Why is Blockchain in BFSI the Next Big Thing in 2024?

March 27, 2024

Why Must Businesses Hire a Smart Contract Audit Firm for Launching Foolproof DeFi Apps?

March 27, 2024Cryptocurrency is at the centre of the digital revolution that the financial industry is currently experiencing. User-friendly crypto banking solutions are in high demand as adoption of this technology soars. This offers a special chance for new and existing companies to join the market with white label crypto bank solutions. These platforms provide a pre-built infrastructure that spares you from having to start from scratch when launching your own crypto bank under your own brand. Although it could appear like a quick route to success, entering the cryptocurrency market has its own set of technical challenges.

A crypto bank’s technical intricacies extend beyond simple account setup and transaction processing. Some of the challenges you will encounter are maintaining smooth scalability as your user base grows, integrating APIs with multiple services seamlessly, and implementing robust security measures. Project delays and budget overruns may result from planning stages that neglect to consider these technical complexities. A clear and detailed cost analysis is useful in this situation.

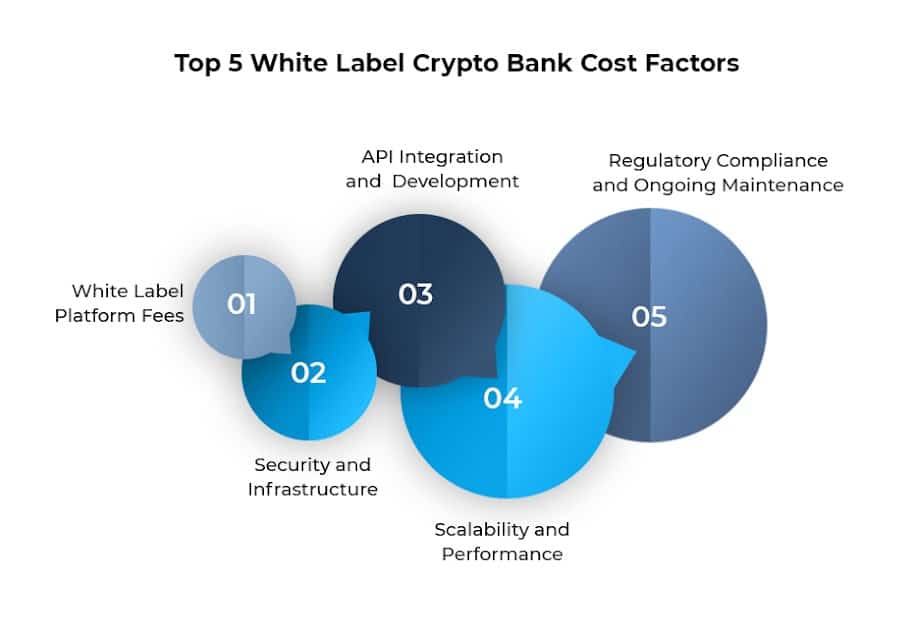

To navigate this technical landscape effectively, let’s delve into the top 5 cost factors you must consider when launching your white label crypto bank, all with a technical lens. We’ll explore how these factors can impact your budget and guide you in making informed decisions for a successful launch.

Mastering White Label Crypto Bank Costs: 5 Factors for Smart Spending

1. White Label Platform Fees: Dissecting the Technical Price Tag

1. White Label Platform Fees: Dissecting the Technical Price Tag

The foundation of your crypto bank rests upon the chosen white label platform. These platforms provide the core infrastructure– digital wallets, transaction processing, and security features– that power your branded operation.

However, their pricing structures can vary significantly, and understanding the technical implications is crucial.

- Subscription-Based : In this, you pay a monthly or annual fee that grants access to the platform’s core functionalities. This model is suitable for startups with predictable usage, but technical limitations could arise. For example, a low-tier subscription might restrict API call volumes, hindering integration with certain services.

- Transaction-Based : This model charges fees per transaction processed on the platform. While cost-effective for low volume operations, high transaction volumes can quickly inflate your budget. Additionally, consider the technical overhead associated with transaction processing. Ensure the platform can handle your anticipated volume without compromising performance.

2. Security and Infrastructure: Building a Fort Knox for Your Crypto Bank

In the digital realm of cryptocurrency, security is paramount. Your crypto bank will be entrusted with users’ valuable assets, making robust security measures non-negotiable. This is where the technical expenses of creating a secure infrastructure become crucial.

Earning user trust requires adhering to industry-recognized security standards. These standards, like SOC 2 (Service Organization Controls) and PCI DSS (Payment Card Industry Data Security Standard), establish a rigorous framework for data protection and access controls. Implementing these standards isn’t a one-time expense. Some ongoing costs to consider are:

- Security Audits : Regular audits by independent security firms are crucial for identifying potential vulnerabilities. These audits can be costly, but they act as a valuable investment in protecting your platform.

- Penetration Testing : Simulating cyberattacks through penetration testing helps uncover weaknesses in your system’s defenses. The cost of penetration testing depends on the scope of the test, but it’s a proactive measure to prevent costly breaches.

- Dedicated Security Personnel : Maintaining a team of skilled security professionals is vital for ongoing vulnerability management, incident response, and system updates.

