How NFTs Revolutionize Academic Credential Verification?

June 12, 2024

The Rise of White Label Crypto Exchange: What You Need to Know in 2024

June 13, 2024Imagine a world where every new blockchain launch brings more chaos than connectivity, much like the fragmented digital landscape of the pre-Internet era. Users are constantly grappling with scaling limitations and poor user experiences due to disjointed liquidity and state. Today’s blockchain environment is disconnected, inefficient, and in desperate need of unification. This is the reality facing many users in the crypto community despite the constant launch of new chains and top rollups solutions.

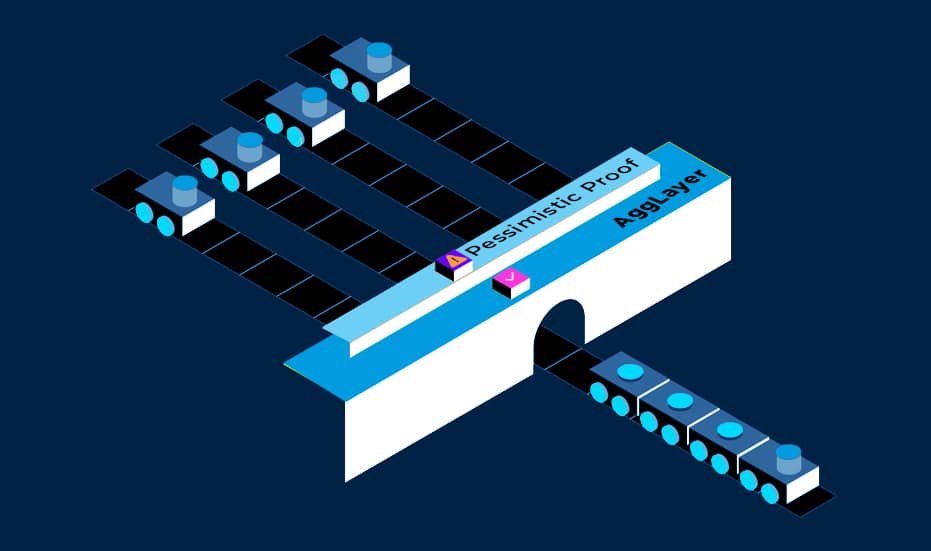

While Gavin Wood, the cofounder of Ethereum, has unveiled the Polkadot JAM Chain to tackle scalability limitations, Marc Boiron, CEO of Polygon Labs, and Brendan Farmer, Co-Founder of Polygon, have introduced the concept of AggLayer. Similar to how TCP/IP unified the internet, Polygon’s aggregation layer aims to unify the web3 ecosystem by integrating ZK-secured L1 and L2 chains into a cohesive network that functions as a single chain.

The Aggregation Layer, or AggLayer, emerges as the first aggregated blockchain network, with its initial components launched in February 2024.

Marc Boiron & Brendan Farmer on the evolution of Polygon & AggLayer

Table of Contents

- The Emergence and Necessity of Aggregated Blockchains

- What is Polygon’s AggLayer?

- Critical Challenges Addressed by Polygon’s Aggregation Layer

- Prominent Benefits of the Polygon’s AggLayer for Developers and Users

- How Does the Polygon’s Aggregation Layer Work?

- How will Smart Contracts Work in an Aggregated Network?

- Why are Aggregated L2 Solutions Better than L3 Blockchains? Myth vs Reality

- How Does Pessimistic Proof Enhance Cryptographic Security in the Polygon’s AggLayer?

