Gamification’s Impact on 3D Immersive Learning Platforms in Modern Education

July 25, 2024

Lessons from the WazirX Hack: How MPC Wallet Can Secure Your Assets

July 25, 2024The winds of change are sweeping across industries, and the financial sector is at the forefront of this transformation. New eras of efficiency and transparency are replacing traditional models, which were formerly dependent on slow, paper-based processes.

This metamorphosis is largely due to the arrival of smart contract development – a technological innovation poised to bridge the gap and create a frictionless financial environment.

“According to Capgemini, Smart contracts can save $480-$960 per mortgage customer and billions for the industry overall. Insurance could save $21 billion, with premiums dropping $45-$90 per customer. Investment banks stand to gain $2-$7 billion annually from faster trade settlements.”

This analysis underscores the rapid expansion of smart contract development services in the financial industry.

Let’s walk through the intricacies of smart contract development, exploring how they work, the key players involved, and the transformative impact they can have on the financial services industry.

Understanding How Financial Smart Contracts Work

Smart contract development eliminates the need for intermediaries, reducing costs and processing times by encoding the terms of a contract directly into code. These digital agreements can access real-time data and execute actions based on predefined conditions, ensuring transparency, efficiency, and accuracy.

Key players in the smart contract ecosystem for finance include:

- Transacting Parties: These are the individuals or institutions entering a financial deal.

- Financial Institutions: Banks, insurers, etc., act as custodians, holding onto assets and verifying transactions authorized by the smart contract.

- Regulators/Auditors: These guards ensure the system adheres to financial regulations and mitigates potential risks.

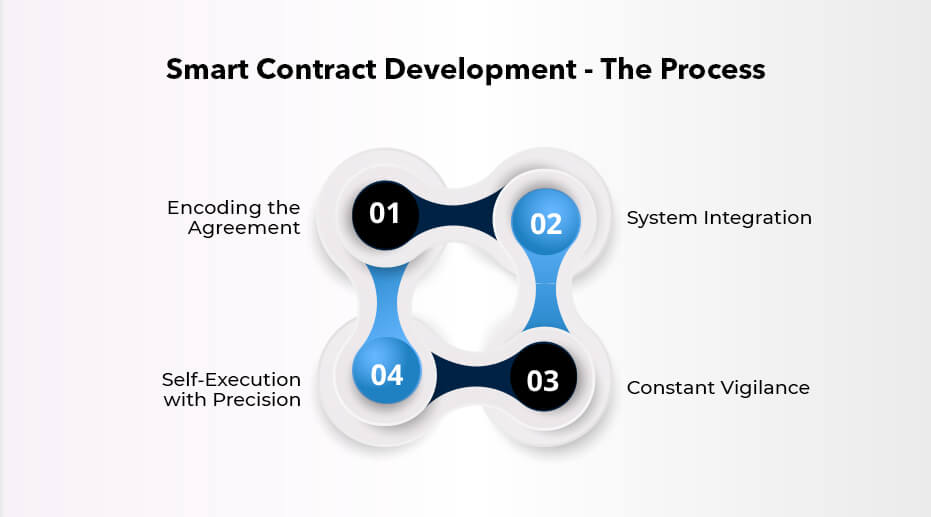

Smart Contract Development – The Process

- Encoding the Agreement: The first step involves translating the traditional paper contract into a digital format. This is done by writing the terms and conditions of the code agreement. This code is then deployed on a permissioned blockchain network.

- System Integration: They connect to various internal and external systems to gather information necessary for execution. Internally, they might connect to bank databases to verify account balances or retrieve credit scores. Externally, they can utilize trusted data providers, to access real-time market data, crucial for certain financial agreements.

- Constant Vigilance: Once deployed, the smart contract becomes an ever-watchful guardian. It continuously monitors whether the pre-defined conditions within the code are being met. These conditions could involve anything from timely loan repayments or triggering an insurance payout due to an accident or damage.

- Self-Execution with Precision: When the smart contract detects that all pre-defined conditions have been fulfilled. The coded instructions are automatically executed, triggering pre-determined actions.

However, it’s crucial to note that while smart contract development offers immense potential, it also requires careful testing and legal considerations to ensure its reliability and compliance with regulations.

Partnering with a renowned smart contract development company specializing in blockchain technology is essential to harness the full potential of smart contracts.

