Real World Asset Tokenization Platform Development

Launch your own White-label Tokenization Platform in 7 Days

Maximize Value with Asset Tokenization

Digital asset tokenization transforms physical and financial assets into blockchain-based tokens, facilitating easy transfer, trading, and fractional ownership. The tokenized RWA process eliminates geographical barriers, reduces costs, and enhances transparency, offering significant benefits for asset owners and investors alike.

When you tokenize real world assets, it boosts liquidity, accessibility, and efficiency across global markets. Real World asset tokenization services open new opportunities in real estate, art, commodities, and securities, etc, reshaping how we interact with assets.

Antier stands out as a leading asset tokenization development company, delivering tailored solutions with meticulous attention to detail. Our experience and innovation ensure top-notch RWA tokenization results for diverse clients.

RWA Tokenization Market Report

Digital asset tokenization market is projected to reach US$ 2709.9 million in 2029, increasing from US$ 1140.7 million in 2022, with a CAGR of 13.0% during the period of 2023 to 2029.

Real estate is expected to become the largest type of tokenized asset in 2030, taking up nearly one-third of the overall market.

World-class Asset Tokenization Development Company

As a leading Real World Asset Tokenization Services provider, we take into account every minute detail to provide exceptional solutions. Antier has worked on some of the most prestigious products whether it’s building top-notch real estate tokenization platforms or private equity tokenization platforms, we have the resources to provide you with world-class asset tokenization services.

In-House Legal Experts for Real World Asset Tokenization

Antier offers one-stop-solutions for all your Real World Asset Tokenization needs! We have experienced legal professionals to guide you through the legal intricacies, ensuring a smooth and compliant path for your RWA tokenization project. Contact us today, the best asset tokenization company to schedule a consultation and take the first step toward unlocking the full potential of tokenizing your valuable assets.

Our Real World Asset Tokenization Services

Modules of our Asset Tokenization Ecosystem

The asset tokenization ecosystem comprises specific modules that are vital for ensuring success. Real-world asset tokenization system developed by

Antier, the best asset tokenization services provider, is underpinned by the following to achieve world-class user experience.

Business Benefits of Our Asset Tokenization Services

As a Real World Asset Tokenization Platform Development Company, Antier provides an end-to-end ecosystem for enterprises to unlock the vast potential of the tokenomy. Our white-label asset tokenization platform benefits asset owners with immutable records & transparent transactions, helping platform owners expand their horizons.

What Token Standards Do We Use for Asset Tokenization?

Token standards for asset tokenization platform development define the structure, behavior, & functionality of tokens, enabling seamless integration & interaction within the

tokenized asset ecosystem. Some of the most popular standards include:

Why Choose Antier for Digital Asset Tokenization Service?

By partnering with Antier, you can rely on a team of technical experts with real-world experience delivering end-to-end blockchain services.

