Exploring the Top Metaverse Trends Shaping the Future

June 12, 2023

Top 6 Blockchain Use Cases in Healthcare You Should Know in 2024

June 12, 2023Table of Contents:

- Understanding of SRC-20 Tokens

- SRC-20 Tokens Vs. BRC-20 Tokens

- Benefits of Developing SRC-20 Tokens

- Technical Aspects of SRC-20 Token Development

- What are the steps involved in implementing SRC-20 Tokens?

- Top-Use Cases and Applications of SRC-20 Tokens

- Emerging Trends and Outlook Of SRC-20 Tokens

- Perks of Collaborating with an SRC-20 Token Development Company

Tokens have surged in popularity, capturing the attention of investors and dominating market capitalization. Amidst this wave, SRC-20 Tokens have emerged as the shining star, captivating the spotlight.

The ascent of tokenization has had a profound impact on the financial landscape, ushering in a revolution in the creation, management, and trading of assets. By transforming assets into digital tokens, fractional ownership becomes a reality, paving the way for democratized investment opportunities, unparalleled innovation, and streamlined processes. Though challenges persist, the transformative force of tokenization propels the industries toward an inclusive and efficient future.

From their humble beginnings to their remarkable potential in the realm of decentralized finance (DeFi), we delve into the captivating world of SRC-20 token development and its role in shaping the future of finance.

Understanding of SRC-20 Tokens

SRC20 tokens represent a unique breed of digital tokens that adhere to the SRC20 token standard, which operates on the Ethereum blockchain with a specific focus on security tokens. These tokens bring forth a range of advantages compared to traditional securities, offering increased liquidity, programmability, and the ability to automate certain processes. With the potential to revolutionize the securities market, SRC20 tokens introduce greater efficiency, accessibility, and innovative possibilities. However, it is imperative to adhere to relevant regulations to ensure a compliant and trustworthy environment for the issuance and trading of SRC20 tokens.

“Ordi, a meme coin, stands out as a prominent SRC-20 token within the BRC-20 sphere. Ordi outstands other tokens with its unique launch strategy, where it was initially offered for free minting. This approach attracted a substantial user base, resulting in over 14,000 BRC-20 tokens of Ordi in circulation. The remarkable success of Ordi is further evident in its market capitalization, which surpasses $300 million.”

Feeling puzzled about the distinctions between SRC-20 Tokens and BRC-20 Tokens? Do not get perplexed anymore! Let us unwind the dissimilarities between these two tokens, providing you with a clearer understanding of their individual characteristics.

SRC-20 Tokens Vs. BRC-20 Tokens

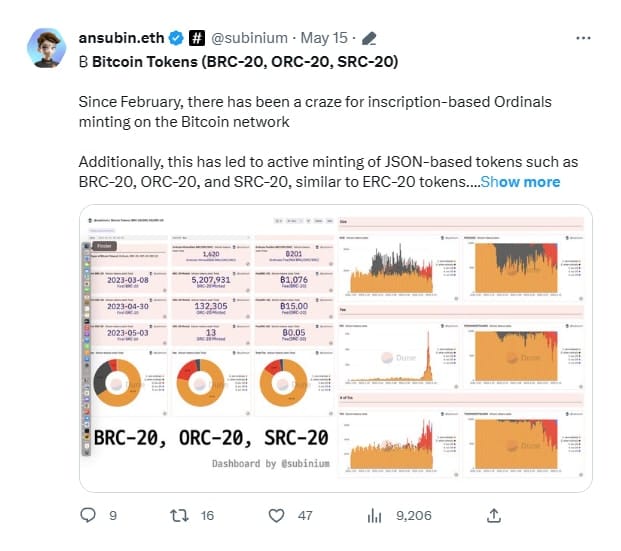

When studying SRC-20 tokens, it’s important to compare them with their BRC-20 counterparts. BRC-20 tokens are quite popular, but SRC-20 tokens have their own advantages and challenges. SRC-20 tokens are still being tested and are deployed using inscriptions or JSON files. They offer a new perspective in the ever-changing world of cryptocurrencies.

