Why Develop a DeFi Wallet on Jito Solana? Unveiling the Advantages

June 13, 2024

Maximize Profits with Jito Backrun Arbitrage Bot: The Future of MEV Trading

June 14, 2024Introduction

The DeFi landscape is in constant flux, reshaping experiences for traders and businesses. Amidst a vast array of protocols, highly volatile markets, staking, lending, and leveraging opportunities, managing a crypto portfolio demands considerate effort and time. Enter DeFi crypto trading bots—automated tools harnessing advanced algorithms to execute trades on DEXs, liberating traders’ time and maximizing their returns.

Today’s DeFi market presents a far more intricate and challenging business environment than a decade ago. Several providers offer diverse services, including exchanges, lending, borrowing, yield farming, stablecoins, derivative trading, asset management, insurance, decentralized identity, etc. Integrating Crypto trading bot DeFi into existing DeFi trading ecosystems enables businesses to offer a seamless and comprehensive experience to users, giving them an advantage in a highly competitive landscape.

In this blog, we will review the 7 Best DeFi Trading Bots in 2024 based on their features, reliability, and competitiveness. But before we start, you must learn what these charmed boxes of technology are.

Understanding DeFi Crypto Trading Bots

DeFi trading bots are computer programs developed to automate the execution of complex trading strategies and manage portfolios without any need for constant vigilance. Like any other dApp, DeFi crypto trading bots are built on blockchain technology and are driven by smart contracts. They’re capable of executing trades across multiple liquidity pools and can be configured to perform various strategies involving market making, arbitrage, portfolio rebalancing, DCA, yield farming, etc.

Features of Best DeFi Trading Bots:

- Automated Trading

- Advanced Algorithms (AI/ML, sentimental analysis, mean reversion, Bollinger bands, relative strength index (RSI), etc.)

- Multi-DEX Integration

- Portfolio Management

- Risk Management Features (Stop-loss orders, potion sizing, portfolio diversification, etc.)

- Market Analysis

- Trading Signals

- Customizable Strategies

- Backtesting and Optimization

- Robust Security Protocols (Such as 2FA, secure API integration, encryption, multi-sign authentication, etc)

- Real-time Monitoring and Alerts

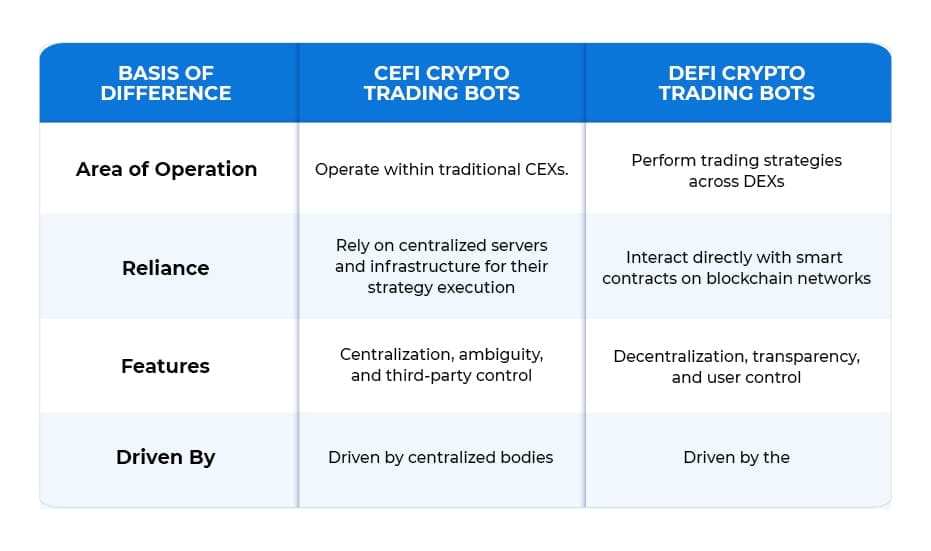

How are CeFi bots different from DeFi bots?

Business Benefits of DeFi Crypto Trading Bot

Various businesses can benefit from developing and launching a crypto trading bot DeFi. Move ahead to discover how several businesses can benefit from building and launching DeFi trading bots:

- For Fintech Startups:

Fintech startups can hire a leading trading bot development company to build an independent and scalable DeFi crypto trading bot and can get effortless access to new markets. It doesn’t require huge investment which makes it an easy-go for trading enthusiasts who have or may not have technical or cryptocurrency know-how.

- Access to new markets

- Competitive advantage

- Requires limited technical knowledge

- Less upfront capital required

- For Traditional Financial Institutions:

Established banks and financial institutions can venture into DeFi by launching their crypto trading bot DeFi. They can become a sensation in their competition by offering crypto-relevant services. This not only enhances their profit potential but also broadens their customer base which simultaneously improves their reputation.

