Table of Contents

Introduction

While decentralized exchanges strive to offer a standout experience, centralized exchanges still rule the crypto town with their soaring trading volumes. Binance, the largest custodial trading platform, experienced a whopping trading volume of $1,142.5 billion in March 2024. Due to higher adoption rates than their counterparts, centralized crypto exchange development remains a top choice for entrepreneurs who want quick, sure-shot success in the industry. But can all the centralized exchanges gain a fair share of the market?

Certainly not! So, in this blog, we will help you with top tips and tricks to make your centralized cryptocurrency exchange development succeed in 2024.

But before that, let’s discuss why building a centralized exchange in 2024 can be the best thing you ever thought of. The stars are aligning, and here’s why…

7 Reasons Centralized Cryptocurrency Exchange Development Is Profitable in 2024

Rather than straightaway running into the point, let’s discuss why 2024 is the best year for centralized crypto exchange development:

- Explosive Market Potential:

When bears run the markets, crypto changes hands and goes from weak to stronger ones, and when bulls lead, people herd at crypto exchanges to buy crypto. We are experiencing price surges followed by major market corrections, a mixed wave that makes it a golden period for crypto exchanges. Centralized crypto exchange development with advanced charting tools, API integrations for algorithmic trading, fiat integration, multiple order types, enhanced security measures, regulatory compliance, and excellent customer support can help businesses capitalize on the opportunity.

- Diversified Revenue Streams:

The trading fee is not the only income exchanges can enjoy. A newbie venture can partner with an experienced centralized cryptocurrency exchange development company to integrate a DEX, margin trading, staking, derivative trading, or any other module. This way, they can offer a wholesome experience to customers, enhance their liquidity, and earn from listing fees, withdrawal fees, margin trading fees, and many more models in just one business.

- Regulatory Clarity and Support:

Regulatory bodies like the SEC and many others are providing clearer guidelines, making it easier for new centralized crypto exchange development projects to comply and operate legally. This regulatory support enhances investor confidence and attracts more users to CEXs

- Enhanced Institutional Investment

According to Cointelegraph, 2023 was a pivotal milestone in the industry’s history as there was an increased inflow of ventures. Many renowned financial institutions, such as Blackrock, JPMorgan Chase, Morgan Stanley, Goldman Sachs, etc., recently embraced digital currency. Increased institutional investment and Centralized Crypto Exchange Development further legitimize the industry and enhance customers’ trust.

- Scalability, Performance, and Liquidity:

CEXs typically are capable of offering higher levels of liquidity, scalability, and performance compared to DEXs. They can handle a large number of transactions per second, ensuring a seamless trading experience even during peak times only if they’re built properly by a proficient centralized cryptocurrency exchange development company. This reliability is crucial for attracting high-frequency traders and institutional investors

- Increasing Market Adoption:

As cryptocurrency adoption grows, there is increased demand for reliable and user-friendly trading platforms. A considerable amount of potential remains untapped as people still find the industry cryptic and it has not reached the mass adoption stage. By partnering with a reliable Centralized Cryptocurrency Exchange Development Company, a CEX venture can blaze the trail and reach the unreached with a simpler user experience and innovative features.

- Enhanced Profit Potential

Popular centralized exchanges like Binance and Coinbase generate significant revenue from trading fees. Even with competitive fee structures, new centralized crypto exchanges can generate substantial and steady income with high trading volumes. They can partner with a leading centralized cryptocurrency exchange development company to strategically optimize and diversify their revenue streams.

Also, Read>>> Alternative Revenue Models To Consider To Enhance Revenues

Ideal Features For Thriving Centralized Cryptocurrency Exchange Development

To attract and retain customers, centralized exchanges need to consider top features for their platforms. Let’s discuss some centralized crypto exchange development features that ensure a customer-centric experience:

- User-Friendly Interface

- High Liquidity

- Advanced Security Measures

- Variety of Trading Pairs

- Efficient Customer Support

- Mobile Application

- Fiat Integration

- Advanced Trading Tools

- Regulatory Compliance

- Low Fees and Transparent Fee Structure

- High Performance and Scalability

- Cold Storage for Funds

- Two-Factor Authentication (2FA)

- Insurance for User Funds

- Educational Resources

- Staking and Lending Services

- API Access for Automated Trading

- Multi-Language Support

- Regular Security Audits

- Market Data and Analytics Tools

Tips and Tricks for Centralized Crypto Exchange Development Success in 2024

With a meticulous and strategic approach and an unwavering focus on customer experience, you can unseat the rock or at least gain a fair share of the market for your exchange. Let’s now discuss some of the top strategies that can help you thrive in centralized cryptocurrency exchange development in 2024.

