How will you react to knowing that you can make money while sleeping or resting on your couch? Yes!

Gone are the days when earning money was limited and an arduous task, but crypto banking has opened doors to limitless financial possibilities. Unlike traditional banking, where your options may be limited by geographic boundaries or institutional regulations, crypto banking offers a global marketplace accessible to anyone with an internet connection.

This article will unveil the secrets to making money with crypto banking solutions, demystifying complex concepts and guiding you through each step. Whether you’re a seasoned investor or new to the world of cryptocurrencies, the strategies are designed to be accessible and rewarding for individuals of all backgrounds.

Without any ados, let’s get started!

The Rise of Crypto Banking: Financial Paradigm Shift

Banking has evolved over time from a system of bartering to a system of centralized institutions that control our money. Crypto banking is the next evolution of banking, a decentralized system that allows users to control their own money.

Where traditional banking systems have long relied on centralized authorities, intermediaries, and legacy infrastructure to facilitate financial transactions, the advent of cryptocurrencies and blockchain technology has sparked a paradigm shift in the way we perceive and interact with money. With crypto banking, the reliance on traditional banks for financial services is diminished as blockchain networks enable peer-to-peer transactions without the need for intermediaries.

A Look at The Figures

Some of the latest statistics on crypto banking:

- The global crypto banking market is expected to reach $2.52 billion by 2029, growing at a CAGR of 6.80% from 2022 to 2029. [Source: Data Bridge Market Research]

- The number of crypto bank accounts is expected to reach 100 million by 2025. [Source: Statista]

- The average interest rate on crypto deposits is 5.2%, which is significantly higher than the average interest rate on traditional bank deposits. [Source: CoinMarketCap]

The total value of crypto assets held in crypto banks is estimated to be $5 billion. The most popular crypto banks are BlockFi, Celsius Network, and Nexo. These statistics show that crypto banking is a growing industry with a lot of potential. As the world becomes more digital, more and more people are likely to adopt crypto banking platforms.

Key Drivers Fueling Crypto Banking’s Growth

The figures give us a clear insight that the crypto banking market is experiencing significant growth, driven by various key factors that are shaping the industry’s expansion and popularity. Understanding these drivers of growth is essential for grasping the potential and future prospects of crypto banking solutions.

The major factors behind crypto banking’s rapid growth are:-

1. Increasing Adoption of Cryptocurrencies

With the pace cryptocurrencies are gaining mainstream acceptance, more individuals and modern businesses are planning to opt for digital assets for their financial transactions. This growing adoption of cryptocurrencies creates a demand for crypto banking solutions, providing a secure and efficient way to manage and utilize digital currencies.

2. Decentralization and Financial Freedom

The underlying principle of cryptocurrencies is decentralization, removing the need for intermediaries such as traditional banks. Crypto banking offers individuals the opportunity to have full control over their financial assets and transactions, empowering them with financial freedom and privacy.

3. Security and Transparency

Blockchain technology, the foundation of cryptocurrencies, provides enhanced security and transparency compared to traditional banking systems. The immutable and transparent nature of blockchain ensures the integrity of transactions and minimizes the risk of fraud, attracting individuals and businesses seeking a more secure banking environment.

All these traits act as the catalysts behind the increasing adoption of crypto friendly banking solutions and signify a fundamental shift in the financial landscape, presenting new opportunities and challenges.

Why Crypto Banking over Traditional Banking?