3. API Integration and Development: The Invisible Connectors of Your Crypto Bank

For seamless operations, your platform needs to connect with various external services– liquidity providers for facilitating crypto transactions, payment processors for fiat on/off ramps, and potentially other third-party applications to offer additional features. The magic behind these connections lies in APIs (Application Programming Interfaces).

APIs act as invisible connectors, allowing your platform to communicate and exchange data with these external services. They play a crucial role in your crypto bank’s functionality:

- Liquidity Providers : To offer users the ability to buy and sell cryptocurrencies, you’ll need to integrate with liquidity providers. These integrations happen through APIs, ensuring efficient execution of user transactions.

- Payment Processors : Enabling users to convert their crypto assets to fiat currency (and vice versa) requires connecting with payment processors. Again, APIs facilitate this communication, ensuring smooth fiat on/off ramps.

- Additional Features : Many white label crypto banking solutions allow integration with third-party applications for functionalities like advanced charting tools or market analysis. These integrations also rely on robust APIs.

4. Scalability and Performance: Gearing Up for Growth

As your crypto bank gains traction, you can expect a surge in user base and transaction volume. This is where scalability becomes a critical factor. In a busy market, for example, your platform’s infrastructure may not be able to support the growing volume of traffic, which could negatively impact user satisfaction and cause potential customer erosion.

A scalable solution is key to ensuring smooth performance. See how scalability impacts your white label bank cost :

- Server Upgrades : As your user base and transaction volume increase, your platform might require more powerful servers to handle the load. This can involve upfront costs for server upgrades or transitioning to a cloud-based infrastructure with flexible scaling options.

- Additional Resources : Scaling might necessitate additional technical resources, such as database administrators and system engineers. This could involve hiring new personnel or outsourcing these services.

5. Regulatory Compliance and Ongoing Maintenance: The Price of Trust

As governments grapple with this burgeoning technology, regulations can evolve rapidly. For your white label crypto bank to operate legally, ongoing compliance monitoring and adaptation are crucial. New regulations can emerge seemingly overnight, and adapting your platform to comply can be challenging. However, failing to comply can lead to hefty fines or even operational shutdowns.

Maintaining compliance requires a multi-pronged approach, and each aspect comes with associated financial considerations:

- Legal Expertise : Consulting with legal professionals who specialize in cryptocurrency regulations is essential. Their guidance can help you navigate the complexities of compliance and ensure your platform adheres to the latest requirements.

- Compliance Tools : Several software tools can automate compliance tasks like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. These tools can streamline compliance processes but often come with subscription fees.

- Staying Updated : The regulatory environment surrounding cryptocurrency is constantly evolving. Staying informed about these changes requires dedicating resources to monitoring industry news, attending conferences, and participating in webinars. These ongoing efforts contribute to the overall compliance cost.

How Cost Planning Can Fuel Your White Label Crypto Bank’s Growth?

The cryptocurrency space is full of opportunity, and starting your own white label crypto bank can be a thrilling endeavour. But amid the excitement of invention, financial planning is an essential component. Efficient cost management is more than just controlling your spending; it is the engine that drives the expansion of your cryptocurrency bank. The following points will clarify how it happens:

- Informed Decision-Making : A well-defined budget provides a clear roadmap for your financial resources. It allows you to make informed decisions regarding platform selection, feature prioritization, and resource allocation. This ensures you’re investing in areas that maximize user value and contribute to long-term growth.

- Risk Management : The crypto space is inherently dynamic, and unforeseen challenges can arise. White label crypto bank cost planning helps you anticipate potential price overruns and develop mitigation strategies. This proactive approach minimises financial risks and ensures your crypto bank remains on solid financial footing.

- Sustainable Growth : Uncontrolled spending can quickly derail your growth trajectory. Cost planning allows you to prioritize investments that deliver a high return on investment (ROI). These investments could be in areas like marketing campaigns, user acquisition strategies, or platform enhancements that attract new users and drive sustainable growth.

- Investor Confidence : Investors seeking opportunities in the crypto space value stability and sound financial management. A well-defined cost plan demonstrates your commitment to responsible financial practices, fostering investor confidence and potentially opening doors to future funding opportunities.

- Scalability and Efficiency : As your user base expands, your platform needs to scale efficiently. Cost planning helps you identify areas for optimization, allowing you to invest in scalable infrastructure and streamline operational processes. This ensures your crypto bank can handle increased demand without compromising performance or incurring unnecessary expenses.

Cost planning is about strategically allocating resources to optimise the potential of your crypto bank, not just about cutting corners and saving money. You can make wise decisions, successfully manage risks, and create a path for long-term growth in the constantly changing cryptocurrency market by being proactive with your financial planning.

How Antier Can Help?

The world of crypto banking presents exciting opportunities, but navigating the technical complexities and cost considerations can feel daunting. Remember, a well-defined budget is the foundation for a thriving crypto bank. By carefully evaluating the top 5 cost factors we’ve explored – white label platform fees, security and infrastructure, API integration and development, scalability and performance, and regulatory compliance – you can make informed decisions and optimize your path to success.

At Antier, we understand the intricacies of launching a white label crypto bank. We offer a comprehensive suite of solutions designed to empower your crypto banking journey. Our secure and scalable white label platform provides the core infrastructure you need, while our experienced team can guide you through cost optimization strategies and ensure your platform adheres to the latest regulations.

Ready to turn your crypto banking vision into reality? Contact us now!