Slot Game Development: The Beginner’s Guide

September 27, 2024

How to Build White Label ICO Software in Just 7 Days?

September 27, 2024The world of cryptocurrency is a whirlwind of innovation, constantly evolving with new approaches and strategies for maximizing profit. One such strategy, arbitrage trading, has been around for some time, but it’s undergoing a radical transformation thanks to the power of Artificial Intelligence (AI).

Trading through crypto arbitrage software involves capitalizing on price discrepancies between cryptocurrency exchanges. Imagine buying Bitcoin at a lower price on Exchange A and then instantly selling it for a higher price on Exchange B – that’s the basic principle. However, the challenge lies in speed and efficiency. Human intervention isn’t fast enough to capitalize on these fleeting opportunities. Enter the AI trading bot development, specifically the crypto arbitrage AI bot.

In this article, we’ll explore the answers to some questions that simply pop into mind when we talk about crypto arbitrage bots. Dive in to gain a better knowledge of how they are an excellent solution for generating profits.

-How ML and AI-Powered Advancements Enhance Crypto Arbitrage Software Trading?

-Crypto Arbitrage AI Bot vs. Traditional Automated Bots: What’s the Difference?

-What are the Key Insights for Developing AI-driven Crypto Arbitrage Software?

-Maximizing Profits with AI in Arbitrage Trading: How Effective is a Crypto Arbitrage AI Bot?

Let’s get started then-

How do ML and AI-powered advancements enhance crypto arbitrage software trading?

The future of crypto trading lies in the synergies between artificial intelligence (AI), machine learning (ML) and blockchain technologies. When applied to crypto arbitrage software, AI and ML bring about significant improvements that can optimize profitability.

AI’s Edge: A Closer Look

- Enhanced Decision Making: AI trading bot development doesn’t just mean crafting a trading tool; but a strategic partner. By analyzing historical and real-time market data, a crypto arbitrage AI bot can identify trends, correlations, and potential arbitrage opportunities that often escape human detection. This precision and speed significantly increase the likelihood of capturing profitable trades.

- Predicting the Future: AI’s predictive analytics capabilities are nothing short of remarkable. These models factor in various elements like market conditions, and sentiment analysis of news and social media, providing forecasts with higher accuracy.

- Adapting to Change: AI bots are not rigid; they’re adaptable. They can learn from new data, adjust their trading strategies accordingly, and evolve. This means they’re equipped to navigate the ever-changing crypto landscape and capitalize on emerging opportunities.

- Risk Management Maestro: AI is a master of risk management. AI algorithms can analyze multiple risk factors, assess portfolio efficiency, and recommend allocation methods to minimize risk while maximizing gains. Integrating such abilities into arbitrage bots yields a balanced, optimized trading approach.

- Market Efficiency Catalyst: The widespread adoption of AI-powered crypto arbitrage software is driving market efficiency. The bots quickly identify and exploit pricing inefficiencies, leading to more balanced and fair market conditions. This benefits the entire trading ecosystem by reducing spreads and enhancing liquidity.

- Compliance and Security Sentinel: AI is a vigilant guardian of regulatory compliance and security. AI trading bot development can be programmed to flag suspicious activities, identify potential cybersecurity threats, and ensure adherence to regulatory requirements. This maintains the integrity of the crypto market and protects traders from fraudulent behavior.

- Sentiment Analysis and NLP: AI’s natural language processing (NLP) capabilities allow the crypto arbitrage AI bot to analyze news articles, social media posts, and other textual data to gauge market sentiment. This valuable insight empowers traders to make more informed decisions based on the prevailing market mood.

While robust data infrastructure, quality datasets, and skilled professionals are needed for successful AI/ML arbitrage bot development, regulated and ethical adoption ensures fair, transparent markets.

Crypto Arbitrage AI Bot vs. Traditional Automated Bots: What’s the Difference?