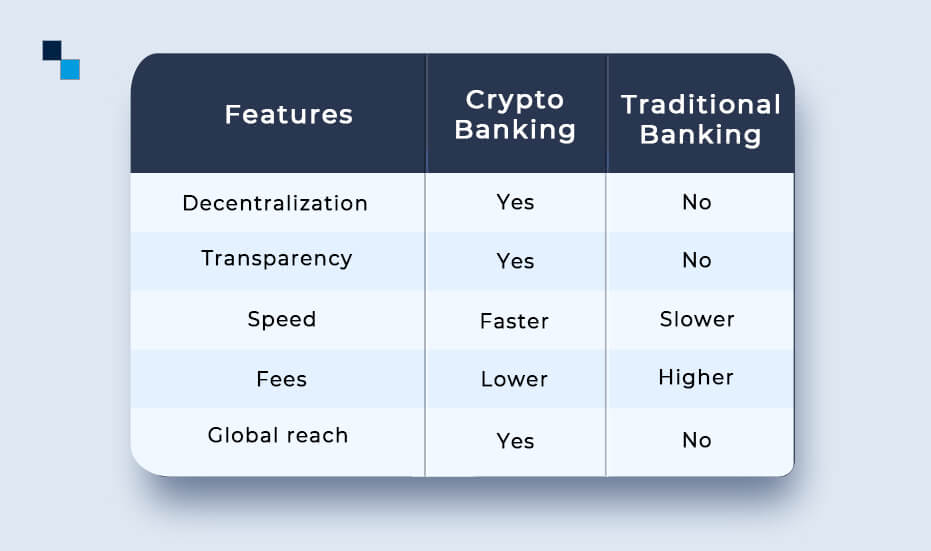

Crypto banking has an edge over traditional banking in many ways, making it an appealing choice for individuals seeking alternative financial solutions. The following are the major advantages that crypto banking offers-

The chart clarifies why modern entrepreneurs and leading businesses are looking into crypto banking for their financial management.

- Firstly, crypto banking operates on a decentralized system, meaning that there is no central authority controlling transactions. This ensures greater transparency as transactions are recorded on a public ledger, visible to all participants.

- In terms of speed, crypto banking transactions are typically faster compared to traditional banking, which often involves intermediaries and processing delays.

- Crypto banking fees are generally lower compared to traditional banking, as it eliminates many overhead costs associated with traditional banking operations.

- Crypto banking offers global reach, allowing users to transact and access financial services across borders without the need for traditional banking infrastructure.

These traits make crypto banking an appealing choice for individuals and financial institutions seeking greater control, transparency, cost-efficiency, and global accessibility in their financial transactions. Therefore, crypto banking solutions are getting more hype for better earnings nowadays.

5 Game-Changing Strategies in Crypto Banking

In the rapidly evolving world of finance, crypto banking has emerged as a game-changer, providing innovative solutions and opportunities for individuals seeking to maximize their earnings including fiat currency as well as cryptocurrency. The strategies are too good to believe that you can even make money while you are asleep or busy with something else.

No wonder, everybody would love to make more money and if that comes with such comfort and flexibility, it seems to be the cherry on the cake. To answer your curiosity, below are the five strategies that showcase the diverse ways in which crypto banking can revolutionize your financial journey-

1. Trading cryptocurrencies

One of the most popular ways to make money with crypto banking is through trading cryptocurrencies. This involves buying and selling of digital assets on cryptocurrency exchanges to take advantage of price fluctuations. In this, the traders aim to buy cryptocurrencies at a low price and sell them at a higher price, making a profit from the price difference.

Unlike traditional financial markets that operate within specific hours, the cryptocurrency market is open 24/7. This means you can trade at any time, even while you’re sleeping or in a different time zone. Successful crypto traders use technical analysis, market research, and trading strategies to identify trends and predict price movements. They also stay updated with news and events that can impact the market.

Moreover, the crypto banking platforms offer automated trading features through the use of trading bots or algorithms. These tools can execute trades on your behalf based on pre-set parameters and market conditions. By setting up trading strategies in advance, you can let the bots work for you even when you’re not actively monitoring the market.

2. Investing in crypto assets

Another way to make money with crypto banking is by investing in crypto assets. This involves buying and holding cryptocurrencies for the long term, with the expectation that their value will increase over time. Investors believe in the potential of cryptocurrencies and aim to benefit from their growth and adoption.

When investing in crypto assets, it’s important to research and choose projects with strong fundamentals, a solid team, and a clear roadmap. Diversification is also crucial to minimize risk. By investing in a portfolio of different cryptocurrencies, investors can spread their risk and increase their chances of making a profit.

Even the crypto market has witnessed significant price appreciation over the years, leading to substantial returns for early investors. Some cryptocurrencies have experienced exponential growth, making them attractive investment options.

3. Staking and earning passive income

Staking is a popular method for earning passive income with crypto banking. It involves locking up a certain amount of crypto tokens in a digital wallet to support the network’s operations, such as validating transactions or maintaining network security. In return for this contribution, stakers are rewarded with additional tokens as an incentive.

Staking rewards vary depending on the cryptocurrency and network. Some cryptocurrencies offer a fixed percentage return, while others use a more complex algorithm to determine rewards. Staking can be done through crypto banking solutions or directly on a crypto exchange.

This can be an attractive way to generate consistent income without actively trading or relying on price fluctuations. Also, staking often comes with the flexibility to unstake and withdraw funds at any time, allowing investors to have liquidity while still earning passive income.

4. Participating in Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) are fundraising events where new cryptocurrencies or tokens are sold to investors. By participating in ICOs, investors can buy tokens at a discounted price before they are listed on exchanges. If the project is successful, the value of the tokens can increase significantly, allowing investors to make a profit.