- Conclusion

The Emergence and Necessity of Aggregated Blockchains

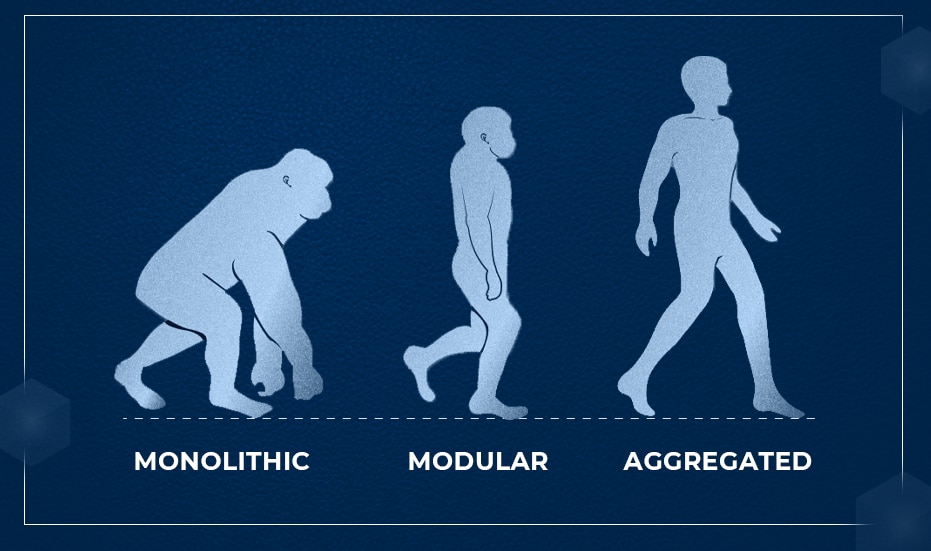

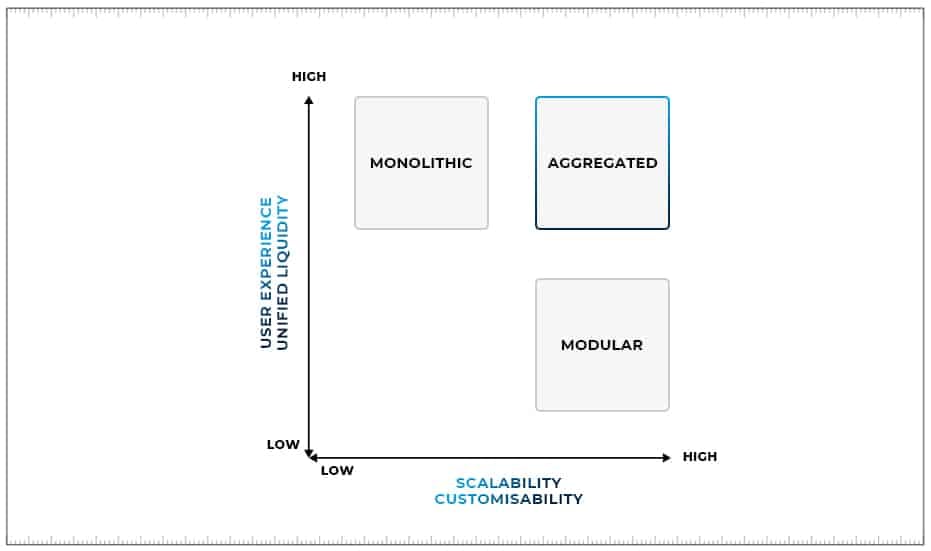

The blockchain landscape has long been defined by a fundamental division between monolithic and modular architectures. Monolithic chains, exemplified by platforms like Solana, offer a unified, interoperable ecosystem where nodes handle consensus, data availability, and execution while serving as a settlement layer.

This architecture provides simplicity and interoperability within the chain itself but struggles with scalability, security, and decentralization as demands increase. Over time, even the most efficient monolithic systems face “state bloat” (an overload of stored data) and “state contention” (high transaction volumes impacting the same data), which degrade performance.

In response, developers have explored modular architectures, which address many of the inherent limitations of monolithic systems by distributing operations across multiple parallel chains, each maintaining its sovereignty. This modularity supports greater scalability and diversity in chain design while catering to varied needs for security, latency, and privacy.

However, while modular systems solve issues like state bloat and contention, they introduce new problems: fragmentation of liquidity and users. In a fragmented ecosystem, maintaining seamless operation across chains often requires inefficient bridging solutions or compromises in chain sovereignty that hinder true scalability and user experience.

Aggregated blockchains emerge as a revolutionary solution to these issues that combine the best features of both monolithic and modular systems.

What is Polygon’s AggLayer?

