Metaverse Shopping Mall Development: Future of Shopping

April 26, 2023

NFT Development – A Worthy Investment for Modern Businesses in 2023

April 27, 2023Are you still among those who stand and wait for their turn on the bank premises? Well… It’s time to get upgraded then! The way banking ecosystem is getting upgraded with time and technology. Digital innovations are easing banking operations by pushing Neo-banking way ahead of traditional banking setups. Be a part of the banking revolution with your white label Neo banking platform.

Neo banking is gaining immense popularity among the modern smartphone generation for its convenience and cost-effectiveness. However, to step into this space either development from scratch is an option or getting a white label solution, the eventual choice is yours though Neobank white label platforms let you launch your bank effortlessly.

This article will take you through the features and factors that determine the cost of a white label Neo banking solution of your choice so that you can make an ideal choice while looking for an effective banking solution without any worries.

Let’s get started!

Why Neo banking is the future of Banking?

The following traits of Neo banking make it a feasible choice for every entrepreneur even a startup to establish a new financial institution or bank-

- Entirely digital services offer the convenience of using and processing transactions

- Fully flexible setup with no time constraints as the system works with an internet connection; no visiting physical branches

- Low overhead costs due to no maintenance expenses make it an affordable banking solution

- Real-time notifications and predictions are quite efficient for making profitable investments

- Agile methodology opts for easy personalization of all the banking operations making it user friendly

- Infallible cross-border transactions as the digital system dissolve the geographical borders

Moreover, the Neobanking market size is skyrocketing at an unexpected pace such that the expectations bar is also raising with time.

As per an industry analysis of Neo banking market-

This figure also sheds light on the fact that Neo-banking is here to stay and grow.

Therefore, it is worthwhile to initiate your progress in crypto-friendly Neobank solutions and grab the coming opportunities with both hands.

Crypto-Friendly Neobank Solutions- in demand?

Today, the whole market and financial industry is revolving around cryptocurrency and other digital assets including the banking sector. The banking industry is the actual solution to manage these assets. Nevertheless, banking operations are getting simplified with ongoing digital innovations, and the amalgamation of cryptocurrency and Neo-banking holds immense potential to transform the crypto structure which still gets the tag of a complex product among the common people.

Neo banking when is already getting an edge over the market trends, and the integration of cryptocurrency will arise the demand for crypto-friendly Neobank solutions. This is because-

- Crypto is an image of future money and therefore a highly preferred product for a futuristic business approach

- Neo banks can be a one-stop solution to optimize investments by providing both the options of checking and investment accounts

- It will draw the attention of cryptopreneurs who ignored Neo banks for not having access to crypto

- This is a profitable blend for Neo banks with better revenue generation options by incorporating crypto from the conversion rate

- With already having cross-border efficiency, becoming crypto-friendly makes transactions easy

All these aforementioned points sound convincing to set up crypto-friendly Neo-bank solutions for giving a boost to the business as both the products are establishing a long-run ground for them and when both these collaborate the results are expected to par excellence and surpass the planned standards.

Want to know the basics of Neo banking, click here.

