Introduction

The total value locked (TVL) in decentralization finance has recently leaped past the $80 billion mark, acquiring heights not achieved since the descent of Terra’s stablecoin in May 2022. The Decentralized Exchange Software market is also struggling to keep up with the pace of dominant centralized counterparts by offering exclusive utility benefits to the users. The top 10 DEXes (Decentralized Exchanges) observed about $205.3 billion of total spot trading volume in the last quarter of 2023, recording a spike of 87.1%.

Even if centralized exchanges dominate the market, Decentralized Crypto Exchange Software solutions are continuously innovating to eschew intermediaries from the crypto trading ecosystem without causing any sort of inconvenience to traders. One of the technologies fostering the growth of decentralized trading ecosystems is rollups. These groundbreaking technologies allow DEXes to attain high scalability without compromising decentralization or security. In this blog, we will dive deeper into how a defi exchange development company can harness zero-knowledge or zk Rollups to enhance the performance of DEXes.

The Scaling Conundrum of Decentralized Exchange Software Solutions

Decentralized Crypto Exchange Software solutions have significantly changed the trading game, proposing a more transparent and permissionless alternative to centralized exchanges (CEXes). However, due to the ingrained scalability trilemma with the underlying technology, where robust security, high throughput, and genuine decentralization cannot be achieved, the user experience and platform’s performance are affected in the following ways:

- Slow transaction processing times: Delayed or slow trades on Decentralized Exchange Software solutions often encourage end-users to choose alternative trading platforms.

- High gas fees: The consumption of computational resources for verifying transactions on the main blockchain usually causes increased gas fees, leading to costly trades.

- Limited scalability: On traditional DEXs relying on a single blockchain network, scalability is the biggest challenge as the network becomes congested when the number of users grows, constraining the capability to manage a growing transaction load.

This is where promising layer 2 protocols step in to elevate user experience, enabling decentralized crypto exchange software solutions to offer head-on competition to their counterparts.

Enter zk-Rollups: Scaling Savior for DEXs

Zero-knowledge rollups are layer 2 scaling solutions that harness the power of zero-knowledge proofs to improve the scalability of the underlying blockchain. They achieve the capability to accommodate an increased number of transactions by processing transactions off-chain and then sending a single proof to verify multiple transactions.

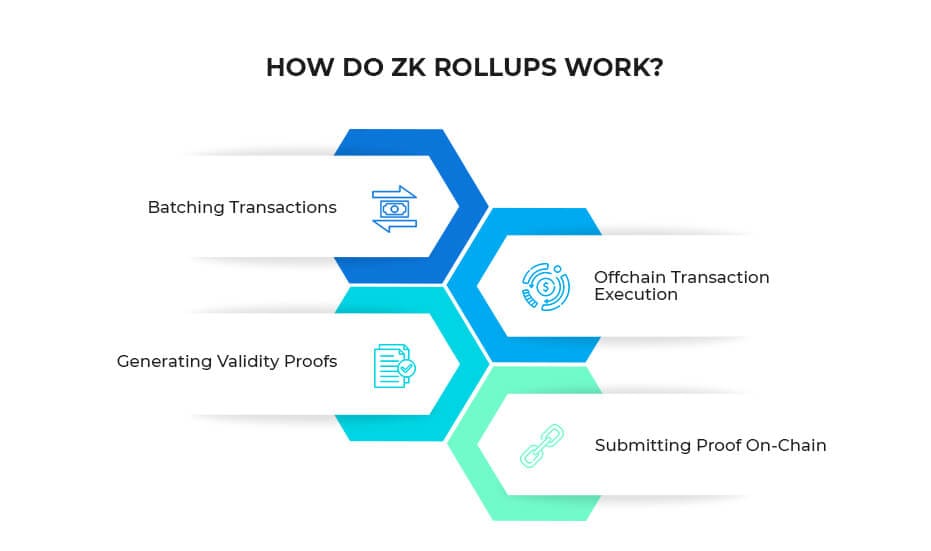

Here’s how they address the scalability challenges associated with Decentralized Cryptocurrency Exchange Development:

- Batching Transactions:

Instead of processing each transaction individually on the main blockchain, the zk-rollups bundle up various transactions together to form a single “batch”.

- Off-chain Transaction Execution:

The transactions are then executed off-chain, significantly slashing the load on the main chain.

