8 Essentials of White Label Sports Betting Game Development

September 16, 2024

How to Earn From DotCoin Clone Script?

September 17, 2024Table of Contents

- Cryptocurrency Futures 101 – What are they and how do they work?

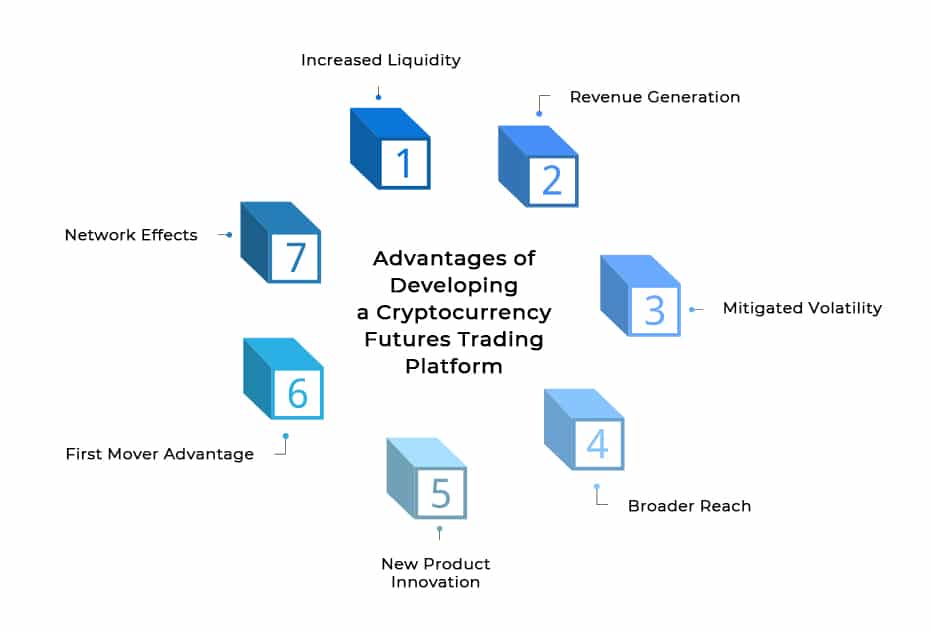

- Advantages of Developing Crypto Futures Trading Platforms

- Costs Involved in Cryptocurrency Trading Software Development

- Components of a Successful Crypto Exchange Development For Futures Trading

- Monetization Models for Crypto Futures Trading Platforms

- Top Crypto Futures Trading Platforms for Development Considerations

- The Road Ahead for Crypto Futures Trading Platforms

- Concluding Words

Futures contracts have long facilitated profiting from price forecasts of traditional assets by locking in a purchase or sale at a preset price for delivery on a future date. Now, the advent of crypto futures trading platforms marks their seamless assimilation into the digital economic sphere. Through these innovative platforms powered by meticulous cryptocurrency trading software development, global traders can partake in the high-return volatility innate to cryptocurrencies using established hedging tools. These trading venues appeal to risk-averse conventional investors as well, enabling speculative positions and risk coverage through standardized contracts. Sophisticated crypto exchange development services invigorate futures trading with seamless onboarding of both retail and institutional participants. This article deep dives into the state-of-the-art crypto exchange development for engineering futures exchange, elucidating both technical and commercial considerations.

Crypto futures are derivative contracts that allow traders to take long or short positions on cryptocurrencies like Bitcoin and Ethereum without physically holding the underlying asset. This section explains the basics, like how exactly the crypto futures trading platforms function.

Cryptocurrency Futures 101 – What are they and how do they work?

Crypto futures are derivative contracts that allow traders to take long or short positions on cryptocurrencies like Bitcoin and Ethereum without physically holding the underlying asset. This section explains the basics, like how exactly the crypto futures trading platforms function.

What are Crypto Futures?