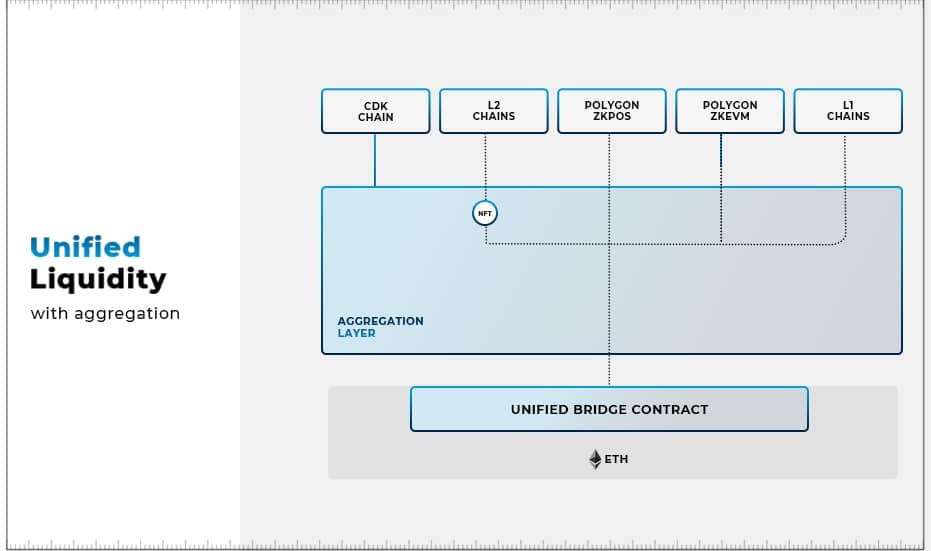

Polygon’s aggregation layer represents a pioneering approach to blockchain architecture, seamlessly combining the advantages of both monolithic and modular systems through the implementation of zero-knowledge technology. It is designed to unify various blockchain projects built on Polygon technology.

It aims to create a seamless, interconnected web of sovereign blockchains that interoperate securely and feel like a single chain. Polygon’s AggLayer not only enhances security, interoperability, & user experience across multiple blockchain platforms but also addresses some of the key challenges faced by current blockchain ecosystems.

Critical Challenges Addressed by Polygon’s Aggregation Layer

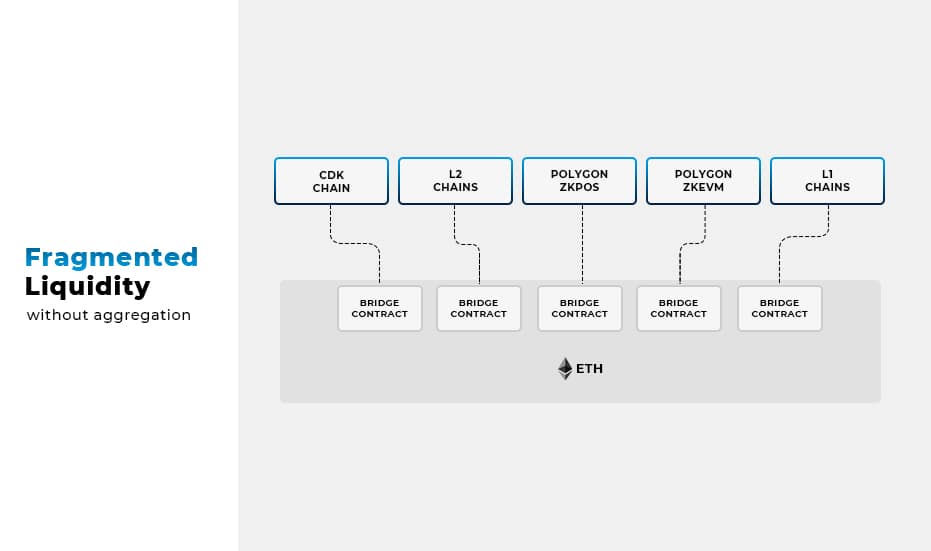

The fundamental challenge addressed by the Polygon aggregation layer pertains to the fragmentation of liquidity & state across various layer 2 solutions and their connection to Ethereum’s layer 1. This fragmentation not only complicates user experience but also escalates costs significantly. Let’s delve into the specifics of these issues and how the Aggregation Layer tackles them.

-

Fragmentation of Liquidity and State

In the current blockchain ecosystem, particularly with the advent of rollups such as optimistic rollups and zk rollups, liquidity is dispersed across multiple platforms. This fragmented liquidity leads to higher slippage rates and less efficient execution of transactions. From a user’s perspective, this means more costly and less predictable trades or transaction outcomes.