Benefits of Developing SRC-20 Tokens

By getting involved in the popular trend of Bitcoin STAMPS/SRC-20 Token Development, you can experience a unique combination of financial opportunities, artistic expression, early adoption advantages, and engagement with cutting-edge technology. Moreover, you have the chance to be at the forefront of this evolving digital collectibles space and contribute to its growth and development. SRC20 tokens make traditional securities more accessible and tradable by tokenizing them.

- Fractional Ownership: With SRC-20 tokens, it becomes possible to divide ownership of assets into smaller, more manageable fractions. This allows for wider participation and investment opportunities, even with limited resources.

- Transparency: SRC-20 tokens leverage the transparency of blockchain technology, providing a clear and auditable record of transactions. It enhances trust among participants and reduces the risk of fraudulent activities.

- Security: SRC20 tokens are built on top of the Swarm protocol, which is a decentralized network that is designed to be very secure.

- Compliance: SRC20 tokens are designed to meet the requirements of a number of regulatory bodies, including the Securities and Exchange Commission (SEC).

- Increased Liquidity: SRC-20 tokens enable improved liquidity by facilitating easier and faster trading on compatible platforms. This liquidity can enhance the marketability and value of the tokens.

- DApp support: SRC20 tokens can be used to create decentralized applications (DApps). If you are looking for a secure, compliant, and feature-rich type of token, then SRC20 tokens are a good option.

- Programmability: SRC-20 tokens can incorporate smart contract functionality, enabling the execution of predetermined conditions and automated processes. This feature allows for the creation of sophisticated features, such as automated distributions and governance mechanisms.

Technical Aspects of SRC-20 Token Development

Developing SRC20 tokens requires careful consideration of several technical aspects. These aspects are essential to ensure the functionality, security, and compliance of the tokens. Here are some key technical considerations involved in SRC20 token development:

- Blockchain platform: SRC20 tokens are typically built on the Ethereum blockchain. Ethereum is a robust and widely adopted platform for token development. It supports the execution of smart contracts, which are essential for implementing the token functionality and features.

- Tokenomics: The tokenomics of an SRC20 token refers to its economic design. This includes factors such as the total supply of tokens, the distribution mechanism, and the fee structure. This should be carefully designed to meet the needs of the project and its users.

- Security: Security is a critical consideration for any token project. SRC20 tokens are particularly vulnerable to hacks and theft. Developers must take steps to mitigate these risks, such as using secure coding practices and implementing security measures such as multi-signature wallets.

- Compliance Requirements: SRC20 tokens are considered securities, so it is essential to comply with all applicable regulations. This includes implementing features such as investor accreditation, Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) checks. Compliance requirements may vary depending on the jurisdiction and the specific offering.

- User Interface (UI) and User Experience (UX): A user-friendly interface is essential for the widespread adoption of SRC20 tokens. This includes designing intuitive interfaces for token transfers, balance checks, and other token-related functions. Integration with wallets and other tools should be considered to enhance usability.

- Token Integration and Interoperability: SRC20 tokens should be compatible with existing wallets, exchanges, and decentralized applications (DApps) to enable seamless integration and interaction within the broader blockchain ecosystem.

It is important to note that the SRC20 token requires collaboration with a well-established SRC-20 token development company that has professional blockchain developers and a proven track record of success.