Crypto futures are agreements between two parties to buy or sell a specific amount of cryptocurrency at a predetermined price on a given future date. Unlike spot trading, futures lock prices for future execution, offering strategic exposure management.

Mechanics of Futures Contracts

A crypto futures contract involves two parties agreeing on contract details like size, expiration date, and settlement method. At expiration, the contract is either cash-settled, where profits/losses are settled in fiat currency, or physically delivered, requiring transfer of the underlying crypto asset.

Key Participants

Major exchanges like Binance, CME, and BitMEX are key players in the nascent crypto futures market. Such cryptocurrency trading software development is aimed to attract both retail traders seeking quick gains and institutional investors contributing much-needed liquidity and stability to price discovery.

Leverage: A Double-Edged Sword

Leverage lets traders control large positions with minimal capital, amplifying gains and losses. For example, 10x leverage means a $1 position controls $10 of crypto. While it multiplies returns, even small moves against the position can trigger mandatory liquidation of losses.

Margin and Liquidation

Traders must deposit an initial margin for positions and maintain a minimum balance known as the maintenance margin. If the account balance dips below this level, crypto exchange development is done so that the platform automatically closes positions through a margin call or liquidation to prevent further losses.

Perpetual Futures: No Expiry

Unlike regular futures, perpetual contracts have no expiration date. To track the underlying price, they utilize a “funding rate” mechanism where traders periodically pay or receive fees depending on the difference between the futures and spot prices. This overview explains the fundamental concepts underpinning crypto futures trading platforms and their functions. Let’s now examine some other specifics.

Advantages of Developing Crypto Futures Trading Platforms

Here are the advantages of developing a cryptocurrency futures trading platform with expert crypto exchange development services:

Increased Liquidity

A platform powered by sophisticated cryptocurrency trading software development attracts high-net-worth traders through leveraged contracts. Advanced order matching engines, margins, and depth analytics ensure liquid markets are immune to manipulation.

Revenue Generation

A futures exchange unleashes incomes from trading tax, listing premiums, loyalty programs, and more. Experts in crypto exchange development design customizable fee models for robust monetization optimizing platform utilities.

Mitigated Volatility

Crypto futures trading platforms facilitate classical hedging. Predictive analytics identify support floors, reducing wild swings, making asset valuation ripe for institutional adoption, and stabilizing prices.

Broader Reach

Catering to pro traders and fund managers through bank-grade security and institutional-level features accelerates global scaling. Continuous research maximizes outreach.

New Product Innovation

By regularly incorporating groundbreaking product lines through adroit crypto exchange development services, the addressable market and trading opportunities expand exponentially.

First Mover Advantage

Pioneering a greenfield area with world-class solutions etched significant brand equity and trust advantage, seizing the greatest share in this evolving cryptocurrency trading software development domain.

Network Effects

A robust network of liquidity providers, market makers, and traders catalyzed by stellar infrastructure strengthens with growing participation, making the crypto exchange development increasingly attractive.

Costs Involved in Cryptocurrency Trading Software Development

➡️ Development Costs

These constitute the largest expense and vary based on complexity. Expert crypto futures trading platforms quote competitive pricing for tailor-made solutions integrating trading, wallets, matching engines, risk management, and other modules.

➡️ Infrastructure Costs

Housing the robust platform delivering high throughput necessitates industrial-grade servers and co-location crypto exchange development services. Quality Cryptocurrency Trading Software Development factors these requirements, minimizing the total cost of ownership over the lifecycle.

➡️ Regulatory & Compliance Costs

Prudent legal consultation regarding statutory guidelines and audit procedures for AML/KYC onboarding is mandatory. Factor these while budgeting cryptocurrency trading software development to ensure seamless operations.

➡️ Operational Costs

Expenses for crypto exchange development, including support staffing, marketing, and liquidity costs to boost trading volumes, must be provisioned. Creative monetization backed by sustainable funding models offsets these.

