How White Label Exchange Help Banks Establish in the Crypto Industry?

July 8, 2024

Explaining DePIN: The intersection of web3 and physical infrastructure

July 9, 2024The DeFi(Decentralized Finance) revolution has emerged as a game-changer within the financial domain, empowering users with complete asset authority. One prominent enabler of this revolution is the White Label DeFi wallet, a powerful tool that provides enticing wealth-generating prospects.

A White Label DeFi wallet is a versatile solution that serves as a key to the decentralized finance realm. It is a pre-built and market-ready solution that saves time & effort spent in building a ground-up. The platform is divided into two primary categories: the default and the advanced, which are implemented according to the requirements and end goals. The default category includes features like sending, trading, managing and holding. In contrast, the advanced ones encompass features like prepaid card & payment gateway integration, Chat & Pay,multi-chain & multi-asset capabilities, dApp & Chrome extension. To leverage the capabilities of the platform, you need to consult a reliable DeFi wallet development provider.

Whether you are a tech-giant, a financial institution or a crypto enthusiast, In this guide, we will discover ways to multiple wealth with a White Label DeFi wallet, use cases & things to consider before hiring a wallet provider for your business:

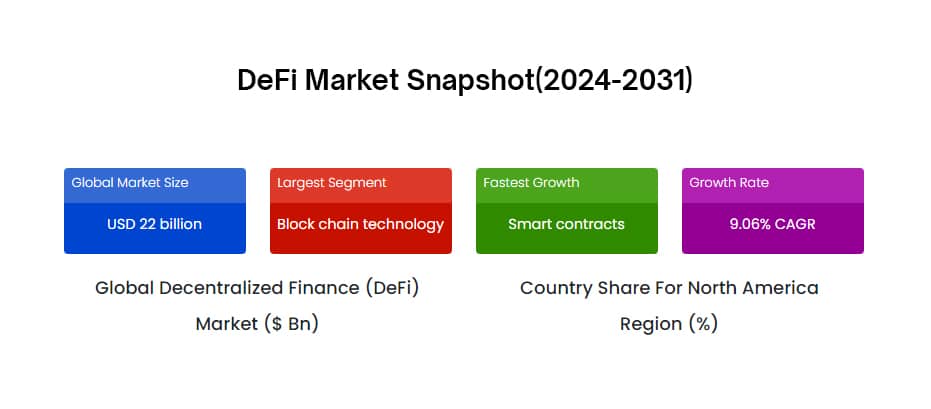

The Decentralized Finance (DeFi) Market was valued at USD 22 billion in 2022, USD 23.99 billion in 2023, and is projected to grow to USD 48.02 billion by 2031, growing at a CAGR of 9.06% in the forecast period (2024-2031). Thus, more individuals will have the opportunity to tap into the segment with crypto wallet development teams to grow their income.

The Decentralized Finance (DeFi) Market was valued at USD 22 billion in 2022, USD 23.99 billion in 2023, and is projected to grow to USD 48.02 billion by 2031, growing at a CAGR of 9.06% in the forecast period (2024-2031). Thus, more individuals will have the opportunity to tap into the segment with crypto wallet development teams to grow their income.

Lucrative Revenue Prospects Offered by White Label DeFi Wallets

A White Label DeFi wallet is integrated with numerous financial services that provide enticing revenue streams. Let us shed a light on each one of them:

1. Transaction Fees from Financial Services

Participate in financial services like lending, borrowing, staking, yield farming and liquidity pools within the platform to get recurring revenue streams.

2. Prepaid Cards

Prepaid cards include credit or debit cards that offer promising money-making prospects. Businesses can earn transaction fees every time a user swipes the card.

3. Subscription Fees from Premium Features

Introduce offer-based subscription plans to unlock advanced capabilities while fulfilling diverse user requirements.

4. Staking Rewards for Offering Liquidity

Leverage staking and yield farming capabilities that help you earn a fair share by holding crypto within the wallet.

5. Integration Fees from 3rd Party Providers

Offer complementary services and applications within your White Label DeFi wallet to earn passive income and create a one-stop solution for users.

6. NFT Marketplace Integration Fees

Engage NFT users by introducing NFT marketplaces where they can participate and get consistent income streams.

7. Token Swaps & Liquidity Provision Spreads

Introduce features like token exchanges and provide liquidity to get a fair share out of them.

