Introduction

Arbitrage opportunities are notoriously challenging to capitalize on. But you can earn endlessly once you get the recipe for arbitrage trading success. It’s the market inefficiencies that crypto arbitrage bots tap into and they’re evident to happen in an immature market like crypto.

Speed, accuracy, and uninterrupted monitoring are essential to exploiting the market’s total potential. Most money-making opportunities go in vain due to delays in actions, manual indecisiveness, and mistakes.

This is where automated arbitrage trading software kicks in. These automation solutions stick to a particular preset strategy, enabling traders to find price distinctions between different markets and execute trades automatically. Once set up, they can individually fetch profits with minimal intervention.

In this blog, we will unravel the top strategies that a trader or a business must consider for crypto arbitrage trading bot development in 2024.

But before that, let’s give you a brief overview of why building an arbitrage bot will be beneficial in 2024.

Benefits of Building a Crypto Arbitrage Bot

Crypto arbitrage trading automation solutions foster a win-win for different stakeholders. Whether you are a trader, exchange owner, or just a keen entrepreneur looking to enter the crypto space a crypto arbitrage bot is the most beneficial tool. Here’s how:

For Traders:

Arbitrage automation solutions benefit both novices as well as experienced traders. No matter what capital you are capable of investing in, with appropriate tools and strategies, you can thrive in the cryptosphere. With the advent of flash loan crypto arbitrage bots, a diversity of trading proficiency levels can trade in a similar setting and get indiscriminate access to limitless profits and a lot of benefits, such as:

- Automated Profit Generation

- Reduced Emotional Trading

- Increased Trading Efficiency

Also Read>>> Flash Loan Arbitrage Bot Polygon: Types and Business Benefits

For Exchanges:

Exchanges usually suffer from indifferent price levels due to uneven orders. While other price discovery mechanisms may take time, automated arbitrage trading software solutions do it effortlessly and efficiently. They set the prices at the same level, minimize the price differences across different exchanges immediately, and help exchanges maintain market uniformity. Here are some benefits of an arbitrage trading bot for exchanges:

- Increased Trading Volume

- Improved Market Efficiency

- Enhanced Liquidity

For Bot-Focussed Businesses:

Crypto arbitrage trading bot development can be a compelling entry point for entrepreneurs seeking to establish themselves in the dynamic market space. The waves of surges followed by market corrections create a perfect environment for arbitrageurs to thrive. It incites an opportunity for businesses to tap into and avail of the following benefits:

- Lower Investment Compared to Exchanges

- Scalable Business Model

- Passive Income Potential

We hope we covered your case. Without further ado, let’s now jump to the core of the blog and discuss the key crypto arbitrage bot strategies to maximize your profits in 2024.

Top Strategies To Consider For Crypto Arbitrage Trading Bot Development in 2024

-

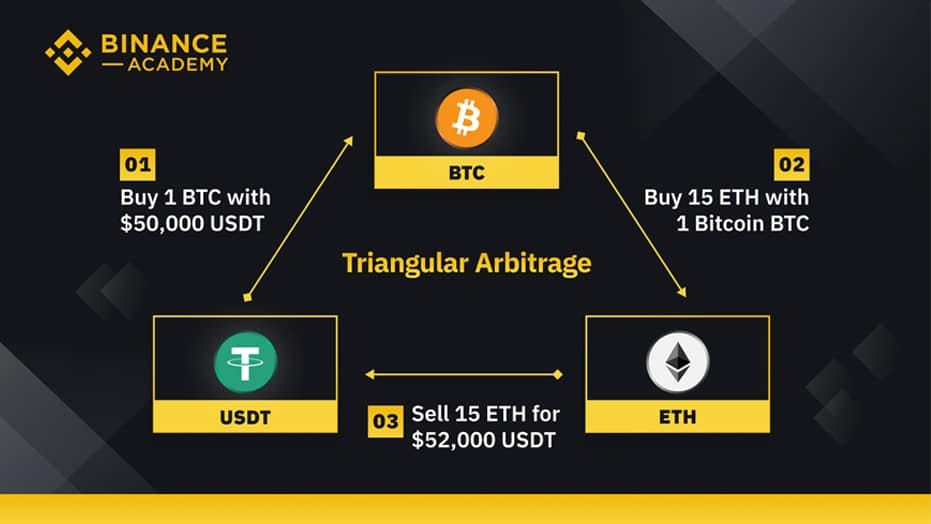

Triangular Arbitrage Strategy:

These cryptocurrency trading bots buy one cryptocurrency on one exchange, then sell it for another, and at last convert the currency back to the original on a third exchange. Triangular arbitrage strategies require prompt action, as differences across three trading platforms may be short-lived. Automated crypto trading bot solutions lend speed to the process by identifying and exploiting the price difference before it disappears.

