Core Technologies Driving Metaverse Development Solutions

August 5, 2024

Smart Contract Development on Ozone Blockchain – Key Advantages

August 5, 2024Are you even counting yourself as a competitive cryptocurrency exchange if you haven’t yet added leverage and margin trading exchange features to your trading platform?

Well… If you haven’t yet integrated margin trading into your existing exchange or considered it for your exchange development, you are missing a crucial feature (that could influence traders’ choice) and a profitable revenue stream. For once, just look around and you’ll find that all the leading exchanges, worth their fame, have a margin trading module.

Margin trading exchanges replicate the traditional money markets’ “Buy Now, Pay Later” concept. Due to its potential to amplify profits without requiring substantial upfront capital, this standout feature has always garnered the attention of seasoned cryptocurrency traders, making it a pivotal tool for attracting and retaining customers. This makes margin trading exchange software development profitable for existing and upcoming exchanges. Without much ado, let’s dive in to discover:

If you want to know more about margin trading platforms and what makes them different from spot and derivatives exchanges, here’s an in-depth blog you can’t miss.

A Quick Recap Before We Move Ahead:

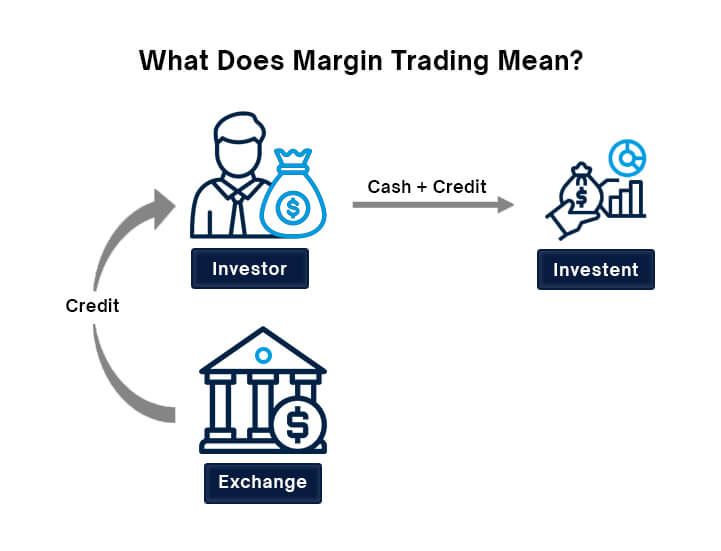

Margin trading is a trading mechanism that involves traders amplifying their purchase power with money borrowed from the exchange. With sized positions, traders are exposed to significant profits as well as risks.

For a detailed explanation, read>>> Understanding Margin Trading

Reasons To Build Your Leverage Trading Crypto Exchange in 2024

As discussed before, crypto leverage trading has become a cornerstone of the modern cryptocurrency landscape. 2024 is poised to be a landmark for crypto, as a confluence of notable events such as Bitcoin halving, ETH and BTC approvals, regulatory developments, SOL spikes, and much more ignited a new era. Let’s shed light on the compelling reasons why one should launch their leverage trading crypto exchange in 2024:

1. Increased Trading Volume With Leverage Motivation:

Leverage on crypto trading platforms may serve as motivation for buyers to enhance their position sizes and keep trading even if they are low on balances, resulting in increased trading volumes. This translates to higher liquidity, profits, and many other benefits for exchanges.

2. Growing Interest in Advanced Trading Tools:

As the market and traders evolve, the demand for robust trading infrastructure with advanced trading tools will increase. With secure, reliable, and fully-featured margin trading exchange software, businesses can capture the growing demand and get on the list of future-proof exchanges.

3. Establishing a competitive edge in the market

As exchanges strategically introduce innovative features and services, their brand reputation gets a boost. This also leads to enhanced competitiveness, customer acquisition, and retention rates.

4. A Bait For Sophisticated Cryptocurrency Traders:

Margin trading is not for faint-hearted traders. Usually, seasoned traders with big-chunk investments invest in these high-risk strategies. So, it goes without saying that a Leverage and Margin Trading Exchange module is a money-spinner integration for trading platforms.

5. Higher Profit Potential For Exchange Operators:

Even if novice traders fall for the money-multiplying bait presented by the margin trading exchanges, they add to the trading volumes and exchange revenues. Moreover, this module adds a lot of income streams, including trading commissions, premium service fees, interest and fees on lent money, etc.

6. Enhanced User Experience

Integrating an advanced margin trading module into your spot trading platform expands the range of trading strategies available to users. So, a leverage trading crypto exchange can significantly enhance user engagement and experience.

Top 6 Popular Margin Trading Strategies

Before getting into the complexities of building a crypto margin trading platform, you must learn how traders often engage with these platforms. Let’s discuss the top 5 margin trading strategies:

1. Day Trading:

Day trading involves utilizing leverage to capitalize on small market fluctuations over a day. This is one of the most popular strategies executed on margin trading exchange software solutions.

2. Scalp Trading:

Similar to day trading, this strategy involves making profits with leverage on small price movements, but the frequency of trades is usually amplified with a trading automation solution. Where a trader may execute 5-7 trades in a day, a scalp trader may perform hundreds of transactions.

3. Long Margin Trading:

Long-margin trading executed on leverage trading crypto exchanges means buying assets using leveraged capital with the expectation that their price will increase. The traders pay back when the price rises and profit is realized after selling.

