Unveiling Possibilities in the NFT Ticketing Marketplaces:From Coachella to the NBA

July 11, 2023

Wallets & Token Standards: Enhancing Crypto Compatibility & Functionality

July 12, 2023Table of Contents

Introduction

Decentralized crypto exchanges (DEXs) solutions are non-custodial cryptocurrency trading platforms that operate without needing a third-party or central authority to oversee, monitor, or facilitate trades. Since they enable users to retain total control of their funds, they are emerging as a more secure, transparent and censorship-resistant alternative to traditional centralized platforms.

The fragmented liquidity on complicated-to-use decentralized finance exchange solutions is one of the primary causes of slippage. Moreover, due to the large number of decentralized trading platforms available, it becomes challenging for users to find the best exchange rates and liquidity.

The decentralized finance (DeFi) market has been rapidly expanding and continuously bringing up innovations to streamline user navigation and enhance user experiences. DeFi DEX aggregator development brings one such innovation to the table.

Overview and Market Trends – DEX Aggregator Development

A DEX aggregator is a cryptocurrency trading platform that consolidates liquidity from various decentralized finance exchanges and market makers onto a unified platform. The primary objective of DeFi exchange aggregators is to facilitate seamless crypto swaps or trades at the most favorable prices, eliminating the need for users to navigate multiple platforms. As they amalgamate liquidity from numerous decentralized exchanges and cast it onto a single interface, they are known as liquidity aggregators.

The increasing proclivity of entrepreneurs and customers towards decentralization during the Web3 era is propelling the expansion of DEX aggregator development.

|

In addition, liquidity poses a substantial challenge with DeFi exchange platforms. Liquidity within the DEX market is distributed across several sources, necessitating users to assess various platforms to obtain the best prices. Certain decentralized crypto exchange software solutions suffer from high slippage, while others offer worse swap rates. DeFi DEX aggregator development addresses these concerns by enhancing the trade execution process through order routing across diverse decentralized exchanges, thereby ensuring optimal outcomes for users.

Exclusive Benefits of DeFi DEX Aggregator Development

- Ample Liquidity and Reduced Slippage

- More Trading Opportunities For Traders

- Improved Price Discovery

- Seamless Trading Experience For Users

- Reduced Complexity

- Lower Trading Fees and Maximum Profits

- Advanced Trading Features

- Enhanced Access To Multiple DEXs

- Multi-Wallet Compliance

- Simplified User Interface

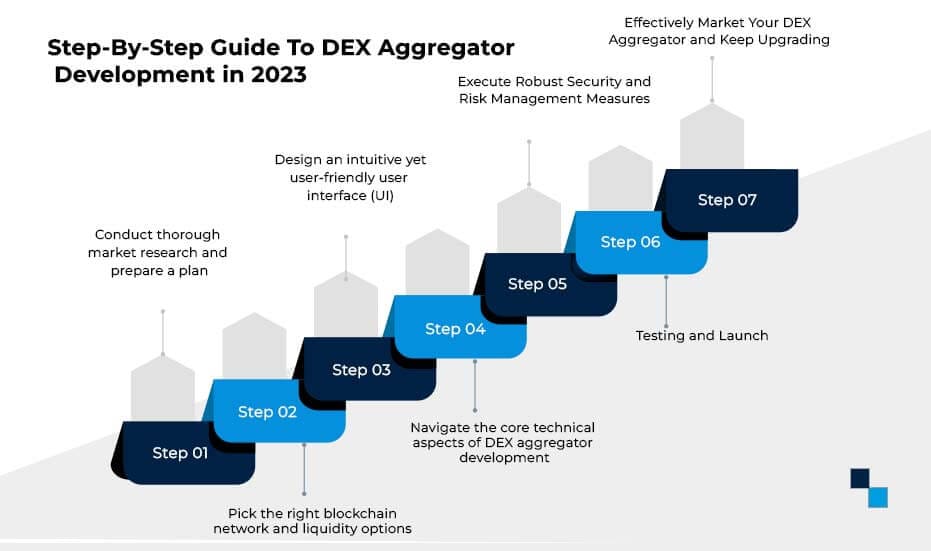

Step-By-Step Guide To DEX Aggregator Development in 2023

Step 1: Conduct thorough market research and prepare a plan:

Conduct comprehensive research to gain a deep understanding of the current competitive landscape, prevailing market trends, prospective customers, and their specific needs and preferences. Analyze the strengths and weaknesses of your competitors to identify potential gaps and areas of opportunity in the market.

