Steps to Successfully Launch Your Cryptocurrency This Year

March 24, 2023

Decentralized Finance (DeFi) – A Brief Overview For Beginners

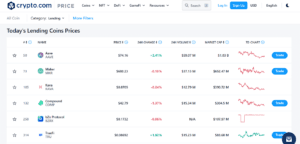

March 28, 2023Over the past few years, decentralized finance has gained massive popularity. As on 23 March 2023, the top DeFi lending platforms include Aave, Maker, Kava, and Compound. Here’s how they are leading the market:

Source: https://crypto.com/price/categories/lending

Won’t you like to create a similar platform that can help gain traction among crypto holders effortlessly? You can start with DeFi lending and borrowing platform development with the help of blockchain experts, as they will know how to empower the users by providing 100% decentralization to the platform. Although DeFi lending platform development is still in its revolutionary phase, it is accepted by the crypto community with open arms. Therefore, the developers providing the DeFi lending platform development services are doing great research to add new features and functionalities to their platforms with great enthusiasm. Each one tries to provide better facilities to grab the attention of big investors, by eliminating the involvement of middlemen that processes loans based on credit. The transformed version of lending-borrowing is becoming pretty much popular these days.

Decentralized Finance (DeFi) & Lending-Borrowing

In DeFi lending, individuals have self-custody of assets and lend them to earn interest, and the safety measures are handled through smart contracts. Anyone entering the crypto money market can earn a handsome income through lending cryptos, depending on the current APY (Annual Percentage Yield). As the borrower can access the decentralized lending pools universally and fulfill their requirements, without disclosing their identity. They don’t have to disclose their personal identity or credit score while borrowing money. It’s beneficial for those who are reluctant to seek the help of banks or financial institutions that charges heavy fees and interest for such services. Furthermore, there will be no need to deposit collateral against the loan amount. In the DeFi world, there is no risk, no collateral, only tokens.

Collateralization

Contrary to traditional lending through banks or financial institutions, DeFi lending and borrowing platform development has brought a big change in the ways of lending cryptos, without putting up collateral for secure recovery of the loan amount. In the past, if the borrower becomes a defaulter, the lender used to keep the collateral under his possession. The collateralized loan is called a secured loan. On the other hand, credit card loans required no collateral, so it is considered to be unsecured loan, and the browser has to pay a higher interest rate for such loans. Usually, collateralized crypto has 2-3 times higher value than loaned ones. The DeFi lending platform development services create smart contracts for the regulation of loan on specific terms and conditions, which simplifies the ways it is repaid. The collateral amount remains in the custody of smart contracts until the loan amount is recovered.

Now, there is a twist. With over-collateralization, crypto holders involved in lending pools possess a lot of crypto assets. Now, the question is that why will anyone lend a bigger amount to obtain a smaller amount of crypto? Therefore, it is always beneficial to acquire more funds than the loaned amount. If lucky, the lenders can even enjoy the increase in value of the assets under their possession.

On the other hand, under-collateralization does not mean that the borrower is not creditworthy. In the decentralized lending process, loans are recovered through smart contracts, so there is no question of distrust.

Why DeFi lending and borrowing platform development is currently in vogue?

As we have already discussed earlier, Aave, Maker, Kava, and Compound are the popular DeFi lending platforms. Won’t you like to hire DeFi lending platform development services to flourish a business similar to theirs? You can include unique features and functionalities in your platform for providing more security to lenders and borrowers against volatility in the crypto market.

Here are some of the best benefits of choosing the DeFi platform for borrowing:

- Get a loan in no time

The blockchain-powered lending platform has fast processing speed and analytics for fraud detection. Loan terms and risk factors are calculated using machine learning. These advanced technologies speed up the loan approval process and send offers through e-contracts. - Compliant & consistent lending decisions

There are definite credit policies that ensure consistent lending decisions. Apart from this, it simplifies compliance with local rules and regulations. - Permissionless

DeFi lending platforms provide permissionless access to their users. It means that anyone around the world can join the platform, attach the crypto wallet, and get funded easily. - Transparent

On a public blockchain, all transactions are verified by all users, and it provides greater transparency to the network users. - Immutable

The records of transactions cannot tamper with, which ends the worries of security and audibility. - Programmability

DeFi lending platform development process involves the creation of smart contracts that are self-executable codes that enable automatic payment processing facilities. - Self-Custody

Integrating a Web3 wallet like Metamask with a DeFi lending-borrowing platform will help ensure self custody of assets by their owners.

How DeFi lending and borrowing platform development is benefiting the financial sector?

Here are some of the significant benefits of developing DeFi lending-borrowing platforms for financial institutions:

- Easier lending & borrowing

The best thing about hiring DeFi lending platform development services is that it helps in building a peer-to-peer lending and borrowing protocol with exclusive features. - Increase Savings

DeFi platform is not only meant for lending or borrowing, it also helps to maximize earnings through interest and savings.

- Asset Management

DeFi lending platforms help manage the assets by incorporating crypto wallets like Metamask. The users can their wallets for sending, receiving, buying, selling, lending & borrowing, and earning interest on investments.

Conclusion

The evolution of DeFi has revolutionized the way lending-borrowing works. It makes it easier to get financial aid from anyone across the globe, without any need to disclose the personal identity. DeFi lending platform development is going to change the way crypto funds are lended or borrowed in the future. Want to experience it? Connect with Antier for DeFi lending platform development services. It will help small and big businesses to enter a DeFi ecosystem that allows the users to send or receive funds through verifiable, timestamped, and audit-free financial applications. Get ready to explore the world of DeFi with the help of Antier today!