- Expansion into new markets

- Enhanced profit potential

- Diversification of earning opportunities

- Easy access to the DeFi ecosystem

- Competitive edge in the digital economy

- For DEXs:

For existing DEXs or comprehensive DeFi ecosystems, it is best to integrate the best DeFi trading bots, as they enhance the liquidity of the trading platform. They also add a prominent revenue stream to the business. Not only existing DEXs but also those planning to build a DEX can pitch a comprehensive trading ecosystem to their clients by integrating a crypto trading bot DeFi.

- Enhanced Liquidity

- Increased Trading Volume

- Increased Customer Base

- Lowered Slippage

- Augmented Customer Experience

- Diversification of Revenue Stream

- Competitive Advantage

- For Asset Management Companies

Companies managing investment portfolios for their clients may explore DeFi crypto trading bot development to automate investment strategies within decentralized protocols. This reduces their workload, enhances their trading efficiency, and reduces their dependence on resources.

- Scalability of operations

- Automation of investment strategies

- Diversification of portfolio

- Improved efficiency in portfolio rebalancing

- Access to DeFi markets

- Reduction in operational costs

- Integration with Traditional Investment Products

7 Best DeFi Trading Bot Considerations in 2024

1. Carbon DeFi:

– Best Features Include: Automated margin trading; limit and range orders; non-custodial trading; transparent fee structure

- Pros: Amplified profit potential; works with both CEXs and DEXs; decentralized approach; allows traders to deploy pre-built strategies; and also supports custom strategies.

- Cons: Creating custom trading assistants may require some technical knowledge.

2. 3Commas:

– Renowned for: Automated crypto trading bot DeFi; portfolio management; smart trading signals; custom bot creation; backtesting; supporting 13 spot, 5 derivatives, and future exchanges, etc.

- Pros: Extensive features; a renowned name in the industry; a user-friendly interface that caters to both experienced and beginner traders; working with both DEXs and CEXs; automated portfolio management, etc.

- Cons: Due to a lot of features, it can be overwhelming for beginner traders.

3. CryptoHopper:

- Features: A versatile cloud-based automated DeFi crypto trading bot; supports market-making, arbitrage, DCA, trailing orders, social trading, and many other prominent strategies; custom bot creation; wide range of features.

- Pros: Works on both CEXs and DEXs, easy accessibility, diverse strategies.

- Cons: Paid plans are overly expensive for basic trading needs.

4. Hummigbot

- Features: Open-source DeFi crypto trading bot; institutional strategies; one-stop liquidity provision for multiple exchanges; customizable source code for personalized trading strategies; suitable for arbitrage; market-making; liquidity cloning, etc.

- Pros: Suitable for professional market makers and liquidity traders; works on both CEXs and DEXs; supports 19 CEXs and 24 DEXs.

- Cons: Not suitable for retail traders.

5. TradeSanta:

-Best Features: Best DeFi trading bots; Grid and DCA bots; backtesting; support of multiple exchanges; portfolio management; social trading signals; and bot creation.

- Pros: Easy accessibility; simple and intuitive interface; easy setup; beginner-friendly; supports various DEXs.

- Cons: Limited advanced features compared to some competitors.

6. Shrimpy:

-Renowned for: Portfolio management; custom bot creation functionality; backtesting; and social trading.

- Pros: Simplifies portfolio rebalancing; strong community-driven crypto trading bot DeFi; user-friendly, great for novice traders; supports trading on multiple DEXs.ts trading on multiple DEXs; easy integration with DEXs.

- Cons: Limited features on the free plan

7. Altrady:

-Standout Features: Advanced charting indicators; technical indicators; portfolio management; advanced trading strategies and order types; customizable layouts and strategies; backtesting; and personalized alerts.

- Pros: Clean and intuitive DeFi crypto trading bot design; suitable for novices as well as professional traders; extensive exchange support (16 spot and futures exchanges); access to a wide range of trading pairs and liquidity pools.

- Cons: Learning curve for advanced features.

These are some of the best DeFi trading bot considerations. If you wish to build your trading bot with advanced functionality and unique characteristics, you can consider the features, benefits, and limitations of each of the abovementioned DeFi trading bots.

Final Word

The fast-paced world of cryptocurrency doesn’t discriminate between entrepreneurs and traders and demands constant vigilance and strategic execution from both. Any cryptopreneur planning to launch the best DeFi trading bot must meticulously navigate the terrain and thoroughly understand customer behavior, as it is the foremost priority for any business to succeed.

Developing your own DeFi trading bot is suitable for businesses planning to launch their bot and institutional investors seeking a personalized trading experience. If you are one of those looking to get started with DeFi crypto trading bot development, Antier can offer you the best solutions that cater to your needs. Shake hands with a renowned web3 consulting company with a rich blockchain-based dApps and trading automation bot portfolio to start building your trading automation solution.

Connect with subject matter experts today to share your crypto trading bot DeFi development requirements!