Considerations during execution:

- Transaction Fees

- Liquidity Across Exchanges

Image Source: Binance Academy

Working of a Triangle Arbitrage Bot:

- Start: The bot begins its operation by initializing all necessary parameters and settings.

- Fetch Market Data: The bot retrieves real-time prices for USDT, BTC, and ETH from various exchanges.

- Identify Arbitrage Opportunities: The crypto arbitrage bot detects a triangular arbitrage opportunity involving USDT, BTC, and ETH.

- Execute Trade 1: The bot converts $50,000 USDT to 1 BTC.

- Execute Trade 2: The bot then converts 1 BTC to 15 ETH.

- Execute Trade 3: Finally, the bot converts 15 ETH back to USDT, resulting in $52,000 USDT.

- Calculate Profit/Loss: The automated arbitrage trading software calculates the profit from the trades. In this case, the profit is $2,000 USDT ($52,000 – $50,000).

- Update Logs and Reports: The bot logs the details of the transactions, including the amounts, prices, and profits.

- Monitor Market Conditions: The bot continuously monitors the market for new arbitrage opportunities and adjusts its strategies accordingly.

- End: The crypto arbitrage bot completes the cycle and either stops or starts the process again based on preset conditions.

-

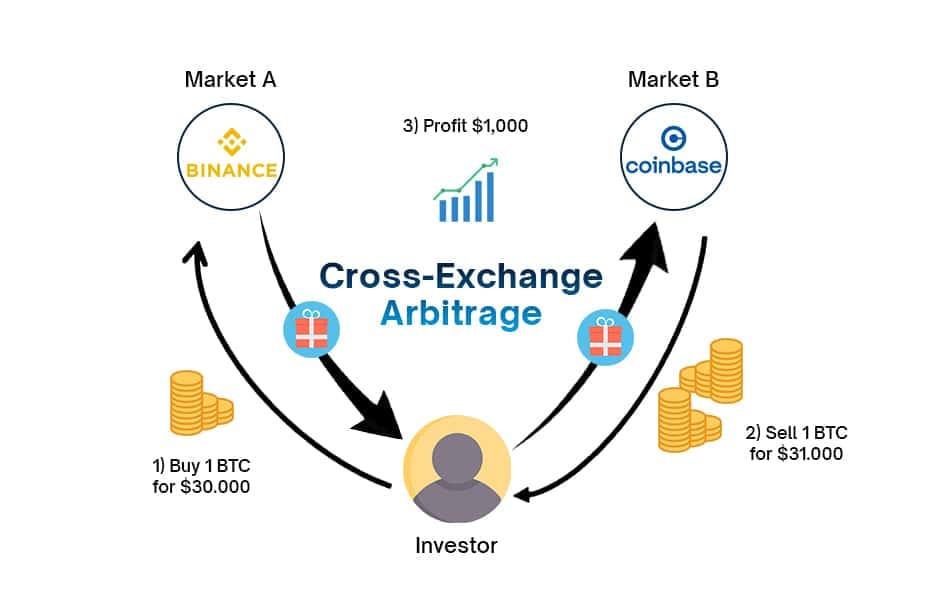

Cross-Exchange Arbitrage:

Cross-exchange arbitrage aims to take advantage of the price heterogeneity of the same digital asset across different exchanges. It involves buying a cryptocurrency on one exchange for a lower price and selling it on another for a higher price, thus pocketing the profit from the trades. This type of automated arbitrage trading software generates a significant amount of income, as traders can deploy the strategy on several cryptocurrency pairs.

Considerations during execution:

- Withdrawal restrictions on various trading pairs

- Transaction fees

- Liquidity across exchanges

Working of a Cross-Exchange Arbitrage

- Start: The bot begins the cross-exchange arbitrage strategy and monitors price differences across exchanges.

