Top 6 Blockchain Use Cases in Healthcare You Should Know in 2024

June 12, 2023

The Top 10 Cryptocurrency Exchange Clone Scripts to Watch in 2023

June 13, 2023The world of digital asset tokenization has experienced a significant transformation with the emergence of blockchain technology. By leveraging the power of decentralized networks, assets that were once considered illiquid can now be divided into digital tokens, providing investors with unprecedented opportunities.

In this blog, we will explore the concept of asset tokenization on Polygon, a leading blockchain platform, and delve into the benefits it offers for both asset owners and investors.

What Exactly is Asset Tokenization?

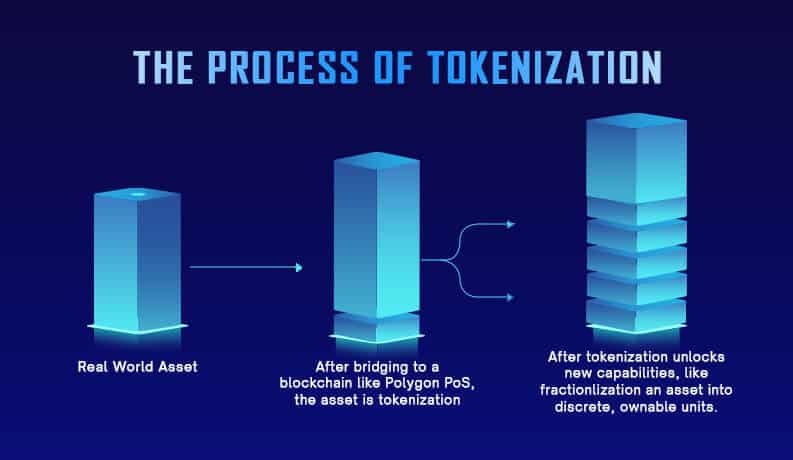

Asset tokenization involves converting physical assets, such as real estate, artwork, or even intellectual property, into digital tokens on a blockchain network. These tokens represent ownership or shares of the underlying asset and can be easily bought, sold, and traded. The use of blockchain technology ensures transparency, security, and immutability of ownership records, revolutionizing traditional markets by unlocking liquidity and enabling fractional ownership.

Asset Tokenization on Polygon:

Polygon, formerly known as Matic Network, is a highly scalable and efficient blockchain platform that operates as a layer 2 solution on top of the Ethereum network. It offers a robust infrastructure for asset tokenization, allowing for seamless and cost-effective transactions.

Here are some of the most popular tokenization platforms on Polygon:

- PolygonX: PolygonX is a decentralized exchange (DEX) that allows users to trade tokenized assets.

- Polymath: Polymath is a platform that allows businesses to tokenize their assets.

- Synthetix: Synthetix is a platform that allows users to trade synthetic assets, which are tokens that track the price of underlying assets.

Key Aspects of Asset Tokenization on Polygon:

Let’s delve into key aspects of asset tokenization on Polygon:

Scalability and Low Transaction Fees

Polygon’s layer 2 solution addresses the scalability challenges faced by Ethereum. With its high throughput and low transaction fees, Polygon provides an ideal environment for asset tokenization. By leveraging Polygon’s infrastructure, asset owners can tokenize their assets without worrying about congested networks or exorbitant fees, ensuring a smooth and cost-effective experience for all participants.

Fractional Ownership and Liquidity

One of the primary advantages of digital asset tokenization is fractional ownership. By dividing an asset into smaller units or tokens, asset owners can enable investors to purchase fractions of the asset. This fractional ownership model opens up investment opportunities to a broader audience, allowing investors to diversify their portfolios with ease. Additionally, asset tokenization on Polygon enhances liquidity, as tokens can be easily traded on decentralized exchanges (DEXs), providing asset owners with a wider pool of potential buyers.