-

The Issue with Cross-chain Transactions

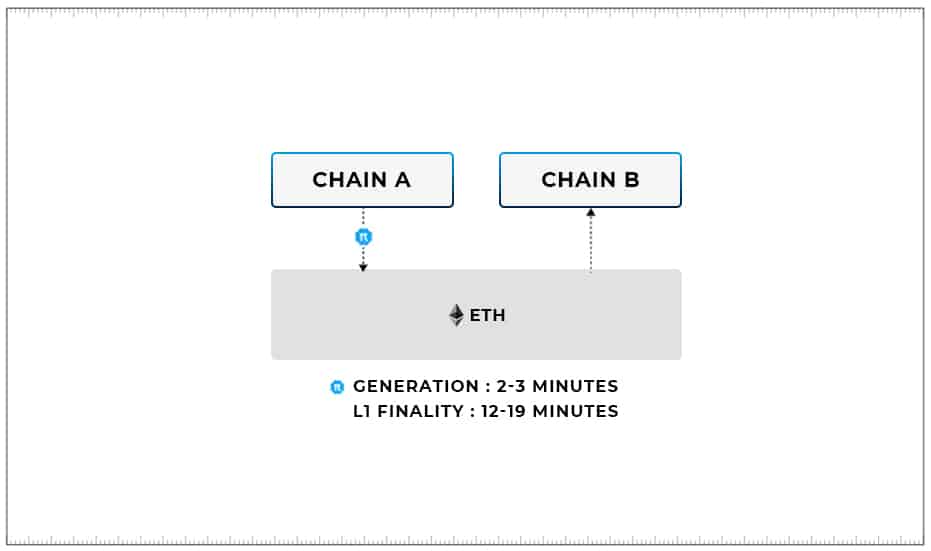

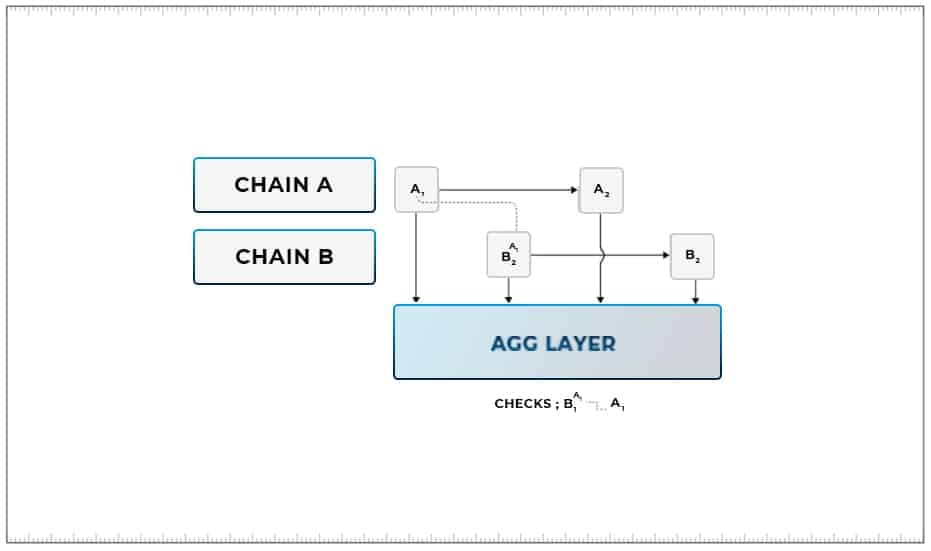

For users operating across different chains, the scenario is further complicated. Consider a user, Alice, who wants to transfer tokens from chain A to Bob on chain B. The process inherently involves locking or burning tokens on chain A, with a corresponding credit on chain B. However, for this transaction to be executed securely, two conditions must be met:

1. Finality on Ethereum L1: The batch of transactions including Alice’s must be finalized on Ethereum L1. Without this, there’s a risk that chain A could falsely report the transaction to chain B, leading to possible double-spending.

2. Validity Verification: Chain B must confirm the validity of the state on chain A post-transaction to ensure no fraudulent activity was recorded. If this verification fails or is bypassed, it could potentially lead to loss of funds through invalid transactions.

These requirements introduce significant delays of up to 12 minutes for finality on Ethereum and additional minutes for proof generation or challenge periods on rollups. This latency is a substantial barrier to efficient and user-friendly cross-chain interactions.

Prominent Benefits of the Polygon’s AggLayer for Developers and Users

How the AggLayer and Polygon CDK affect dev workflows

-

Cryptographic Security and Atomic Composability

Polygon AggLayer maintains cryptographic integrity and composability across all connected chains without compromising their autonomy. To ensure robustness and prevent censorship, the AggLayer is operated by a decentralized network of validators.