- Identify Arbitrage Opportunity: It detects a significant price difference for BTC between Binance and Coinbase.

- Buy on Exchange A (Binance): The crypto arbitrage bot executes the trade to buy 1 BTC at $30,000 on Binance.

- Transfer BTC to Exchange B (Coinbase): It transfers the purchased BTC from Binance to Coinbase.

- Sell on Exchange B (Coinbase): The bot executes the trade to sell 1 BTC at $31,000 on Coinbase.

- Calculate Profit: The automated arbitrage trading software subtracts the purchase price from the selling price to calculate the profit: $31,000 – $30,000 = $1,000.

- Monitor and repeat: Continue to monitor the markets for new arbitrage opportunities and repeat the process as long as it is profitable.

-

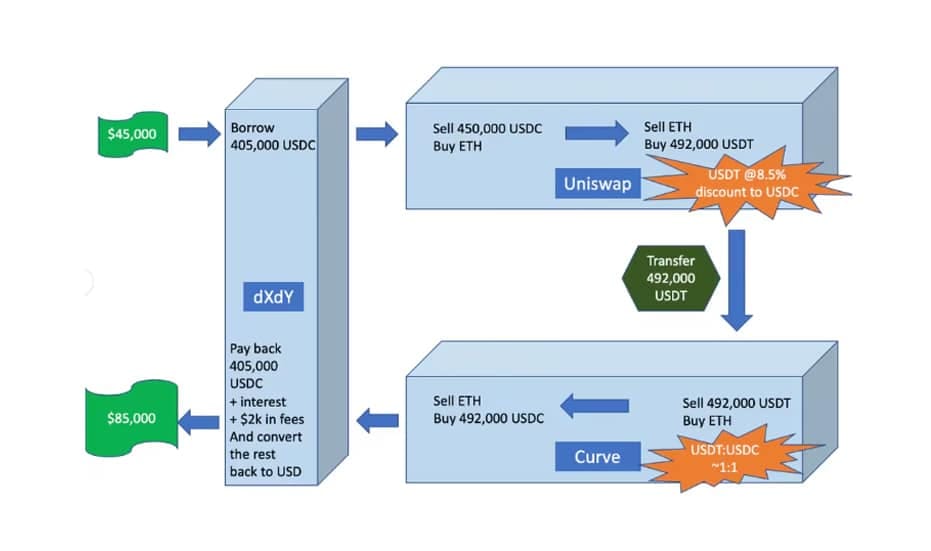

DeFi arbitrage

The core idea behind this crypto arbitrage bot is to take advantage of differences in exchange rates, price differences, interest rates, and other financial aspects over different DeFi protocols. Unlike the previous types, this strategy is complex and requires an in-depth understanding of how various DeFi protocols work to assess vulnerabilities and security risks.

Considerations during execution

- Comprehensive DeFi Market Research

- Transaction and Gas fees

- Slippage Issues

- DeFi Crypto Arbitrage Bot Is Only Suitable For Beginner Traders

Image Source: Coindesk

Working of a Cross-Exchange Arbitrage

The image above showcases the best real-life example of a complex DeFi arbitrage trade that made a trader an 89% profit in a matter of minutes. (Let’s assume that it is executed through a DeFi arbitrage bot.)

- Start: The DeFi automated arbitrage trading software initializes the transaction with the necessary parameters. It continuously tracks the prices of assets on different DEXs.

- Identify Arbitrage Opportunities and Calculate Potential Profit: The bot identifies a price discrepancy for the same asset across various DEXs and calculates potential profit after considering transaction fees, gas fees, and slippage.

- Borrow Funds: The trader leveraged a crypto arbitrage bot to invest $45,000 in USDC tokens and borrowed an amount of 4,05,000 USDC from dXdY.

- Execute Trade 2: The bot sells 4,50,000 USDC to buy ETH on UniSwap and then sells the ETH on the same exchange platform to buy 4,92,000 USDT. (Converted $4,50,000 USDC to 4,92,000 USDT)

- Exploit Trade 3: The trader used automated arbitrage trading software to swap 4,92,000 USDC for 4,92,000 USDT on Curve Finance (in two transactions).

