Crypto Banking Solutions: Decode the Secrets to Safe Crypto Transactions

June 9, 2023

Exploring the Top Metaverse Trends Shaping the Future

June 12, 2023Decentralized Finance (DeFi) has rapidly emerged as a disruptive force in the financial industry, revolutionizing traditional financial systems. However, the potential of DeFi extends far beyond finance alone.

In 2023, the DeFi market is anticipated to generate US$16,960.00m in revenue, and the DeFi market will generate an average of US$2,026.00 per subscriber.

As the underlying technology of blockchain networks evolves, innovative applications are emerging, bringing decentralized finance development solutions to various industries and sectors.

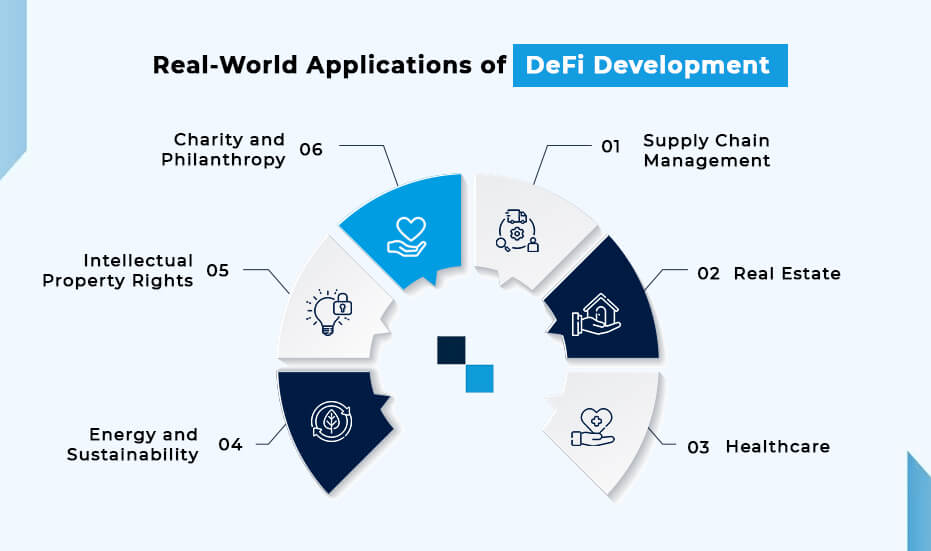

Let’s explore the above-listed real-world applications of DeFi development beyond the realm of finance:

1. Supply Chain Management

One area where DeFi is making a significant impact is supply chain management. By leveraging the transparency, immutability, and traceability of blockchain technology, DeFi solutions enable secure and efficient tracking of products throughout the supply chain. A DeFi development company can create smart contracts to automate processes such as inventory management, authentication, and quality control, reducing fraud, ensuring compliance, and enhancing trust between stakeholders.

2. Real Estate

Decentralized finance development is also transforming the real estate industry. Traditionally, the process of buying, selling, and investing in real estate has been complex, involving intermediaries, lengthy paperwork, and high costs. With DeFi, smart contracts can facilitate the automation of property transactions, eliminating intermediaries, reducing costs, and enabling fractional ownership. Tokenization of real estate assets also provides increased liquidity and accessibility to a wider range of investors.

3. Healthcare

In the healthcare sector, DeFi offers several compelling applications. Blockchain-based platforms can securely store and manage patient records, ensuring data privacy and interoperability. Moreover, DeFi development solutions can streamline medical supply chain management, facilitating the tracking and authentication of pharmaceuticals, medical devices, and other healthcare products. Tokenized healthcare systems can incentivize healthy behaviors and enable secure micropayments for telemedicine services.

4. Energy and Sustainability

DeFi is playing a crucial role in the transition to a more sustainable and decentralized energy ecosystem. Blockchain-enabled platforms allow for peer-to-peer energy trading, enabling individuals and communities to buy and sell excess renewable energy directly, bypassing traditional energy intermediaries. Additionally, the DeFi token development service can help in the tokenization of renewable energy assets can unlock investment opportunities, democratizing access to clean energy projects.

5. Governance and Voting

Decentralized governance is a powerful application of DeFi development technology. Blockchain-based voting systems can enhance transparency, security, and efficiency in elections and decision-making processes. By leveraging smart contracts and decentralized platforms, individuals can participate in governance and voting procedures directly, reducing fraud and ensuring a fair and inclusive democratic process.

6. Intellectual Property Rights

The protection of intellectual property rights is a critical concern across various industries. DeFi offers innovative solutions to authenticate and manage intellectual property assets through blockchain-based registries and smart contracts. This enables creators to securely protect their copyrights, patents, and trademarks, ensuring fair compensation and reducing infringement.

7. Charity and Philanthropy

Decentralized finance development is revolutionizing the way we engage in charitable and philanthropic activities. Blockchain-based platforms provide transparent and auditable donation processes, ensuring that funds are efficiently allocated to the intended causes. Smart contracts can automate the distribution of funds, making sure that they reach the beneficiaries directly, bypassing traditional intermediaries and reducing administrative overheads.

How is DeFi impacting finances?

