Exploring the Variables Impacting the Cost of White Label Crypto Exchange Software

March 29, 2023

Transform Your Business With DeFi Lottery Development – The Emerging Future of Finance

March 30, 2023Decentralized technologies and cryptocurrency are booming at present. The numbers happen to clearly speak for themselves in this regard. The market capitalization has been skyrocketing, transaction volume has been going through the roof, and there is a continuously increasing rate of adoption among businesses, individuals, & governments on a global scale. This, in turn, gives a clear picture of the emerging popularity of decentralized technologies.

All the credit here goes to blockchain technology which plays a significant role in propelling us toward a trustless economy where the need for any third party or intermediary is eliminated. One of the most happening decentralized technologies in recent times is decentralized exchanges. We have seen a rapid evolution of decentralized exchanges over the past few years because of their power to combat the problems in centralized exchanges. Now, let us delve a little deeper into the topic to gain a better understanding of decentralized exchanges.

What Is Decentralized Exchanges

Decentralized exchanges or DEXs are a type of cryptocurrency exchange that permit direct peer-to-peer crypto transactions to take place without the need for any third parties or intermediaries. These exchanges rely on self-executable pieces of code on a blockchain referred to as smart contracts.

Smart contracts allow much more privacy to traders and offer lower transaction costs or slippage. It is because peer-to-peer transactions can be directly carried out by the traders from their digital wallets without going through any intermediary. Most importantly, every trader is always in complete control of their funds at any given point in time.

Categories of Decentralized Exchanges

Coming to the different categories of decentralized exchanges or DEXs, there are three types –