These validators are responsible for aggregating zk proofs and ensuring that all transactions are processed fairly and transparently. By aggregating zk proofs, Polygon’s AggLayer ensures that each chain’s state is valid and consistent with others, thereby preventing fraud and double-spending.

-

Near-Instant Cross-Chain Transactions

Traditional cross-chain interactions often suffer from delays due to the need for proofs to be verified on Ethereum. Polygon aggregation layer significantly reduces transaction latency and enables chains to coordinate & operate at lower-than-Ethereum latency. This capability facilitates fast transactions between chains while enhancing the overall user experience.

Low-latency interactions are crucial for applications that require real-time responsiveness and smooth user experiences. This is achieved through a unique architecture that supports a unified bridge and allows direct transfers of native assets across chains with significantly reduced latency.

-

Unified Bridge for Asset Fungibility

Unlike typical cross-chain bridges that necessitate the creation of synthetic tokens, Polygon AggLayer facilitates the transfer of native tokens across the connected chains using a shared liquidity pool. This unified approach not only simplifies user transactions but also preserves the integrity and value of the assets being transferred.

This shared liquidity enhances the efficiency of decentralized applications and other blockchain-based services, making them more accessible and user-friendly. By ensuring asset fungibility, trustless interoperability, and low-latency transactions, Polygon’s AggLayer fosters a more interconnected and fluid environment where liquidity can move seamlessly across.

How Does the Polygon’s Aggregation Layer Work?

Polygon aggregation layer operates in three distinct phases: Pre-Confirmation, Confirmation, and Finalization. Here’s a detailed look at each phase:

1. Pre-Confirmation

- Header Submission: Suppose that chain A, which is a zk-powered chain in the Polygon ecosystem, submits a header for a new block or batch (A1) to the AggLayer. This submission includes a light client proof.

- Dependencies: The header contains commitments to all other blocks and bundles that A1 depends on(B1, C1, etc).

- Pre-Confirmation Status: When the new batch is accepted by the AggLayer without requiring a validity proof, it is considered “pre-confirmed.” This status means the batch is acknowledged but not yet fully verified.

2. Confirmation

- Proof Generation: Chain A, or any full node operating on chain A, generates a proof for A1 and submits this proof to the AggLayer.

- Verification: The AggLayer verifies the submitted proof.

- Batch Confirmation: A1 is officially confirmed once the proof is verified, provided all batches that A1 depends on are also confirmed.

3. Finalization

- Proof Aggregation: After A1 is confirmed, its proof is aggregated with proofs from other rollups.

- Posting to Ethereum: The combined proof is then posted to Ethereum.

- Consistency Enforcement: The aggregated proof ensures that all dependent chain states and bundles are consistent.

Chains within the Polygon ecosystem can navigate the tradeoff between latency and liveness guarantees based on their specific needs. The critical safety guarantee for cross-chain transactions is enforced at the finalization step.

By ensuring that all proofs and dependencies are consistent and verified before posting to Ethereum, Polygon AggLayer provides a robust framework for secure and efficient cross-chain interactions.

How will Smart Contracts Work in an Aggregated Network?

The AggLayer introduces a smart contract library known as bridgeAndCall(), which is designed to facilitate seamless cross-chain functionality within the aggregated network. This feature represents a major advancement in allowing diverse blockchain networks to operate cohesively.

bridgeAndCall() is a robust library that empowers developers to embed cross-chain operations within smart contracts. Consider a use case where a user desires to:

- Transfer an asset from chain A to chain B

- Exchange it for a different asset

- Move this new asset to a gaming chain

- mint a gaming NFT.

With bridgeAndCall(), all these actions are consolidated into a single transaction, achievable with just one click. This functionality extends beyond mere asset transfer between chains (bridge). It also enables the initiation of smart contracts on an alternate chain once the asset has been transferred (call).

This capability allows developers to design sophisticated, multi-chain processes that were either previously impossible or would have involved complex and costly bridging solutions. This enhancement significantly betters user experience by eliminating the need for multiple signatures and reducing waiting times between transactions.