The Role of Smart Contracts in the Financial Services

Smart contract development offers the tantalizing prospect of transforming the financial services industry through automation and efficiency. Here are some pointers to consider:

Enhancing Automation and Efficiency

- Streamlined Processes: Automating key tasks such as loan origination, insurance claims processing, and trade settlements to streamline operations.

- Cost Reduction: Minimizing operational expenses by eliminating intermediaries and reducing manual paperwork.

- Accelerated Transactions: Speeding up financial processes to deliver faster transaction times and improve overall service efficiency.

Promoting Transparency and Trust

- Immutable Record-Keeping: Establishing transparent and auditable transaction records for enhanced accountability.

- Fraud Prevention: Implementing robust measures to reduce the risk of fraudulent activities.

- Strengthened Trust: Building confidence among stakeholders through reliable, smart contract development mechanisms.

Enhancing Compliance and Risk Management

- Regulatory Compliance: Ensuring adherence to financial regulations through automated compliance checks.

- Risk Mitigation: Effectively managing and reducing counterparty and operational risks.

- Improved Auditing: Simplifying compliance audits and reporting processes to ensure transparency and accountability.

Smart contract development offers a potential cost-saving solution for businesses and their clients. While the potential benefits are substantial, the widespread adoption of smart contracts in this domain is still hindered by various challenges.

However, this innovative technology offers a promising avenue to address some of these longstanding problems. Engaging with a trusted smart contract development company can help navigate the complexities of smart contracts, ensuring they deliver the efficiency and transparency your business needs.

For more detailed information on the challenges facing financial services, please refer to our blog.

Related Read:

Let’s explore how smart contract development can shed light on the potential issues of financial services.

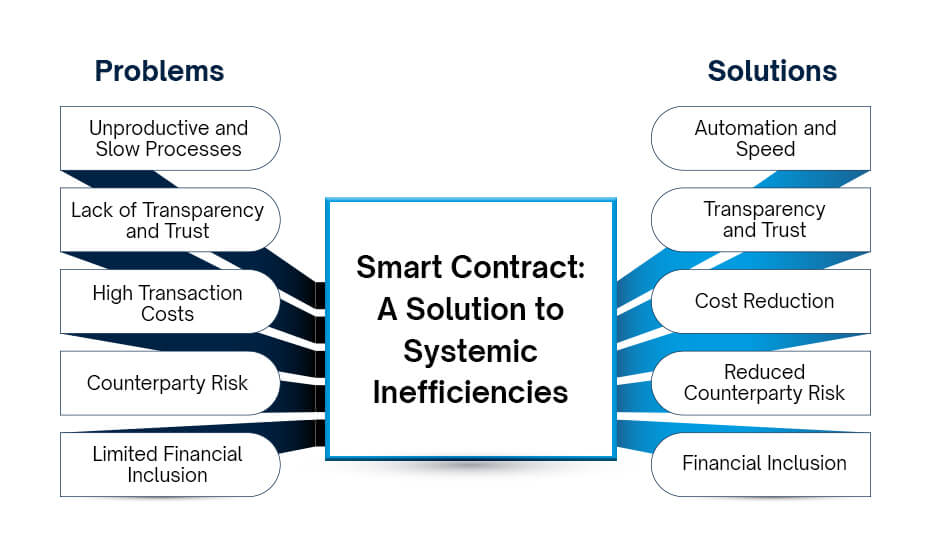

Smart Contracts in Financial Industry: A Solution to Systemic Inefficiencies

Traditional systems, which depend heavily on intermediaries and manual processes, often create substantial friction, restricting financial inclusion and stifling innovation. Smart contract development services present a groundbreaking solution to these systemic inefficiencies.

Let’s take a quick overview of the key challenges faced by the traditional financial industry and demonstrate how smart contract development can provide practical solutions.

Problem – Unproductive and Slow Processes:

- Traditional financial processes are often manual, time-consuming, and prone to errors. This leads to delays, increased costs, and reduced customer satisfaction.

Solution – Automation and Speed:

- Smart contracts can automate various financial processes, significantly reducing processing times and minimizing human error. This leads to faster settlements, improved efficiency, and cost savings.

Problem – Lack of Transparency and Trust:

- Complex financial transactions often lack transparency, leading to mistrust between parties. This can hinder business relationships and impede innovation.

Solution – Transparency and Trust:

- Smart contract development solutions offer transparency by recording all transaction details on a public blockchain. These builds trust and fosters collaboration among participants.