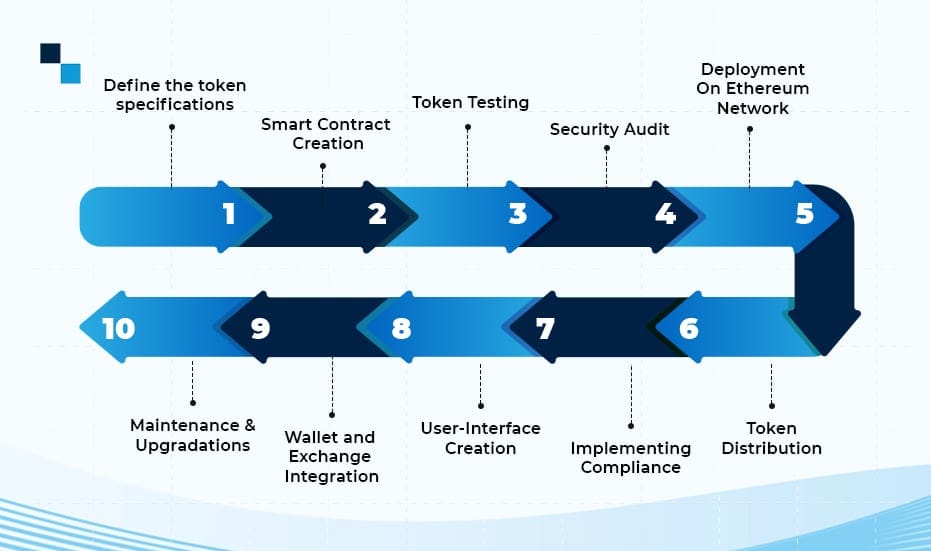

What are the steps involved in implementing SRC-20 Tokens?

SRC20 token development involves a step-by-step process to create and deploy the tokens on the Ethereum blockchain. Here is a simplified overview of the process(refer to the flowchart below):

- Define the token specifications- Determine the specifics of your token such as name, symbol, total supply, decimal places, and any additional properties or functionalities.

- Smart contract creation- Develop the smart contract that defines the behavior and functionality of the SRC20 token. This includes implementing the necessary functions, such as token transfers, balance checks, ownership management, and compliance features.

- Token testing-Test the smart contract thoroughly to identify and resolve any bugs or vulnerabilities. This method incorporates unit testing to verify the authenticity of the functions and integration.

- Security Audit- Have an external security auditor perform a comprehensive security audit of the smart contract. This helps in identifying any potential threat and ensures that the token is robust and secure.

- Deployment process on Ethereum Network- After the smart contract test and audit, deploy the smart contract onto the Ethereum blockchain. The process involves the interaction of the tokens with the EVM.

- Token Distribution- Determine the method and parameters for distributing the SRC20 tokens. The distribution process can involve private sales, public sales, or any other mechanism.

- Implementing compliance- Implement compliance features such as investor accreditation, KYC procedures, and AML checks within the smart contract. These measures ensure the issue and transfer of security tokens through regulatory compliance.

- User-Interface Creation- Create a user-friendly interface: a web application or mobile app, that allows users to interact with the SRC20 tokens.This interface pledges to provide functionalities for token transfers, monitoring balances, and other operations.

- Wallet and Exchange Integration- Integration of the SRC20 token with popular wallets and decentralized exchanges enhance usability and trading. However, this requires compatibility with the blockchain platforms and token standards to offer seamless interoperability.

- Maintenance and Upgradations- Continuously monitor and maintain the token contract, addressing any issues or bugs that may arise. Consider future upgrades or enhancements based on user feedback or evolving industry requirements.

Involve skilled blockchain developers and legal experts to acquire the best SRC-20 Token development services. It can contribute to a smooth implementation process. It also ensures compliance with applicable regulations, leading to a successful outcome.

Top-Use Cases and Applications of SRC-20 Tokens

SRC20 tokens have a wide range of uses across various industries. Here are some notable examples:

- Tokenized Securities: SRC20 tokens are used to convert traditional securities like stocks, bonds, and real estate into digital assets. This allows for easier access, divisibility, and liquidity, enabling fractional ownership and broad market participation.

- Gaming and Virtual Assets: In the gaming industry, SRC20 tokens can represent in-game assets, virtual currencies, or ownership rights to virtual goods. Players can trade and monetize their virtual assets outside the game, creating a vibrant secondary market.

- Venture Capital and Private Equity: The tokens enable the tokenization of investments in startups and private companies. Investors can gain exposure to these ventures through tokenized securities, providing a more efficient way to invest, track ownership, and potentially exit their investments.

- Real Estate Investment: SRC20 tokens can tokenize real estate, making it easier to divide ownership, enable fractional investment, and facilitate trading. This allows investors to access specific properties or portfolios without traditional barriers and increases liquidity.

- Tokenized Funds and ETFs: These Bitcoin Stamps can create tokenized investment funds and exchange-traded funds (ETFs). These tokens represent shares in diversified asset portfolios, providing convenient exposure to specific investment strategies or market sectors.

- Peer-to-Peer Lending(P2P): SRC20 tokens can facilitate peer-to-peer lending by tokenizing debt instruments. Borrowers tokenize their loan obligations, while lenders invest in those tokens to earn interest. This streamlines the lending process, reducing intermediaries and increasing transparency.