Why Aggregated L2 Solutions are Better than L3 Blockchains? Myth vs Reality

Here are some important insights to help developers understand why aggregated L2 solutions are superior to L3s:

-

Customizability

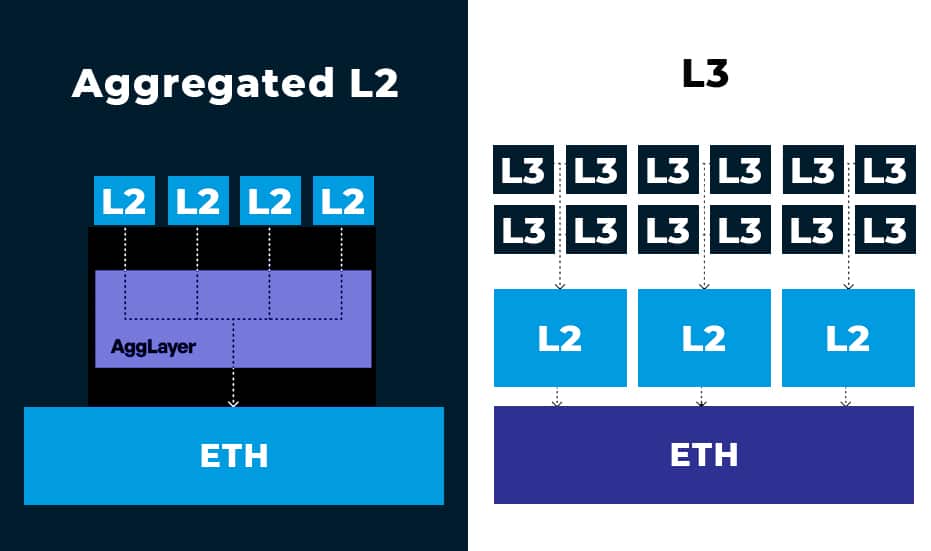

Myth: L3s provide unparalleled customization that L2s cannot match.

Reality: Aggregated L2 solutions offer complete customization freedom, contrary to the belief that only L3s offer limitless customization options. While L3s are touted for their customizability, they actually impose limitations due to their dependence on the underlying L2s, restricting true sovereignty and customization.

Aggregated L2 solutions, like those using the Polygon CDK, enable developers to create ZK-powered chains with a wide range of custom features from gas tokens to sequencer types without the constraints of external governance models or consensus mechanisms.

-

Cost Amortization

Myth: L3s optimize transaction costs more effectively by posting data to an L2 instead of directly to Ethereum.

Reality: Aggregated L2 solutions can reduce costs more efficiently through proof aggregation. ZK technology enables these networks to bundle multiple chain states into a single recursive proof, posting it to Ethereum, thus amortizing costs across potentially thousands of chains. This recursive aggregation is unique to zk technology and is not achievable in optimistic models that L3s use, where each state must maintain its own fraud proofs.

-

Multichain Interoperability

Myth: L3s enhance multichain interoperability.

Reality: Aggregated L2 solutions are superior for multichain interoperability. Unlike the L2/L3 model which can lead to economic exploitation and transaction ordering biases by L2 operators, aggregated L2 solutions maintain neutrality and do not involve asset extraction or transaction ordering, preventing potential censorship and maximization of extractable value. This model supports robust, secure, and low-latency transactions across multiple chains without compromising on sovereignty.

-

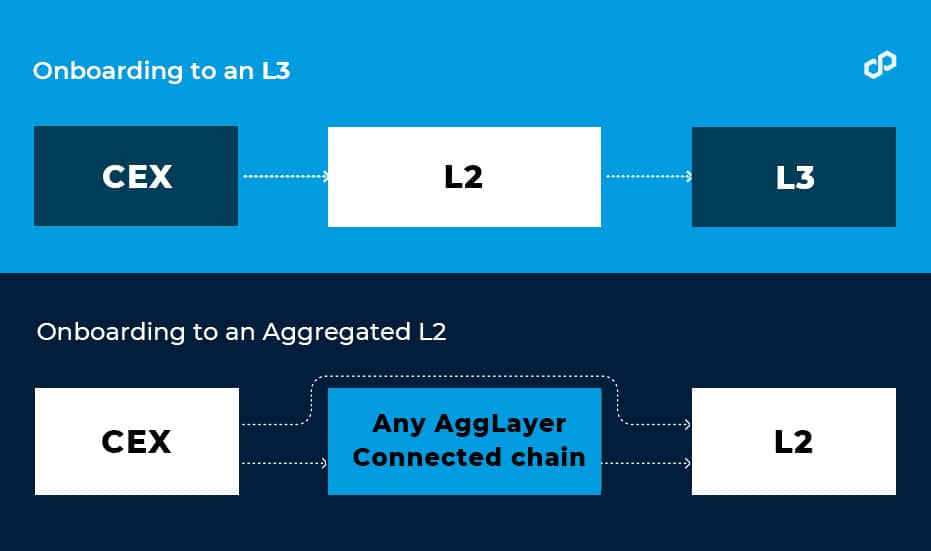

Onboarding Simplicity

Myth: It’s easier to onboard users to an L3 due to its connections with centralized exchanges.

