Top 10 Cryptocurrency Exchange Software Development Companies in 2024

September 17, 2024

How GameFi Brings an Excellent Solution to Key Challenges Faced by Blockchains

September 18, 2024Introduction

Whether you are an existing spot exchange or an emerging future-ready crypto exchange, crypto margin trading is the key to amplifying your market exposure manifold. This unique trading mechanism, which allows individuals to borrow funds to trade larger positions than their actual balance, has become a cornerstone of high-risk, high-reward strategies. Since traders can effortlessly expand their profits significantly, its prominence among crypto traders has increased.

Crypto margin trading platforms are famous among experienced traders as they let them execute complex trading strategies like leverage trading, hedging, arbitrage, mean reversion trading, scalping, momentum trading, etc. As innovations in and around the dynamic crypto space drive adoption rates, we expect more adoption rates and the growing sophistication of traders, which translates into growing demand for crypto margin trading exchanges.

The development of a cutting-edge margin trading platform presents a compelling opportunity for entrepreneurs and established businesses alike. It can be your goldmine for crypto profits as well. Let’s discuss:

- The Opportunity in the Margin Trading Exchange Market

- Top Strategies to Dominate the Margin Trading Exchange Market

- Things to Consider While Building Competitive Crypto Margin Trading Platforms

Also Explore: Understanding Leverage and Margin Trading Exchange: Borrowing For Bigger Battles

The Opportunity in the Margin Trading Exchange Market

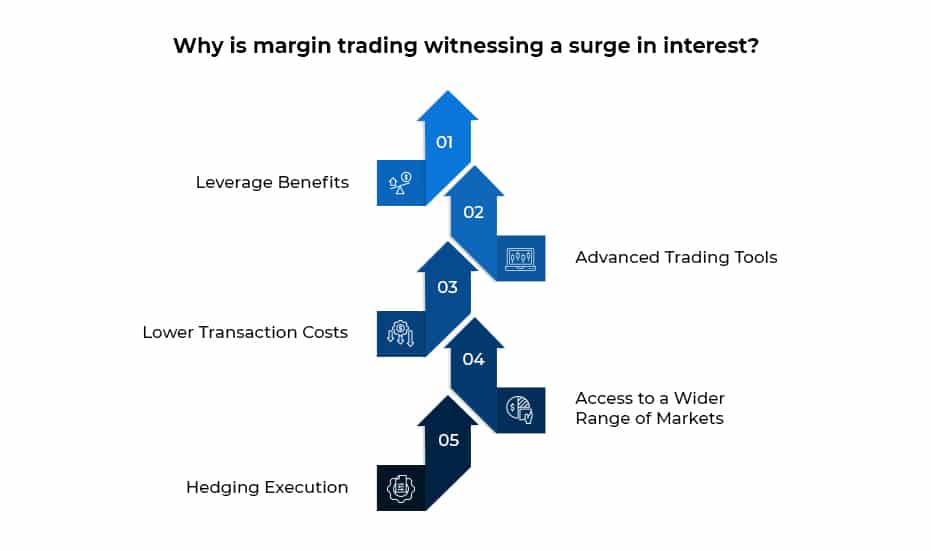

The cryptocurrency market’s volatility creates fertile ground for margin trading to breed and grow. Both novice and experienced traders seek exchanges that offer innovative tools to capitalize on these market variations. This presents a prime opportunity for businesses to tap into the demand and capture market share by developing a feature-rich and highly secure crypto margin trading exchange. Apart from this, the following factors drive the demand for such platforms:

- High-Profit Potential: The demand for margin trading services has increased significantly and is only expected to rise further as traders can earn higher returns on their investments with these platforms.

- Scope for Improvement: While the crypto margin trading market is competitive, there is still room for innovative and well-executed exchanges. A strategic approach is crucial to building a robust platform that meets current demands and anticipates future market trends.

- Industry Growth: The cryptocurrency industry is experiencing enormous growth. A larger influx of retail and institutional investors is causing the proliferation of decentralized liquidity pools, pushing crypto margin trading volume to new heights.

- Technological Advancements: Advances in blockchain and trading technologies are advancing the game with margin trading. One evolving use case is crypto margin trading on DEXs. DeFi protocols facilitate a trustless environment for margin trading, making it more transparent, accessible, and secure.

Also Explore: Understanding Margin Trading on DEXs

- Advanced Risk Management: As traders grow more sophisticated, they expect crypto margin trading platforms to provide automated tools like stop-loss orders, AI-powered analysis, advanced charting tools, liquidation alerts, and risk calculators to safeguard their assets.

With the opportunity comes significant competition and great responsibility on the shoulders of current and emerging players in the crypto margin trading space. Being a pioneer is not an easy endeavor, nor is getting a fair share of the market pie. However, with comprehensive research, the right approach, and flawless execution, one can accomplish their goal. Let’s now discover how to position themselves as a leading crypto margin trading exchange in 2024 and beyond.

Top Strategies to Dominate the Margin Trading Exchange Market

To build a successful margin trading exchange in 2024, it is crucial to address the evolving needs of traders and the competitive landscape. Here’s your checklist for setting up a market-leading crypto margin trading platform.

1. Incorporate Advanced Risk Management Tools:

Margin trading is inherently risky, but providing advanced risk management tools can significantly enhance user confidence in such platforms.

- Negative balance protection, customizable stop-loss and take-profit settings, and margin call notifications.