By participating in ICOs, investors often have the advantage of obtaining tokens before they are listed on cryptocurrency exchanges. This early access allows them to potentially buy tokens at a lower price, increasing the likelihood of earning profits when the tokens become available for trading.

Some ICOs offer airdrops, where they distribute free tokens to holders of specific cryptocurrencies or to individuals who complete certain tasks or participate in promotional activities. By participating in airdrops or bounty programs, individuals can receive tokens without making a direct investment. If the value of these tokens appreciates over time, participants can earn profits by selling or holding them.

5. Crypto Lending

Crypto lending is a practice that allows individuals to earn passive income by lending their cryptocurrency assets to borrowers. In this process, borrowers, such as traders or investors, can borrow cryptocurrencies from lenders in exchange for collateral or interest payments.

Crypto banking solutions act as intermediaries here, connecting lenders and borrowers, facilitating the loan process, ensuring the security of funds and managing the loan agreements. The lenders earn interest on their crypto loans, which may vary based on factors such as the lending period, the cryptocurrency being lent, and market demand. The borrowers secure their loans by providing collateral, usually in the form of other cryptocurrencies.

In this process, the interest earned is typically paid out periodically, such as monthly or annually, depending on the chosen time period. In the event of default, some reputable crypto banking platforms have mechanisms in place to ensure fair liquidation processes and provide borrowers with an opportunity to address their repayment obligations before collateral liquidation.

Proven Tips to Supercharge Your Crypto Earnings

Though the super easy ways to make money in crypto banking are clear, the volatility of the crypto market can’t be neglected. Therefore, whenever you plan to invest in crypto or the aforementioned earning options, the following are the essential tips to keep in mind in order to maximize your earnings and minimize risks in crypto banking:

1. Stay informed : Keep up with the latest news, market trends, and regulatory developments in the crypto industry. Join online communities, follow reputable influencers, and read industry publications to stay ahead of the curve.

2. Diversify your portfolio : Spread your investments across different cryptocurrencies and asset classes to reduce risk. Diversification can help protect your capital and increase the potential for higher returns.

3. Set clear goals : Define your investment objectives and develop a well-defined strategy. Whether you’re looking for short-term gains or long-term wealth accumulation, having clear goals will guide your decision-making process.

4. Manage risk : Understand the risks associated with different crypto banking strategies and implement risk management techniques. Set stop-loss orders, use proper position sizing, and never invest more than you can afford to lose.

5. Stay secure : Protect your crypto assets by using secure wallets, enabling two-factor authentication, and being cautious of phishing attempts. Keep your private keys and passwords safe and regularly update your security measures.

These are the influential tips that every cryptopreneur needs to stick with so as to boost earnings, keep himself prepared for volatility and enjoy the benefits of investing in crypto banking solutions to the fullest.

Choose a Worthy Crypto Banking Platform

When engaging in crypto banking activities, it’s crucial to choose the right platform that aligns with your investment goals and risk tolerance. Consider the following factors when selecting a crypto banking platform:

- Security : Look for platforms with robust security measures, such as cold storage for funds, two-factor authentication, and encryption protocols.

To know more, click here.

- Reputation : Research the platform’s reputation and read reviews from other users. Look for platforms that have been operating for a significant period and have a track record of reliability.

- User experience : Consider the platform’s user interface, ease of use, and customer support. A user-friendly platform with responsive customer service can make your crypto banking experience smoother.

- Supported cryptocurrencies : Ensure that the platform supports the cryptocurrencies you want to invest in or trade. Some platforms offer a wide range of options, while others may have limited selections.

- Fees and costs : Consider the platform’s fee structure, including trading fees, deposit and withdrawal fees, and staking rewards. Compare different platforms to find the most cost-effective option.

How Antier Can Help?

With the rapid growth of the crypto market, there are plenty of opportunities to make your investments work harder for you, wherein crypto banking solutions offer exciting opportunities for individuals to enhance their earnings. By welcoming innovative approaches and blockchain technology, individuals can diversify their income streams and capitalize on the potential growth of the crypto market.

When it comes to maximizing your crypto earnings, having a reliable partner by your side can make all the difference, this is where Antier comes into action. As a leading blockchain development company, we offer comprehensive crypto banking solutions and white label banking platforms tailored to meet your specific needs. From best solutions to expert guidance, Antier has got you covered, so trust in our experience, commitment to excellence, and cutting-edge solutions to take your crypto earnings to new heights.

What are you looking for, schedule a free talk now!