Significant Considerations Before Choosing a White Label DeFi Wallet Solution

As the DeFi domain continues to grow, the significance of choosing a suitable White Label DeFi wallet solution can’t be overstated. Here are the crucial aspects you must consider before making your decision:

1. Security : Security is the foremost crucial component of DeFi wallet development as compromises could lead to catastrophic business loss. Invest in a solution integrated with impenetrable security mechanisms to prevent unauthorized access. These primarily include Multi-Factor Authentication, Encryption & secure enclaves.

2. Supported Blockchains : White Label DeFi wallets support a variety of Blockchain networks. Make sure that the platform supports the Blockchain and networks you wish to work with. Alternatively, you can consider cross-chain compatible solutions allowing you to manage assets across multiple chains.

3. User Experience (UX) : User experience plays a major role in the wallet’s success. The solution must have a simple, easy-to-navigate interface that allows both novice and experienced users to have seamless access.

4. Integration Capabilities : Make sure that the solution you choose supports DeFi protocols, dApps and other Blockchain applications. The wallets must offer swift access to DeFi services like exchanges and platforms, eliminating the need for external apps.

5. Regulatory Compliance : Be cautious of your region’s regulatory landscape, including KYC(Know Your Customer) and anti-money Laundering(AML). This will ensure transparency and save you from legal hassles later.

6. Support & Maintenance : Trustworthy customer support is crucial. Determine the level of support, maintenance, and updates offered by the Defi wallet development team. Learn whether they address issues rapidly and ensure solution updation from time to time.

Assess these components thoroughly to make an informed choice that streamlines your vision and needs in the dynamic decentralized finance realm.

Spotlighting the Diverse White Label DeFi Wallet Use Cases

White Label DeFi wallets support various use cases for enterprises and individuals willing to harness their potential. Let us dive deeper into these prominent use cases:

1. Personal Asset Management

The wallet can be used to manage and enable secure asset storage. It supports cryptos, tokens, and NFTs, giving users complete control and offering effortless portfolio management.

2. DeFi Investments

Investors can use these wallets to access Decentralized Applications(dApps) and DeFi protocols. Users can also participate in lending, borrowing, staking, and liquidity provision directly through the platform and earn profitable investment returns.

3. Institutional Solutions

Enterprises, financial institutions, and crypto platforms can introduce them as branded wallets. These solutions can be aligned with the organization’s branding needs and mission to make their venture successful.

4. Cross-Chain Operations

Several wallets support multiple chains, allowing users to manage assets across diverse chains. This can be helpful to those planning to expand their work on different platforms.

5. Custody Solutions

The platforms can be launched as a custody solution for institutional clients, facilitating secure storage and asset management on behalf of investors or businesses.

Key Segments That Can Leverage the Potential of White Label DeFi Wallet Investment

After learning the diverse wallet use cases, it is time to discover the major groups that can harness the power of the White Label DeFi wallet:

- Entrepreneurs & Startups

- Tech Giants

- Retail Investors

- Banks & Financial Institutions

- Crypto Enthusiasts

Factors Impacting the Cost of White Label DeFi Wallet

Compared to developing a solution from the ground up, a White Label DeFi wallet is an affordable solution. The cost estimate is impacted by several components that have been shared below:

1. Feature Set & Complexity

A highly advanced solution will be more costly than a basic solution. Features like Multi-currency support, NFT integration, prepaid cards, and payment gateways increase the overall development charges.

2. Development Team Size

The cost of hiring an in-house development team will be higher than that of a freelancer. The experts will charge more without compromising the project quality.

3. Technical Stack Involved

The programming languages, frameworks and technical components involved will impact the wallet development cost. Investing in a robust and scalable architecture is an expensive endeavour.

4. Time Allocated

The time required to develop a project has an enormous impact on the wallet cost. The charges will increase if building a project is a time-consuming endeavour.

5. Ongoing Maintenance & Support

The cost of maintaining and technical support can add up to the wallet costs. Some companies integrate them within the comprehensive plan, while others charge separately.

Get an upfront & accurate estimate by collaborating with a reliable crypto wallet solution provider.

How Antier Can Help?

Team up with the world’s largest wallet provider and discover our distinguished solutions, including custom and DeFi crypto wallets. Their team consists of security specialists, marketers, designers, and developers who leverage their skills to build a promising branded solution for your needs. Our experts take full responsibility for building a solution that demonstrates your vision and mission. Get an efficient business solution in less than three days by consulting us today!