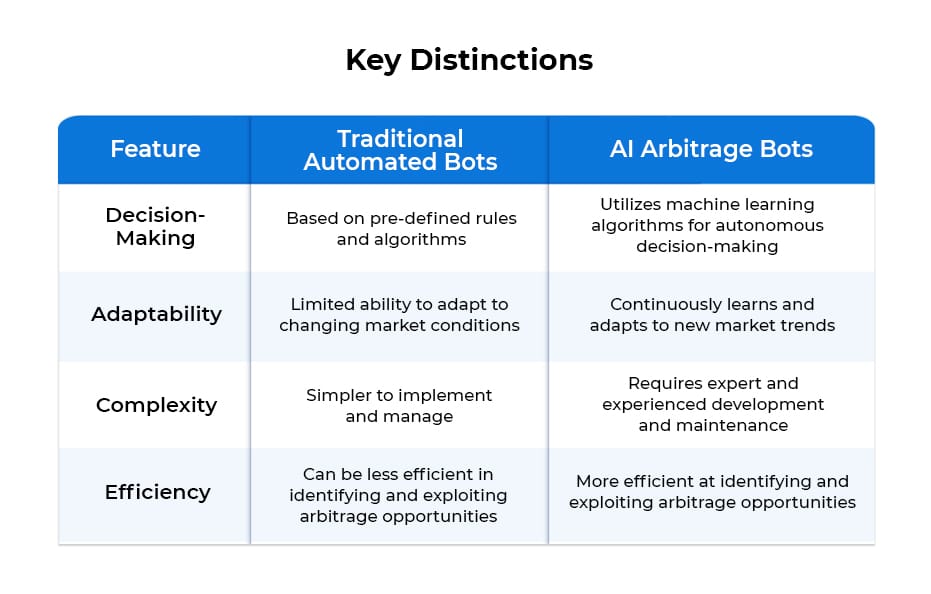

When it comes to crypto arbitrage software, there’s a clear distinction between traditional automated bots and AI-powered arbitrage bots. While both aim to capitalize on price discrepancies across different exchanges, their underlying technologies and capabilities set them apart.

Traditional Automated Bots: A Rules-Based Approach

Traditional automated bots operate on a set of predefined rules and conditions. They’re essentially programmed to execute trades when specific market criteria are met. For example, a bot might be programmed to buy a cryptocurrency on Exchange A if its price is lower than on Exchange B by a certain percentage. While these bots can be effective in certain scenarios, they have limitations. They struggle to adapt to rapidly changing market conditions and may miss out on opportunities that require more nuanced decision-making.

AI Arbitrage Bots: Learning and Evolving

A crypto arbitrage AI bot, on the other hand, is powered by machine learning algorithms. AI trading bot development enables the bots to learn from historical data, identify patterns, and make more informed decisions. Unlike traditional bots, AI arbitrage bots can adapt to changing market conditions and discover opportunities that might be overlooked by their rule-based counterparts.

Why AI is Taking the Lead?

The ability of AI in the crypto arbitrage software to learn, adapt, and make more informed decisions gives its users a significant advantage over traditional automated bots. In the fast-paced market where conditions can change rapidly, AI’s flexibility and intelligence are essential for maximizing profits.

What are the Key Insights for developing AI-driven crypto arbitrage software?

