Top 10 Real Estate Tokenization Platforms and Companies of 2025

January 7, 2025

How Does AI Game Development Enhance Realism in Virtual Worlds?

January 8, 2025Introduction

Two decades ago, cryptocurrency didn’t even exist, and today, we have ample variants, trading methods, and technologies to enhance the trading experience. The pace of change is accelerating.

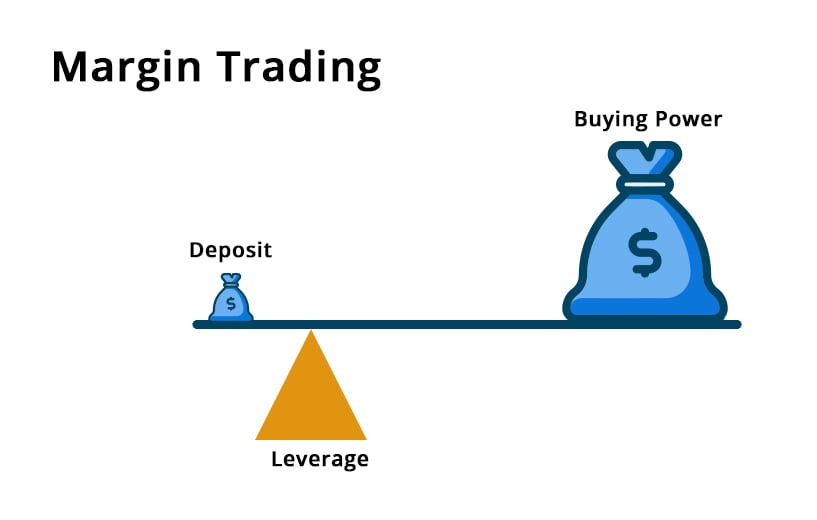

Since traders crave leverage and enhanced returns, margin trading is evolving as an engine of amplified profits, unlocking exponential gains but at an amplified risk. While sophisticated compared to their predecessors, today’s margin trading exchanges will seem almost archaic a few years from now. A new era is dawning, one defined by AI, advanced decentralization technologies, and unprecedented levels of security and personalization. Let’s explore the forces driving this transformation.

Source: PrimeXbt

Top Trends Shaping the Future of Margin Trading Exchanges in 2025 –

Imagine a trading platform that anticipates your next move, dynamically adjusts your risk parameters, and executes complex strategies with superhuman speed. Sounds like science fiction? Think again. In 2025, this vision can be a reality, driven by a confluence of powerful trends reshaping the very fabric of margin trading exchange software solutions.

Also, Read>>> Understanding Leverage and Margin Trading Exchange: Borrowing For Bigger Battles

Let’s explore key trends that are poised to reshape the dynamic crypto margin trading exchange market.

1. Intelligent Automation Powered By AI

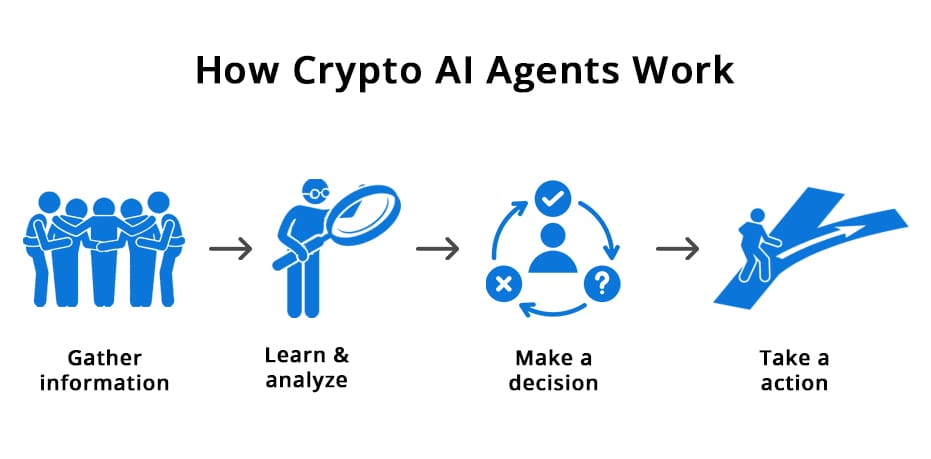

Gone are the days of manual order execution and static risk parameters. AI-powered margin trading exchanges will be the new norm in 2025. These intelligent systems will analyze vast datasets in real time, identifying trading opportunities, optimizing strategies, and managing risk with unprecedented precision.