1. Automated Market Makers or AMMs –

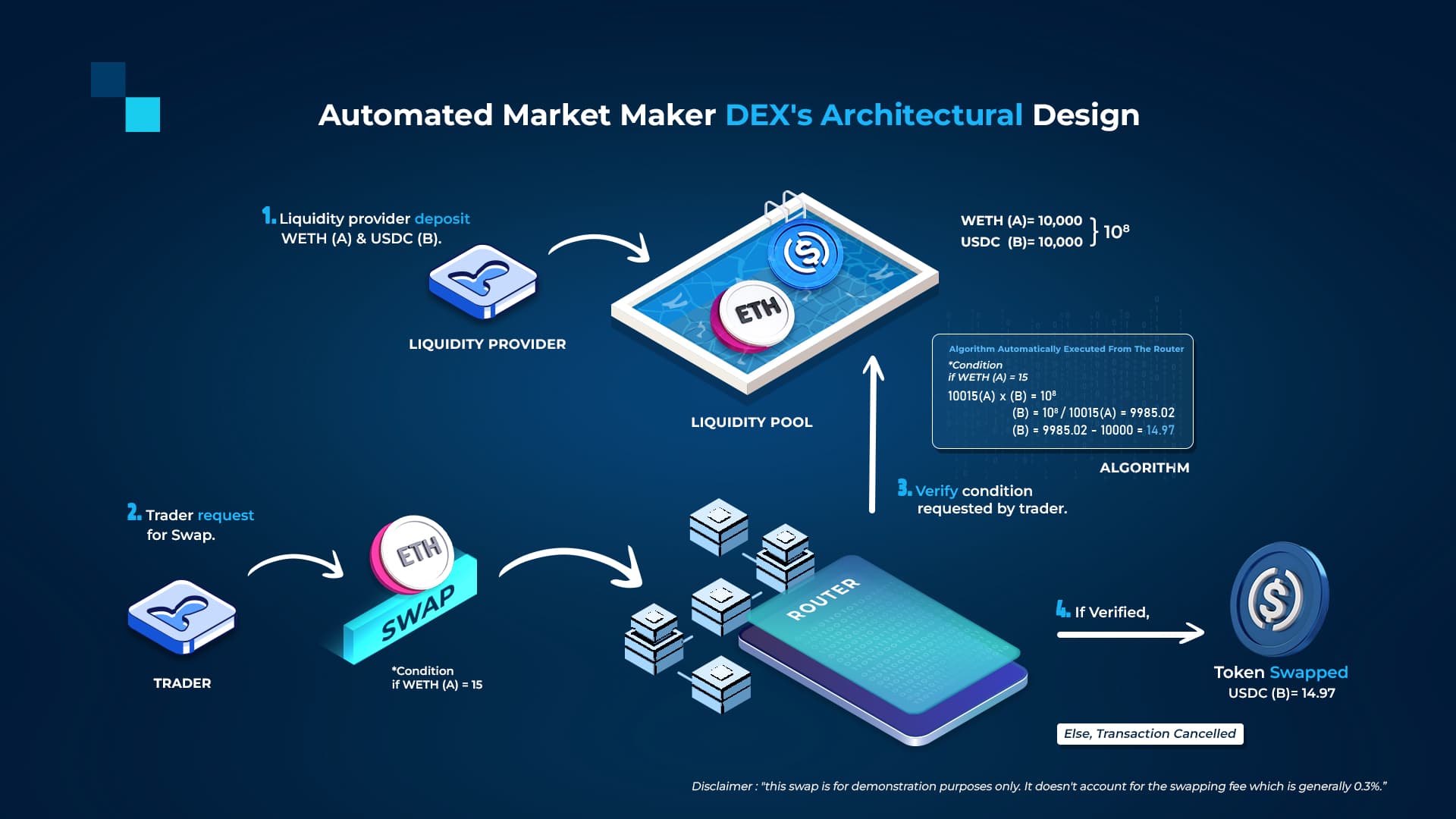

The system relies on smart contracts and was developed to deal with liquidity problems in the case of order books. Automated market makers-based decentralized exchanges instead of matching buy and sell orders make use of pre-funded pools of assets referred to as liquidity pools. Additionally, using liquidity pools permit traders to earn interest or execute orders in a trustless and permissionless manner.

2. Order Book DEXs –

Order books collate records of every open order to buy and sell assets for specific pairs of assets. A buy order implies that a trader is interested in buying or bidding for an asset at a specific price. On the other hand, a sell order implies that a trader is ready to sell an asset or quote a specific price for an asset. Order book DEXs are further classified into On-chain order books and Off-Chain order books. Order books decentralized exchanges many times hold open order information on-chain, while the funds of traders remain in their wallets. These types of exchanges might permit traders to utilize their positions by the use of borrowed funds from lenders on their platform.

