How can DEXs benefit from RIP-7212 implementation?

July 1, 2024

Crypto P2P Lending for Fractional Ownership: The Future of Real Estate

July 2, 2024The financial landscape is undergoing a significant transformation driven by the convergence of two disruptive technologies: Decentralized Finance (DeFi) and Artificial Intelligence (AI). DeFi, with its emphasis on peer-to-peer transactions and open-source protocols, is disintermediating traditional financial institutions and empowering individuals. However, DeFi is not operating in isolation. It’s increasingly collaborating with AI to create a more efficient, secure, and accessible financial ecosystem.

This blog explores the specific applications of Artificial Intelligence in DeFi and how they are orchestrating this transformation. Here, we’ll not only showcase the potential but also provide real-world examples to illustrate the practical implementation of AI within the DeFi space.

Benefits of AI-Driven DeFi Platforms

By leveraging AI’s analytical prowess, DeFi platforms are becoming more efficient, secure, and accessible, paving the way for a more inclusive and dynamic financial future. Here’s a closer look at the key benefits this collaboration brings:

1. Enhanced Efficiency and Automation:

- Streamlined Processes: AI automates repetitive tasks involved in DeFi protocols, like loan approvals and liquidity management. It leads to faster transactions and a smoother user experience.

- Algorithmic Trading: AI-powered Decentralized Finance Solutions and bots can analyze market trends in real-time, identifying arbitrage opportunities and executing trades with greater speed and precision. It can potentially increase returns for investors.

2. Robust Security and Fraud Prevention:

- Advanced Threat Detection: AI acts as a vigilant guardian, analyzing transaction patterns to identify suspicious activity indicative of fraud attempts. It helps AI DeFi Solutions and platforms mitigate risks associated with flash loan attacks or wash trading.

- Smart Contract Optimization: AI-powered tools can analyze and audit smart contracts, the backbone of DeFi applications. It helps identify and address vulnerabilities, preventing potential exploits and safeguarding user funds.

3. Personalized User Experience and Investment Strategies:

- Tailored Recommendations: AI analyzes user data and risk tolerance to recommend suitable investment opportunities within the DeFi ecosystem. It empowers users to make informed financial decisions, even those new to DeFi.

- Frictionless Onboarding: AI can simplify user interfaces and onboarding processes, making DeFi platforms more accessible to a wider audience. Educational resources powered by AI can further demystify DeFi concepts and foster user confidence.

4. Increased Market Efficiency and Transparency:

- Data-Driven Insights: AI can analyze vast datasets encompassing historical price data, social media sentiment, and news feeds. It can lead to more informed decision-making by investors and potentially greater market efficiency.

- Price Discovery: AI algorithms can contribute to a fairer price discovery process by identifying discrepancies between asset valuations on different Decentralized Finance solutions and platforms.

5. Innovation and the Potential for New Products:

- Unleashing Creativity: The fusion of AI and DeFi can pave the way for entirely new financial products and services. Imagine AI-driven insurance protocols that dynamically adjust premiums based on risk factors, or personalized wealth management solutions powered by machine learning. These are just a few possibilities within this ever-evolving space.