Source: Coingecko

Source: Coingecko

Top AI Use Cases For Margin Trading Exchanges Software in 2025 –

- Real-time Market Surveillance and Data Analytics

- Automated Decision-Making

- Predictive Algorithms

- Sentiment Analysis

- Anomaly Detection Systems For Enhanced Security

- Real-time Leverage Strategy Optimization

- Predictive insights and alert systems For Risk Mitigation

- Personalized dashboards

- AI Chatbots for Instant Support.

- Personalized Trading Experiences

- Adaptive Learning Models

Leverage and margin trading exchanges may utilize AI-driven predictive analytics to forecast market trends and provide insights that help traders optimize their strategies, leveling the field for both novice and experienced participants. Machine learning algorithms could analyze individual user behavior to offer personalized trading recommendations and alerts based on historical performance and market conditions. AI crypto agents integrated within margin trading exchange software can dynamically adjust leverage based on market volatility, automatically hedge positions to minimize potential losses for traders, and take decisions independently.

This isn’t science fiction; it’s the future of margin trading powered by AI.

2. The Rise of DeFi Margin Trading

CEXs may dominate the margin trading arena but DeFi is bringing exciting possibilities to the origin. We might see a surge in sophisticated DeFi margin trading exchange development offering users greater control over their funds, enhanced transparency, and the potential for higher yields through innovative lending and borrowing mechanisms.

Also, Read>>> Understanding Margin Trading on DEXs

Features of Decentralized Margin Trading Exchanges –

- Leverage Trading

- Borrowing & Lending

- Cross-Margining

- Isolated Margin

- Liquidation Protection

- Stop-Loss Orders

- Take-Profit Orders

- Order Types (Market, Limit, Stop-Limit)

- Real-time Market Data

- Trading Charts & Indicators

- API Access

- Multi-factor Authentication

- Cold Storage

- Transparency & Auditability

- Decentralized Governance

This shift towards decentralization will empower users and challenge the traditional dominance of centralized platforms. A non-custodial margin trading exchange ensures that users have full control over their funds. Smart contract-driven automation reduces operational inefficiencies and costs and enhances security as there is no single honeypot for hackers. This minimizes the risks of centralized breaches.

With growing trust in trustless ecosystems, decentralized margin trading exchange software solutions are expected to capture a significant share of the margin trading market.

3. Diversified Collaterals With Tokenized RWAs

The future of margin trading isn’t confined to conventional crypto assets. In 2025, we’ll see the integration of tokenized RWAs as collateral and even tradeable assets, opening up new possibilities for traders. Imagine using tokenized real estate, stocks, or even commodities as collateral for margin trades. This diversification will bring greater stability and liquidity to the market and will broaden the user base for margin trading exchanges.

Tokenized RWA X Margin Trading: New Features Unlocked –

- Fractional Ownership

- Diverse Collateral Options

- Increased Liquidity

- More Tradeable Assets

This trend is unlocking new opportunities for traders while broadening the scope of margin trading beyond conventional assets. By tokenizing traditional and digital assets, margin trading exchange software solutions can offer new trading opportunities to traders with broader collateral options.

Bridge the gap between traditional finance and the digital asset world with new-gen margin trading platforms featuring tokenized RWAs.

4. A New Era of Legitimacy with Regulatory Clarity and Institutional Adoption

As the crypto market matures, regulatory clarity will become increasingly important. We can anticipate greater regulatory oversight of margin trading exchanges, whether centralized or decentralized. This provides a more stable and predictable environment for both retail and institutional investors, making margin trading exchange development a lucrative venture for businesses as crypto adoption increases.

How Margin Trading Exchanges Ensure Legitimacy in Times of Enhanced Regulatory Oversight?

- Enhanced KYC/AML protocols

- Implementing DIDs

- Transparent leverage limits

- Regulatory sandboxes

As regulators worldwide focus on safeguarding investors, margin trading exchanges will have to adopt proactive compliance measures, keeping in mind user privacy and fund security. Regulatory clarity will pave the way for increased institutional adoption, bringing more capital and liquidity into the market.