- Generating Validity Proofs:

In response to the off-chain execution, a cryptographic proof, also known as zero-knowledge or zk-proof is generated to prove the validity of the entire batch of transactions without revealing their unique details.

- Submitting Proof On-chain:

The zk-proof is then submitted to the main blockchain, confirming the validity of aggregated transactions.

Zk rollups have the potential to bring transformative changes to DEX development, enhancing the performance and utility of decentralized trading ecosystems.

How zk Rollups Enhance Decentralized Cryptocurrency Exchange Development

- Increased Transaction Throughput

Batching transactions and off-loading their execution can significantly increase the number of transactions a decentralized exchange software can handle in a given time, elevating the user experience with faster trade execution.

- Lowered Transaction Costs

By moving the heavy load of computational work off the main chain, zk rollups can effectively minimize the gas fees associated with each transaction, making transactions on DEXs more cost-effective.

- Faster Confirmation Times

Instant trades are no longer limited to centralized exchanges. With zk rollups implementation, decentralized crypto exchange software solutions can take advantage of faster confirmations, enabling nearly instantaneous trades and settlements.

- Improved Scalability

As explained earlier, zk rollups can enable DEXs to process and settle a large number of transactions. They allow DEXs to scale efficiently, enhancing their capability to accommodate a growing number of users and transactions.

- Enhanced Sustainability and Energy Efficiency

Harnessing zk rollups in DEX development reduces the consumption of computational resources required for transaction processing and settlement. This leads to lower energy consumption compared to traditional on-chain transactions, contributing to reduced environmental impact and overall sustainability.

- Interoperability

By aggregating multiple transactions, compressing them into succinct proofs, and validating them on the main blockchain, data size and transaction fees can be reduced, enabling easier interaction between different blockchain networks.

- Customizable Security

While incorporating zk rollups in Decentralized Exchange Software Development, the entrepreneurs can choose consensus mechanisms, adjust parameters such as level of cryptographic proofs required for transaction validation and frequency of data submission to main chain. It impacts overall security of the trading system.

- Enhanced User Experience

Improved scalability, faster transaction processing, lower transaction fees and enhanced security ensure a smoother and more efficient trading experience for users decentralized crypto exchange software solutions.

Case Study: Loopring Protocol, A Game-changer For DEXs

Several promising zk-Rollup solutions are emerging, enhancing the overall decentralized trading ecosystem. Some of the most prominent ones include ImmutableX that is specifically made for NFT trading and Loopring that supports DEX functionalities. Loopring is an incredible Ethereum layer 2 scaling protocol that enables high transactional throughput and cost efficiency on non-custodial decentralized trading protocols. Here’s how Loopring 3.0 enhances Decentralized Exchange Software Development.

- On-Chain Data Availability:

The hybrid approach utiilizes On-chain data availability or OCDA feature which enables decentralized exchanges to decide whether they want to store data on-chain or off-chain. By offloading data during the computational phase, a high-transactional throughput is achieved using zk rollups.

- Ring Miners:

In decentralized exchange software solutions, Loopring harnesses a unique protocols that involves ring miners who rapidly fill orders in return of rewards in form of LRC tokens.

- Order Rings:

A ring miner completes the order ring and Loopring protocol decides how to fill it. When either side of the order is accomplished ,the smart contract initiates an atomic swap which processes a direct transfer from smart contract to user wallets.

- Order Sharing:

Order sharing is made possible via order rings. When certain order cannot be fulfilled in a single trade, the protocol splits it in partial components, uses ring-matching technology to aggregate separate orders in a ring and therefore achieves complete order execution.

Final Words

While zk-rollups present a significant advancement in DEX development, it is essential to acknowledge security considerations and other performance limitations that might arise as the rollups technologyare still in their early stages.

These groundbreaking innovations hold immense potential for revolutionizing decentralized crypto exchange software by addressing the scalability challenges that currently hinder their growth. As the technology matures and adoption increases, we can expect a new era of efficient, scalable, and user-friendly DEXes that unlock the full potential of decentralized finance.

Antier is a pioneering defi exchange development company enabling game-changing transformations in the world of finance by leveraging cutting-edge web3 technologies.

Don’t Let Scalability Issues Hold You Back. Harness their experience to set up a revolutionary DEX.