How to Create an Inventive MPC Super Crypto App

May 31, 2024

Stablecoin Development on the XDC Network: Detailed Guide and Cost Considerations

May 31, 2024Decentralized exchanges have revolutionized the way crypto assets are traded in 2024. From providing a secure, trustless, and permissionless environment for transactions to significantly reducing the risk of hacks and fraud associated with centralized platforms, they have reshaped the crypto landscape to a great extent. With the rising popularity of DEXs, building your own DEX like Uniswap would be a lucrative move.

According to DefiLama, Uniswap is the largest decentralized exchange that significantly surpasses its competitors in terms of trading volume & total value locked. Now the question arises, how can you build a robust DEX like Uniswap?

This guide delves into the essential aspects of creating a Uniswap-like DEX, offering insights into the mechanics, benefits, and step-by-step development process. The guide will equip you with the knowledge to embark on your DEX-building journey seamlessly.

Table of Contents

- What is DEX?

- Building the DEX: Core Components and Considerations

- Step-by-Step Process for Developing DEX like Uniswap

- Opt for a Reputed DEX Development Company for Your Project

- Conclusion

What is DEX?

A Decentralized Exchange (DEX) is a cryptocurrency exchange that operates without a central authority, such as banks, brokers, payment processors, or other institutions. Unlike traditional exchanges, DEXs facilitate peer-to-peer transactions directly between users through an automated process governed by blockchain-based smart contracts, facilitating the exchange of crypto assets.

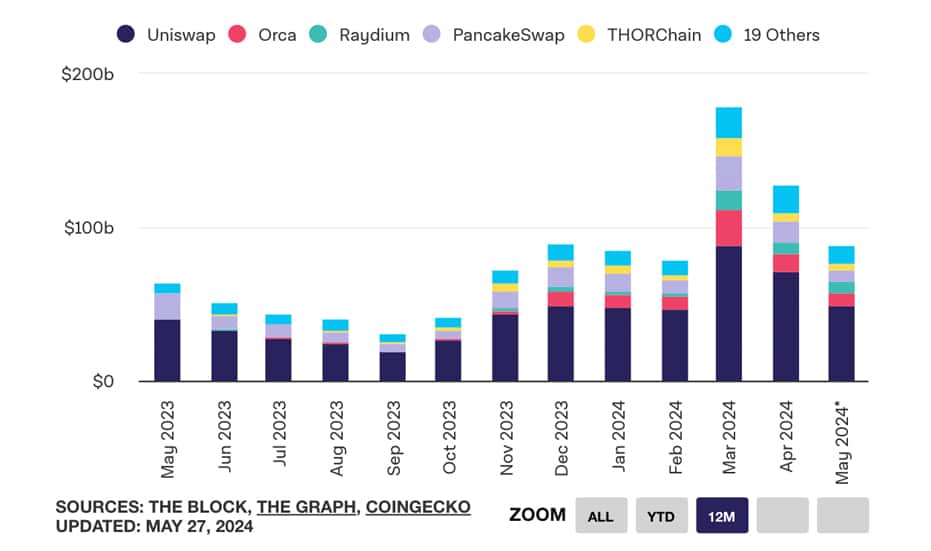

The benefits of decentralized exchanges (DEXs) include the absence of centralized intermediaries, increased transparency, reduced counterparty risks, enhanced financial inclusion, and more. These advantages are driving its popularity among investors worldwide. (See the below fig.)

The growth of DEX (Source)

Uniswap DEX Surges to the Top of the Growth Chart

The Block data shows that Uniswap DEX holds a high share of DEX volume, making it an attractive investment for many. Uniswap DEX is a leading DEX built on the Ethereum blockchain and known for its innovative AMM (Automated Market Maker) model. Uniswap DEX follows an approach of using liquidity pools that allow users to contribute assets to facilitate trading. Such an approach allows for continuous liquidity and eliminates the need for a central order book.

Why is it so popular?

- Operates without a central authority

- Automated Market Maker (AMM) Model

- User-friendly interface

- Simple process for swapping tokens

- Allows users to earn fees by providing liquidity

- Supports a vast array of ERC-20 tokens

- Competitive fees compared to centralized exchanges

- Open-source protocol

- Permissionless Trading

- Governance token (UNI) enables user participation in decision-making

Building the DEX: Core Components and Considerations

DEX like Uniswap includes a number of core components and a set of features required for its proper functioning. Below, we have covered a few you must have a look at

- Smart Contracts

Uniswap DEX built on Ethereum uses various smart contracts that automate trading, enforce rules, and ensure trustless transactions. It is a vital component that needs to be thoroughly audited for increased security and efficiency.