- Commodity Trading: The tokens can represent ownership or rights to commodities like gold, oil, or agricultural products. Tokenization enables fractional ownership and trading, simplifying investor access to commodities without physical ownership or complex contracts.

These examples demonstrate the versatile nature of SRC20 tokens and their potential to tokenize various assets, enabling innovative financial instruments in a compliant and efficient manner.

Emerging Trends and Outlook Of SRC-20 Tokens

Standardization initiatives may also emerge to establish common practices and guidelines for SRC20 token development and operations.

SRC20 tokens are poised to play a significant role in the future of tokenized securities and asset representation. As the SRC-20 ecosystem matures, we can expect to see more standardized tooling, protocols, and best practices emerge, making it easier for developers to create and interact with SRC-20 tokens. This will lead to increased adoption of SRC-20 tokens by businesses and individuals, as well as the development of new and innovative applications for SRC-20 tokens. Listed below are some of the potential future trends and outlooks for SRC20 token development.

Some of the emerging trends and outlooks are:

- Decentralized finance (DeFi) applications– DeFi applications allow users to lend, borrow, and trade digital assets without the need for a central authority. SRC-20 tokens are well-suited for DeFi applications due to their compatibility with the Ethereum blockchain.

- Tokenized securities- Tokenized securities are digital representations of traditional securities, such as stocks, bonds, and derivatives. SRC-20 tokens can be used to tokenize securities, making them more liquid and accessible to a wider range of investors.

- Interoperability and Standardization: Efforts to improve interoperability among different blockchain networks and token standards will grow. This will enable the seamless transferability of SRC20 tokens across multiple platforms, fostering an efficient and interconnected tokenized securities ecosystem.

- Secondary Market Development: As liquidity and trading volumes for SRC20 tokens grow, dedicated secondary markets for tokenized securities are expected to emerge. These markets will provide efficient platforms for trading, price discovery, and liquidity provision, attracting both institutional and retail investors.

To ensure the success and widespread adoption of SRC20 token development in the crypto landscape, it is essential to foster ongoing innovation, encourage collaboration among stakeholders, and remain adaptable to the changing market demands.

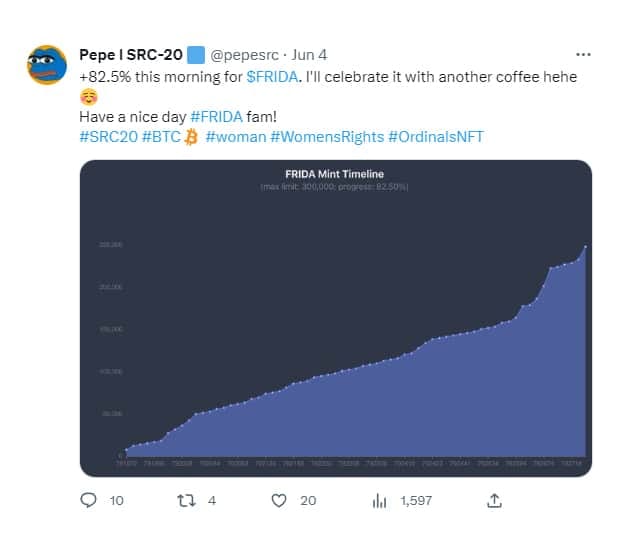

Let us have a look at what Twitter has to say about SRC-20 Tokens-

Perks of Collaborating with an SRC-20 Token Development Company

The future of SRC-20 Tokens seems promising. Developing an SRC-20 Token from scratch is a complex process. However, hiring quality SRC-20 Token development services help you to ensure that your token is secure, reliable, compliant, and cost-effective.

Antier is a popular blockchain protocol that allows for the creation of interoperable blockchains. We have a team of experienced developers who can help you to build a secure and reliable SRC-20 token that can be used across multiple blockchains. The developers of our company help you choose the right token standard, design the tokenomics, and deploy the tokens on any compatible and popular blockchain platform.

When choosing an SRC-20 token development company, it is important to consider your specific needs and requirements. Be sure to do your research and compare different companies before making a decision.