Top 5 Real-life Blockchain Use Cases in Supply Chain in 2024

June 8, 2023

DeFi Beyond Boundaries: Innovations Shaping Industries Across the Globe

June 9, 2023Are you the one who hesitates to step into the digital space of crypto banking, just because you are unsure about its security? It’s time to put these concerns to rest and probe the secrets to safe and secure crypto transactions!

Indubitably, security is always a major concern in this digital era especially when it comes to financial transactions involving cryptocurrencies. Though crypto transactions, these days, are gaining popularity, still having concerns about safety and security, it’s where crypto banking solutions come in. These are designed with security at their core, employing advanced technologies and cryptographic mechanisms to ensure the safety and integrity of your transactions. This article will take you through these in detail.

Whether you’re a seasoned crypto investor or just getting started, understanding the ins and outs of crypto banking solutions is essential for safe and successful transactions. Are you ready to unlock the secrets to safe crypto transactions? Let’s start then!

Fundamentals of Crypto Banking Solutions

Crypto banking solutions are digital platforms that enable users to securely manage and transfer cryptocurrencies. Unlike traditional banking systems, which are centralized and controlled by a single entity, crypto banking solutions operate on a decentralized network of computers. This decentralized nature enhances security and transparency since there is no third party to compromise or manipulate the system.

No doubt, the solutions have emerged as groundbreaking platforms and are continuously transforming the way individuals and businesses interact with digital assets securely. These solutions incorporate a range of key features, designed with a strong focus on ensuring robust security.

Key Features :

- Multi-Currency Wallets : These safely store and manage diverse cryptocurrencies in a single and user-friendly interface.

- User-friendly Interface : Intuitive and easy-to-navigate interfaces ensure a seamless user experience, even for beginners in the world of cryptocurrency.

- Mobile Compatibility : Users can access digital banking platforms on the go, with mobile apps or responsive websites, enabling convenient management of digital assets from anywhere.

- Security Measures : Robust security protocols, including encryption, multi-factor authentication, and cold storage, protect users’ digital assets from unauthorized access and potential threats.

- Low Fees : The cost-effective transactions and minimal fees compared to traditional banking systems, make crypto banking solutions an attractive choice for individuals and businesses.

- Payment Integration : A crypto banking platform often includes integration with traditional payment systems, enabling users to seamlessly make payments and transfer funds between crypto and fiat currencies.

- Customer Support : A dedicated customer support channel, infused with chatbots, helps users address their concerns, and receive assistance as needed.

This set of traits forms the foundation of a comprehensive crypto banking solution. By combining all of these in a single platform, these solutions offer a seamless and trustworthy banking experience in the world of cryptocurrencies. However, the security features in itself are a blend of multiple aspects, those will be discussed later on in this article.

How Crypto Banking Provides Security?

While the traditional banking setup was doing fine, the rise of online and digital platforms brought about a shift in the financial landscape. Crypto banking services emerged as a game-changer, offering a host of advantages. One of the key factors that set crypto banking apart is its robust security features. With such advanced security features crypto banking ensures a high level of security for users. In this ever-evolving digital era, the focus on security becomes paramount, and crypto banking rises to the challenge, providing a safe haven for financial transactions and asset storage.