- Liquidity Pools

Decentralized exchanges or DEX rely on liquidity pools. Uniswap DEX employs an Automated Market Maker (AMM) model that sets prices for trades without needing a traditional order book. The AMM model automatically figures out how much one token is worth compared to another. If one token is in high demand and the other isn’t, their relative prices will adjust accordingly.

- Wallet Integration

Users basically require a crypto wallet to interact with DEX. Uniswap DEX is compatible with a variety of wallets, including its own Uniswap Wallet as well as popular options such as MetaMask, Coinbase Wallet, and WalletConnect. The seamless wallet integration enhances user experience and security and facilitates trading.

- Interoperability Protocols

Compatibility with various tokens and blockchain networks is vital for a versatile DEX. Uniswap DEX already operates on different blockchains, including Ethereum, Arbitrum, Optimism, Arbitrum, Polygon, Binance Smart Chain, and Celo.

- Security Mechanisms

Implementing robust security mechanisms, including multi-signature wallets and regular audits can help address smart contract vulnerabilities, protect user funds, and maintain platform integrity. Uniswap DEX gets smart contracts thoroughly checked by third-party security audit companies who spot the potential weaknesses in the code and address them using better strategies.

Step-by-Step Process for Developing DEX like Uniswap

Developing a decentralized exchange (DEX) like Uniswap involves the following steps that one should consider to ensure a secure, efficient, and user-friendly platform development.

Step 1: Define the Project Scope

The first step in developing a DEX is to define the project scope, which includes outlining the goals, target audience, and key features of the platform.

- Objectives: Determine the primary objectives of your DEX. Are you looking to provide a platform for trading a specific set of tokens, or do you aim to support a wide range of assets?

- Target Audience: Identify your target users. Are you catering to professional traders, DeFi enthusiasts, or the general public?

- Unique Selling Points: What will set your DEX different from existing platforms? Consider unique features, user interface innovations, or special incentives for users and liquidity providers.

Step 2: Assemble a Development Team

A successful decentralized exchange (DEX) requires the efforts of a skilled team with diverse DEX development expertise:

- Blockchain Developers: Highly proficient in writing and deploying smart contracts.

- Frontend and Backend Developers: For building the user interface and integrating backend systems.

- UI/UX Designers: To ensure a seamless and intuitive user experience.

- Security Experts: To identify and mitigate potential vulnerabilities.

- Project Managers: To oversee the development process and ensure timely completion.

Assembling a team with the right mix of skills is imperative to the success of your DEX having the Uniswap capabilities.

Step 3: Choose a Development Framework

Selecting the right development tools and frameworks is also important to build robust Uniswap-like DEXs.

- Programming Languages: Select appropriate programming languages for smart contract development. Solidity is widely used for Ethereum-based contracts, whereas Rust and other languages might be suitable for different blockchain platforms.

- Development Tools: Choose development tools and frameworks that streamline the coding, testing, and deployment processes. Truffle, Hardhat, and Remix are popular for Ethereum development.

Choosing the right programming language and tools will help streamline the development process.

Step 4: Develop Smart Contracts

Smart contracts are the backbone of the DEX. Consider developing the following smart contracts while creating Uniswap-like DEXs–

- Token Swap Contracts: Write smart contracts to handle token swaps. These contracts should implement the Automated Market Maker (AMM) model, enabling users to trade tokens directly from liquidity pools.

- Liquidity Provision Contracts: Develop contracts that manage liquidity pools. These should allow users to deposit token pairs and receive Liquidity Provider (LP) tokens in return. Ensure these contracts distribute trading fees proportionally among liquidity providers.

- Governance Contracts: If your DEX includes a governance mechanism, develop contracts that enable token holders to vote on platform changes and proposals.

Test and audit your smart contracts thoroughly to prevent vulnerabilities and ensure its optimal functioning and performance.

Step 5: Create Liquidity Pools

Liquidity pools are essential for the automated market maker (AMM) model used by Uniswap-like DEXs. These pools consist of pairs of tokens that users deposit into the platform.

To create effective liquidity pools:

- Define Token Pairs: Determine which token pairs will be supported initially. Popular pairs typically include stablecoins and high-volume cryptocurrencies.

- Incentivize Liquidity Providers: Develop mechanisms to attract liquidity providers, such as offering a share of trading fees or distributing governance tokens as rewards.

- Manage Pool Depth: Ensure there is sufficient liquidity to minimize slippage and provide a smooth trading experience.