4. Short Margin Trading:

This strategy involves traders using borrowed capital to buy an asset whose price is going to fall and then immediately selling it. When the price decreases, traders purchase the asset again at the lower price, return it to exchange, and pocket the price difference.

5. Swing Trading:

Swing trading on margin trading exchanges aims to capture gains from market swings by holding positions for several days or weeks.

6. Hedging:

Hedging is a strategy to reduce risk by taking an opposite position in a related asset. This can protect against potential losses in the original position.

Types of Margin Trading

- Leveraged Levels

Some leverage and margin trading exchange software solutions offer varied levels of leverage to cater to different risk appetites.

- Isolated Margin Trading:

In isolated margin trading, the risk associated with a position is confined to a separate margin assigned for that trade.

- Cross Margin Trading:

In cross-margin trading, the risk associated with any position spreads to a shared pool of collateral kept for multiple open positions. It promotes more efficient use of funds but comes with a higher liquidation risk, as all positions can be affected if the collateral value drops significantly.

- Spot and Futures Margin:

Spot margin trading exchanges allow traders to borrow funds to buy cryptocurrency at real-time market prices, while futures margin trading involves leveraging leverage to trade futures contracts. The latter is usually used for hedging and speculating on price movements.

Also Read>>> Centralized Vs Decentralized Margin Trading

How to Create Your Leverage and Margin Trading Exchange in 2024

- Market Research:

Before you enter the leverage trading crypto exchange market, you must be aware of how it works and the different revenue models of margin trading exchanges. After elementary research, get prepared to determine the ideal user profile, analyze the existing margin exchange’s strengths and weaknesses, and stay abreast of industry trends.

- Platform Design and Development:

This phase involves building a robust leverage trading module with a high-performance trading engine, integrating a cold and hot wallet, and intuitive platform design for margin trading exchange software. However, it happens after many consulting sessions that may involve concept ideation, feasibility analysis, solution architecture planning, etc. While you build ensure to opt for a cloud-based architecture that supports scalable and reliable infrastructure.

- Security and Risk Management Implementation:

Security should be the top-most priority for any cryptocurrency exchange project so you must ensure the integration of cutting-edge security features like SSL, encryption, firewalls, etc. Apart from that risk management is a crucial implement for leverage and margin trading exchanges, so integrate robust assessment models that evaluate risks based on profiles, leverage limits, automatic liquidation engine, and efficient collateral management mechanisms.

- Regulatory Compliance

The regulatory environments in the cryptocurrency world are constantly evolving. Apart from the regular KYC/AML implementations, you must take into account basic human rights, user data privacy, and other relevant laws while executing your margin trading exchange software development. The next step is obtaining all the necessary licenses and permits.

- Testing and Launch:

After everything is set up, it is time to rigorously test the trading platform and pinpoint the errors before your excited users find them. Join forces with your technology partner to comprehensively test your leverage trading crypto exchange platform.

- Marketing and User Acquisition:

You immediately need a marketing agency after your technology specialist finalizes your launch dates. Partner with them to develop a strong and unparalleled brand image, and identify and reach your target market. Also, last but not least maintain unwavering commitment to customer satisfaction by offering excellent support, prompt feedback integrations, regular security audits, and top-grade technology updates.

Choosing the Right Margin Trading Exchange Development Company in 2024

If you’re on the lookout for a reliable margin trading exchange software development company, these are some of the things you must consider:

- Experience and Expertise: Look for companies with proven track records and carefully access their portfolios and past projects to gauge their expertise.

- Comprehension of Services: Go with a technology company offering a comprehensive range of services from development to deployment and beyond.

- Security and Compliance: Evaluate the leverage and margin trading exchange development company based on its experience in implementing sophisticated security and regulatory measures.

- Customization and Flexibility: A team of seasoned and expert margin trading platform developers will allow for total flexibility, allowing you to build your preferred user interfaces, margin ratios, order types, etc.

- Client Reviews and Case Studies: Get access to authentic client reviews, and analyze case studies and product demos to learn about the leverage trading crypto exchange development company’s capabilities and quality of work.

- Cost and ROI Analysis: At last, consider all the long-term benefits, short-term expenses, and development efforts, and curate a rational budget for your trading platform. Match with the potential return on investment for a well-informed decision.

Also Read>>> 5 Leading Players in Margin Trading Platform Development: 2024 Edition

Take Away:

The promising cryptocurrency price trends and surging innovations are driving the success of the overall cryptocurrency industry including leading margin trading exchanges.

We are in the second half of the year and this year certainly seems promising and optimistic. The first quarter filled with growths, booms, and ATHs was smacked down by a relatively low and stagnant quarterly growth. Well, this doesn’t mean that the quarter saw downfalls in businesses. Coinbase reporting $1.4 billion total revenue in Q2 amid the challenges and correction-driven market, is your reminder that exchanges can remain sane and profitable even in poor market conditions if built and run strategically. So, you always need a reliable leverage trading crypto exchange development company with unparalleled expertise and proven experience.

However, this market phase certainly wasn’t going to last long. The market has started showing signs of an uptrend after the Ethereum ETF approval and regulatory shifts. And this could be the best time for you to launch your hack-proof, advanced leverage and margin trading exchange platform.

Don’t wait another minute overthinking profitability, share your project requirements right away!