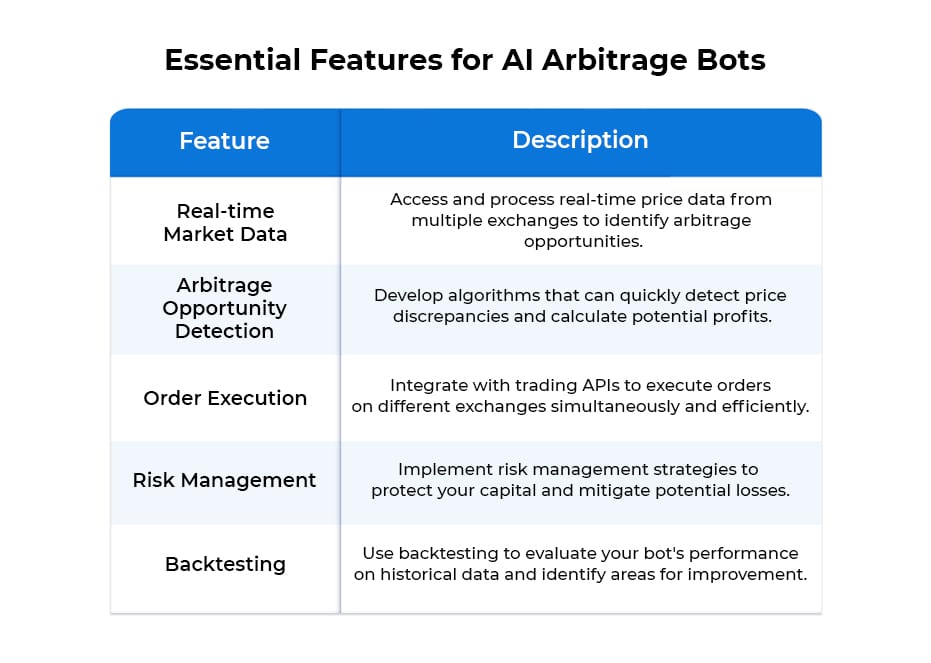

A powerful AI trading bot development requires a solid foundation. There are some key components to consider.

The foundation of a crypto arbitrage AI bot requires:

- Robust Data Infrastructure: Access to high-quality, real-time market data is crucial. This includes price data from multiple exchanges, order book information, and relevant news and sentiment analysis.

- Scalable Technology Stack: Choose a technology stack for your crypto arbitrage software that can handle the demands of high-frequency trading. This includes a powerful programming language like Python, a reliable database, and a fast trading API.

- Machine Learning Algorithms: Select appropriate machine learning algorithms for tasks like pattern recognition, prediction, and optimization. Consider using techniques such as time series analysis, reinforcement learning, and deep learning.

Best Practices for AI Arbitrage Bot Development

- Continuous Learning: Regularly update your bot’s algorithms with new data and adapt to changing market conditions.

- Rigorous Testing: Thoroughly test your bot after AI trading bot development in a simulated environment before deploying it to live markets.

- Risk Management: Implement robust risk management strategies to protect your capital and mitigate potential losses.

- Scalability: Ensure your crypto arbitrage AI bot can handle increasing trading volumes and market volatility.

- Security: Prioritize security measures to protect your bot from hacking and unauthorized access.

Maximizing Profits with AI in Arbitrage Trading: How Effective is a Crypto Arbitrage AI Bot?

The world of crypto arbitrage software has been abuzz with the potential of AI-powered bots. However, are these bots truly effective profit maximizers, or are they simply overhyped tools? Let’s take a closer look.

Evaluating the Performance of AI-Driven Arbitrage Bots

-Most early “AI trading bot development” efforts produced lackluster results as the technology was still maturing. The resources needed to create bots that could exploit minute price differences at machine speeds were prohibitively high.

-In recent years, as crypto arbitrage trading software has incorporated more sophisticated AI techniques like machine learning, results have significantly improved. Bots can now analyze vast troves of market data, detect patterns too subtle for humans, and execute trades nearly instantaneously across multiple exchanges.

-Leading platforms like Cryptohopper and 3Commas have seen success incorporating AI features to supplement traditional algorithmic strategies. The crypto arbitrage AI bot enhances existing logic with insights gathered from constant market monitoring.

-For retail traders, the key is choosing reputable platforms that specialize in arbitrage trading. Conduct thorough due diligence on performance metrics and user reviews.

When properly implemented within a rigorous trading framework, AI-powered crypto arbitrage software demonstrates the potential to capture small arbitrage opportunities across numerous exchanges and asset pairs more consistently. For the savvy trader, the AI trading bot development can translate to optimized risk-adjusted returns over time. Continued advances in AI ensure their effectiveness will only strengthen further.

Final Remarks

As illustrated throughout this article, a crypto arbitrage AI bot shows tremendous potential to maximize arbitrage profits through its advanced capabilities. Trading bot development powered with AI will continue to make leaps as more data and computational power become available for refining algorithms.

At Antier, we are at the cutting edge of integrating powerful AI to automate trading strategies on crypto arbitrage software. In addition to offering ready-made arbitrage bots developed by our highly skilled team of AI experts, we also specialize in integrating the bots with existing exchanges or designing fully customized trading platforms outfitted with AI. Our solutions are tailored to leverage the fullest potential of AI-driven arbitrage for maximizing returns. Connect with our expert team to learn more about how we can assist your endeavors.