3. DEX Aggregators –

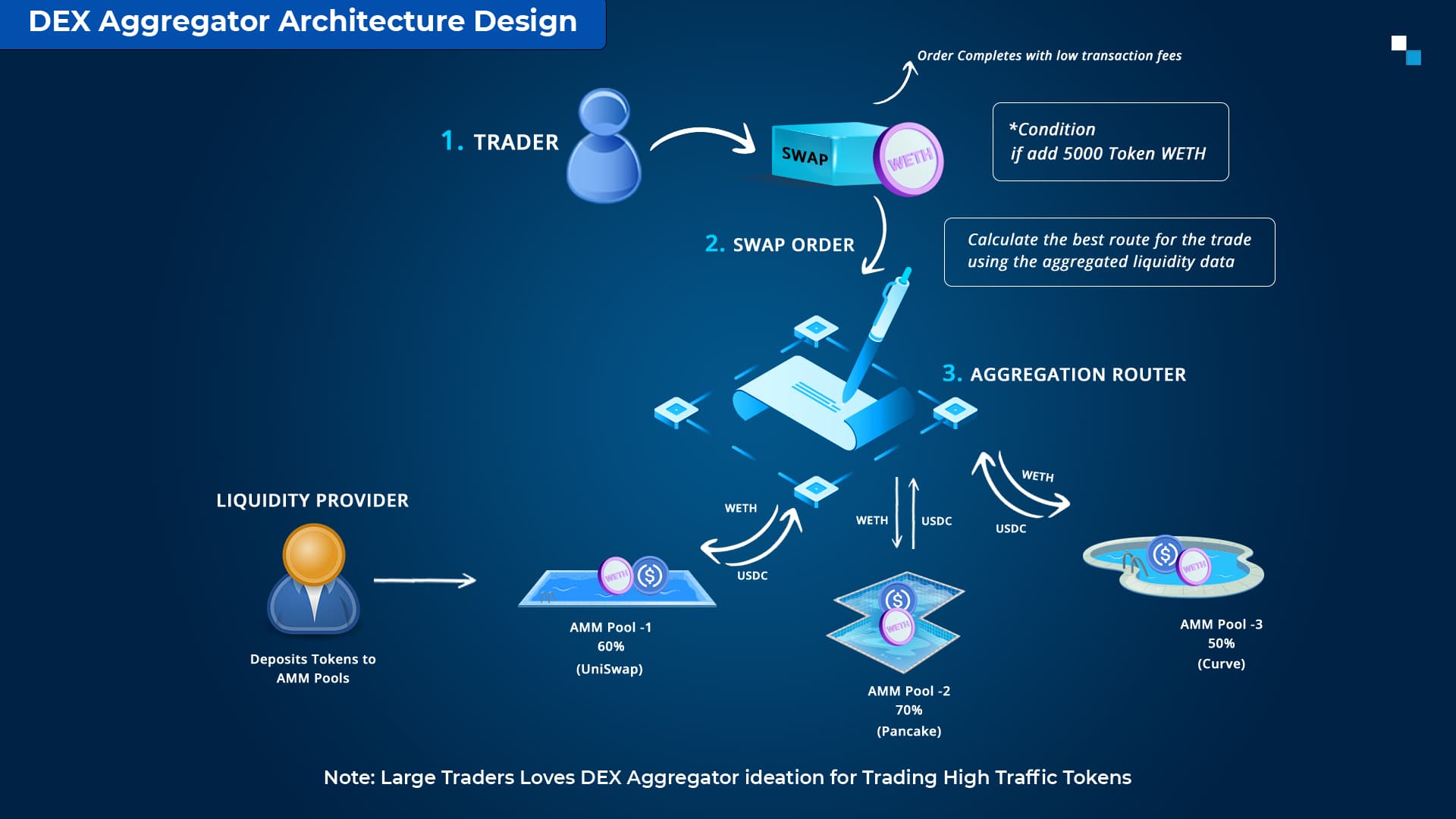

DEX aggregators make use of a number of different protocols as well as mechanisms to deal with liquidity. These types of decentralized exchanges typically aggregate liquidity from a number of other decentralized exchanges for the purpose of minimizing slippage on large orders, optimizing the prices of tokens & swap fees, along with offering traders the best possible price in the shortest possible time. In addition to this, DEX aggregators protect traders from the pricing effect and reduce the chances of failed transactions.

All categories of decentralized exchanges permit users to carry out direct trade or peer-to-peer trade via their smart contracts without the need for any intermediary or a third party.

The trading volume on decentralized exchanges was dominated by USDC amidst depegging incident.

USDC trades below $0.975 which accounted for over $26 billion on Saturday.

Uniswap’s top two pairs on Saturday, March 11, 2023.

Source

The Working Process of Decentralized Exchanges

Decentralized exchanges are basically peer-to-peer marketplaces that allow traders to carry out transactions without needing to hand over their assets to any intermediary or custodian. These exchanges bring in the functionalities of blockchain and smart contracts. Instead of relying on intermediaries or custodians, the transactions on decentralized exchanges are facilitated by smart contracts.

Decentralized exchanges make use of smart contracts for executing all market transactions by the distribution of transactions to autonomous code and users can keep their funds in the smart contracts on their chosen blockchain networks. In addition to this, decentralized exchange users can also utilize various alternatives for order fulfillment on the exchange with different levels of decentralization.

Decentralized Exchanges’ Architecture

The term ‘decentralized exchange’ can be used to describe both blockchain-based exchange protocols and applications that make use of the protocols. A decentralized exchange protocol usually refers to a software program, hosted on one or more distributed ledgers or integrated into them, thereby enabling peer-to-peer transactions that are settled automatically on the distributed ledger. In DEXs, users are able to retain sole custody of their private keys during the entire transaction process.

Decentralized exchange applications are built on top of a decentralized exchange protocol along with adding an on-chain or off-chain order book database, a graphic user interface or GUI, and APIs based on the requirements to make sure that there is easy access to information.

When speaking about the architecture of decentralized exchanges, it can be broken down into four components listed below.

- The blockchain platform is to be used in the decentralized exchange and its technical implementation in the right way so that it is perfectly compatible.

- The counterparty discovery mechanism to be used enables buyers to track down sellers who are interested in executing transactions on mutually agreeable terms.

- The order matching algorithm to be used in the decentralized exchange refers to the matching process via which buy orders are paired with sell orders that have mutually agreeable terms.

- The transaction settlement protocol of the decentralized exchange is usually on-chain settlement. It happens to be a necessary element that enables users to eliminate the need for trusting any centralized authority or party in order to control traders’ assets, settle trades, and make sure that all account balances are reflected correctly.

These four components happen to be crucial in terms of building a functional decentralized exchange that is ready for the market.

Advantages of Decentralized Exchanges

Decentralized exchanges come with a host of benefits which is exactly the reason why they are edging past centralized exchanges and removing their dependability for crypto transactions. Let us have a look at the benefits offered by decentralized exchanges.

