Blockchain Carbon Credit Software: The Future of Sustainable Business

July 17, 2023

7 Factors to Consider While Creating a DeFi Staking Token

July 18, 2023Table of Contents

Introduction

Since the dawn of the Web3 era, both artificial intelligence (AI) and cryptocurrency have gained more prominence than ever before. However, their nature and applications differ significantly. AI, a data-dependent technology, continuously improves itself at learning, predicting, and executing as more datasets are fed to it. Conversely, cryptocurrency utilizes distributed ledger technology to ensure data authenticity and immutability. While we are in the early years of the adoption of Blockchain and AI in tandem, numerous real-world applications are emerging.

One such application that is gaining momentum is an AI-based crypto market maker bot. Traditionally, a crypto market maker raises and executes a large number of buy and sell orders based on manual inputs by exchange owners or traders who aim to amplify trading outcomes. The integration of AI with the conventional crypto market maker concept introduces automation and intelligence to the process.

In this blog, we’ll delve into the concept of AI-powered crypto market making bots, explore their benefits, and outline the steps involved in building one from the ground up.

“AI and cryptocurrency can democratize access to information, financial services, and opportunities, creating a more inclusive and equitable society.”

-Arif Naseem

The Need for AI-Driven Cryptocurrency Market Making

Market making is an essential activity wherein traders contribute liquidity to financial markets by placing both buy and sell orders, aiming to profit from the spread between the bid and ask prices. The traders, known as market makers, utilize an algorithmic trading instrument called a crypto market making bot to execute this activity efficiently.

Given the round the clock nature of crypto markets, market makers must ensure the availability of adequate liquidity at all times to maintain an orderly market. However, the constantly changing digital asset prices in the dynamic crypto market present a challenge for manual or traditional market making systems. This is where AI technology emerges as a game-changer.

AI-Powered Cryptocurrency Market Making Bot: An Overview

AI-based crypto market maker bots are sophisticated computerized programs that harness advanced data analysis and machine learning algorithms to analyze market trends, historical data, order books, and market sentiments. By utilizing their capability to process and analyze vast amounts of data, they identify trading opportunities that humans may overlook and make well-informed trading decisions with precision and speed.

AI-driven cryptocurrency market making bots possess the ability to swiftly analyze and adapt to changing market conditions in real-time. They constantly adjust strategies to ensure maximum profitability and uninterrupted liquidity even in times of high volatility. By eliminating human intervention from the crypto market making process, these bots enable complete automation and mitigate the risk of costly mistakes driven by emotions.

Traders can leverage a crypto market maker bot to monitor rapid price movements across multiple exchanges and various trading pairs. This enables traders to capitalize on cross-platform trading opportunities that would otherwise be missed.

Key Statistics:

| According to research and market forecasts, the global blockchain AI market is projected to experience significant growth, with a compound annual growth rate (CAGR) of 25.2%. The market is expected to expand from USD 0.48 billion in 2023 to USD 1.18 billion in 2027.

A research conducted by A2Z indicates that the AI crypto trading bot market is forecasted to grow at a CAGR of 23% by 2030. |

AI-Based Crypto Market Making Bot: Business Benefits

With its extensive capabilities, groundbreaking AI-powered crypto market making technology assures that there is always a market available for traders to confidently execute their trades. They can effectively slash slippage and tighten spreads, making trading cost-effective and markets more efficient and trader-friendly.

The integration of AI-driven cryptocurrency market making bots into your cryptocurrency exchange platform offers several compelling reasons. Here are some of the key benefits:

- Increased Agility

- Real-Time Decision Making

- Immediate Execution of Trades

- Total Automation

- Smart Trading Decisions

- Improved Profitability

- 24/7 Market Making

- Reduced Risks

- Enhanced Liquidity

- True Price Discovery

- Lowered Costs of Market Making

- Steadiness During Adverse Market Conditions

- Future-proof Solution

- High-volume trades

For a detailed explanation of the abovementioned benefits of AI-driven crypto market maker bots, you can refer to this blog.