By aligning with evolving regulations, leverage and margin trading exchanges are building trust and ensuring sustainable growth in the sector.

5. Gamified Leverage and Margin Trading Exchanges

To attract a new generation of traders, exchanges will incorporate gamification elements into their platforms. Think interactive tutorials, trading competitions with leaderboards, and even reward systems for achieving specific trading milestones. This gamified approach will make margin trading more engaging and accessible, particularly for newcomers to the crypto space.

Gamification Elements for Margin Trading Exchanges –

- Leaderboard challenges

- Reward systems

- Interactive tutorials

- Trading Contests and Competitions

- Tiered Systems and Achievements Badges/Points

- Social and Community Features

- Gamified Rewards

- Gamified Risk Management

Gamification not only enhances user engagement but also fosters a sense of community among traders. This enhances user attraction and retention, benefiting margin trading exchange software solutions significantly.

6. Integration of Web3 Wallets For Seamless and Secure Access

Web3 wallets, with their emphasis on user ownership and control, will become the standard for accessing margin trading exchanges. In the coming years, seamless integration with these new-gen wallets will be crucial, allowing users to connect their funds and execute trades with greater security and convenience.

Key advantages of Integrating Web3 Wallets in Margin Trading Exchanges Include –

- Direct wallet-to-exchange integration

- Cross-chain compatibility

- Enhanced privacy

Web3 wallets are becoming a cornerstone for leverage and margin trading exchange development, offering seamless connectivity with decentralized ecosystems. This trend aligns with the broader movement towards user-centric trading experiences and decentralization.

7. Advanced Risk Management Mechanisms

Margin trading inherently involves risks, and 2025 will witness the rise of sophisticated risk management solutions. Expect to see margin trading exchanges offering advanced features like real-time risk assessments, customizable margin alerts, and automated stop-loss orders.

Advanced Risk Management Features For Margin Trading Exchange Development –

- Dynamic Margin Requirements

- Position Sizing Tools

- Volatility-Based Leverage Limits

- Portfolio Diversification Analytics

- Real-time liquidation alerts

- Social Sentiment Analysis and Risk Scoring

- AI-Powered Risk Management Tools

- Implementing AI Crypto Agents

- Dynamic Margin Adjustments

- Gamified Risk Management

- Real-Time Risk Monitoring and Alerts

Implementing effective risk management tools in leverage and margin trading exchanges will empower users to make informed decisions and manage their risk more effectively. Such tools are critical for fostering confidence among traders and driving adoption.

8. Let The Communities Drive With AI-Powered Social Trading

Social trading platforms, powered by AI, will allow users to follow and learn from the strategies of successful traders. Integrating this into margin trading exchange software development offers users valuable insights and fosters a more collaborative trading environment, democratizing access to advanced trading strategies and empowering users to learn from the best.

Gamification Top Social Trading Features For Margin Trading Exchange Development –

- Copy Trading

- Social Trading Leaderboards

- Trading Signals & Alerts

- Expert Trader Profiles & Rankings

- Community Forums & Chats

- Follow & Subscribe Features

- Performance Tracking & Analytics

- Risk Management Tools for Copy Trading

- Transparent Performance Reporting

- Educational Content & Trading Strategies

- Social Trading Contests

- Gamified Social Interaction

Social trading platforms are gaining traction tremendously, and margin trading exchanges are integrating this power-packed functionality to enable community-driven strategies. This democratization of knowledge empowers traders to harness collective intelligence for better outcomes.

Also Read>>> Top 5 Margin Trading Software Development Companies

9. Sustainability and Green Trading Practices

As environmental concerns go grave, the crypto industry is starting to focus on sustainability. The adoption of renewable energy for mining, sustainable consensus mechanisms, carbon offsetting projects, and sustainability tokens are a few initiatives taken by the digital asset industry.

Eco-friendly Initiatives that Margin Trading Exchanges Can Adopt –

- Offsetting Carbon Footprint with Investment in Renewable Energy

- Other Carbon Offsetting Programs

- Carbon-Neutral Trading Platforms

- Incentives for Trading in Sustainable Assets

- Blockchain Solutions That Minimize Environmental Impact

Sustainability is becoming a key differentiator for margin trading platforms seeking to appeal to socially conscious traders. Emerging leverage and margin trading exchanges can adopt these sustainable practices and make their projects stand out.