- Establish clear margin call procedures and appropriate leverage limits to streamline the liquidation of positions and mitigate risks for both traders and the exchange.

- Collaborate with a reliable crypto margin trading exchange development company to integrate AI-based margin calls and liquidation procedures.

Offering robust risk management features builds trust, reduces liquidation risk, and encourages more users to trade on your platform.

2. Competitive Fees and Flexible Financing Options:

Money matters the most and if traders can save some on your platform, it gives you an upper hand in the competitive market.

- Lure the traders towards your crypto margin trading platform with competitive trading fees, interest-free periods, or tiered fee structures.

- Include spot wallets, margin accounts, and AI-based personalized recommendations reflecting traders’ preferences and risk tolerance.

- Cater to traders with varying risk appetites by offering flexible leverage options from as low as 2x to as high as 100x.

However, remember to strike a balance between leverage and losses with suitable risk mitigation strategies catering to both conservative and aggressive traders.

3. Embrace Multi-Asset Approach:

Tread towards the success of your margin trading exchange by implementing a “one-roof to diverse asset class” strategy.

- Support a wide array of cryptocurrencies. Include Bitcoin, Ethereum, and promising altcoins and tokens to bring aboard Bitcoin backers, meme-coin maniacs, and altcoin advocates.

- Push the envelope by expanding offerings beyond cryptocurrencies to include derivatives, NFTs, ETFs, and other possible assets.

- Top your success-assured crypto margin trading platform development off by including a wide variety of order types, enabling customers to play on different trading strategies.

Multi-asset support not only attracts a diverse user base but also allows traders to diversify their portfolios and explore new markets.

4. High-Performance Trading Engine:

Boost your bottom line by strengthening the core of your crypto margin trading exchange. Enable fast and efficient trades with a highly promising trading engine.

- Invest in a scalable and efficient trading engine created with cutting-edge technologies to handle high trading volumes.

- Partner with liquidity provider or connect with liquidity aggregators or pools to ensure tight spreads, low latency and minimal slippage.

- Leverage advanced algorithms to optimize order matching and execution

Focus on scalability, speed and reliability of your trading engine to ensure top-notch performance of your crypto margin trading exchange.

5. Prioritize User Interests and The Success Follows:

Give your customers a hundreds of reasons to choose your exchange. While you do everything necessary, the significance of a user-friendly interface is unbeaten in attracting and retaining traders.

- Prioritize ease of navigation, intuitive dashboards, responsive mobile apps and prompt and efficient customer support during your crypto margin trading platform development.

- Offer educational resources, tutorials, demo accounts, etc. to onboard new users and help them gain confidence before trading with leverage.

- Adhere to strictest security, regulatory requirements and licensing standards to facilitate a protected and reliable trading environment.

By offering a secure, compliant and user-friendly platform to trade, you can enhance your chances of success in the highly competitive margin trading crypto space.

6. Marketing and Community Building:

No matter how much you have embellished your trading platform with the most utile features and easy-to-use interface, all is waste until you communicate with effective marketing tactics.

- Reach out to potential users through social media, content marketing, and partnerships and build a strong brand identity with a consistent brand voice, color scheme, value proposition focus, etc.

- Foster a vibrant community around your margin trading exchange through relevant forums, events, and frequent social media interactions.

- Apart from this, exchanges must collaborate with top web3 marketing experts to devise strategies for maintaining transparency and building trust.

Conniving and deploying relevant promotion strategies can assist trading platforms in aggressively enhancing their customer base and profits.

7. Integrating Latest Technologies For Enhanced Performance:

Don’t let your exchange catch the dust of time. An ever-evolving margin trading crypto exchange built on a state-of-the-art infrastructure has more chances to succeed than an outdated old-school exchange.

- Integrate AI-powered analytics, automated trading, big data, sentiment, and predictive analysis for real-time market insights.

- Implement IoT elements, and advanced cloud computing techniques to improve data quality, infrastructure scalability, and cost-effectiveness.

- App-chains, layer zero, 2, and 3 integrations, zk and optimistic rollups, etc can significantly improve the performance of margin trading exchanges.

Top crypto exchange development companies can harness the latest technologies to build an all-inclusive, high-end cryptocurrency trading ecosystem with relevant modules.

Also Explore: Top 5 Margin Trading Software Development Companies

Things to Consider While Building Competitive Crypto Margin Trading Platforms

- Regulatory Compliance

- Security and Audits

- Liquidity Management

- Technological Advancements

- Competitive Analysis

- Scalability Requirements

- Integration with DeFi

Also Explore: How to Create Your Leverage and Margin Trading Exchange in 2024

Final Word

With the growth of Web3 and decentralized finance (DeFi), 2024 promises to be an exciting year for competitive and feature-rich crypto margin trading exchanges. Existing margin trading platforms will evolve and new competitors will surface. As competition intensifies, innovation and adaptability will be the keys to long-term success in this dynamic landscape. Identifying the opportunity and having a perfect strategy to put in place can help you achieve the massive success your trading platform idea deserves. So, get ready to become a market leader with innovative and future-ready crypto margin trading platform built by industry’s most experienced exchange development experts.

At Antier, we boast 8+ years of experience in building competitive exchange platforms that are assured to thrive in the booming margin trading crypto market. Explore their portfolio and live demos to gain insights into their technical expertise and strategic foresight.

Schedule a demo now!