Direct Peer-to-Peer Transactions

Decentralized exchanges facilitate direct peer-to-peer crypto transactions without the need for any central authority or intermediary. It proves to be immensely beneficial since transactions are directly made from one person to another without any other party involved in them and hence it is time-saving in nature.

No Custodian of Assets

In decentralized exchanges, none of the traders require to transfer the custodian of their assets to anyone else like a company, third party, or others. Therefore, the risk of a company being hacked is also eliminated. It is exactly why traders are assured of much better safety from hacking, theft, fraud, or failure.

Censorship is Reduced

Decentralized exchanges run on decentralized protocols, thereby making sure that none of the parties can censor any of the transactions. This, in turn, ensures that censorship is readily reduced.

Market Manipulation is Prevented

The peer-to-peer nature of crypto transactions of decentralized exchanges plays a significant role in preventing market manipulation. These exchanges protect users from fake trading and wash trading, thereby helping to prevent manipulation of the market.

Availability of Tokens

Decentralized exchanges are able to include any token that is minted on the blockchain they are built on. It means that there is a vast variety of tokens on these exchanges. If anyone is interested in finding a hot token in its infant stage, decentralized exchanges offer a limitless range. The range here can be anything from the well-known to the totally random and weird. It is because anyone can mint a token and develop a liquidity pool for it.

Security Risks are Lower

All assets or funds involved in trading on the decentralized exchanges are stored in the traders’ own wallets without the need to deposit any funds into any third-party or intermediary wallets or accounts, making them less vulnerable to hacks, thereby ensuring enhanced safety and security. Moreover, traders are in complete control over their funds and transactions by using self-custody wallets and hence they have complete ownership.

Unregulated

Decentralized exchanges are unregulated in nature since they are not bound by any regulations such as the KYC process, AML, or anti-money laundering standards, etc. and hence they are able to operate autonomously.

Counterparty Risk is Eliminated

Decentralized exchanges are based on smart contracts and they operate without the involvement of any third party or intermediary. If there are no other parties involved, the counterparty risk is also eliminated which proves to be beneficial since there is no dependency on any other party.

Permissionless

No permission is necessary to transact on decentralized exchanges, meaning anyone who has an active connection to the internet can access these exchanges regardless of their location.

Anonymous in Nature

In decentralized exchanges, the anonymity of traders is preserved since they need not go through any KYC or know your customer procedure. Therefore, none of the traders on these exchanges need to share any of their personal information, thereby making sure that everyone can transact keeping their identity confidential.

Charges are Lower

Transactions carried out in decentralized exchanges come with lower charges since they do not avail of paid services of any third-party exchanges. Therefore, the transactions are more affordable.

Transactions are Quick

Transactions in decentralized exchanges are almost instantaneous since there is no dependency on anyone. Thus, the transactions are quick without any delay.

Using Decentralized Exchanges

Using a decentralized exchange is neither tough nor lengthy. The best part is that it does not require any sign-up process as it is not even needed to input any email address to use or interact with these exchanges. Traders just require a crypto wallet that is compatible with the smart contracts existing on the network of decentralized exchange.

Any interested individual possessing a smartphone and connection to the internet can make use of decentralized exchanges.

Future of Decentralized Exchanges

Decentralized exchanges first came into existence in the crypto industry in the year 2014, permitting users to trade a wide range of assets peer-to-peer. The first iterations of these exchanges were not user-friendly and quite difficult to use. They only became popular due to the decentralized interface. In the early times, most decentralized exchanges used to order books, which is a system that keeps records of all transactions.

However, with the consistent improvement of technology and the hard work of developers, decentralized exchanges evolved steadily making them much easier to use and more accessible to users. In addition to this, the evolution of automated market makers or AMM technology played a significant role in solving the problems with liquidity faced by previous decentralized exchanges.

Automated market makers use smart contracts as well as liquidity pools to bring about an improvement in the liquidity of decentralized exchanges. At the same time, they also manage the token’s price whenever a trade is placed. At the time when traders access any decentralized exchanges that are based on AMMs, they interact with liquidity pools that store several token pairs.

This gives a clearer picture of the evolution of decentralized exchanges since they came into existence. Moreover, the ways in which the decentralized exchanges are removing the dependency on the centralized exchanges ensure their bright future. Although the fullest capability of decentralized technology is not yet utilized, it is certainly expected in the time to come. Therefore, we need to wait and see what the future has in store for decentralized exchanges and technology as a whole.