- Payback: The trader paid off 4,05,000 worth of USDC with interest and fees and converted the rest of the amount to USDT, giving the trader a total profit of $85,000.

- Update Logs and Reports: The crypto arbitrage bot records the details of the trades and performance metrics for future analysis and optimization.

- End: The bot completes the cycle and prepares for the next arbitrage opportunity.

-

Time Arbitrage

This arbitrage bot focuses on the time component of the trade and capitalizes on price disparities on different asset trading platforms. Prices on several exchanges may take longer than others to get updated due to technical lags, time zone differences, and order processing speeds. This strategy, leveraged by many automated arbitrage trading software solutions, focuses on finding that time difference (usually in highly volatile markets) and quickly leverages the opportunity to make profits.

Considerations during execution

- Speed of order execution

- Meticulous monitoring of time differences

Working of a Time Arbitrage Trading Bot

- Start: The bot monitors the market carefully based on traders’ preferences and preset parameters.

- Analysis: The crypto arbitrage bot analyzes that on Exchange A, the SOL/USD rate is updated every 7 minutes, while on Exchange B, it takes 17 minutes to update the pair rate.

- Trade Execution: The arbitrage bot observes that at a particular time, SOL/USD costs $50,000 on Exchange A while it is $48,000 on Exchange B. It quickly buys on A and sells on B, pocketing a profit from the temporary price difference.

- Update logs and preparation for the next trade: The automated arbitrage trading software does the usual record-keeping and simultaneously looks for other opportunities to crack.

-

Funding Rate Arbitrage

This arbitrage strategy focuses on benefiting from the funding rate differential on various crypto derivatives trading platforms. It is more commonly deployed on perpetual contracts, as supply and demand for underlying assets regulate the funding rates there. The idea behind the crypto arbitrage bot strategy is to execute the purchase or sale of contracts as per their funding rates. When funding rates are positive, users are paid interest, making it profitable to hold long positions. In cases of negative funding rates, traders pay interest so they must hold short positions.

Considerations during execution

- Change in funding rates

Working of a Funding Rate Arbitrage

- Market monitoring: The automated arbitrage trading software detects that SOL is being traded on both exchanges – A and B. The funding rate on Exchange A is 0.09% per day, whereas on Exchange B is 0.04%.

- Strategy Execution: As per the preset parameters, the trader takes a long position on Exchange A and a short position on Exchange B so that it receives interest at a higher rate and pays at a lower rate for a short position.

- Profit Generation and Log Updates: The crypto arbitrage bot generates profit from the difference in funding rates and updates the records. That’s not all. It prepares for the next trade simultaneously.

Top Features To Consider For Your Automated Arbitrage Trading Software Development

- Real-Time Data Aggregation

- Layer 2 Integration

- Multi-Exchange Support

- Efficient Order Execution

- Advanced Price Discrepancy Analysis

- Risk Management

- Advanced Algorithmic Strategies

- Cloud-Based Deployment

- Transaction Cost Optimization

- Robust Security Measures

- Scalability

- Backtesting and Simulation

- Machine Learning and Artificial Intelligence Integration

- Legal and Regulatory Compliance

- User Interface and Experience

- Community and Developer Support

Don’t forget to ensure adaptability during Crypto Arbitrage Trading Bot Development. The cryptocurrency environment changes rapidly and it is better to regularly update and maintain the bot than to cry about its declining profitability.

Put Your Desired Crypto Arbitrage Strategy On Autopilot

Get in Touch

Final Word

Whether you are building one for yourself or your prospects, it is advisable to hire a leading technology company for crypto arbitrage trading bot development. The development is demanding and requires just the right blend of technical expertise, market know-how, and strategic planning. Only an experienced technology provider with proven expertise can give you the desired results.

Another Advice: Nothing replaces your research. No matter who you are hiring for your automated arbitrage trading software development, a thorough understanding of cryptocurrency markets and algorithmic trading is necessary before entering this lucrative yet risky space.

At Antier, we have been bringing decentralization dreams to life with our unparalleled subject matter expertise in the DLT and thriving ecosystems. If you wish to blaze the path by setting up a distinguished crypto arbitrage bot, now is the time to join forces with the best techno experts.

Share your requirements right away!