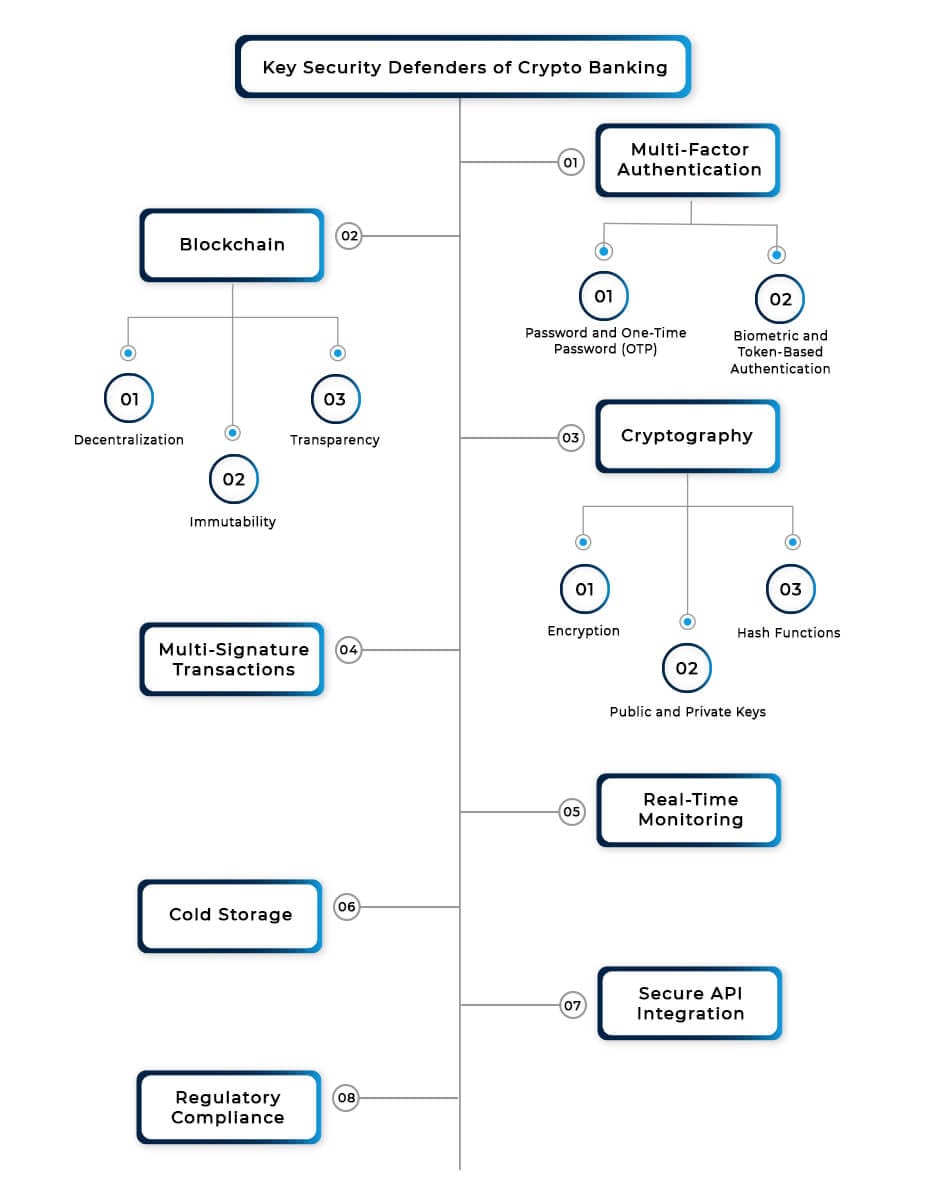

Key Security Defenders of Crypto Banking

- Multi-Factor Authentication

- Blockchain

- Cryptography

- Multi-Signature Transactions

- Real-Time Monitoring

- Cold Storage

- Secure API Integration

- Regulatory Compliance

- Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) is a method that requires users to provide multiple forms of identification to access their accounts or perform sensitive actions. By combining two or more independent factors, MFA significantly enhances security by adding an extra layer of protection against unauthorized access.

Some basic types of MFA are-

1. Password and One-Time Password (OTP) :

In this, the user enters username and password as the first factor. Then a One-Time Password (OTP) is received via SMS, email, or authenticator app as the second factor. It is just like logging into any application by entering a password. Upon successful entry, OTP is received on the registered mobile number that is entered to complete the authentication process.

2. Biometric and Token-Based Authentication :

In this case, users provide a unique biometric identifier such as a fingerprint, facial recognition, or iris scan as the first factor coupled with a physical token, such as a security key or smart card, as the second factor. Both these must be successfully verified to grant access.

- Blockchain

Blockchain technology offers several security features that contribute to the overall security of crypto banking. The primary security benefits of blockchain are its decentralized, transparent and immutable nature.

1. Decentralization

Blockchain operates on a decentralized network of nodes, where multiple participants validate and record transactions. This eliminates the need for a central authority, reducing the risk of failure and making it difficult for malicious actors to manipulate the system. In this context, each node independently verifies the transaction, ensuring consensus among the participants. This enhances security by eliminating the dependence on a single entity.

2. Immutability

In crypto banking, when a transaction is recorded on the blockchain, it becomes an immutable entry that cannot be modified retroactively. This feature ensures that transactional data remains trustworthy, preventing unauthorized changes or tampering.

3. Transparency

Blockchain offers transparency by maintaining a public ledger where all transactions are recorded and visible to participants. Any participant can access and verify these transactions, creating a transparent and auditable record. This visibility allows users to track the flow of funds, ensuring the legitimacy of transactions and minimizing the risk of fraud.

- Cryptography

Cryptography plays an important role in securing crypto banking transactions and protecting sensitive user information. It involves using advanced algorithms, such as AES (Advanced Encryption Standard), and mathematical principles to encrypt data, making it unreadable to unauthorized parties.

1. Encryption

Cryptography employs encryption techniques to convert plaintext data into ciphertext, which can only be decrypted with the corresponding key. This ensures the confidentiality of sensitive information, such as transaction details and user identities.

2. Public and Private Keys

The public key is shared openly, while the private key is kept secret. Transactions are encrypted with the recipient’s public key and can only be decrypted using their corresponding private key.

3. Hash Functions

Cryptography also utilizes hash functions to ensure the integrity of data. Hash functions convert an input (data) into a fixed-size string of characters, known as a hash. Even a small change in the input data will produce a significantly different hash value.