Tip 1: Become a Security-First Exchange:

Go overboard on users’ security. Don’t only invest in basic multi-factor authentication, secure APIs, cold storage, and end-to-end encryption. Invest in advanced security features during centralized crypto exchange development, such as:

- Hardware Security Models

- Bug Bounty Programs and Regular Audits

- AI-Based Abnormality Monitoring

- IP Whitelisting

- Device Management

- ML-Based Behavioral Analysis

- Withdrawal Whitelists

- Session Management

- Time-Locked Transactions

- Biometric Authentication

- Data Encryption At Rest

- Advanced DDoS Protection

- Transaction Limits and Alerts

Many do it but only a few announce it. So, if you are doing it, say it loud and clear. FLEX IT.

Tip 2: Let Compliance Be Your Crown’s Jewel

Outshine others by focusing on the legal aspects. A top-notch centralized cryptocurrency exchange development company like Antier extends your relationships with the best legal experts in your preferred country, who can help you fetch various licenses and registrations. Additionally, these are some advanced compliance features and considerations that enable exchanges to operate legally and effectively in various jurisdictions:

- KYC Procedures

- AML Controls

- Data Privacy and Protection

- Regular Financial Audits and Regulatory Reporting

- Transaction Monitoring System

- Sanctions and PEP Screening

- Compliance Team and Officer

- Enhanced Due Diligence

- Risk Assessment Framework

- Whistleblower Policies

- Fraud Detection and Prevention

- Client Asset Segregation

- Incident Response Plan

- Use of Cryptomixers

The list doesn’t end here. Collaborate with legal experts at the best centralized cryptocurrency exchange development company to learn about the rest of the requirements.

Tip 3: Stand Out With A Competitive Advantage

During centralized crypto exchange development, walk the path less trodden so that you can stand apart from the competition. Also, it should be a continuous process. Keep innovating and improving to keep up with evolving trends and technologies. A few standout strategies include:

- A Holistic Trading Experience (including Margin Trading, Derivatives, and DeFi Modules)

- Competitive Fee Structure

- Partnerships and Collaborations

- Strong Content Marketing Strategy

- Effective Social Media and Community Management

- Lucrative Referral Programs

- User-Centric Design (Seamless, Uncluttered & Intuitive)

- 24/7 Multi-Channel Customer Support

- Simplified Onboarding Process

- Mobile Experience Optimization

- Advanced Trading Tools (Catering to pros and noobs)

Mmm… The list seems longer than we can write.

Tip 4: Scale Up Your Credibility With Enhanced Liquidity & Scalability

No matter what, the ability of your exchange to accommodate as many transactions as possible without any trader facing slippage issues or delays is always awarded with customer satisfaction and retention. Always remember to leverage as many utility solutions as possible during centralized cryptocurrency exchange development to keep the backbone of your exchange (the liquidity) strong and sound. Let’s now discuss some implementations to pursue this:

- Cloud-Based Infrastructure To Scale On-Demand

- Micro-services Architecture

- Load Balancing Techniques

- Market-Making Bots and Services

- Leveraging Liquidity Pools

- Cross-Exchange Liquidity Aggregation

- Advanced Order Types (as they invite professional traders)

- DeFi and Layer 2 Integration

- High-Frequency Trading Infrastructure

- Community and Developer Incentives

- Transparent and Competitive Fee Structure

- Marketing and Outreach Campaigns

- Algorithmic Trading Support and Integration

- Liquidity Mining Programs

Tip 5: Keep up With The Cryptoverse’ Constant Evolution

Lastly, keeping oneself updated and responsive is the key to staying relevant and ready for the future. Maintain your relationship with your centralized cryptocurrency exchange development company in case you need integrations and improvements. Keep reading the latest industry reports from leaders, scrutinizing competitors and regulatory activities, and adapting to the latest standards as soon as possible. It is always better to be an early bird with all eyes on you than a slow, lazy, and obsolete trading platform that doesn’t update easily.