The DeFi market is growing quickly, with considerable growth shown between 2018 and 2020, when it climbed by over three times, from US$1.2 billion to US$3 billion. This growth has been steady, almost doubling the year. By 2026, according to industry analysts, the market will be worth US$67.4 billion.

DeFi (Decentralized Finance) is making a profound impact on traditional financial systems. Here are some keyways in which DeFi development is reshaping and impacting finances:

1. Disintermediation

DeFi eliminates the need for intermediaries such as banks, brokers, and other financial institutions. Through smart contracts and blockchain technology, individuals can directly interact with financial services, reducing costs, and eliminating middlemen.

2. Accessibility and Inclusivity

DeFi provides financial services to anyone with an internet connection, bypassing the need for traditional banking infrastructure. It offers financial inclusion to the unbanked and underbanked populations worldwide, granting them access to loans, savings, investments, and other financial tools.

3. Global Reach

DeFi operates on decentralized networks that are accessible globally. This enables individuals to participate in financial activities without being restricted by geographical boundaries. Anyone with an internet connection can engage in cross-border transactions, investments, and lending/borrowing activities.

4. Transparency and Security

Decentralized finance development specialists leverage blockchain technology, providing transparent and immutable transaction records. Users can view and verify transactions, ensuring trust and reducing the risk of fraud or manipulation. The use of smart contracts also enhances security by automating processes and reducing the potential for human error.

5. Programmable Money

DeFi introduces programmable money through smart contracts. This allows for the automation of financial operations, including lending, borrowing, interest payments, and more. Smart contracts execute predefined rules without requiring intermediaries, enabling more efficient and autonomous financial processes.

6. Financial Innovation

DeFi encourages financial innovation by fostering experimentation and the development of new financial products and services. Developers are creating decentralized exchanges, lending platforms, stablecoins, prediction markets, and more. These innovations have the potential to disrupt traditional financial systems and unlock new possibilities in finance.

Revolutionizing Finance Through DeFi Token Development

The DeFi ecosystem’s overall market capitalization for governance tokens as of March 2023 exceeds US$100 billion.

DeFi (Decentralized Finance) Token Development is gaining significant traction for several compelling reasons.

Let’s explore the key factors contributing to its rising popularity:

1. Financial Inclusion

DeFi Tokens have the potential to provide financial services to individuals who are unbanked or underbanked. These tokens enable anyone with an internet connection to access a wide range of financial services, such as lending, borrowing, and earning interest, without relying on traditional financial institutions. This inclusivity is particularly significant for individuals in underserved regions or countries with limited access to banking services.

2. Transparency and Trust

DeFi Tokens are built on blockchain technology, which offers transparency and immutability. Smart contracts, the backbone of DeFi protocols, are self-executing contracts with predefined rules. DeFi token development services make use of smart contracts to ensure that transactions are transparent and verifiable by anyone on the blockchain network. This transparency enhances trust among participants and reduces the need for intermediaries, ultimately reducing costs and improving efficiency.

3. Open and Permissionless

DeFi Tokens operate on decentralized networks, allowing anyone to participate without requiring permission or approval from central authorities. This open nature democratizes access to financial services, enabling individuals to have full control over their funds and engage in peer-to-peer transactions. It removes barriers to entry and fosters financial empowerment.

4. Yield Opportunities

DeFi Tokens present unique opportunities for investors to earn attractive yields through activities like liquidity provision, staking, and yield farming. These activities allow individuals to lock their tokens in smart contracts and receive rewards in the form of additional tokens or fees generated by the underlying DeFi protocols. The potential for high returns has attracted a significant influx of liquidity and interest in DeFi token development.

5. Innovation and Experimentation

DeFi is a rapidly evolving sector, characterized by constant innovation and experimentation. Developers and entrepreneurs are exploring new ways to leverage blockchain technology to create novel financial products and services. This innovation attracts the attention of investors, developers, and users who are eager to be part of the next groundbreaking DeFi project.

6. Decentralized Autonomous Organizations (DAOs)

DeFi Tokens play a crucial role in the governance of decentralized protocols and platforms. DAOs are organizations governed by token holders, allowing participants to have a say in decision-making processes. Token holders can vote on protocol upgrades, parameter adjustments, or allocation of funds. This decentralized governance model provides a voice to token holders and promotes community-driven decision-making.

7. Interoperability and Composability

DeFi Tokens can interact and integrate with various protocols and platforms within the DeFi ecosystem. This interoperability and composability allow developers to combine different DeFi services, creating new and more sophisticated financial products. This synergy encourages collaboration and enables the building of decentralized financial ecosystems.

Conclusion

While DeFi development strategies have made remarkable strides in revolutionizing finance, its potential goes far beyond the financial sector alone. As blockchain technology continues to evolve, innovative applications are emerging in supply chain management, real estate, healthcare, energy, governance, intellectual property rights, charity, and many other sectors.

The decentralized nature of DeFi brings transparency, security, and efficiency to traditional industries, disrupting centralized systems and empowering individuals and communities. At Antier, we embrace the possibilities of decentralized finance development in the real world, as we are witnessing a transformative shift toward a more decentralized and inclusive future. We also indulge in DeFi token development. Get in touch with us, the leading DeFi development company, for exploring the possibilities of a decentralized future today!