- Multi-Signature Transactions

Multi-Sig is a mechanism that requires multiple signatures to authorize a transaction. It adds an extra layer of security and reduces the risk of unauthorized or fraudulent transactions. In this setup, a predetermined number of participants must provide their signatures to approve a transaction.

Also, it reduces the risk of one party acting maliciously or making mistakes. Even if one participant’s private key is compromised, the funds remain secure as the attacker would still need access to the other participant’s keys. This makes your digital financial system ultra-secure.

- Real-Time Monitoring

Real-Time Monitoring is a vital shield in crypto banking that involves continuous surveillance and analysis of network activities and transactions in real time. It enables the detection of potential security threats and ensures prompt response to mitigate risks.

By constantly monitoring transactional patterns, network traffic, and user behavior, real-time monitoring systems can identify unusual or suspicious activities that may indicate a security breach. This proactive approach allows for immediate alerts and notifications, enabling swift action to prevent unauthorized access or fraudulent activities. This enhances the overall security of crypto banking solutions by providing a proactive defense against emerging threats and ensuring the integrity of transactions and user data.

- Cold Storage

Cold Storage is a security measure employed by crypto banking solutions to protect digital assets by storing them offline away from internet-connected devices. It involves storing private keys in hardware devices or offline storage mediums like offline computers, hardware wallets, or paper wallets.

By keeping the private keys offline, cold storage prevents unauthorized access and reduces the risk of hacking, as cybercriminals cannot directly target offline storage. This method provides a layer of security by eliminating vulnerabilities associated with online storage and minimizes exposure to potential threats.

- Secure API integration

Secure API integration is essential in a crypto banking platform as it ensures safe and reliable communication between different systems and platforms. It involves the implementation of robust security protocols and encryption techniques to protect data transmitted via APIs (Application Programming Interfaces).

This further ensures that sensitive information, such as user credentials and transaction data, remains confidential and inaccessible to unauthorized entities. By adhering to industry standards and best practices, secure API integration minimizes the risk of data breaches, unauthorized access, and malicious attacks. It provides a secure and seamless experience for users, allowing them to interact with the crypto banking solution and access their accounts securely.

- Regulatory compliance

Regulatory compliance is a critical aspect of crypto banking solutions that ensures adherence to relevant laws, regulations, and guidelines set forth by regulatory authorities. It involves implementing measures and processes to meet legal and compliance requirements specific to the jurisdiction in which the solution operates.

This includes-

1. KYC (Know Your Customer)

2. AML (Anti-Money Laundering)

3. Data privacy regulations

4. Financial reporting obligations

5. Customer protection standards

By complying with these, the banking solutions promote transparency, accountability, and trust among users and regulators. They also help prevent illicit activities, such as money laundering and terrorist financing. Therefore, adhering to regulatory compliance, the crypto banking services foster a secure and compliant environment for users and contribute to the overall integrity of the financial ecosystem.

How to Choose a Reliable Crypto Banking Solution?

Picking the right crypto banking solution is paramount for the security and success of your business. Here are five tips to help you make an informed decision:

1. Assess Security Features : Look for a solution that offers robust security features such as encryption, multi-factor authentication, cold storage, and secure key management. Consider the solution’s track record in safeguarding user assets and protecting against hacking attempts.

2. Evaluate Scalability and Flexibility : Consider the scalability and flexibility as it should be able to handle your business’s growing needs and adapt to changing market dynamics. Choose features like multi-currency support and integration with other financial systems.

3. Consider Regulatory Compliance : Ensure that the solution complies with relevant regulatory requirements in your jurisdiction. Pick solutions that have implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to maintain regulatory compliance.

4. Check Reputation and Reliability : Research the reputation and reliability of the solution provider. Analyze customer reviews, testimonials, and industry recognition. Consider the provider’s financial stability, years of experience, and commitment to customer support.

5. Seek Integration and Customization Options : Evaluate the solution’s integration capabilities with other software and services you may already be using. Additionally, check if the solution allows customization to meet your specific business requirements.

By considering these factors, you can end up choosing a crypto banking solution that aligns with your security needs, regulatory compliance, scalability, and customization requirements. It’s important to conduct thorough research, seek recommendations, and engage in discussions with potential solution providers to ensure you make the right choice for your business.

Where to Find A Comprehensive Solution Like This?

In a rapidly evolving digital landscape, banking security has become a prominent concern. Choosing the right crypto banking solution is not just about welcoming innovation, but also about safeguarding your assets and ensuring the trust of your customers. By prioritizing security features like advanced cryptography, blockchain traits, regulatory compliance, and more as mentioned above, you can fortify your platform against threats.

By prioritizing banking security features and partnering with a reputable provider like Antier, businesses can confidently establish a secure crypto banking platform that meets the highest industry standards. We offer a range of services tailored to meet the needs of businesses in the crypto banking industry. Even our white label solutions provide a solid foundation for building a secure and feature-rich platform.

Without any delays, get in touch with the experts and get started!