Our Partners

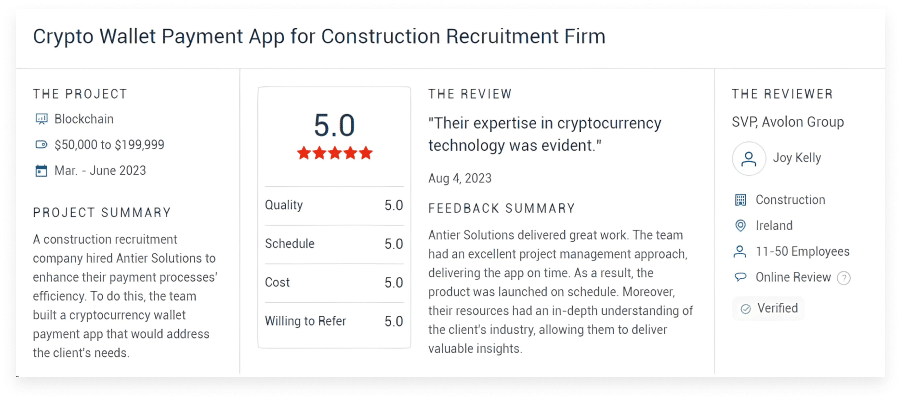

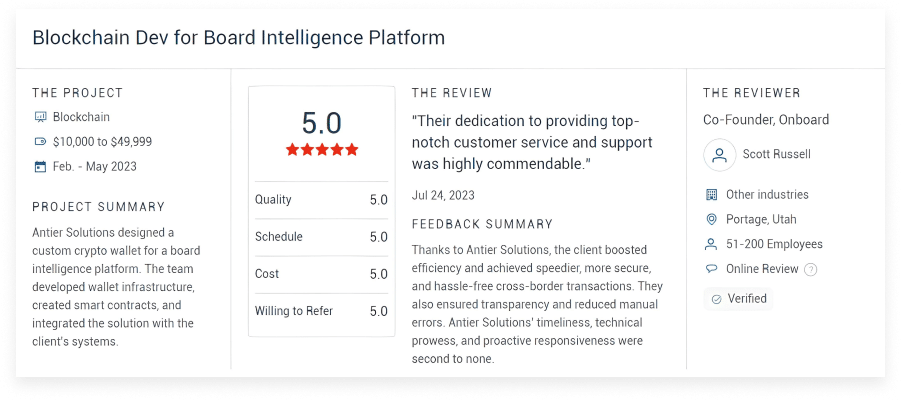

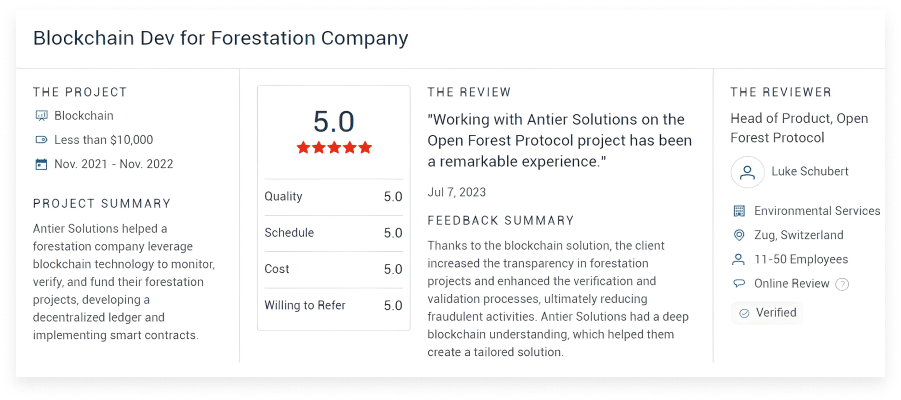

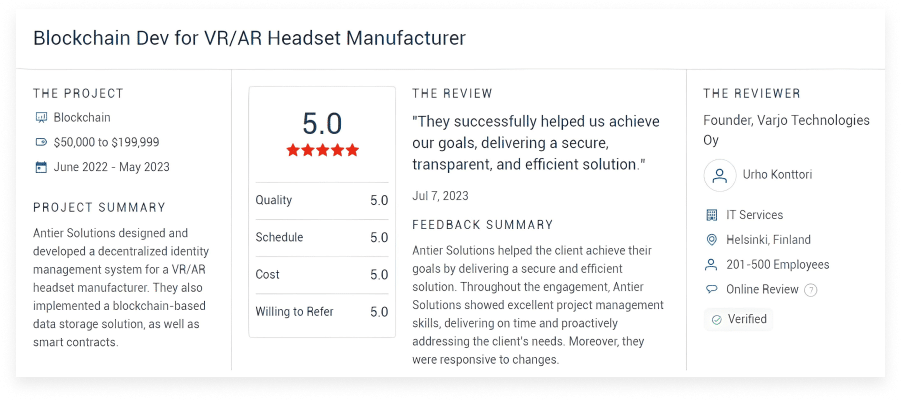

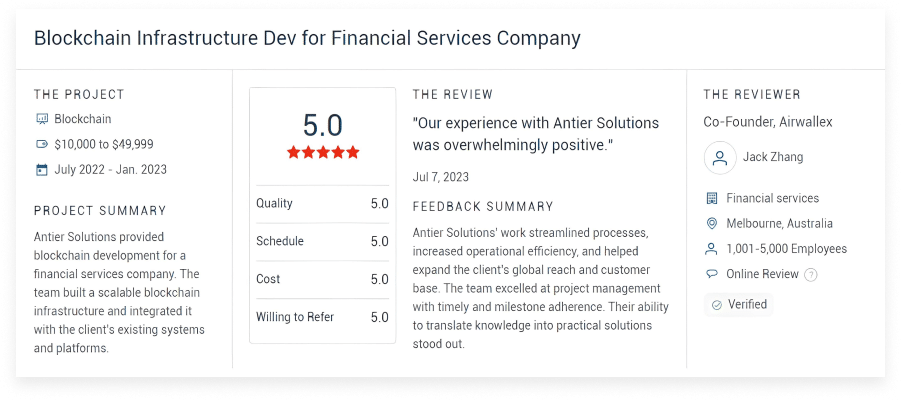

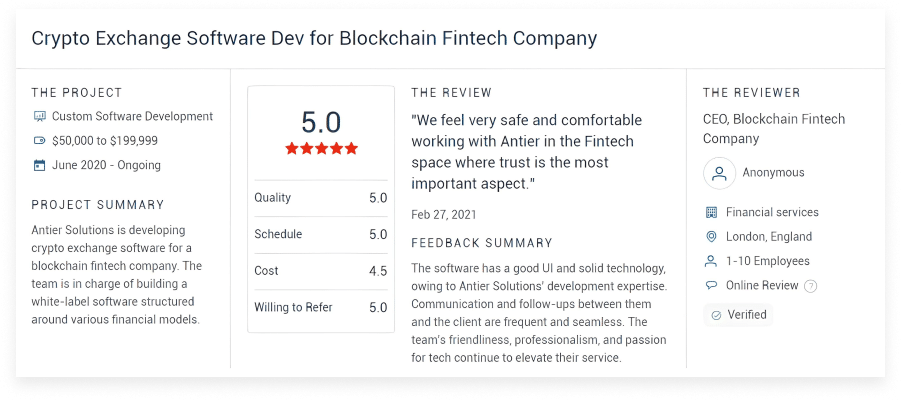

What Clients Say

Frequently Asked Questions

● Fractional ownership

● Increased liquidity

● Global accessibility

● Reduced costs

● Enhanced transparency

● Faster settlement times

● Increased security

Get in touch with our premium asset tokenization company to know more.

● Ownership

● Automate the payment process

● Regulation and compliance

● Greater transparency

Schedule a call with our team to better understand our digital asset tokenization service.

Initial Coin Offerings (ICOs)

Companies can issue tokens in exchange for funds to finance a new project, product or service. The tokens can represent equity in the company, access to a platform, or a specific product or service.

Security Token Offerings (STOs)

STOs allow companies to raise capital by selling securities that comply with regulatory requirements, making them more accessible to investors than traditional securities.

Tokenization of Assets

Assets such as real estate or fine art can be tokenized, allowing investors to purchase fractional ownership in the asset. This provides a new way for investors to invest in assets they may not have had access to before.

Crowdfunding

Tokenization can be used for crowdfunding campaigns, allowing companies or individuals to raise funds for a specific project or cause by offering tokens in exchange for contributions. .

Decentralized Finance (DeFi)

DeFi platforms allow users to borrow and lend funds using cryptocurrency as collateral. Tokenization can be used to create new financial products and services that are accessible to a wider range of investors.

● Real estate

● Fine art

● Commodities

● Stocks and equities

● Bonds and debt

● Intellectual property

● Collectibles

● Royalties

Let our premium real estate tokenization development company help you understand the different types of assets that can be tokenized.