Would you believe that banks can exist without physical walls? The answer could be a NO a couple of years back, but today it’s a YES! This is true with new banking set up under the name neo-banking, which certainly is banking beyond the walls.

With cryptocurrency becoming the globally adopted digital asset and people investing more in it, it is necessary to manage and handle all the transactions and assets for which a financial or banking setup is a must. However, if the assets are digital, the setup needs to be digital too, hence neo-banking is an appropriate system. No wonder establishing a crypto bank or neo bank from scratch is not a piece of cake, so using a white label neo-banking platform is an apt solution.

This article will take you through the basics of neo-banking along with a focus on how neo-banking simplifies the crypto-banking process. Let’s start then!

What is Neo-banking?

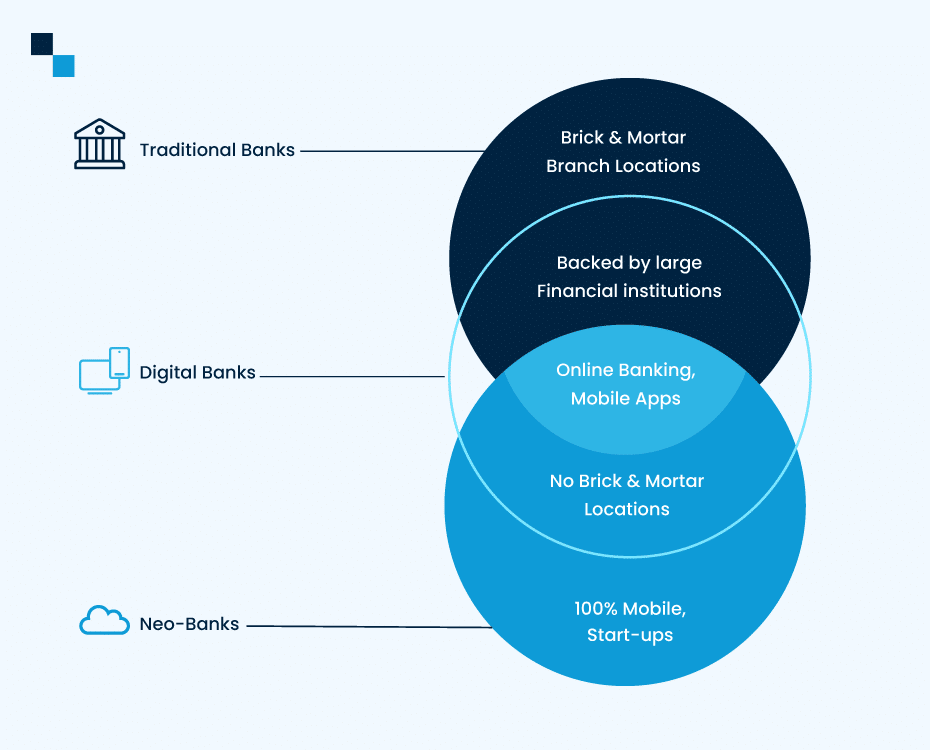

“Neo” in neo-banking indicates new so as a whole it means the new banking system, the banking which is entirely online without any physical office or branch. These enable all sorts of banking operations from bank accounts and debit cards to money transfers and payments. All services are via digital or mobile channels like a smartphone or web interface.

Why Neo-banking is gaining traction?

- Banking with convenience

Neo-banks can be operated anytime anywhere just with a few clicks.

- Customized banking

Customer’s choices are highly taken care of in the design and functionalities.

- Entirely Digital banking

Neo banks are completely digital and online with an immersive experience and innovative services.

- Pocket-friendly banking

As the whole setup is digital, it cuts the expenses of management and the whole focus goes to banking services. Also, the system offers more savings and banking at comparative prices.

- Techno-driven banking

The whole system of neo-banking is technology driven with easy and effortless integration of APIs from both sides.

It is not much far off when people used to stand in lines in front of banks to transfer and withdraw their money. The transforming financial structure whilst is changing the ways making neo-banking a comprehensive solution for every age group.

What is a White Label Neo-Banking Platform?

A white label neo banking platform is a pre-structured and pre-designed ready-to-deploy solution that incorporates all the required features and operations within, albeit with the feature of customization.

Whenever any entrepreneur decides to go ahead with the development of their own neo-bank, it can either be crafted from scratch which is considered a bit complex and time-consuming or the other option is purchasing a white label solution and getting it modified as required.

Therefore remain ahead in the race of this tech-savvy era, not just in the banking sector, many other verticals including healthcare, logistics, accounting, food delivery, and so on are leveraging white-label platforms to scale up their operations.

Get Started With Robust White Label Neo-Banking Platform

Schedule Free DemoHow a White Label Solution Simplifies Banking?

- A large basket of value-added tools

This sort of banking is quite user-friendly because of its interactive and intuitive UI/UX designs plus is majorly dedicated towards product and business model innovation. The tools like ATM locators, currency converters, bill splitters, monthly budget creators, and so on make banking operations seamless.

- Real-time tracking

Gone are the days when a credit/ debit took a couple of days or sometimes weeks to appear in your account, now with white label solutions and digital banking is making it an act of fractions of seconds. Even real-time tracking is possible regardless of time and location.

- Hassle-free operations

Having a mobile and internet connection is all that you need to process anything over the banking platform. The whole process is paperless and presence-less and things are quite quick, like opening an account hardly takes 5 minutes.

- Cuts cost

From a business perspective, establishing a bank requires a huge chunk of money, a team of tech experts, and some financial regulations but with a white label solution, all these complications are resolved saving much money and making the process speedy as well.

- Autonomous nature

As neo-banks are not physically present, they do not actually possess or need any banking license nor they are controlled by any authority like RBI. This makes them enjoy more autonomy in their operations and functionality which somehow permits them to keep their cost low as well.

Wrap up: How Antier can help?

It is apparent that not just traditional banking but even crypto banking is getting revolutionized with a plethora of innovative features and is paving the foundation for future-proof banking. The white label neo banking platform is proving that banking can be user-friendly and effortless by rendering a differentiated and simplified, yet holistic banking experience.

If you also wish to take charge of your personal finances and boost your business with crypto banking and a blend of neo-banking features, contact the subject matter experts of Antier who are well-versed with cutting-edge technologies and current market trends.

Turn your ideas into reality by leveraging the technical expertise of Antier!