➡️ Maintenance Costs

Regular software fixes, upgrades, and security audits necessitated by the dynamic threat landscape require administrative allocation. Robust architecture and incident response planning by experts curtail long-term maintenance spend on your crypto futures trading platforms.

➡️ Listing Costs

Promoting new trading products entails costs for listing, sponsorship, liquidity incentives, etc. Monetization through premium services and customized fee structures balances this imperative investment.

Overall costs largely depend on scale, complexity, and infrastructure requirements.

Components of a Successful Crypto Exchange Development For Futures Trading

The core components that drive a successful cryptocurrency futures trading platform include the following:

- Matching Engine

- Order Types

- Margin Trading

- Perpetual vs. Delivery Contracts

- Multiple Cryptocurrencies

- Transparent Trading Fees

- Fortified Security

- Intuitive User Interface

- Advanced Functionalities

- Educational Resources

Monetization Models for Crypto Futures Trading Platforms

Operating a successful exchange requires understanding key monetization strategies and professional crypto exchange development services. This section explores various revenue models for platform providers.

➡️ Funding Fees from Leveraged Trading

Perpetual contracts utilize funding rates to ensure the price tracks the spot value over time. Operators earn interest by periodically charging traders funding fees depending on whether they hold long or short positions. Higher trading volumes translate to increased funding income.

➡️ Transaction Fees

Operators levy fees on all trades occurring on the exchange. You can typically charge a percentage of the trade value or a fixed amount per contract for your crypto exchange development project.

➡️ Withdrawal & Deposit Fees

Users can be charged small fees for cryptos deposited into or withdrawn from their exchange wallets for a steady income stream.

➡️ Premium Subscriptions

Top-tier traders can opt for premium APIs or data feeds on the crypto futures trading platforms for an added monthly or annual charge. Advanced order types and reduced fees further boost premium subscriptions.

➡️ Listing & Promotion Fees

Projects desire prime spots on high-volume exchanges to boost visibility. Exchange owners can charge non-recurring fees to fast-track the listings of new tokens or contracts. Promoting select coins also generates advertising revenue.

Top Crypto Futures Trading Platforms for Development Considerations

Here are some of the top futures exchanges worth referring to based on their robust offerings, security measures, and track record:

-Binance

-Bybit

-OKEx

-BitMEX

-Huobi

These leading crypto futures trading platforms have invested heavily in security, infrastructure, and user experience over the years. New entrants seeking cryptocurrency trading software development must match their speed, reliability, and regulatory compliance to succeed in this cutthroat market.

The Road Ahead for Crypto Futures Trading Platforms

The nascent crypto futures market continues to evolve rapidly, driven by technology and rising institutional demand. Let’s check out some emerging trends shaping the future of crypto exchange development services for futures exchanges.

➡️ Advanced Analytics & Algorithms

Predictive market analytics, AI, and sophisticated quantitative trading algorithms can be integrated to gain an edge.

➡️ New Contract Varieties

Beyond perpetual futures, crypto exchange development may launch options, futures spreads and other innovative contracts tailored for specialized use cases and risk profiles.

➡️ Institutional Onboarding

As regulations clarify, institutional participation in crypto futures trading platforms is projected to surge exponentially with their capital and expertise offering much-needed stability.

➡️ Interoperable liquidity

Leading the interchain economy shift, futures DEXs may enable borderless trading of contracts across multiple blockchains while optimizing liquidity.

➡️ Regulatory Sandboxes

Collaborative compliance frameworks like regulatory sandboxes help test progressive products under supervision, facilitating the smooth entry of compliant innovation without upfront costs.

Concluding Words

Crypto futures trading offers both opportunities and challenges for experienced traders as well as prospective platform operators. While competition is fierce among established giants, there is ample room for upcoming exchanges to innovate and carve niches. The keys to success include looking for professionals with deep expertise in cryptocurrency trading software development. Our team at Antier distinguishes itself through unique value propositions, scalable development, and an adaptive organizational culture for building crypto futures trading platforms.