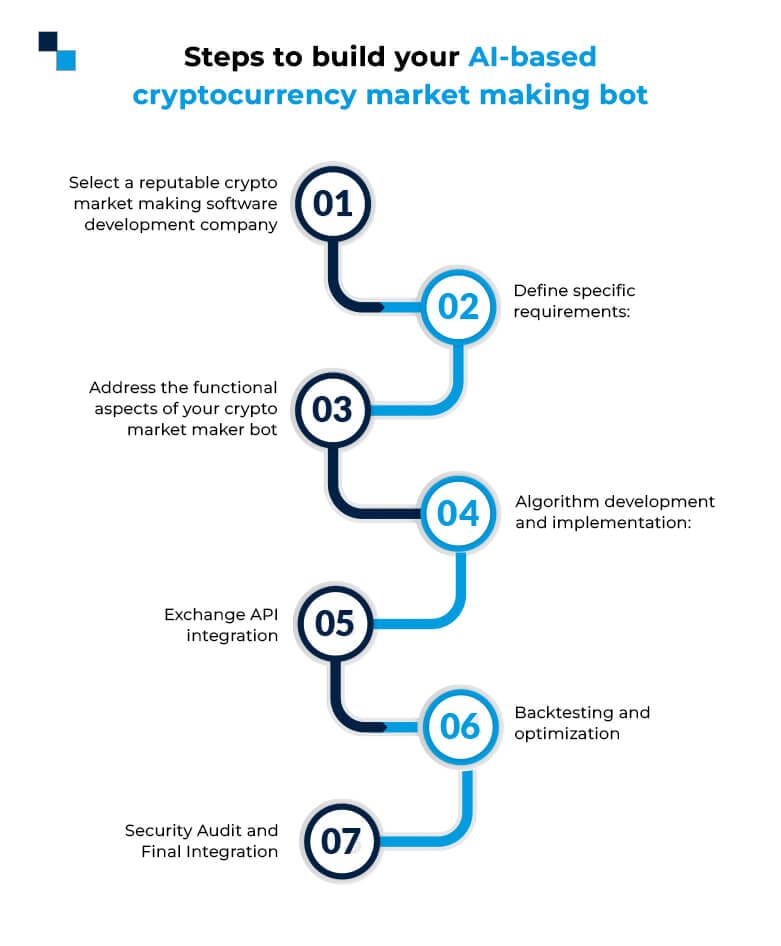

Steps to build your AI-based cryptocurrency market making bot Step 1: Select a reputable crypto market making software development company

Step 1: Select a reputable crypto market making software development company

With appropriate skillsets and sufficient experience, it is possible to build straightforward and advanced crypto market making bots that exceed expectations in terms of performance and security. Choose a technology provider with a strong track record and extensive experience in developing high-performance and secure market making bots for volatile financial markets.

Step 2: Define specific requirements:

Clearly communicate your expectations for the cryptocurrency market making bot. Specify desired outcomes such as bid-ask spreads, order sizing, price bands, etc. Share your preferred trading strategies, risk tolerance levels, and desired return on investment to ensure that the market making bot aligns with your specific needs.

Step 3: Address the functional aspects of your crypto market maker bot:

Collaborate closely with the development team to ensure the creation of a fast, transparent, scalable, secure, and user-friendly bot with a customized dashboard. The crypto market making bot should be easily-configurable, allowing cryptocurrency exchange owners and traders to switch to manual mode when necessary.

Step 4: Algorithm Development and Implementation:

Monitor the process as the development company integrates high-quality AI algorithms capable of processing large volumes of market data. Set liquidity, market volatility, and risk management parameters to guide the algorithm’s design.

Step 5: Exchange API integration

To access multiple exchanges, the cryptocurrency market making bot will require integration with the APIs of major exchange platforms. Work closely with the development team to ensure seamless integration with the necessary exchange APIs.

Step 6: Backtesting and Optimization

Perform thorough testing of your AI-powered crypto market maker using historical data. Analyze the backtesting results to identify areas for improvement in the bot’s parameters and algorithms. Refine the bot’s functionality and algorithms based on these findings to enhance its effectiveness and performance.

Step 7: Security Audit and Final Integration:

Before integrating the AI-driven crypto market maker bot into your cryptocurrency exchange, conduct a thorough security audit. Evaluate the potential vulnerabilities and make necessary adjustments to trading parameters as market conditions evolve.

Final Thoughts

The success of your trading platform is dependent on the performance of your AI-powered crypto market making bot. It is important to constantly track its performance. Besides being a cryptocurrency exchange business, you must also stay up to date with the latest trends in the market. Therefore, monitor market conditions and be proactive enough to adjust trading parameters when required.

The revolutionary AI-driven cryptocurrency market making technology can make cryptocurrency trading more accessible to small as well as large ticket-size traders. If you are a cryptopreneur interested in building a sophisticated trading bot for your exchange, you can embark on the journey by hiring a reputed Web3 consulting company.

As a leading technology provider, we understand the growing demand for AI-powered crypto market making bots given their transformative power in automating market making and enhancing trading outcomes. At Antier, we have delivered more than 1,000 projects in the cryptocurrency domain. Count on our prowess to build a superior crypto market maker bot tailored to your needs.

Let’s connect to get started!