Step 6: Integrate Wallets

Seamless wallet integration is one of the crucial steps to ensure user experience and security.

- Compatibility: Ensure your decentralized exchange (DEX) is compatible with popular cryptocurrency wallets, such as MetaMask, WalletConnect, and others. This allows users to connect their wallets seamlessly and interact with your DEX.

- User Experience: Optimize the wallet integration process for a smooth user experience. Ensure that connecting, trading, and managing assets are straightforward and intuitive.

Step 7: Develop the Frontend

The user interface is a key element of your DEX. A well-designed front end can significantly enhance user satisfaction. Focus on the following points while developing the front end of Uniswap like DEXs.

- User-Friendly Design: Ensure the interface is intuitive and easy to navigate, with clear calls to action and accessible features.

- Responsive Layout: Optimize the design for various devices, including desktops, tablets, and smartphones.

- Real-Time Data: Provide real-time updates on token prices, pool liquidity, and trading volumes to help users make informed decisions.

- Security Features: Incorporate measures such as two-factor authentication and secure sign-in methods to protect user accounts.

Step 8: Implement Security Measures

Security is paramount in DEX development. Implement the following robust security measures to protect user funds and platform integrity:

- Smart Contract Audits: Conduct comprehensive audits of your smart contracts to identify and fix vulnerabilities.

- Multi-Signature Wallets: Use multi-signature wallets for holding funds, requiring multiple approvals for transactions.

- Cold Storage: Store the majority of funds in offline wallets to prevent hacking attempts.

- Bug Bounty Programs: Encourage the community to identify and report security issues by offering rewards for discovering bugs.

Step 9: Test Extensively

Before launching your decentralized exchange (DEX), conduct thorough testing to ensure all components function correctly and securely:

- Testnet Deployment: Deploy your DEX on a testnet environment to conduct thorough testing. Simulate various scenarios, including high trading volumes, to ensure the platform can handle real-world conditions.

- User Testing: Conduct thorough user testing to identify usability issues and areas for improvement.

- Performance Testing: Conduct performance testing to ensure the platform can handle peak loads without compromising speed or functionality.

- Security Testing: Perform rigorous security testing, including code reviews, vulnerability scans, and penetration tests. Address any identified issues promptly.

Step 10: Launch and Monitor

Once testing is complete and all issues are resolved, launch your DEX on the mainnet. Post-launch, continuous monitoring, and maintenance are crucial:

- Performance Monitoring: Track key performance metrics such as transaction throughput, latency, and user activity.

- Security Monitoring: Regularly audit the platform and smart contracts to identify and mitigate any new vulnerabilities.

- User Support: Provide ongoing customer support to assist users with any issues they encounter.

- Updates and Improvements: Continuously improve the platform based on user feedback and evolving market conditions, adding new features and optimizing existing ones.

Launching a DEX is not the end of the journey; it requires ongoing attention and adaptation to ensure long-term success.

Opt for a Reputed DEX Development Company for Your Project

Choosing a reputable DEX development company can significantly streamline the process of building your Uniswap-like DEX. A professional development firm offers several advantages:

- Expertise and Experience: Reputable companies have a proven track record in blockchain development and DeFi projects. Their expertise can help you navigate technical challenges and ensure your platform is built to high standards.

- Security Focus: Security is paramount in DEX development. Experienced companies like Antier employ best practices and conduct rigorous audits to safeguard your platform against vulnerabilities and attacks.

- Efficient Development Process: A professional team can accelerate the development timeline, ensuring that your DEX is launched promptly and efficiently. Their structured approach minimizes delays and optimizes resource allocation.

- Customization and Support: Development companies offer customized solutions tailored to your specific needs and objectives. They also provide ongoing support and maintenance and also ensure your DEX remains up-to-date and secure.

- Regulatory Compliance: Navigating the regulatory landscape can be complex. Reputed firms stay abreast of regulatory requirements and help ensure your DEX complies with relevant laws and regulations.

Conclusion

Developing a Uniswap-inspired DEX in 2024 requires a strategic blend of technological innovation, user-centric design, and regulatory compliance. The blog has covered every detail to help start the development journey of DEX like Uniswap.

As we step into 2024, the demand for DEXs continues to soar, and it would be beneficial to take a foot forward to DEX development by hiring a reliable blockchain development company, Antier. The company has proficient blockchain developers who employ their skills to develop a DEX for crypto enthusiasts who are eager to explore the possibilities of creating their own Uniswap-inspired platforms. Connect with us to gain insight into our DEX development services.