- Continuous User Feedback and Journey Optimization

- Agile Development and Modular Architecture

- Collaborations and Partnerships

- Integrate AI/ML and Latest Technological Trends

- Cater To Evolving Needs Of Customers

- Include Derivatives, Margin, Perpetuals Trading, and P2P Modules

- Comprehensive Charting Tools

- Multiple Order Types

- API Access for algorithmic traders

Also, Read>>> Top 8 Centralized Crypto Exchange Development Trends in 2024

Top 7 Centralized Crypto Exchanges in 2024

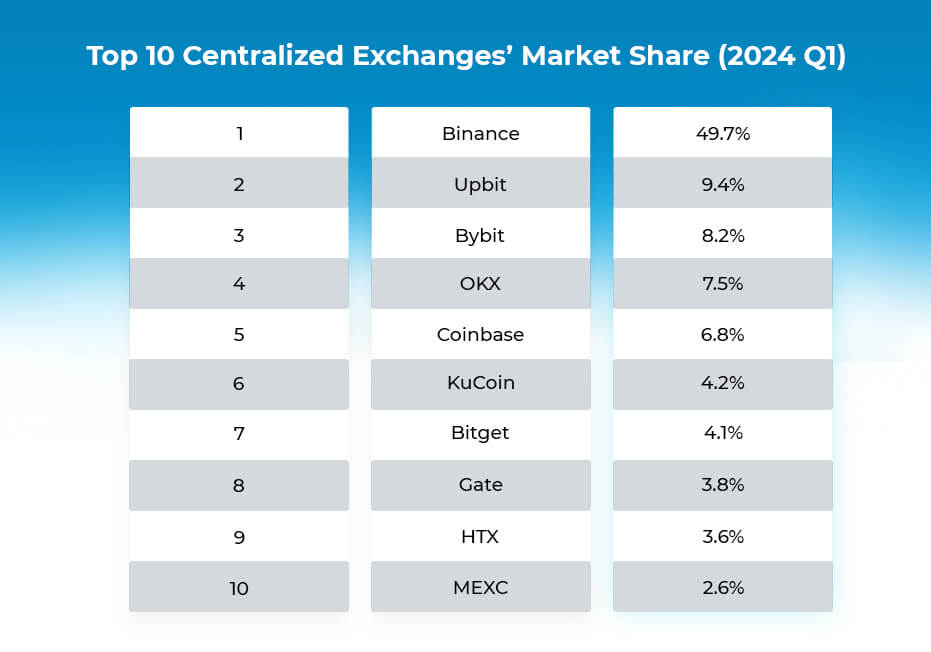

Source: Coingecko

Despite many centralized crypto exchange development projects surfacing at a fast pace, Binance remains the top choice for customers worldwide. According to Coinbgecko, it snowballs at 131.6% MOM (month-on-month), having recorded a revenue of $493.4 billion in February 2024. Upbit maintained its second-best position and took the second-highest market share, while Bybit is a new entrant in the top 3 with a significant market share. These game-changing centralized cryptocurrency exchange development projects are contributing to the gradual mainstream adoption of digital currencies.

Also, Read>>> Upbit-inspired Guide to Centralized Crypto Exchange Development in 2024

Conclusion

Despite many innovations in the exchange market, the centralized exchanges stand tall and steady, unaffected by the waves. While innovative minds and technology specialists still keep collaborating to prove centralization in the crypto exchange market is a boon, centralized crypto exchange development will remain a dominant trend for cryptopreneurs.

If a large market share, incredible capabilities, and a well-built market excite you, you can be the next success story in the centralized exchange arena. We have already mentioned some tips you can use to be a top choice for your customers. The next thing you need is a reliable centralized cryptocurrency exchange development company.

And, of course, no one beats us. Here’s why:

- 15 Years Of Experience

- 1200+ Successful Enterprise Implementations

- 1000+ Blockchain Expertise Housed

Know the rest of the reasons yourself by scheduling a free centralized crypto exchange development demo.