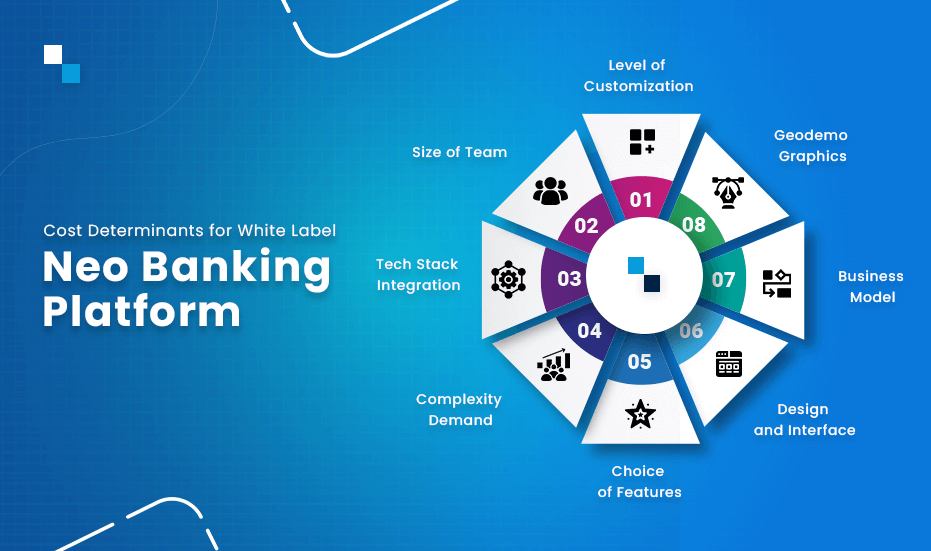

What factors determine the cost of crypto-friendly Neobank solutions?

A very basic thought that every investor would have while planning for some new projects is the expenses, isn’t it? And when it’s about a new version of an existing product or a whole new product the business might get in a dilemma for doing so.

Albeit, the below-mentioned aspects can provide you with a rough idea to figure out the best choice for your business.

- Level of Customization

A Neobank white label solution is actually a pre-built structure, though can be modified as per business requirements, so the extent to which the client needs modification in that structure is one of the significant factors that adds to the cost of development. The major alterations with specific demand can be time-consuming and hence will seek more investment.

- Size of Team

The other important factor is the resources involved in the development of the solution, and the count of team members which would include developers, testers, designers, and other experts. Thus, the project intensity and the timeline for deployment frame the team size which in turn frames the idea of cost.

- Tech Stack Integration

When any white label solution is to be used, it also seeks easy integration with the ongoing business process and technology that is being used. Therefore, for seamless execution of the solution deployed for services, a relatable tech stack is needed which includes programming languages, APIs, and other stuff.

- Complexity Demand

A white label Neo banking platform is a pre-structured read-to-deploy solution which means it is a basic setup that can be used without any changes too, while the client might ask for some sort of complex processing and services to be included to enhance the quality or security of the application which adds to the capital requirement.

- Choice of Features

With ever-changing technology and innovations, there is a never-ending list of features that a user might seek for a convenient and seamless experience. This could be –

- Security

- Passwords

- Currency options

- Location Access

- Market analysis

- Real-time tracking

- Account onboarding

- Personalized notifications and so on.

Thence, the list of features to be included while developing the solution and those asked while customizing the platform are both crucial to give a cost structure.

- Design and Interface

Every user gets drawn towards an application that is user-friendly and seems easy to work on occupies lesser space in their smartphone memory and appears interesting to use. That is why, the UX/UI design of the platform plays a vital role in the development and cost determination.

- Business Model

Though the Neobank white label solution developed is a ready-to-use platform, the business services that the client organization is already offering which tells their experience and expertise while exploring their target audience and targets might vary too. Therefore, the business model has a huge impact on solution development and cost.

- Geodemographics

This aspect covers the population and their geographical location which is another vital factor to determine cost. This is because it emphasizes different market values and currency values. Moreover, it varies with consumer segmentation and demands.

How Antier can help?

With the transforming market, modern platforms like crypto-friendly Neobank solutions are somehow getting an edge over conventional banking services. Banks and financial institutions are embracing cutting-edge technology to deliver high customer satisfaction with top-notch features. The white label solution packed with full features seems to deliver precise solutions to modern industries.

Planning to choose a white label Neo-banking platform to render par excellence customer satisfaction? Antier can help you deliver a comprehensive banking solution. We believe in delivering Neo banking solutions and customized platforms for startups, investors, enterprises, and organisations with robust features in a budget-friendly manner.

Still in dilemma? Get in touch with our team of experts and choose the best solution for your business!