Security and Transparency

Blockchain technology forms the foundation of asset tokenization on Polygon, ensuring a secure and transparent ecosystem. Each transaction is recorded on the blockchain, providing an immutable and auditable record of ownership. This transparency builds trust among participants, eliminates the need for intermediaries, and reduces the risk of fraudulent activities. Asset owners and investors can verify ownership, track transactions, and ensure compliance with regulatory requirements.

Global Accessibility

Polygon’s asset tokenization capabilities bring global accessibility to previously localized markets. By removing geographical barriers, investors from around the world can participate in asset ownership and trading. This democratization of investment opportunities enables a more inclusive and diverse ecosystem, benefiting both asset owners and investors.

Smart Contract Functionality

Polygon supports smart contract functionality, which plays a crucial role in digital asset tokenization. Smart contracts are self-executing contracts with predefined rules and conditions. They facilitate the automatic distribution of dividends, revenue sharing, and other contractual agreements associated with asset ownership. Smart contracts on Polygon offer efficiency, security, and enforceability, ensuring a seamless experience for all parties involved in asset tokenization.

Process of Asset Tokenization on Polygon

The process of asset tokenization on Polygon involves several key steps that enable the conversion of physical assets into digital tokens. Let’s explore the process in detail:

1. Asset Evaluation and Structuring

The first step is to evaluate the asset that is being considered for tokenization. This involves assessing its value, legal status, and potential market demand. Once the asset is deemed suitable for tokenization, a structured plan is developed to define the fractional ownership model, the number of tokens to be created, and the rights and benefits associated with each token.

2. Smart Contract Development

Smart contracts play a critical role in asset tokenization on Polygon. These self-executing contracts are coded to represent the terms and conditions of the asset ownership. They automate the processes of token issuance, ownership verification, dividend distribution, and other contractual agreements. The smart contract is developed using programming languages such as Solidity, specifically tailored to the asset being tokenized.

3. Token Creation and Distribution

With the smart contract in place, the digital asset tokenization representing fractional ownership of the asset are created on the Polygon network. The number of tokens created is determined based on the asset valuation and the desired fractional ownership model. These tokens are then distributed to the asset owner or the designated custodian.

4. Compliance and Regulatory Considerations

Asset tokenization is subject to regulatory requirements and compliance obligations. It is essential to ensure that the tokenization process complies with applicable laws and regulations governing securities, property rights, and investor protection. Legal experts and compliance professionals should be consulted to ensure adherence to the relevant regulatory frameworks.

5. Platform Integration and Token Listing

Once the tokens are created, they need to be integrated into a platform that supports trading and liquidity. This involves collaborating with cryptocurrency exchanges or decentralized exchanges (DEXs) that operate on the Polygon network. Listing the tokens on these platforms allows investors to buy, sell, and trade the tokenized assets.

6. Investor Onboarding and KYC/AML

To participate in asset tokenization on Polygon, investors need to undergo a Know Your Customer (KYC) and Anti-Money Laundering (AML) verification process. This ensures that the platform maintains compliance with regulatory requirements and prevents illicit activities. Investors are required to provide relevant identification and supporting documentation to verify their identity and eligibility.

7. Secondary Market Trading

After the tokens are listed on the trading platform, investors can engage in secondary market trading. The fractional ownership tokens can be bought and sold by participants, enabling liquidity and price discovery. Investors have the flexibility to trade their tokens based on market conditions and investment preferences.

8. Asset Management and Governance

Post-tokenization, ongoing asset management and governance are crucial. This includes managing the physical asset, maintaining its value, and ensuring compliance with any contractual obligations associated with the tokens. Asset management may involve periodic audits, maintenance, and updates to the smart contract as needed.

Conclusion

Asset tokenization on Polygon presents a new era of investment possibilities, offering liquidity, fractional ownership, and increased market accessibility. With its scalable infrastructure, low transaction fees, and integration of smart contracts, Polygon provides a robust platform for asset owners and investors to tokenize and trade a wide range of assets.

If you are an asset owner looking to unlock the value of your assets or an investor seeking diversified investment opportunities, exploring asset tokenization is a must.

Looking for the best digital asset tokenization service provider? Get in touch with Antier and discuss your requirements.