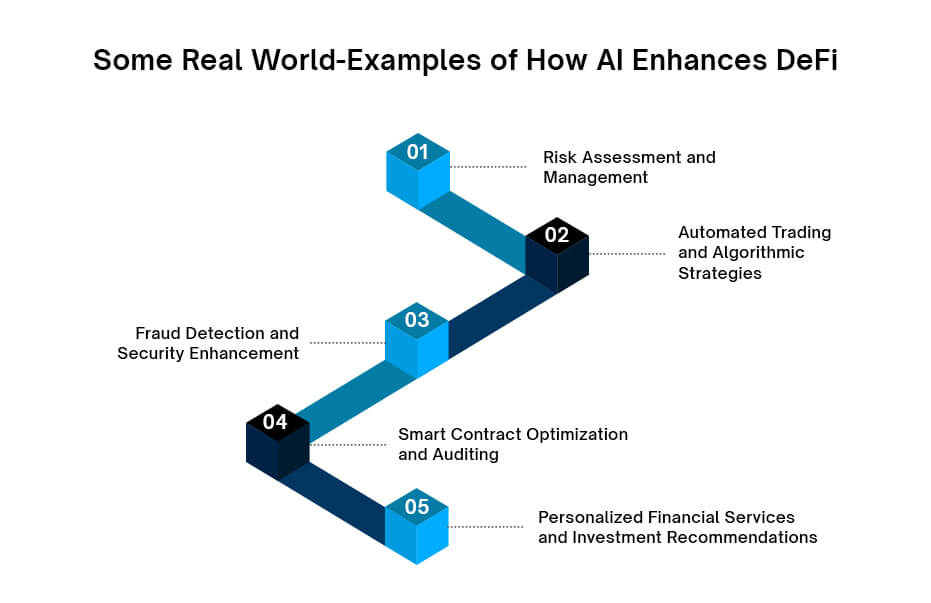

AI offers a diverse toolbox that can significantly enhance DeFi protocols and platforms. Let’s delve into some key areas where AI is making a significant impact:

Risk Assessment and Management:

- Real-World Example: A lending platform like Aave can leverage machine learning algorithms to analyze a borrower’s financial history, credit scores, and other relevant data points to create a comprehensive risk profile. It allows Aave to automate loan approvals efficiently, setting the foundation for a smoother lending process while mitigating credit risks.

Automated Trading and Algorithmic Strategies:

- Real-World Example: DeFi platforms likedYdX cater to traders seeking advanced strategies. Here, AI functions as an automated trading engine, composing complex algorithms. These algorithms analyze market data in real-time, identifying trends and price patterns, and then execute trades based on pre-defined parameters. It allows investors to delegate some trading decisions and potentially generate returns based on intricate algorithmic models.

Fraud Detection and Security Enhancement:

- Real-World Example: DeFi protocols like Uniswap, a decentralized exchange (DEX), operate in a dynamic environment. Here, the AI-driven DeFi Platform offers a robust security system, constantly scanning for suspicious activity. AI-powered tools can detect anomalous transaction patterns potentially indicative of fraudulent activity, such as wash trading or flash loan attacks. It helps Uniswap identify and prevent fraudulent behavior, safeguarding the platform’s integrity and protecting users’ funds.

Smart Contract Optimization and Auditing:

- Smart contracts, the foundation of DeFi applications, require meticulous attention to detail. Here, AI functions as a sophisticated code analysis tool, ensuring security and functionality. AI-powered tools are being developed to analyze smart contracts, identify vulnerabilities like integer overflows or reentrancy attacks, and even suggest code improvements. It can significantly reduce the risk of exploits within AI DeFi solutions, contributing to a more secure and trustworthy environment.

Personalized Financial Services and Investment Recommendations:

- Imagine a future where DeFi platforms leverage AI to personalize user experiences. Here, AI acts as a personalized financial advisor, tailoring investment options for each individual. By analyzing user data and risk tolerance, AI can recommend suitable investment opportunities within the DeFi ecosystem. This can empower users to make informed financial decisions, even those new to the world of DeFi.

Beyond the Present: A Glimpse into the Future Landscape

The current integration of Artificial Intelligence in DeFi is like the opening act, setting the stage for a powerful performance. Here’s a peek into the potential future advancements of this collaboration:

- Enhanced Market Efficiency: AI-powered algorithms can analyze vast datasets encompassing historical price movements, social media sentiment, and news feeds. It allows for the identification of arbitrage opportunities and the execution of trades with greater speed and precision, potentially leading to a more efficient market overall.

- Democratizing Financial Services: AI can revolutionize user interfaces within DeFi platforms, making them more user-friendly and intuitive. Additionally, AI-powered educational resources can be developed to demystify DeFi concepts and empower a broader audience, even those with limited financial knowledge, to participate in this revolutionary space.

- Unleashing New DeFi Products and Services: The fusion of AI and DeFi can pave the way for innovative financial products and services that were previously unimaginable. Imagine AI-driven insurance protocols that dynamically adjust premiums based on risk factors, or personalized wealth management solutions powered by machine learning that can automatically rebalance investment portfolios. These are just a few possibilities within the ever-evolving landscape of AI and DeFi.

Conclusion

AI and DeFi are not competing forces; they are complementary technologies with the potential to revolutionize finance. By leveraging AI’s analytical capabilities, DeFi platforms can become more efficient, secure, and accessible. This symbiotic relationship holds immense promise for the future of finance, creating a more inclusive and dynamic financial ecosystem for everyone. Are you interested in AI DeFi Development? Get in touch with Antier, the experienced organization that has worked extensively in building top-notch AI DeFi solutions.