Crypto wallets have become crucial tools commonly used for storing, transferring, managing and monitoring digital currencies. Custodial wallets have become a prominent crypto wallet category in which private key control is provided to third parties while allowing enterprises to focus on core business operations.

Developing a secure and reliable wallet solution requires sound domain knowledge, experience and expertise. This is when you must consult a custodial crypto wallet development partner that tailors the solution according to your specific needs while adhering to the highest standards of security and compliance.

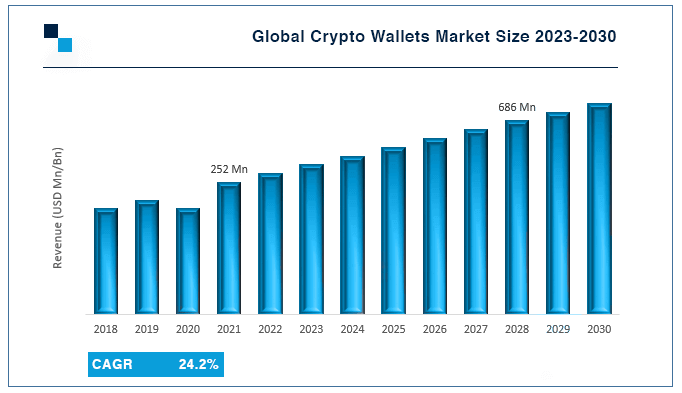

The crypto wallet market has expanded significantly over the past few years. The segment began to grow in 2021 and continues to garner the attention of enterprises and investors. According to ZionMarketReseach, the wallet market will rise to 686 million in the next 6 years. This means more investors and enterprises will develop wallet solutions with the guidance of crypto wallet development experts and grow their earning potential.

Custodial crypto wallets are generally used for storing and managing digital assets. Unlike physical wallets, they don’t hold digital assets but store private keys to retrieve the contents. Losing the keys means losing the wallet contents, which can be catastrophic for business.

Now you have understood what the wallets hold. It is time to discover the business benefits of the custodial crypto wallets:

Custodial wallets have been widely known for their convenience and simplicity of use. Crypto exchanges are often integrated with custodial wallets, thereby making it simple for users to maintain their digital assets and participate in trading. The wallets relieve the users of storing and managing their backup phrases and private keys.

Non-custodial wallets offer greater digital asset control but come with dangers and responsibilities. It would be impossible to regain access once you lose the private keys. Also, hacks and breaches could wipe off digital assets in minutes. On the other hand, custodial wallets hold digital assets securely and many wallet providers give insurance which is covered against theft or loss.

Custodial wallets are less expensive than non-custodial wallets as customers pay low transaction fees while transferring assets between the wallet and exchange. This can be advantageous for users looking for ways to minimize transaction costs and grow their income.

Businesses and investors opt for custodial wallets as they are regulatory complaint. They are registered with regulatory entities, so suppliers must strictly abide by security and reporting standards. This can benefit enterprises that become the target of regulatory audits or compliance inspections. The wallets offer more accountability and transparency, making them a preferred investment choice.

Custodial wallets give users opportunities to earn money. The wallets offer interest rates that are way higher than traditional saving accounts, which makes it a lucrative investment choice. Furthermore, the staking services offered by the platform are compensation for the users to participate in the network’s consensus mechanism.

In the case of custodial wallets, all the sensitive data is handled by hot and cold storage. Leaving these wallets unattended will make them vulnerable to hacks and breaches. To prevent such situations, it is vital to adopt security approaches. Apart from adopting robust security mechanisms, the following practices will enhance asset security:

Choosing an optimum solution can be daunting among several custodial wallet options. However, we have compiled a list of things to be considered before choosing a custodial crypto wallet solution:

Determine whether you are associating with a reputable and trustworthy provider. You can check this via reviews, testimonials and the history of security incidents and breaches.

Read the terms of service and legal requirements thoroughly to ensure that the solution aligns with your business needs and expectations.

The custodial wallet solution you invest in must be integrated with the advanced technical stack. By integrating advanced techniques, you will gain a competitive edge in the industry and will keep security hassles at bay.

The wallet must be integrated with robust security mechanisms like Multi-Layer security. This will safeguard your assets from unauthorized access and breaches.

Make sure that the wallet aligns with your business operations and systems. Some wallets support APIs for seamless integrations.

In case your business deals with international transactions, make sure that the wallet you choose is a cross-border transaction complaint.

Obtain the details related to transaction fees, withdrawal fees or any other charges associated with the custodial wallets.

Customer support is an integral aspect of wallet development. Make sure that the custodial wallet team you hire puts its foot forward in case any queries or concerns arise.

With the right skills, you can develop a wallet by yourself. However, if you are unable to do so it’s better to consult Antier . Being a credible custodial wallet development company we have developed over 50 feature-rich wallets for start-ups and established enterprises. We develop solutions that align with your business needs, enabling a swift transaction process. Our solutions support various financial services to boost the earning capabilities of the users. We adopt high-graded security mechanisms to protect your assets and data from unauthorized access. To know more, schedule a consultation or view a live demo by connecting with us today!

Please fill in the details below to share your business needs and avail our services.

We will never share your information and always

give #1 priority for your privacy.

Please fill out the form to make the request. We’ll be in touch to schedule a free demo.