A recently published report by IBM reveals that businesses using AI in their financial processes enjoy a 33% faster budget cycle time, a 25% reduction in the cost per paid invoice, and a 43% reduction in uncollectible balances. With its ability to process large volumes of data, identify patterns, and generate human-like outputs, GenAI in finance is driving the next wave of digital transformation. This blog unveils the key factors driving the rapid adoption of generative AI in financial services, real-world gen AI use cases in finance, and how Antier, a trusted generative AI development company helps businesses integrate gen AI into their financial operations.

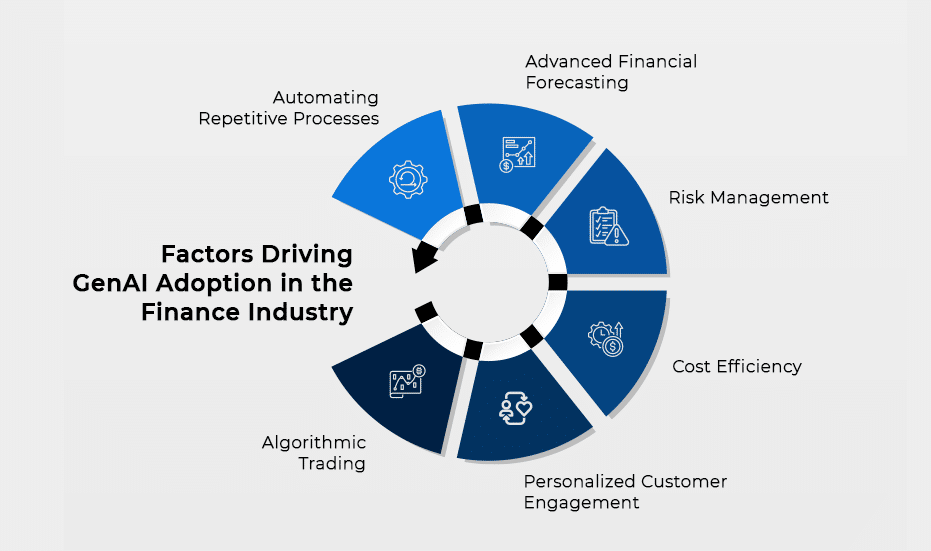

Factors Driving the Adoption of Generative AI in Finance Industry

Automating Repetitive Processes

Financial institutions handle vast amounts of repetitive tasks such as data entry, reconciliation, and report generation. These processes often drain resources and time. Generative AI in finance and accounting enables organizations to automate these tasks and improve operational efficiency. Generative AI models can analyze financial statements, invoices, and transactional data, automatically generate reports, and reconcile financial information with minimal human intervention.

Key Benefits

- Streamlined financial reporting

- Reduced manual errors and faster reconciliation

- Enhanced accuracy in transactional data processing

Advanced Financial Forecasting

Generative AI in finance enables institutions to harness historical data, market trends, and real-time information to make more informed decisions. GenAI tools can generate predictive models that simulate various market conditions and help firms forecast market movements, optimize portfolios, and assess investment risks. By automating data analysis, generative AI significantly enhances an institution’s ability to make strategic decisions with agility, whether in investment management, portfolio rebalancing, or strategic planning.

Key Benefits

- Accurate financial forecasting using AI-generated models

- Improved decision-making with real-time data analysis

- Optimized investment strategies

Risk Management

Financial institutions face constant threats from hacktivists and vandalists. GenAI models can rapidly process large datasets to detect anomalies and predict potential risks in real time. This capability allows institutions to identify fraudulent activities and suspicious transactions earlier and with greater accuracy. Generative AI-driven systems are also helping firms to proactively manage credit risks by analyzing borrower behavior and predicting loan default probabilities.