Problem – High Transaction Costs:

- Traditional financial systems involve intermediaries who charge fees for their services, increasing overall transaction costs.

Solution – Cost Reduction:

- Smart contracts can significantly reduce transaction costs, making financial services more accessible and affordable by eliminating intermediaries.

Problem – Counterparty Risk:

- Financial transactions involve counterparty risk, where one party may default on their obligations. This can lead to financial losses.

Solution – Reduced Counterparty Risk:

- Smart contract development enforces the terms of agreements automatically, reducing the risk of default. This provides greater security and certainty for financial transactions.

Problem – Limited Financial Inclusion:

- Many people lack access to traditional financial services. This financial exclusion hinders economic growth and development.

Solution – Financial Inclusion:

- Smart contracts can facilitate the creation of new financial products and services, making them accessible to a wider population. This can promote financial inclusion and economic empowerment.

The potential of smart contracts to reshape the financial industry is immense, with the power to streamline processes, increase transparency, reduce costs, and democratize access to financial services.

A prime example of this transformative power can be seen in the insurance sector, where companies like Lemonade are leveraging smart contract development to revolutionize crop insurance.

Real-World Example: Lemonade – Crop Insurance Powered by Smart Contracts

Company Overview

Lemonade, a leading insurtech innovator, is transforming crop insurance with the power of Smart contract development services. Lemonade delivers a decentralized, transparent, and efficient insurance solution for farmers.

Conventional crop insurance procedures are rife with inefficiencies, including protracted claim processing periods, convoluted documentation, and fraud susceptibility. These challenges pose significant financial risks to farmers, hindering their ability to recover from crop losses promptly.

Lemonade’s innovative crop insurance platform leverages smart contract development services to streamline and automate critical insurance processes.

Here are the key changes you can expect after utilizing smart contract development services:

- Instantaneous Policy Issuance: Farmers can purchase crop insurance policies online with ease. Smart contracts define policy terms, coverage, and premiums transparently, eliminating paperwork and manual processing.

- Real-Time Risk Assessment: The platform continuously monitors crop conditions by integrating weather data and satellite imagery. Smart contracts analyze this data to assess risks in real time, enabling proactive risk management.

- Automated Claims Initiation and Processing: When predefined claim criteria are met (e.g., excessive rainfall, hail damage), smart contracts automatically trigger the claims process. This eliminates delays and reduces administrative burdens for farmers.

- Transparent and Secure Claims Management: All claim information, including supporting documentation and payment details, is securely stored on the blockchain. This ensures transparency, prevents fraudulent claims, and facilitates audits.

- Swift Payouts: Upon claim verification, smart contracts instantly disburse funds to farmers’ digital wallets, providing rapid financial relief in times of crop loss.

Lemonade’s crop insurance powered by smart contracts demonstrates the potential of blockchain technology to transform the insurance industry. This use case highlights the advantages of using smart contract development services for insurers and policyholders by streamlining procedures, boosting transparency, and decreasing fraud.

For businesses looking to leverage blockchain technology, consulting with a reputable smart contract development company can unlock new opportunities and enhance operational efficiencies.

The Future of Smart Contracts in Finance

Smart contract development is emerging as a key technology in the financial industry. Banks are increasingly adopting them for applications such as P2P payments and streamlining transaction processes.

For example, Citibank has introduced a pilot program using blockchain and smart contracts to offer digital asset services to institutional clients. These services include cross-border payments, automated trade finance, and efficient asset transfers between branches.

Moreover, other financial institutions are also exploring the potential of smart contracts. Barclays, Bank of America, Standard Chartered, and the Development Bank of Singapore are among those testing this technology to streamline ownership transfers and payment processes. As the industry continues to mature, we can expect to see even more groundbreaking applications of smart contract development in finance.

Wrap-Up

Smart contracts represent a paradigm shift in contract execution, offering unparalleled levels of automation, efficiency, and transparency. These self-executing contracts streamline processes, reduce costs, and minimize errors by eliminating the need for intermediaries.

Moreover, the immutability of blockchain technology ensures the integrity and verifiability of transaction records, fostering trust and accountability among all parties involved. Connecting with a renowned smart contract development company, Antier is the crucial step towards unlocking the full potential of smart contract development and transforming your business operations. We can empower your organization to navigate the complexities of this emerging technology, gain a competitive edge, and drive innovation in your industry.

Partner with us now!