10. Hyper-Personalized Trading Experiences Through Data Analytics

One-size-fits-all is no longer applicable to all sorts of user-centric digital platforms. Margin trading platforms, to stay relevant, will have to offer highly personalized experiences tailored to individual user preferences and risk profiles. AI-powered recommendation engines will provide customized trading strategies, educational resources, and risk management tools, empowering users to make informed decisions and optimize their trading performance.

Personalization Strategies for Margin Trading Exchange Development –

- Tailored trading recommendations based on individual risk profiles

- Customized educational content addressing unique learning needs

- Personalized risk management recommendations

- Intuitive UI/UX designs

- AI-Powered Personalization Programs

- AI Crypto Agents Implementation

By prioritizing personalization during margin trading exchange development, businesses can build stronger relationships with their user base.

11. Fort Knox Security Protocols For Margin Trading Exchanges

In the high-stakes world of margin trading, one can’t miss prioritizing security protocols during margin trading exchange software development. Expect significant security advancements in the coming years. Decentralized leverage and margin trading exchanges will also play a crucial role in enhancing security by eliminating single points of failure and distributing risk across a network of users.

Advanced Security Protocols for Margin Trading Exchange Development –

- Multi-Factor Authentication

- Biometric Authentication

- Cold Storage for Crypto Assets

- Hardware Security Modules

- Intrusion Detection Systems

- Anti-Money Laundering & KYC Procedures

- Behavioral Analytics

- Encryption

- Vulnerability Scanning & Penetration Testing

- Bug Bounty Programs

- Emergency Response Plans

- Blockchain Forensics

- Regular Security Audits

- Zero Trust Security Model

- Data Loss Prevention

The focus will be on building robust and resilient platforms that can withstand even the most sophisticated cyberattacks.

12. The Rise of Cross-Chain Margin Trading

Interoperability is key to unlocking the full potential of blockchain technology. Implementing effective cross-chain interoperability solutions is essential for a completely enhanced user experience, as it allows users to seamlessly trade assets across different blockchains.

Cross-Chain Interoperability Solutions for Margin Trading Exchange Development –

- Atomic Swaps

- Bridge Protocols

- Sidechains

- Layer-2 Solutions

- Inter-Blockchain Communication

- Cross-Chain Oracles

- DEXs with Cross-Chain Functionality

We can expect a growing trend towards cross-chain margin trading. Therefore, implementing these solutions during margin trading exchange software development will open up new trading opportunities, increase liquidity, and create a more interconnected and efficient market.

Imagine leveraging assets on one blockchain to trade on another—this is the future of borderless finance.

13. Layer 2s Powering High-Frequency Margin Trading Exchange

Layer 2 technologies like rollups, sidechains, and state channels will play a crucial role in enabling high-frequency trading and reducing transaction costs. These solutions will offload transaction processing from the main blockchain, significantly improving speed and efficiency, and making them essential for the future of leverage and margin trading exchanges.

Why Layer-2s are Essential for Margin Trading Exchange Software Development in 2025?

- Reduced Transaction Fees

- Faster Transaction Speeds

- Improved Scalability

With over 560 million cryptocurrency owners existing worldwide and still growing, exchanges need to prepare for sudden influx of users. As transaction volume and user activity increase, layer 2 solutions will become an integral part of margin trading exchange development. They directly address issues of scalability, transaction speed, and cost, which are all highly relevant to margin trading.

Also, Read>>> Top Strategies for Successful Margin Trading Exchange Development in 2024

The Future is Leveraged, Intelligent and Secure

A few years from now, margin trading exchanges will become an essential functionality of all cryptocurrency exchanges and it will be unrecognizable. Not because the core principles of leverage will change, but because how we access and manage it will be utterly transformed powered by AI and other disruptive decentralization technologies. The amalgamation of technological advancements and user-centric developments will bring together a new generation of leverage and margin trading exchanges.

Tap into the era of more secure, efficient, and engaging platforms by leveraging Antier’s margin trading exchange development expertise. With a deep understanding of these emerging trends and a commitment to innovation, Antier can help you build a cutting-edge margin trading platform that meets the demands of tomorrow’s market.