protocols can expand your on-chain exchange’s utility, enabling users to do more than just trade on your platform. It also adds more revenue streams to the trading platform, enhancing business profitability.

- Enhanced User Experience with Layer-2 Solutions

Layer-2 scaling solutions, such as zk-rollups and optimistic rollups, will be indispensable in 2025 to ensure fast, low-cost transactions on your on-chain exchange platform. Implementing these solutions improves the user experience and allows your exchange to handle high transaction volumes without congestion or high gas fees. Forward-thinking businesses can also offer a unique value proposition with layer 3 solutions.

- Multi-Signature and Hardware Wallet Support

Security is paramount for any on-chain exchange development. Offering multi-signature wallet options and supporting hardware wallets like Ledger and Trezor ensures users feel safe while interacting with your platform. This is particularly important for high-net-worth individuals and institutional participants.

How To Build Your On-Chain Trading Exchange in 2025?

As more individuals and institutions turn to on-chain solutions seeking transparency, autonomy, and trustless transactional systems, we expect DeFi to touch new heights.

Whether you’re a zealous noobie looking to disrupt the DeFi space or an established enterprise aiming to expand into decentralized trading, there are two key approaches to building an on-chain trading exchange: building from the ground up or leveraging on-chain white label exchange development. Depending on your business goals, technical capabilities, and timeline, you can select any of these development methodologies.

Building From the Ground Up

Do you want complete control over development and the liberty to customize every aspect of the platform? It’s the best-suited approach for your on-chain crypto exchange development. Always opt for this approach when you want to integrate cutting-edge technology and create a unique offering that actually gives you an edge over competitors.

Key Steps to Build an On-Chain Exchange Platform From Scratch:

Step 1: Determine Core Features and Market Positioning

- Define the segment of traders you want to target—high-frequency traders, institutional investors, or retail users.

- Settle on whether your exchange focuses on meme coins, specific asset classes such as tokenized real-world assets, NFTs, cryptocurrency derivatives, and futures, or is it going to be an all-inclusive platform.

- Decide on the core features of your on-chain exchange platform, such as automated market makers (AMMs), order books, cross-chain interoperability, and yield farming options.

Step 2: Choose a Robust Blockchain Infrastructure

- Pick a blockchain network that aligns with your scalability and security needs. Options like Ethereum, Polygon, Base, or Solana are popular due to their decentralized ecosystems and advanced smart contract capabilities.

- Leverage layer-2 solutions like zk-rollups or optimistic rollups to enhance scalability and minimize transaction fees, ensuring a smooth trading experience. Harnessing the expertise of your crypto exchange development company, you may also explore prominent layer 3 solutions

Step 3: Smart Contract Development and Security Protocols Integration

- Set up smart contracts to automate trading, token issuance, liquidity management, and staking. Ensure these smart contracts are optimized for security, efficiency, and upgradability.

- Conduct thorough security audits with the help of reputable blockchain auditors and on-chain exchange development companies. Continuous vulnerability testing is pivotal to prevent breaches and ensure a hack-proof trading environment.

Step 4: UI/UX Design

- Create an irresistible and seamless UI/UX to make it hard for your customers to leave you and easier for newcomers to join.

- Coordinate with your crypto exchange development company to ensure a clean design that gives effortless access to the platform’s features and top it off with customizable dashboards and fast transaction speeds.

- As per a recent report, 4.88 billion people own mobile phones worldwide. Given the increasing demand for mobile trading, you must optimize your on-chain exchange for mobile devices, ensuring users can trade on the go.

Step 5: Integrate Liquidity Solutions

- Incentivize liquidity providers to supply assets to your exchange by offering yield farming and staking rewards and benefits. Liquidity mining is a popular feature that can help bootstrap the initial liquidity.

- Your on-chain crypto exchange development company might help you partner with reliable market-making agencies or may build excellent market-making bots as per your requirements.

- Enable cross-chain liquidity to offer users access to assets from multiple blockchains, increasing trading volume and user engagement.

Step 6: Implement Compliance and Regulatory Tools

- Implement KYC and AML checks within your on-chain exchange platform to comply with local and global regulations. In 2025, many jurisdictions may mandate KYC/AML and other compliance mechanisms for DEXs. Therefore, they will be crucial for gaining user trust and regulatory approval.

- Incorporate governance tokens that allow users to vote on platform changes and participate in crucial decision-making. A reliable on-chain exchange development company can effortlessly create a decentralized governance structure that aligns with regulatory requirements and community interests.

Step 7: Launch and Test

- Before the official launch, conduct beta testing that involves rigorous testing with a small group of users. It helps identify any bugs or inefficiencies before they hamper the user experience. The on-chain exchange platform’s security, liquidity, and performance must meet or exceed industry standards.

- Building a strong community around your on-chain exchange will drive early adoption. Engage with users through forums and social media, and incentivize participation in governance.

Leveraging On-Chain White Label Exchange Development

It’s not necessary to reinvent the wheel. You can launch your on-chain trading platform in just 7 days with competent on-chain white label exchange development. It bypasses the complex process and makes development quick and cost-efficient. The smart solution offers a ready-to-deploy on-chain, customizable trading platform that you can rebrand to save significant time and resources. The benefits? You tap into a proven model, faster time to market, thousands of dollars saved, built-in security and compliance, and whatnot. The only condition? You need to find a good on-chain white label exchange development company.

4 Steps To Launch With On-Chain White Label Exchange Development Solution:

Step 1: Choose a White Label Provider

The only time-consuming and challenging task is to find yourself a reliable white label on-chain exchange provider. Research and select a reputable white label provider with sufficient experience in on-chain exchange development, commendable implementations, and pocket-friendly pricing. Ensure the provider offers robust support, highly scalable solutions, and all the features you need.

Step 2: Customize Your Platform

Work with the provider to customize the platform’s branding, interface, and features. Add elements that will differentiate your on-chain exchange platform from competitors, such as specialized trading pairs, liquidity pools, yield farming options, futures trading, or anything else.

Step 3: Integrate Liquidity and Trading Pairs

Leverage existing liquidity options provided by the white label platform or bring in your own liquidity providers to ensure a seamless trading experience. Add popular or niche trading pairs based on your target audience’s needs.

Step 4: Launch and Market

Once your on-chain exchange is customized, tested, and ready for launch, focus on building an engaged user base. Run promotional campaigns, incentivize early adopters through rewards or governance tokens, and ensure strong community management to drive adoption.

Final Word

The year 2025 promises to be a watershed moment for on-chain exchanges. As the world moves toward greater decentralization and self-sovereignty, DeFi will expand beyond cryptos, and more on-chain activities are opined to happen.

Mastering on-chain exchange development is key to staying ahead in the DeFi ecosystem. Whether you’re an entrepreneur or investor planning to take over the crypto and DeFi space with unique custom-built or a robust on-chain white label exchange development solution, Antier can assist you in taking advantage of the on-chain popularity surge.

We house the top 1% of crypto exchange development talent so no matter how unique or demanding your idea is, we have got you covered. Let’s come together to create a thriving on-chain exchange platform.

Your budget, your idea, your timeline and our unparalleled technical expertise will set an incredible on-chain exchange development environment.

Share your requirements today!