Based on your research, you can define your business objectives, determine your target audience, outline key features and unique selling points, and formulate a roadmap for your DeFi DEX aggregator development.

Step 2: Pick the right blockchain network and liquidity options:

The first step is to select a suitable blockchain network that aligns with your specific requirements. Factors to consider include compatibility with popular tokens, transaction fees, and the scalability inherent to the chosen blockchain platform. Some popular options for DEX aggregator development include Ethereum, Polygon, Binance Smart Chain, etc.

Forge strategic partnerships with reputable DEXs and liquidity providers to integrate their liquidity into your platform. With appropriately integrated APIs and proper connectivity with real-time order books, you can ensure the availability of a broader range of trading pairs and competitive pricing. Collaborating with DEXs that possess a strong user base unlocks potential opportunities for cross-promotion and marketing collaborations.

Step 3: Design an intuitive yet user-friendly user interface (UI):

During DeFi DEX aggregator development, focus on delivering a seamless user experience (UX) by designing a clean and compelling UI that enables effortless navigation and swift trade execution. You can integrate customizable trading views and popular wallets that cater to diverse user preferences and ensure smooth access to real-time market data

By crafting a simple yet visually appealing UI/UX, you can attract new users and establish stronger relationships with existing ones. The emphasis on user-centric design will contribute to the overall success of your DEX aggregator platform.

Step 4: Navigate the core technical aspects of DEX aggregator development:

Collaborate closely with a decentralized exchange software development company while they work on smart contracts to automate several functionalities of your decentralized finance exchange aggregator.

Monitor the development and implementation of blockchain networks, interoperability protocols, and other essential algorithms for smooth integration of DEXs on a unified interface. Implement smart order routing to split orders across different decentralized finance exchanges for optimizing trade execution and enhancing user outcomes.

Step 5: Execute Robust Security and Risk Management Measures:

Prioritize the implementation of robust and resilient security and risk management measures to safeguard user funds from potential threats. Consider integrating multi-factor authentication, employing robust encryption techniques, utilizing cold wallet storage, conducting regular security audits for enhanced security, and adhering to regulatory guidelines to ensure compliance and gain users’ confidence.

Step 6: Testing and Launch:

Following the integration of state-of-the-art security measures, conduct rigorous quality assurance tests to identify and address any remaining bugs, glitches, or performance issues that may have arisen during DeFi DEX aggregator development. Beta Testing, involving a select group of users, is an effective way to gather valuable feedback. Launch the DeFi trading aggregator once it is fully functional and stable.

Step 7: Effectively Market Your DEX Aggregator and Keep Upgrading:

Devise and execute a comprehensive marketing strategy encompassing social media campaigns, influencer marketing, content marketing, and other community engagement activities. Ensure comprehensive coverage across various marketing channels to reach your target audience and educate them about the USPs and benefits of utilizing your DEX aggregator platform.

At last, it is essential to sustain the superiority of your platform by staying agile and adaptable to meet the evolving needs and preferences of users, ensuring the competitiveness of your DEX aggregator in the dynamic world of DeFi. Keep a close watch on market data, competitor activities, and user feedback to recognize areas for improvement and opportunities.

Top 10 DEX Aggregators in 2023

- 1Inch

- Rango Exchange

- ParaSwap

- SwapZone

- OpenOcean

- AtlasDEX

- Matcha

- dydX

- Tokenlon

- Orion Protocol

Final Thoughts

The DeFi aggregator market is a rapidly growing space with ample potential for entrepreneurs. By offering users enhanced liquidity, improved price execution, and access to the services of multiple DeFi trading platforms, DeFi DEX aggregator development offers a compelling solution for traders seeking efficiency and convenience. Sushiswap launched its DEX aggregation platform recently. It is poised to intensify entrepreneurial interests in DEX aggregator development.

Antier is a leading technology provider with unprecedented expertise in disruptive distributed ledger technology and extensive experience in building fully-fledged decentralized exchanges. As a trusted technology partner, they are well-equipped to help you unlock the true potential of decentralized finance through tailored DEX aggregator development solutions built in line with the highest security, scalability, and performance standards.

Talk to our subject matter experts today to revolutionize the way traders access liquidity and execute trades!