Reality: Aggregated L2 solutions offer a more inclusive onboarding process. Instead of relying on a single L2’s CEX connections, aggregated L2s like the AggLayer enable any connected chain to leverage the collective CEX connections of the entire network, simplifying user access and promoting a unified liquidity and user base.

How Does Pessimistic Proof Enhance Cryptographic Security in the Polygon’s AggLayer?

Although the Polygon AggLayer is designed to support various proof systems and consensus mechanisms, the likelihood of errors rises. Without an adequate safety system, a malicious user on one chain could disrupt the entire bridge. To address this, Polygon AggLayer employs a special type of zero-knowledge proof called pessimistic proof to ensure cryptographic safety for transactions between chains.

Polygon’s AggLayer assumes that all connected chains might be unreliable. This means that if one chain has problems, those issues cannot affect the other chains on the bridge. By taking this cautious approach, Polygon AggLayer ensures the safety of the entire network of chains. Even though each chain keeps its own security measures, the pessimistic proof ensures that problems on one chain won’t harm the others.

How do Pessimistic Proofs Work?

From the AggLayer’s point of view, the unified bridge is a complex network of chains. To keep it secure, Polygon’s aggregation layer needs to track all asset transfers and messages between chains. This ensures that no chain can withdraw more from the bridge than it has deposited in its L1 contract. The AggLayer checks three key things:

- Chain updates are correct

- Chains have accurately accounted for their tokens

- All chains together have done their accounting correctly

Role of Merkle Trees, Leafs, & Exist Roots

Every chain linked to the Polygon’s AggLayer keeps a local exit tree to monitor withdrawals. The AggLayer uses the root of each chain’s local exit tree to create a complete picture of all withdrawals across the unified bridge, which is referred to as the “global exit tree.”

This helps the Polygon AggLayer keep track of the total balances across all chains. To make sure everything is correct, the AggLayer creates a pessimistic proof by gathering three inputs from every chain:

- The most recent update of the local exit tree

- The inventory of new withdrawals

- The projected new local exit root

Polygon’s AggLayer matches the newly computed local exit root with the expected root to ensure the update is accurate. Before locking in a new global exit root on the L1, it verifies that no chain is withdrawing more tokens than it has deposited. This method helps detect any chain attempting to withdraw excessively.

By using the pessimistic proof, the AggLayer sums up withdrawals from each chain to monitor total balances. If a chain displays a negative balance, it means there’s an attempt to withdraw tokens that haven’t been deposited, which invalidates the update of that chain. Such a proof cannot be validated on the L1, thereby blocking the problematic update from being executed on Ethereum and protecting the network.

To sum up, Pessimistic proof is a critical innovation for enhancing cryptographic security in the AggLayer. By assuming all chains are unreliable and ensuring that no chain’s issues can contaminate the rest, Polygon AggLayer provides a robust mechanism for cross-chain security. This approach ensures that the entire network remains safe and that each chain’s balance is accurately maintained, preventing malicious actors from exploiting the unified bridge.

Conclusion

As we look to 2024 and beyond, Polygon’s aggregation layer is poised to be a game-changer in the blockchain landscape. The emergence of aggregated blockchains marks a significant step forward in the evolution of decentralized networks. Polygon aggregation layer exemplifies this progress by providing a unified platform that allows various blockchain projects to interoperate as if they were a single chain.

Its innovative approach to scalability, security, and interoperability addresses the limitations of current blockchain ecosystems and sets the stage for a more integrated and user-friendly future. As we move forward, developers and users alike will find immense value in the capabilities of Polygon aggregation layer, driving further innovation and adoption of blockchain technology.

For those looking to leverage the full potential of Polygon’s cutting-edge solutions, partnering with experts is crucial. Antier, as the top Polygon expert, offers unparalleled insights and services to help you navigate and maximize the benefits of AggLayer. With Antier’s expertise, you can stay ahead in the rapidly evolving world of blockchain technology.