Key Benefits

- Enhanced fraud detection and prevention mechanisms

- Proactive risk management and credit scoring

- Automated compliance and reporting

Cost Efficiency

Generative AI reduces operational costs by automating repetitive tasks, reducing human errors, and optimizing decision-making processes. The ability to scale AI-driven systems to handle growing volumes of transactions and data without requiring proportional increases in resources makes GenAI a cost-effective solution for financial institutions. Moreover, AI models can be updated continuously to ensure that firms remain competitive and responsive to market changes without major infrastructure investments.

Key Benefits

- Lower operational costs through automation

- Scalable AI solutions for handling large datasets

- Ongoing cost savings from improved efficiency

Personalized Customer Engagement

Financial institutions are leveraging generative AI in financial services to offer hyper-personalized customer experiences. Chatbots and virtual assistants powered by GenAI provide 24/7 support to customers, address queries and offer financial advice. Generative AI also helps in creating tailored financial products by analyzing customer behavior, preferences, and risk profiles. This leads to more personalized offerings such as customized investment portfolios, lending solutions, and insurance products.

Key Benefits

- Real-time customer support through AI-powered chatbots

- Customized financial products and services

- Enhanced customer experience with predictive insights

Algorithmic Trading

Algorithmic trading involves using complex algorithms to execute trades at optimal times, based on market data and predefined strategies. Generative AI use cases in finance include the development of AI-driven trading systems that can analyze market conditions in real-time and execute trades more efficiently than human traders. Generative AI models simulate multiple trading scenarios and allow institutions to optimize their strategies by predicting how markets will react to specific events.

Key Benefits

- More accurate trade execution

- Data-driven optimization of trading strategies

- Reduced market risks and improved returns

GenAI Use Cases in Finance: Real-World Examples

- Morgan Stanley is using Gen AI to create personalized financial plans for their clients while considering factors such as risk tolerance, investment goals, and lifestyle preferences.

- Swiss Re is using Gen AI to develop more accurate risk models and to better assess and manage risks associated with various insurance products.

- JPMorgan Chase has implemented Gen AI-powered chatbots to provide 24/7 customer support, answer inquiries, and assist with simple transactions.

- Wells Fargo is using Gen AI to create highly personalized marketing campaigns and target customers with relevant offers and promotions based on their preferences and behavior.

- Allstate is using Gen AI to detect insurance fraud by analyzing claims data and identifying inconsistencies or suspicious patterns.

How Antier Helps Businesses Integrate GenAI into Their Finance Operations?

As a trusted generative AI development company, Antier helps businesses seamlessly implement Gen AI solutions tailored to their specific financial needs.

Comprehensive AI Strategy Development

We work closely with financial institutions to develop a roadmap that aligns their business objectives with AI-driven solutions. This involves:

- Assessing current operations: Understanding how existing processes can benefit from generative AI.

- Identifying use cases: Identifying high-impact areas where AI can drive operational improvements.

End-to-End AI Integration Services

Implementing AI into finance operations involves integrating it with existing financial systems, data flows, and infrastructure. Antier offers end-to-end integration services to ensure seamless deployment of AI technologies.

- System compatibility: Antier ensures that the generative AI models are compatible with the organization’s existing financial software.

- AI deployment and testing: Our team handles the full deployment process while rigorously testing AI solutions to ensure they deliver accurate, actionable insights.

Custom AI Models for Finance-Specific Applications

As a specialized Generative AI development company, Antier builds custom AI models tailored to specific financial use cases. This includes:

- Credit risk analysis: AI models that evaluate customer creditworthiness based on historical data, market trends, and alternative data sources.

- Automated customer service: AI-driven chatbots that offer personalized, 24/7 support for customers, from managing accounts to providing investment advice.

Conclusion

As Gen AI continues to evolve, its applications in the finance industry are likely to expand further. With Antier’s expertise as a leading generative AI development company, businesses can seamlessly implement AI-driven solutions that enhance efficiency, reduce risks, and improve customer experiences. Whether it’s automating financial reporting, detecting fraud, or optimizing investment strategies, Antier empowers financial institutions to harness the full potential of generative AI.